Wisconsin Small Estate Heirship Affidavit Package for Estates Not More Than $50,000

Description

How to fill out Wisconsin Small Estate Heirship Affidavit Package For Estates Not More Than $50,000?

Out of the great number of services that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing forms before purchasing them. Its complete library of 85,000 samples is grouped by state and use for simplicity. All the documents on the platform have already been drafted to meet individual state requirements by licensed legal professionals.

If you already have a US Legal Forms subscription, just log in, look for the form, hit Download and gain access to your Form name in the My Forms; the My Forms tab holds all your downloaded forms.

Stick to the guidelines listed below to obtain the document:

- Once you discover a Form name, make sure it is the one for the state you need it to file in.

- Preview the template and read the document description just before downloading the template.

- Search for a new sample using the Search field if the one you’ve already found is not appropriate.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the document.

Once you have downloaded your Form name, you are able to edit it, fill it out and sign it in an online editor that you pick. Any form you add to your My Forms tab can be reused many times, or for as long as it remains the most updated version in your state. Our service provides quick and easy access to samples that fit both legal professionals and their clients.

Form popularity

FAQ

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

In Wisconsin, the estate executor is known as a "personal representative". Subject to approval of the court, executor fees are set at 2% of the net value of the estate assets, or a rate agreed with the decedent or the majority interest of the heirs.

In Michigan you can use an Affidavit if the estate does not include real property and the value of the entire estate, less liens and encumbrances, is less than $15,000. There is a 28-day waiting period.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

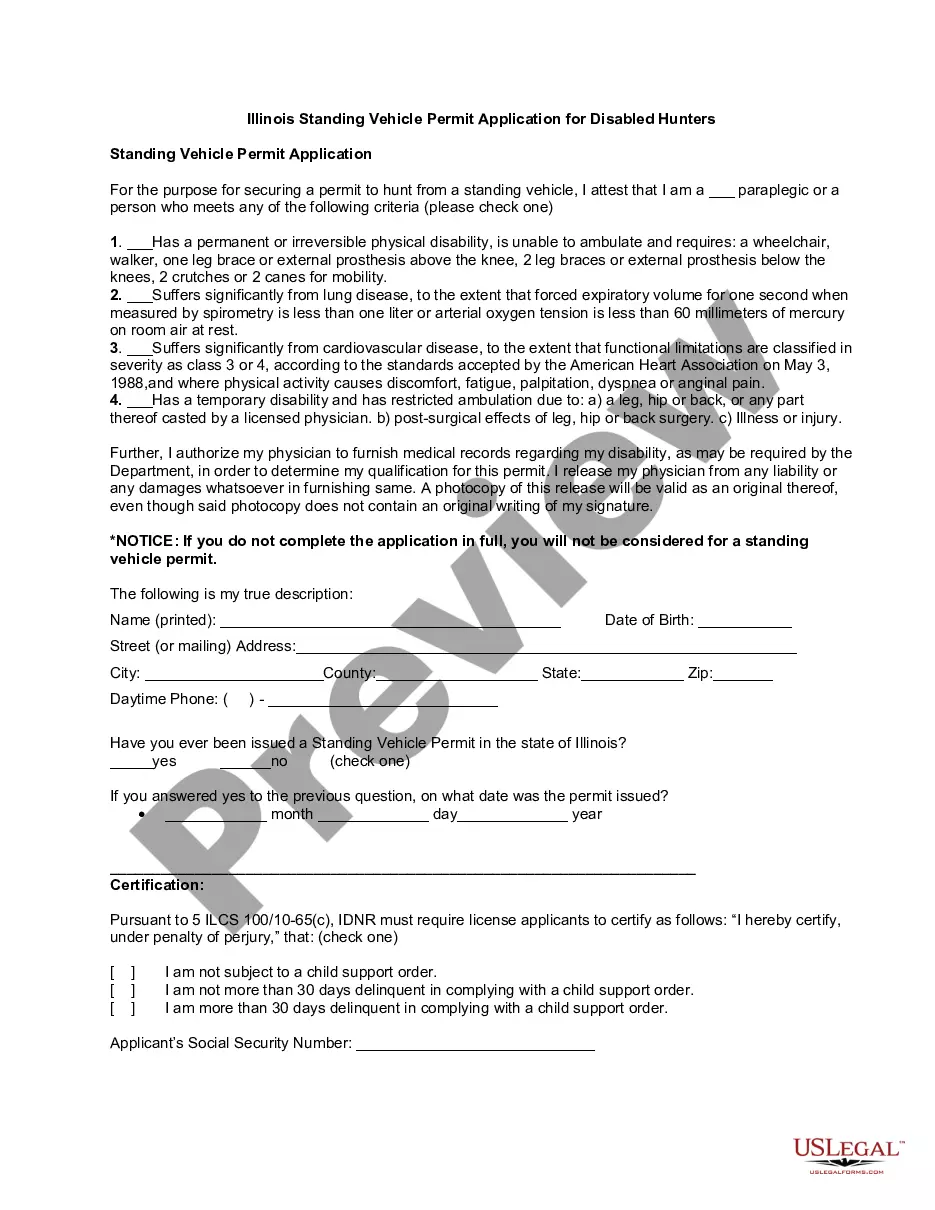

The Illinois small estate affidavit provides a streamlined way for an heir-at-law of a decedent to gather and distribute the assets of the estate of a person who died, provided that no other petition to open an estate in probate court has been filed and that the assets of the person who died do not exceed $100,000.

To be able to file a small estate affidavit in Texas for a loved one, when no will was executed, you must be a person who would inherit under Texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or children).

In Wisconsin, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).