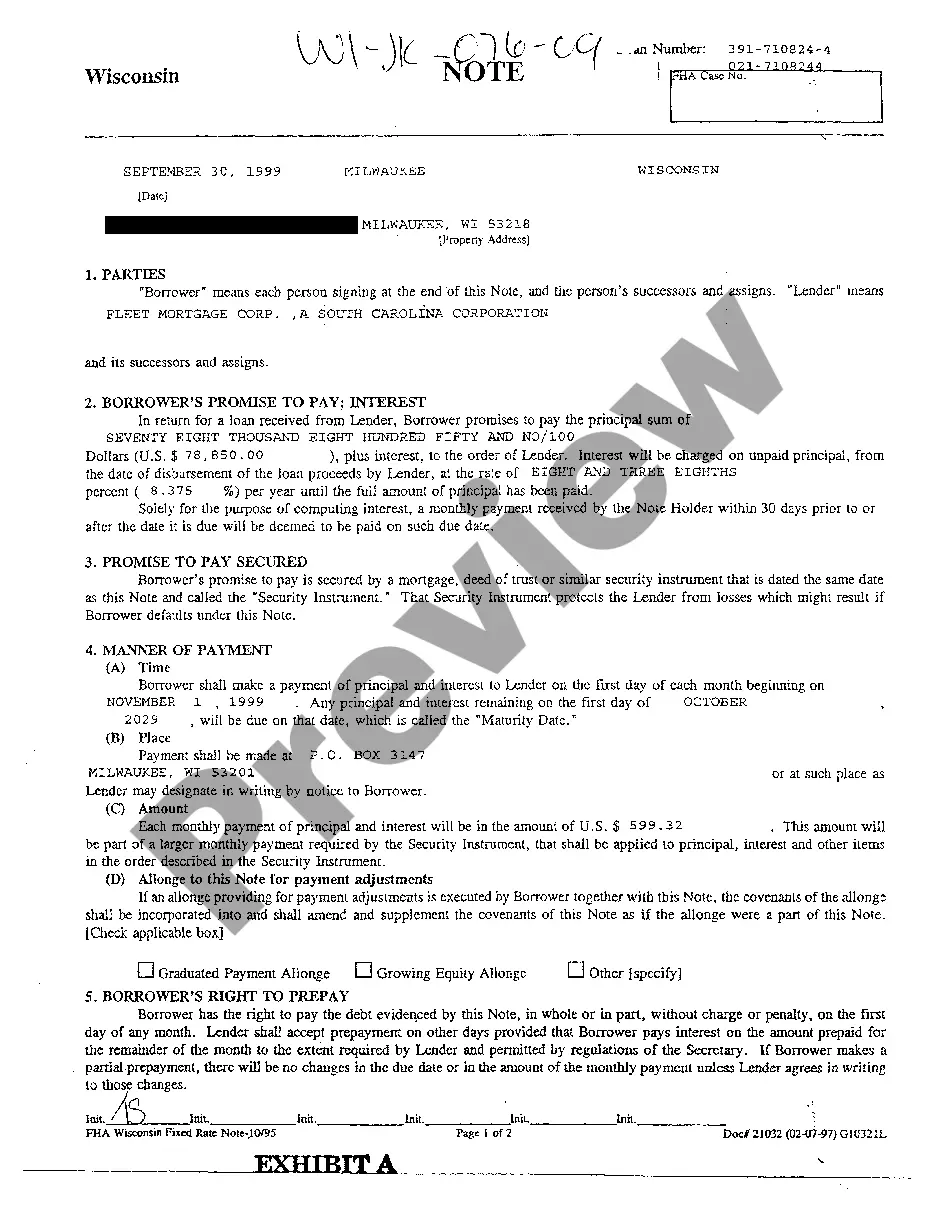

Wisconsin Promissory Note

Description

How to fill out Wisconsin Promissory Note?

Out of the multitude of services that offer legal samples, US Legal Forms provides the most user-friendly experience and customer journey while previewing templates prior to buying them. Its complete library of 85,000 templates is grouped by state and use for efficiency. All of the forms available on the platform have already been drafted to meet individual state requirements by qualified legal professionals.

If you have a US Legal Forms subscription, just log in, search for the form, click Download and get access to your Form name from the My Forms; the My Forms tab holds your saved documents.

Stick to the guidelines listed below to get the form:

- Once you see a Form name, ensure it is the one for the state you need it to file in.

- Preview the template and read the document description prior to downloading the sample.

- Look for a new sample via the Search field if the one you’ve already found is not proper.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

After you’ve downloaded your Form name, it is possible to edit it, fill it out and sign it with an online editor of your choice. Any document you add to your My Forms tab might be reused multiple times, or for as long as it continues to be the most updated version in your state. Our service offers fast and easy access to templates that suit both legal professionals and their customers.

Form popularity

FAQ

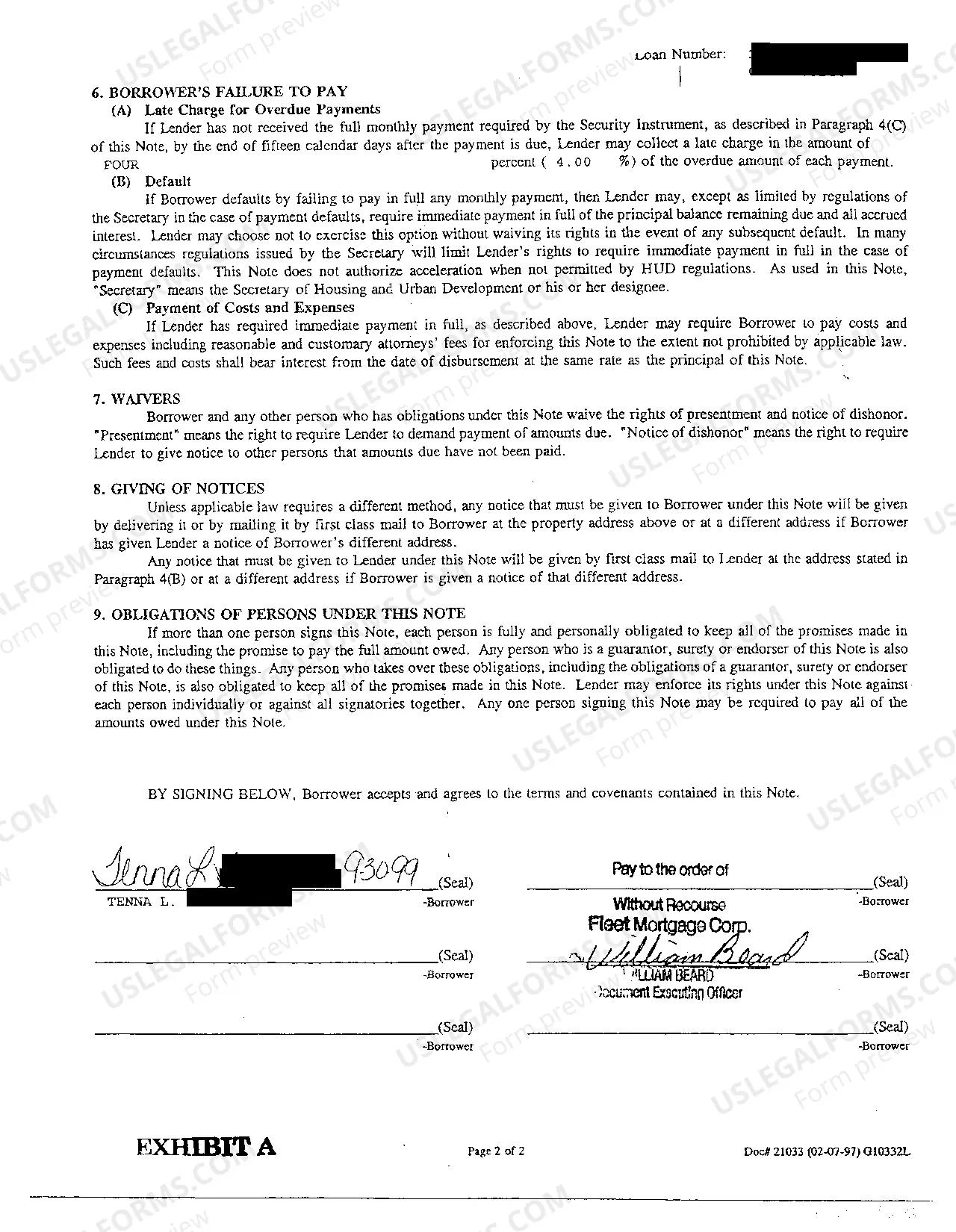

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied. When the loan is paid off, the trustee automatically records a deed of reconveyance at the county recorder's office for safekeeping.

No. California promissory notes do not need to be notarized or witnessed for validity.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.