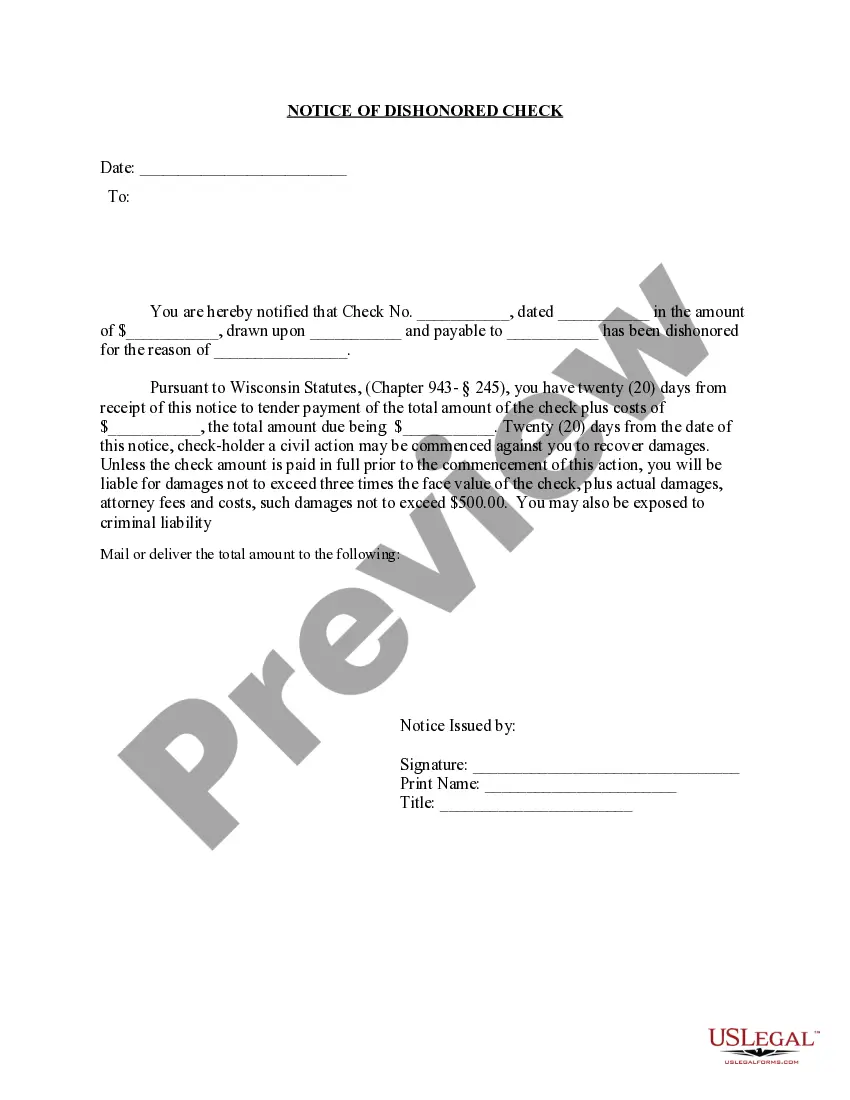

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Wisconsin Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Wisconsin Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Out of the multitude of services that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing forms before buying them. Its comprehensive catalogue of 85,000 samples is categorized by state and use for efficiency. All the documents on the platform have been drafted to meet individual state requirements by licensed lawyers.

If you have a US Legal Forms subscription, just log in, search for the template, hit Download and access your Form name in the My Forms; the My Forms tab holds your downloaded documents.

Stick to the guidelines listed below to obtain the document:

- Once you find a Form name, make certain it is the one for the state you need it to file in.

- Preview the template and read the document description before downloading the template.

- Search for a new sample using the Search engine in case the one you’ve already found is not appropriate.

- Click on Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

When you have downloaded your Form name, you are able to edit it, fill it out and sign it with an online editor that you pick. Any form you add to your My Forms tab might be reused multiple times, or for as long as it remains the most up-to-date version in your state. Our platform offers fast and easy access to samples that suit both attorneys and their clients.

Form popularity

FAQ

When there are insufficient funds in an account, and a bank decides to bounce a check, it charges the account holder an NSF fee. If the bank accepts the check, but it makes the account negative, the bank charges an overdraft (OD) fee. If the account stays negative, the bank may charge an extended overdraft fee.

Writing bad checks can lead to several theft charges, but with the help of a skilled defense attorney, you can work to reduce or even dismiss charges.

Writing a bad check, also known as a hot check, is illegal. Banks normally charge a fee to anyone who writes a bad check unintentionally. The punishment for trying to pass a bad check intentionally ranges from a misdemeanor to a felony.

Penal Code 476a PC is the California statute that makes it a crime for a person to write or pass a bad check, knowing there are insufficient funds to cover payment of the check. The offense can be charged as a felony if the value of the bad checks is more than $950.00. Otherwise, the offense is only a misdemeanor.

A bounced check occurs when the writer of the check has insufficient funds available to fulfill the payment amount on the check to the payee. When a check bounces, they are not honored by the depositor's bank, and may result in fees and banking restrictions.

Bouncing a check can happen to anyone. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

If you are given a bad check, you can sue for the amount of the check plus bank fees. You can also add damages to your claim.

If the tellers at the checks bank tell you there ARE sufficient funds you have three options: cash the check immediately (actually get cash - probably not recommended if it's several thousand dollars), take the check to YOUR bank and deposit the funds (this will take 2-3 days for the check to clear - not recommended),

People who write bad checks are normally charged fees by their banks and could be on the hook for any fees incurred by the payee. Knowingly writing a bad check may constitute a misdemeanor or felony, depending on the amount of the check and the state in which it was written.