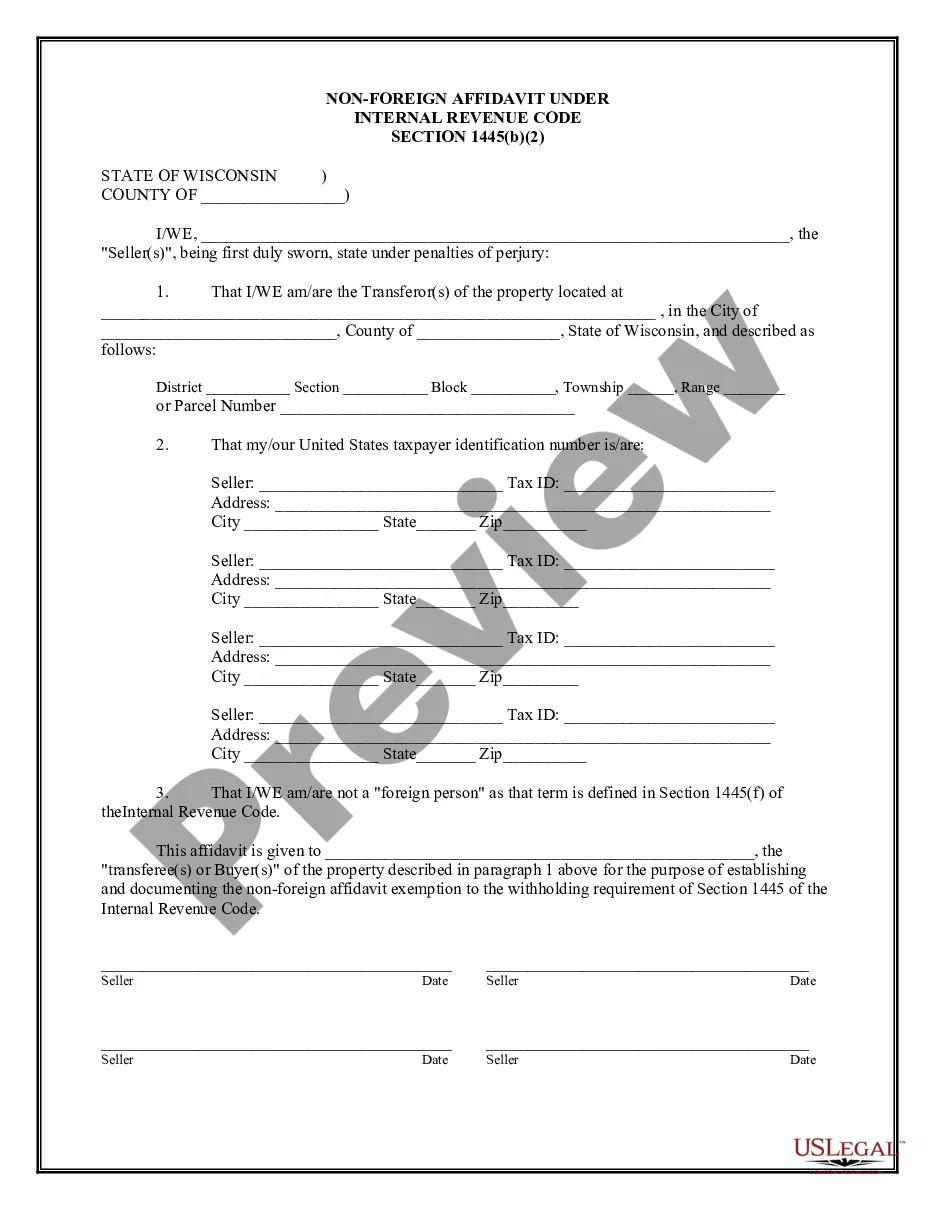

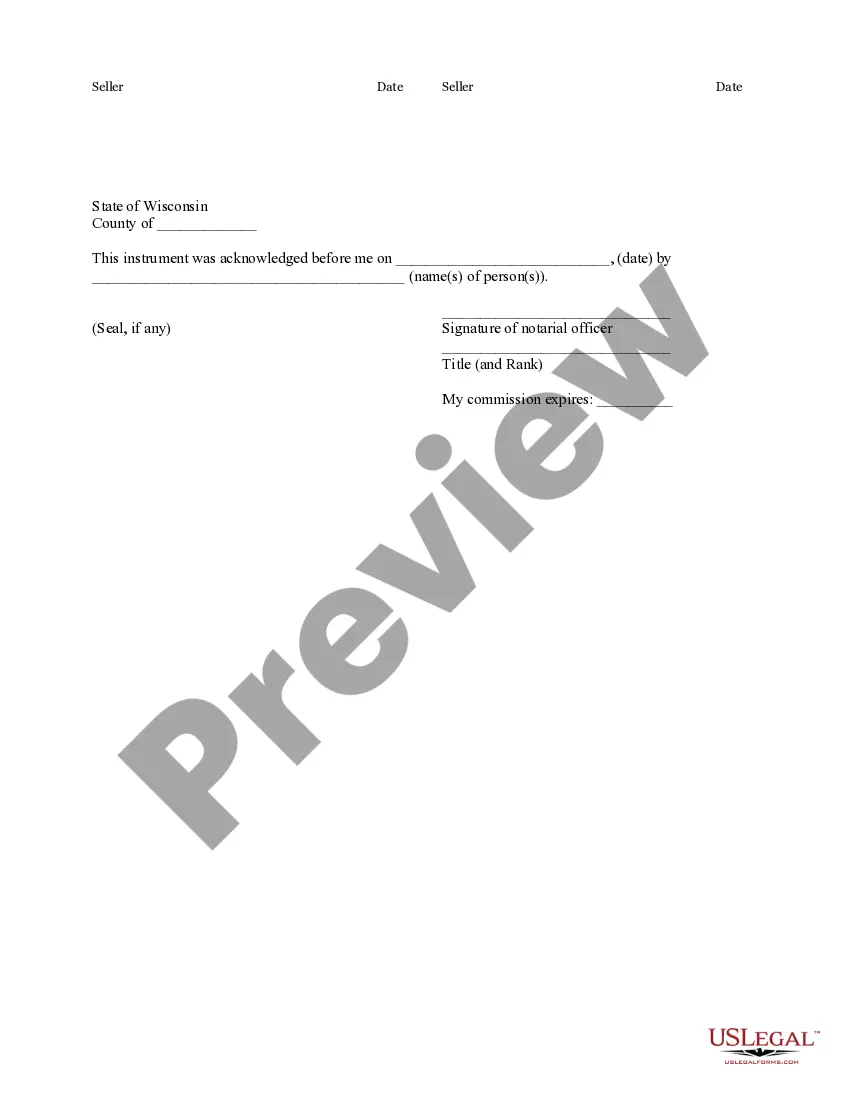

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Wisconsin Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Wisconsin Non-Foreign Affidavit Under IRC 1445?

Out of the great number of services that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates prior to buying them. Its extensive library of 85,000 samples is grouped by state and use for simplicity. All the documents available on the platform have already been drafted to meet individual state requirements by licensed lawyers.

If you already have a US Legal Forms subscription, just log in, search for the template, press Download and get access to your Form name from the My Forms; the My Forms tab holds all your saved forms.

Follow the guidelines listed below to get the document:

- Once you find a Form name, make certain it is the one for the state you need it to file in.

- Preview the form and read the document description just before downloading the template.

- Look for a new sample through the Search engine if the one you have already found is not correct.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the document.

After you have downloaded your Form name, you may edit it, fill it out and sign it in an web-based editor of your choice. Any form you add to your My Forms tab can be reused multiple times, or for as long as it continues to be the most updated version in your state. Our service provides quick and simple access to templates that fit both lawyers as well as their clients.

Form popularity

FAQ

The only other way to avoid FIRPTA is via a withholding certificate. If FIRPTA withholding exceeds the maximum tax liability realized on the sale of the real property, sellers can appeal to the IRS for a lower withholding amount.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

FIRPTA withholding is required to be submitted to the IRS within 20 days of the closing together with IRS Form 8288, U.S. Withholding Tax Return for Disposition by Foreign Persons of U.S. Real Property Interests, and Form 8288-A, Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property

Persons purchasing U.S. real property interests (transferees) from foreign persons, certain purchasers' agents, and settlement officers are required to withhold 15% (10% for dispositions before February 17, 2016) of the amount realized on the disposition (special rules for foreign corporations).

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

The address of the property being transferred (or sold) The seller or transferor's information: Full name. Telephone number. Address. Social Security Number, Federal Employer Identification Number, or California Corporation Number.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

Rather, A buyer or other transferee of a U.S. real property interest, and a corporation, qualified investment entity, or fiduciary that is required to withhold tax, must file TIP Form 8288 to report and transmit the amount withheld. If two or more persons are joint transferees, each is obligated to withhold.