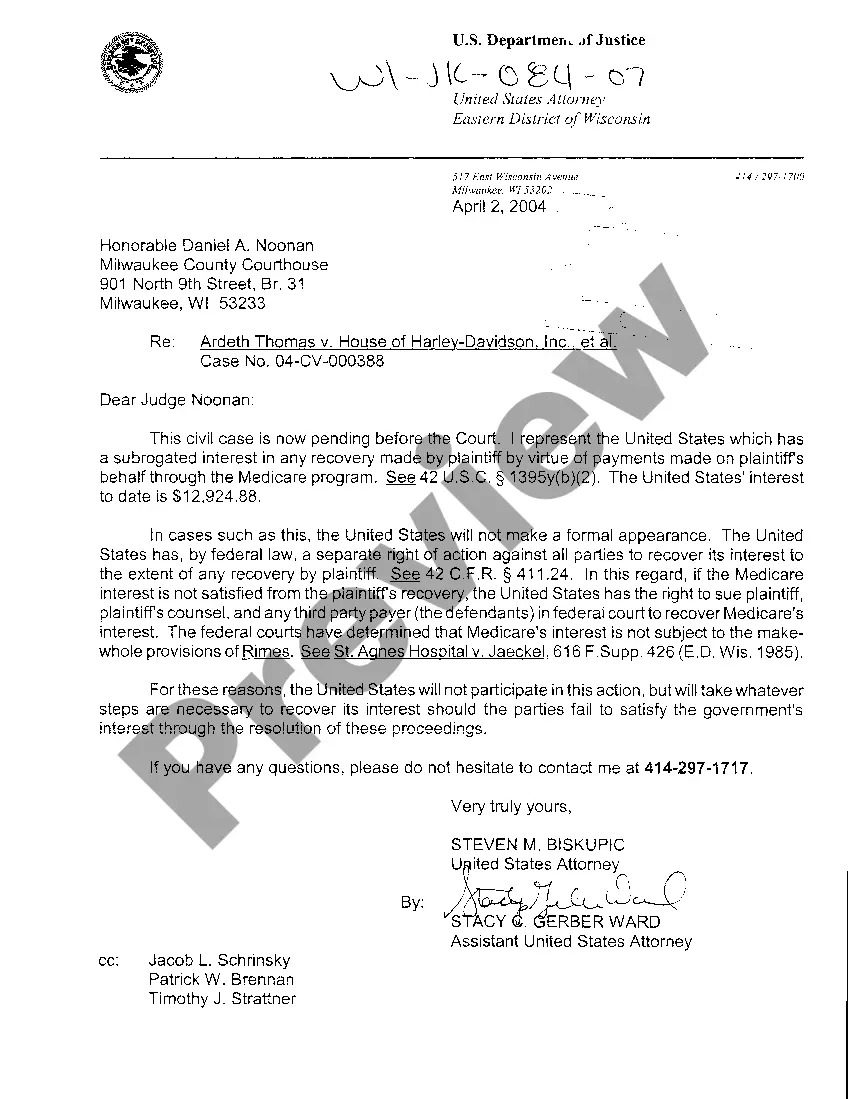

Wisconsin Letter regarding Medicare Interest

Description

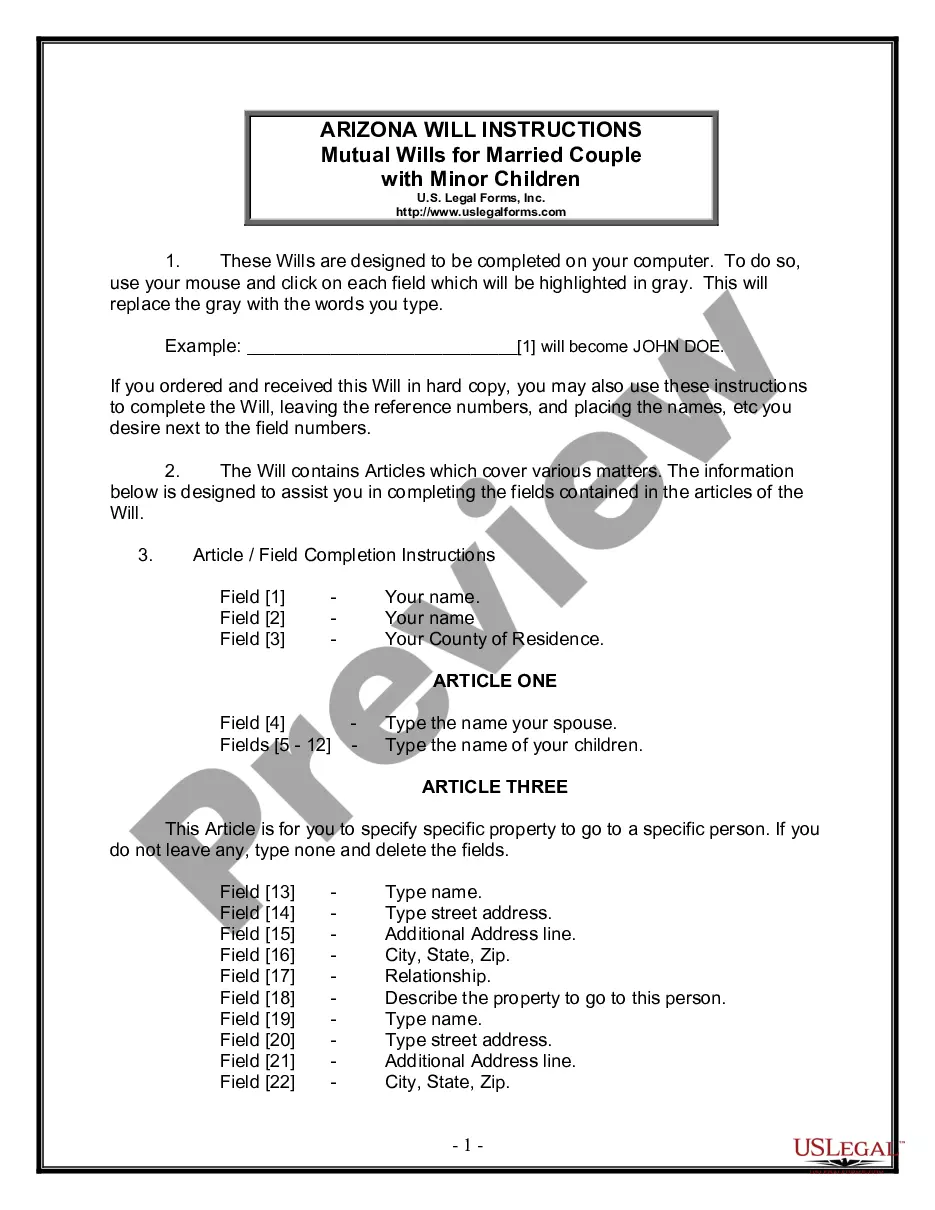

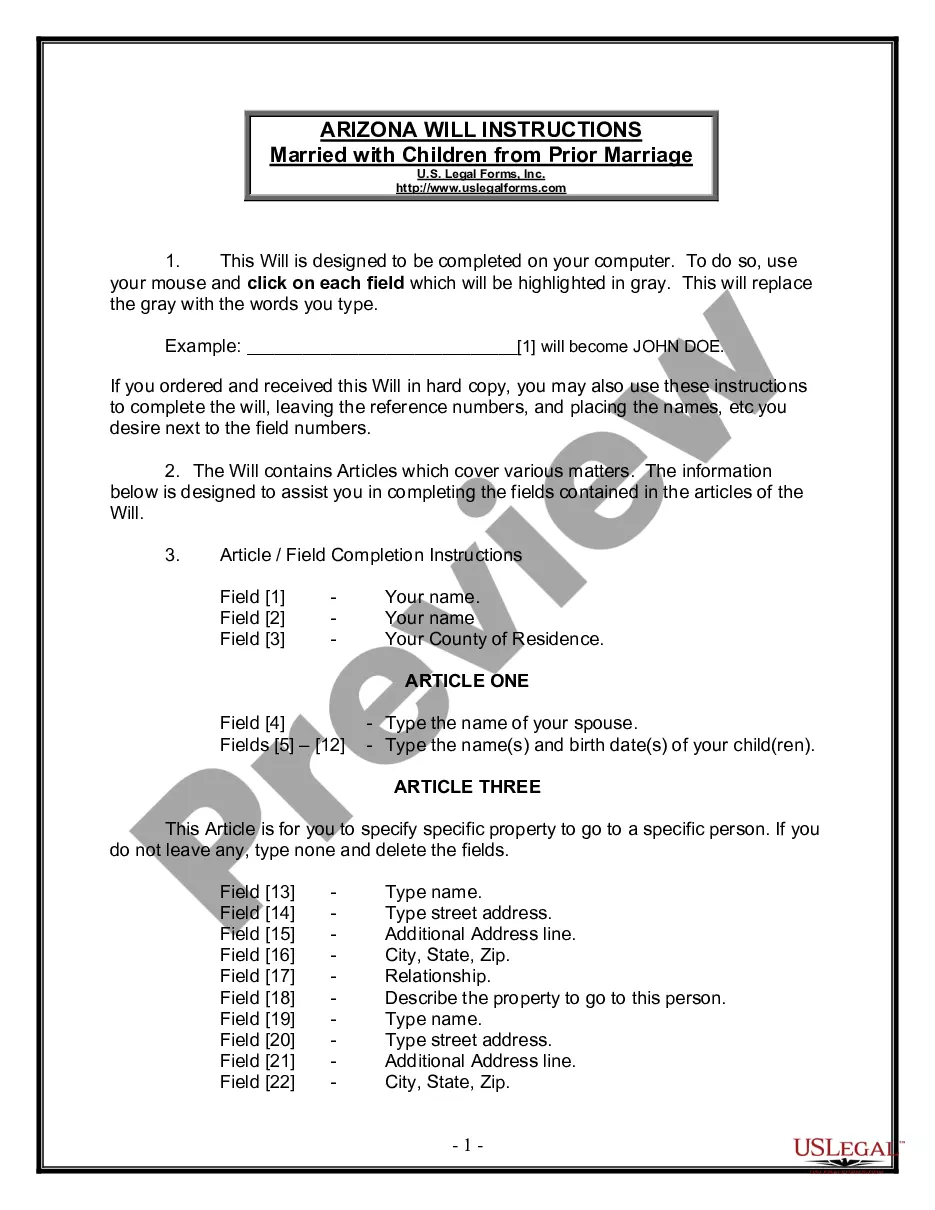

How to fill out Wisconsin Letter Regarding Medicare Interest?

Out of the multitude of services that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms prior to buying them. Its extensive catalogue of 85,000 samples is categorized by state and use for efficiency. All of the forms available on the service have already been drafted to meet individual state requirements by qualified lawyers.

If you already have a US Legal Forms subscription, just log in, look for the form, press Download and access your Form name from the My Forms; the My Forms tab keeps all of your saved forms.

Keep to the guidelines listed below to get the document:

- Once you find a Form name, ensure it is the one for the state you need it to file in.

- Preview the form and read the document description before downloading the sample.

- Search for a new template via the Search field in case the one you’ve already found is not appropriate.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

When you have downloaded your Form name, you may edit it, fill it out and sign it in an web-based editor that you pick. Any form you add to your My Forms tab might be reused many times, or for as long as it remains the most up-to-date version in your state. Our service offers quick and easy access to samples that fit both attorneys as well as their customers.

Form popularity

FAQ

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 (PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA (1-800-772-1213) to get this form.

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium.To learn more, read Medicare Premiums: Rules For Higher-Income Beneficiaries.

Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance). You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years.

Per-beneficiary spending for Medicare in Wisconsin Nationwide, average per-beneficiary Original Medicare spending stood at $10,096.

If you get help with Medicare costs through a state Medicaid program, such as a Medicare Savings Program, then your Medicare premiums may be paid for by the state.In this case, your Medicare plan will send you a bill for your premium, and you'll send the payment to your plan, not the Medicare program.

The Medicare Premium Bill (CMS-500) is a bill for people who pay Medicare directly for their Part A premium, Part B premium, and/or Part D IRMAA (an extra amount in addition to the Medicare Part D premium).Your bill lists the dates you're paying for.

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

If you buy only Part B, you'll get a "Medicare Premium Bill" (Form CMS-500) every 3 months. If you buy Part A or if you owe Part D IRMAA, you'll get a Medicare Premium Bill every month.

You're not Drawing Social Security Income Yet This is the main reason that your bill is much larger than you expected. It's true that if you are drawing Social Security, the Part B premium gets deducted each month from your check.