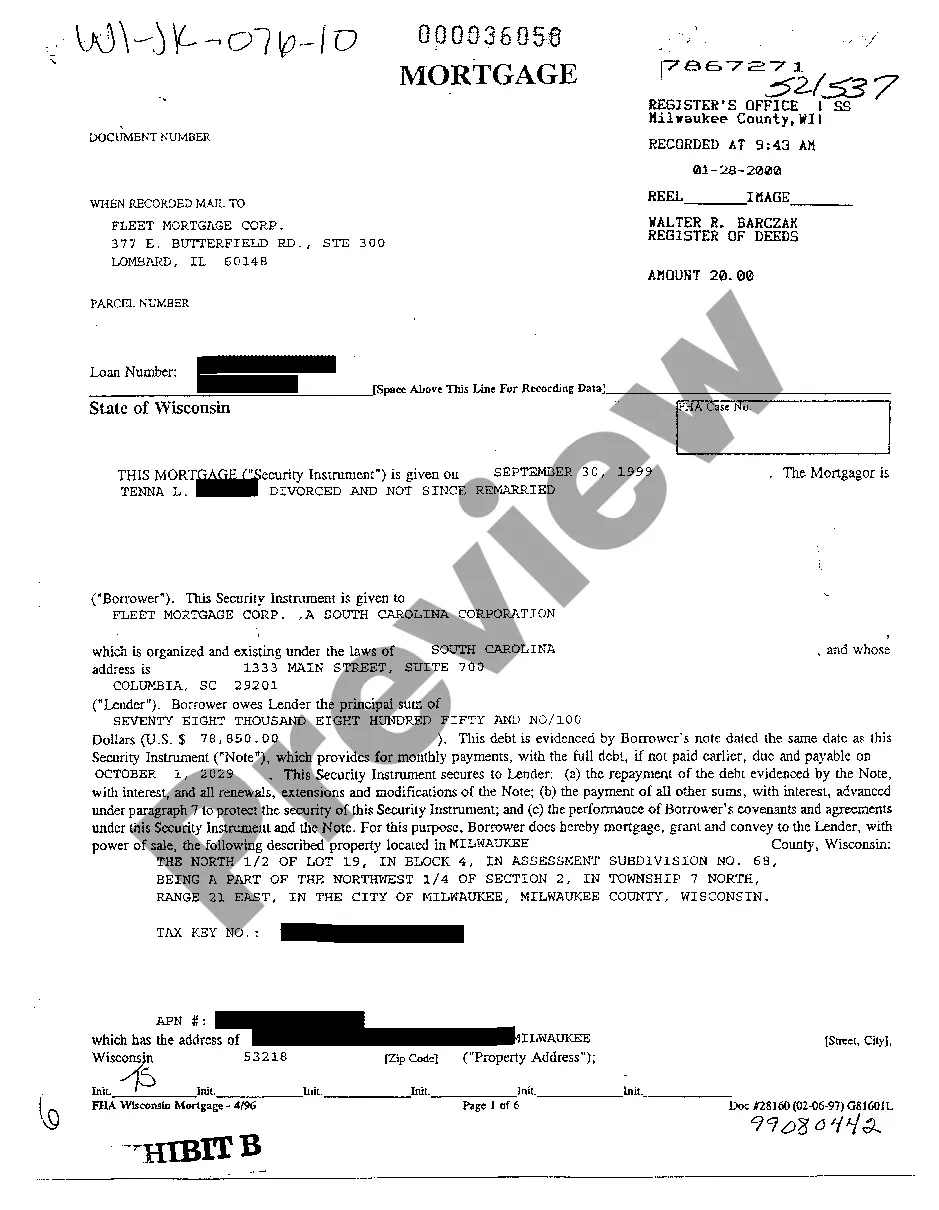

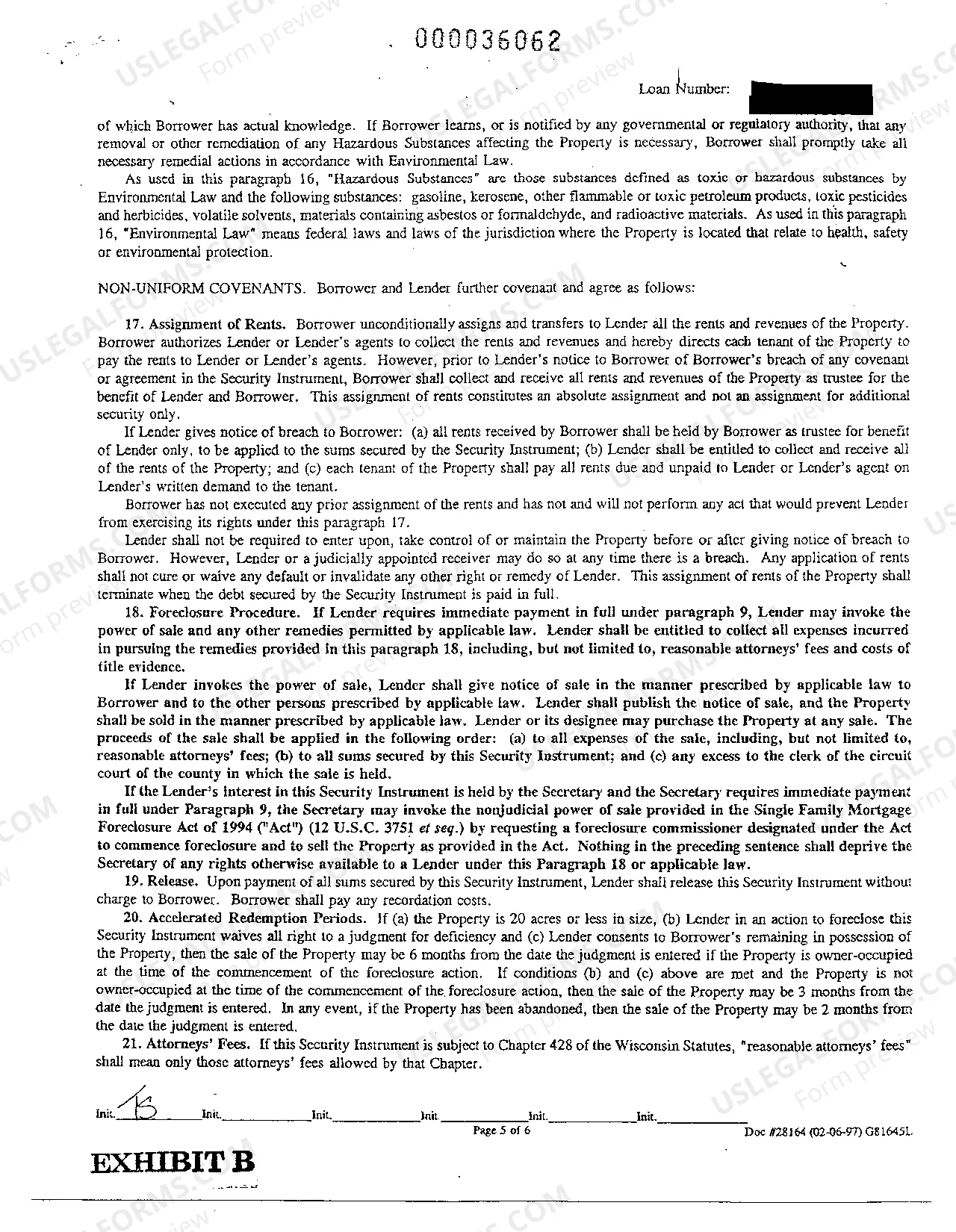

Wisconsin Mortgage

Description

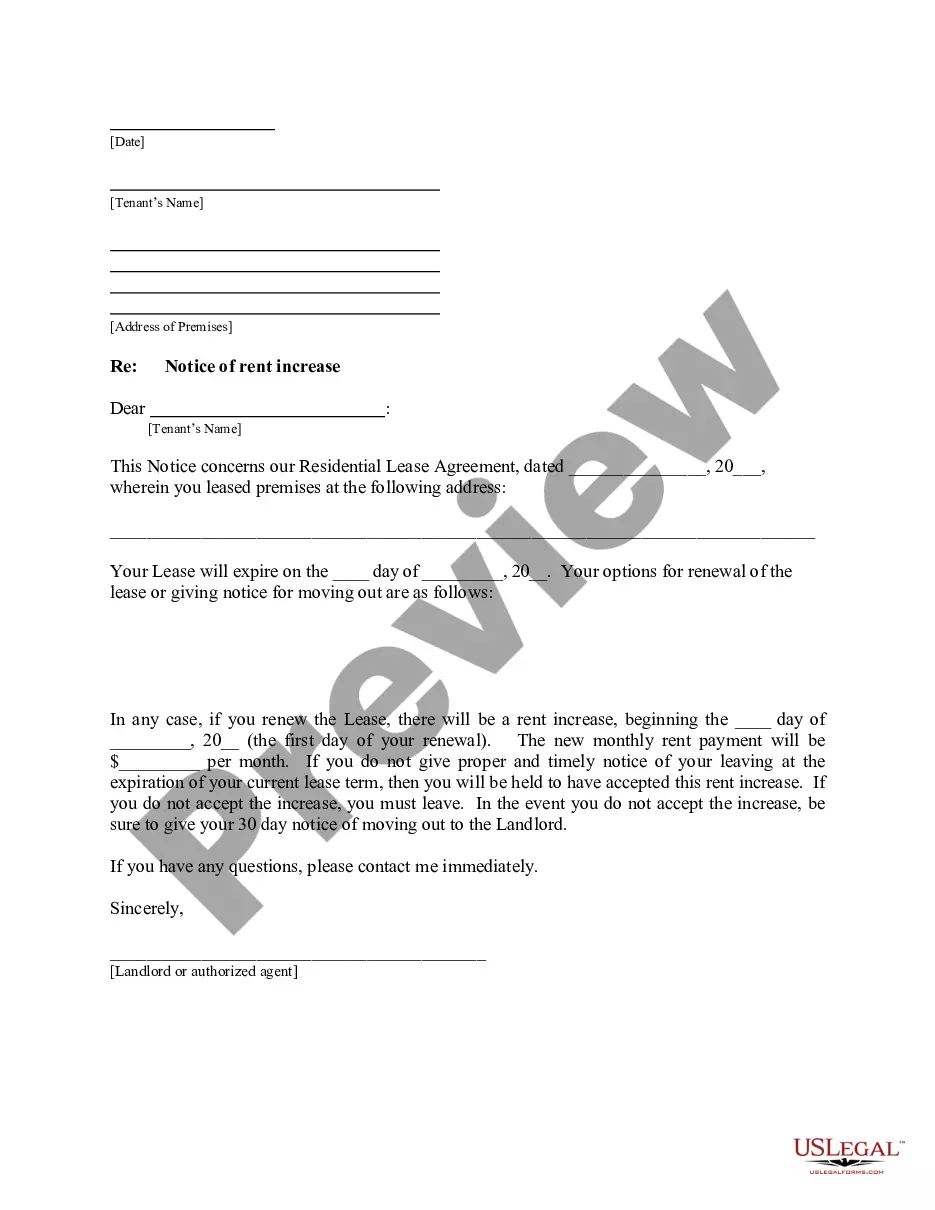

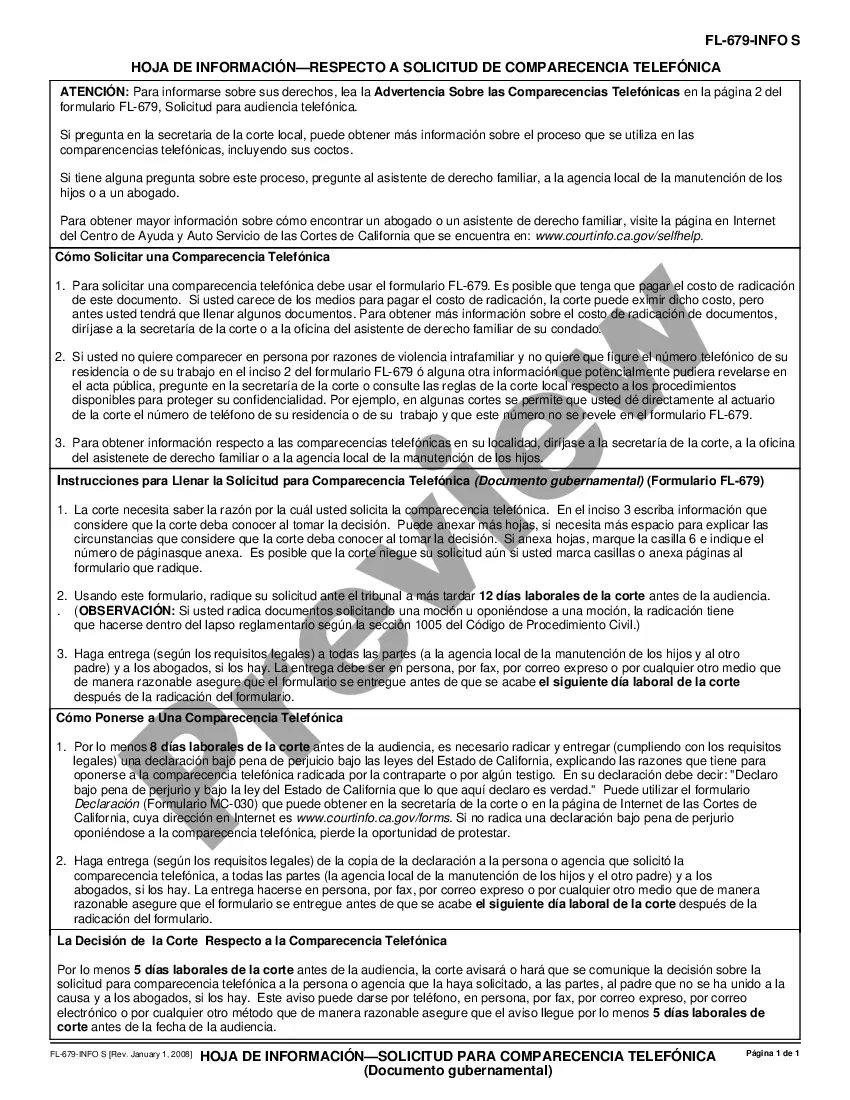

How to fill out Wisconsin Mortgage?

Out of the large number of services that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates before buying them. Its extensive catalogue of 85,000 samples is categorized by state and use for simplicity. All the forms available on the platform have been drafted to meet individual state requirements by qualified lawyers.

If you already have a US Legal Forms subscription, just log in, search for the template, hit Download and obtain access to your Form name in the My Forms; the My Forms tab holds your downloaded documents.

Stick to the guidelines listed below to obtain the document:

- Once you find a Form name, make certain it is the one for the state you really need it to file in.

- Preview the template and read the document description just before downloading the sample.

- Look for a new template via the Search engine if the one you’ve already found isn’t proper.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the document.

After you’ve downloaded your Form name, you are able to edit it, fill it out and sign it with an web-based editor of your choice. Any form you add to your My Forms tab might be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our platform provides quick and simple access to samples that fit both attorneys as well as their clients.

Form popularity

FAQ

Have a good FICO® credit score (Most loans require a score of at least 620) Meet income limits (Varies by county) Property must be your primary residence.

Programs for borrowers buying a house with a 600 credit score include: FHA home loan These are government loans insured by the Federal Housing Administration (FHA). FHA loans are intended for people with lower credit; they allow a minimum credit score between 500 and 580.

Conventional / Fixed Rate Mortgage. Conventional fixed rate loans are a safe bet because of their consistency the monthly payments won't change over the life of your loan. Interest-Only Mortgage. Adjustable Rate Mortgage (ARM) FHA Loans. VA Loans. Combo / Piggyback. Balloon. Jumbo.

Minimum Credit Score Needed: You'll need a minimum credit score of 580 to qualify for an FHA loan that requires a down payment of just 3.5%. There is no minimum FICO®Score, though, to qualify for an FHA loan that requires a down payment of 10% or more.

Here are four types of mortgage loans for home buyers today: fixed rate, FHA mortgages, VA mortgages and interest-only loans.

Still, to buy a home, aim for a score of at least 620, recognizing that other factors weigh in the decision and that some banks may require a higher score. With an FHA mortgage, however, a FICO score of 600 or higher is enough to qualify for the 3.5% down payment loan.

The Mortgage Satisfaction Act (2013 Wisconsin Act 66), enacted in December 2013, governs satisfaction procedures, including required payoff statements and penalties for secured lenders who do not timely submit a satisfaction of mortgage for recording.

Fixed-rate loans are ideal for buyers who plan to stay put for many years. A 30-year fixed loan might give you wiggle room to meet other financial needs.Adjustable-rate mortgages are riskier than fixed-rate ones but can make sense if you plan to sell the house or refinance the mortgage in the near term.

Borrowers with FICO®Scores of 650 are likely to be offered adjustable-rate mortgage (ARM) loans, with introductory interest rates that apply for a set number of yearstypically one, but sometimes three, five, seven or even 10and then change annually.