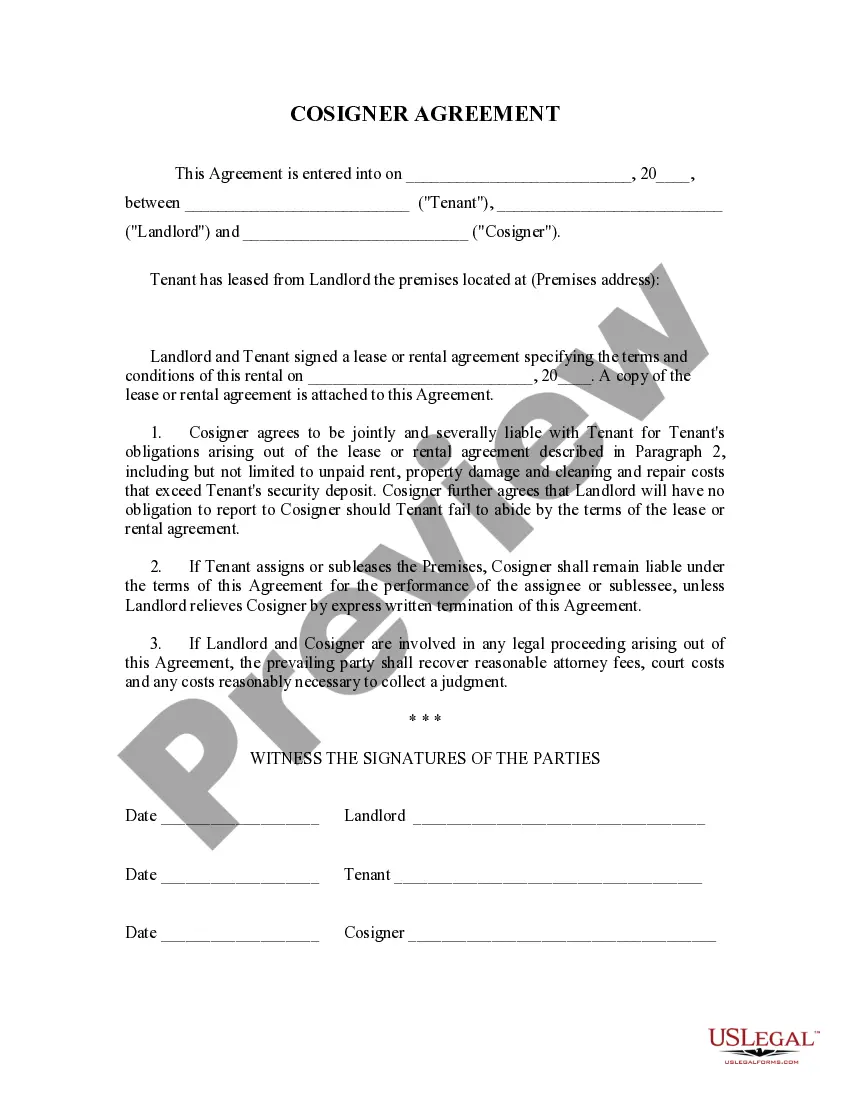

This is a Landlord Tenant Lease Co-Signor Agreement for use by a landlord in contracting with a cosignor on a lease to be liable for rent, damage, etc., if the tenant fails to pay. Cosignor is thereby liable to landlord for payment of rent should tenant not fulfill his/her contractual obligation.

The cosigner is also sometimes be called a guarantor. A guaranty is a contract under which one person (guarantor) agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).