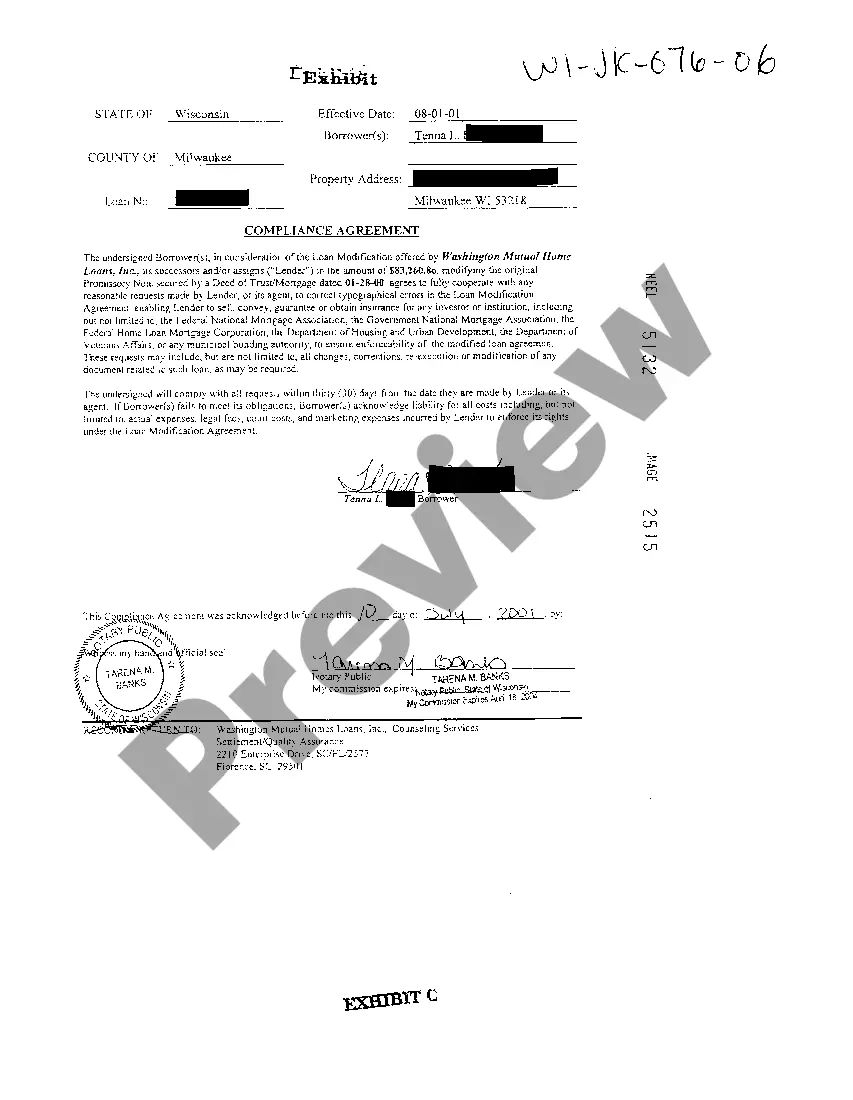

Wisconsin Compliance Agreement

Description

How to fill out Wisconsin Compliance Agreement?

Out of the great number of platforms that offer legal templates, US Legal Forms provides the most user-friendly experience and customer journey while previewing forms before purchasing them. Its comprehensive library of 85,000 samples is grouped by state and use for efficiency. All the documents available on the platform have been drafted to meet individual state requirements by qualified legal professionals.

If you already have a US Legal Forms subscription, just log in, look for the form, hit Download and access your Form name from the My Forms; the My Forms tab holds all of your saved documents.

Keep to the tips listed below to obtain the document:

- Once you see a Form name, make certain it is the one for the state you need it to file in.

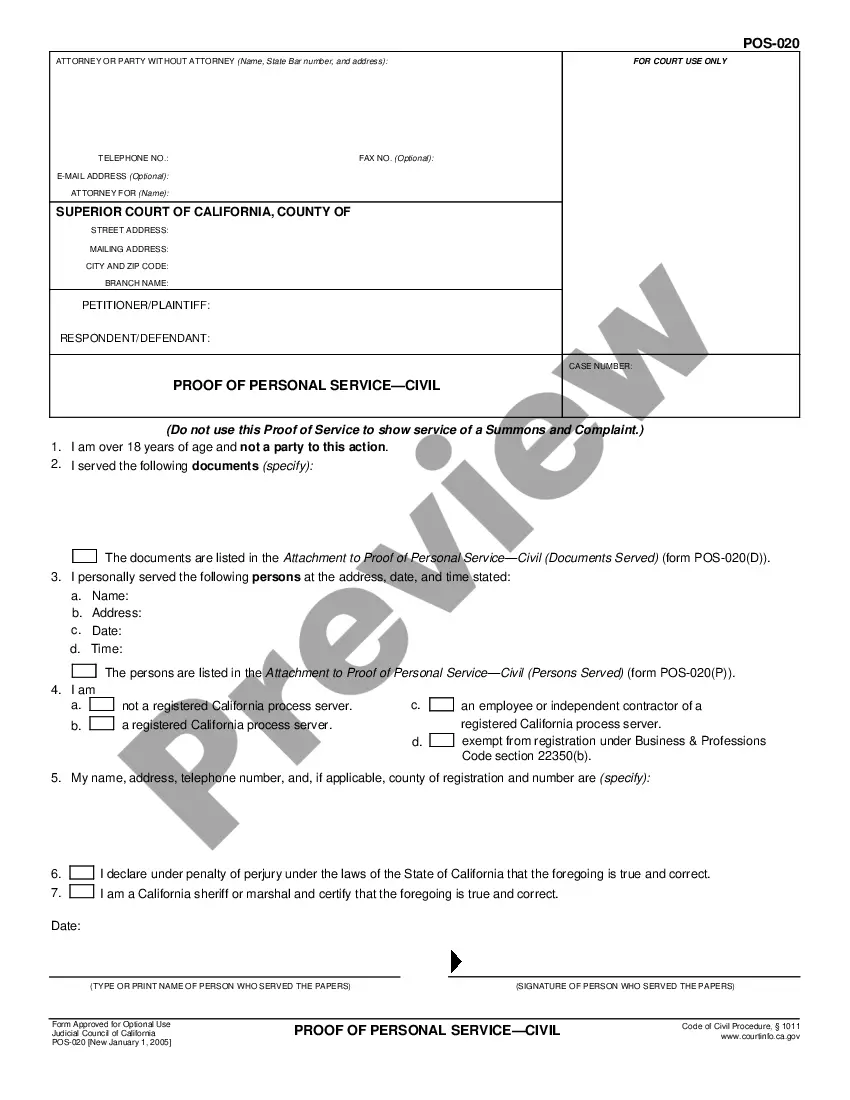

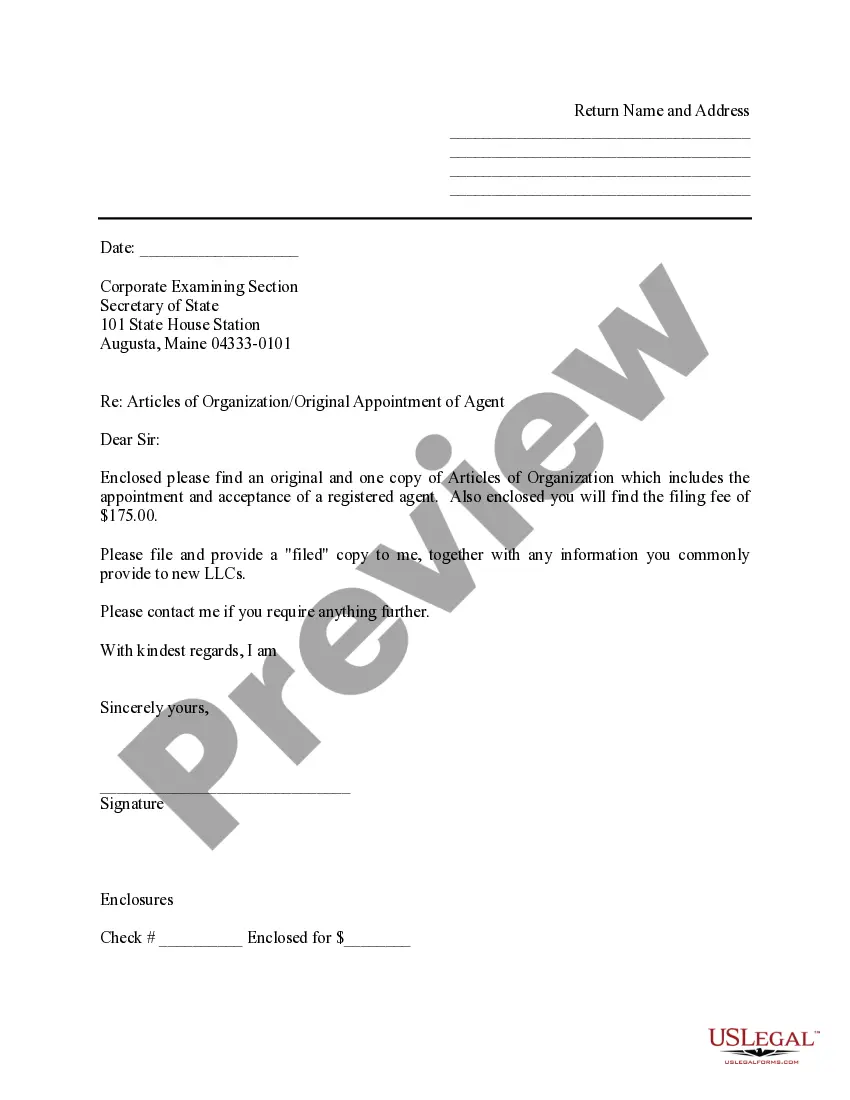

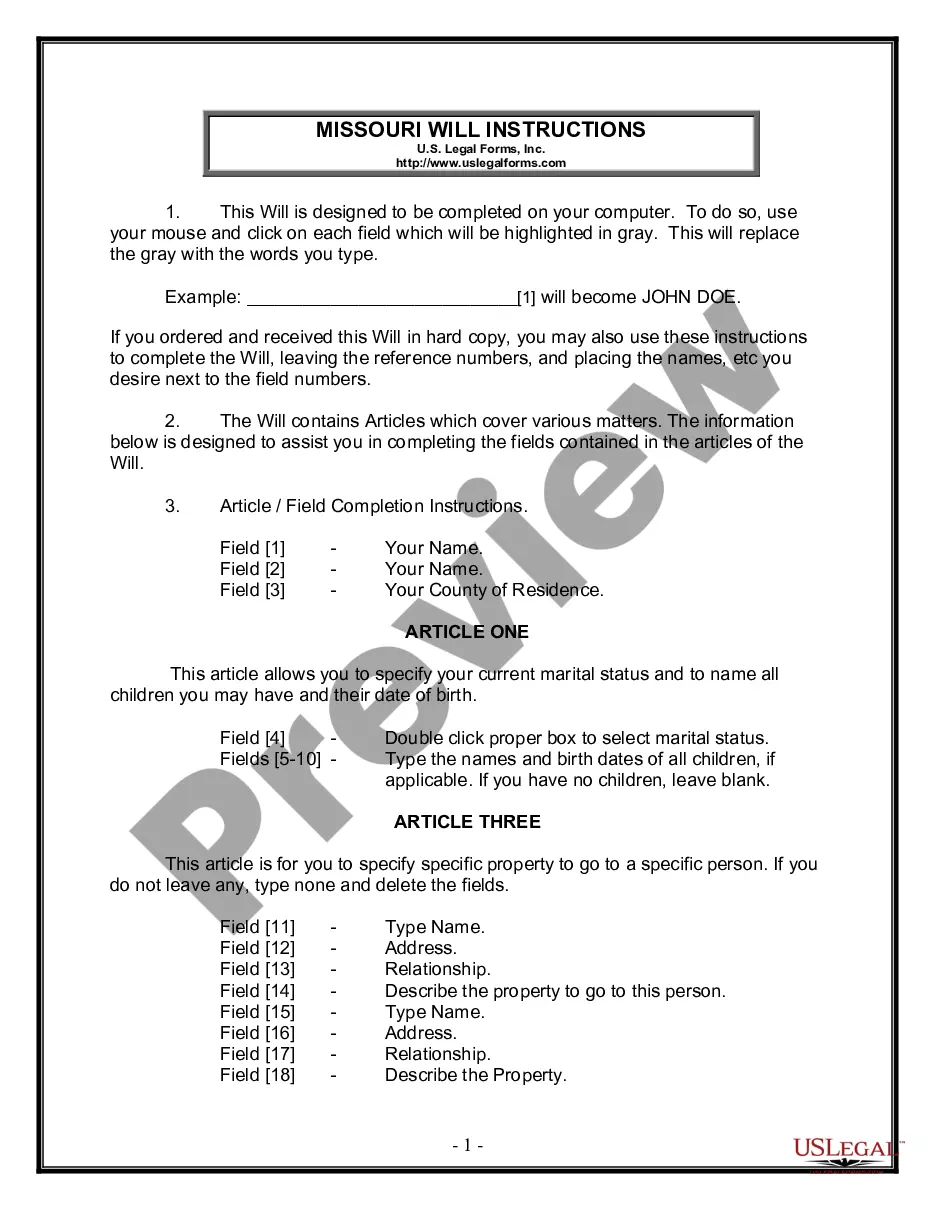

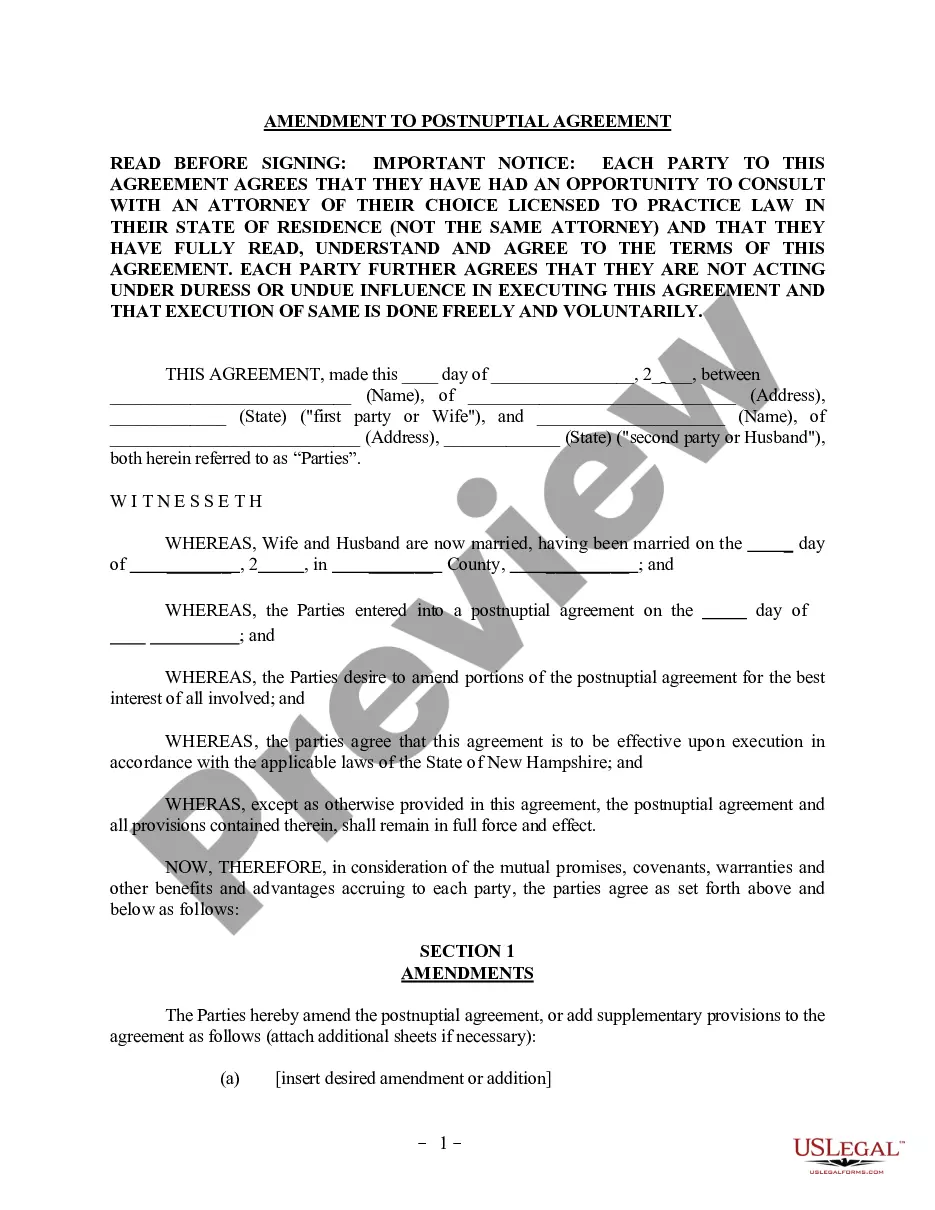

- Preview the template and read the document description before downloading the template.

- Look for a new sample through the Search field if the one you’ve already found is not proper.

- Click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the template.

After you have downloaded your Form name, you may edit it, fill it out and sign it in an web-based editor that you pick. Any document you add to your My Forms tab might be reused multiple times, or for as long as it continues to be the most up-to-date version in your state. Our service provides quick and simple access to samples that suit both attorneys as well as their customers.

Form popularity

FAQ

Private note holders, usually seller-financed property or business sales. Hedge or private equity funds that buy in bulk from banks and servicers and then resell. Note exchanges and marketplaces.

A promissory note is often referred to as a mortgage note and is the document generated and signed at closing. A mortgage, or mortgage loan, is a loan that allows a borrower to finance a home.The promissory note is exactly what it sounds like the borrower's written, signed promise to repay the loan.

Borrowers Affidavit: This document must be signed by the borrower in the presence of a notary public. In the document the borrower attests that they have not done anything to affect the title to property, that they are not the subject of divorce or bankruptcy proceedings, etc.

Correction Agreement Limited Power of Attorney This document authorizes the lender to make corrections to clerical errors.The type of clerical errors which are typically corrected would include mispelled names, typos, and other clerical mistakes which don't effect the conditions of the loan in any way.

What is a Compliance Agreement? A Compliance Agreement is a document in a closing loan document package in which a borrower agrees to comply with requests from the lender or closing agent to correct typographical or clerical errors and inadvertent mistakes in the loan documentation.

A mortgage note is the document that you sign at the end of your home closing. It contains all the terms of the agreement between the borrower and the lender and accurately reflects all the terms of the mortgage.

A limited power of attorney is a document that gives the named person, the agent or attorney-in-fact, with the legal authority to perform certain actions on behalf of the person who signs the document (known as the principal).

Essentially, a mortgage promissory note is an agreement that promises that the money borrowed from a lender will be paid back by the borrower. The mortgage note also explains how the loan is to be repaid, including details about the monthly payment amount and length of time for repayment.

When you buy a note and mortgage, you're buying the debt that remains to be paid on the note, secured by the asset outlined in the mortgage. You're not buying the property -- you're buying the debt and secured interest in the property. Essentially, a note buyer steps into the shoes of the bank.