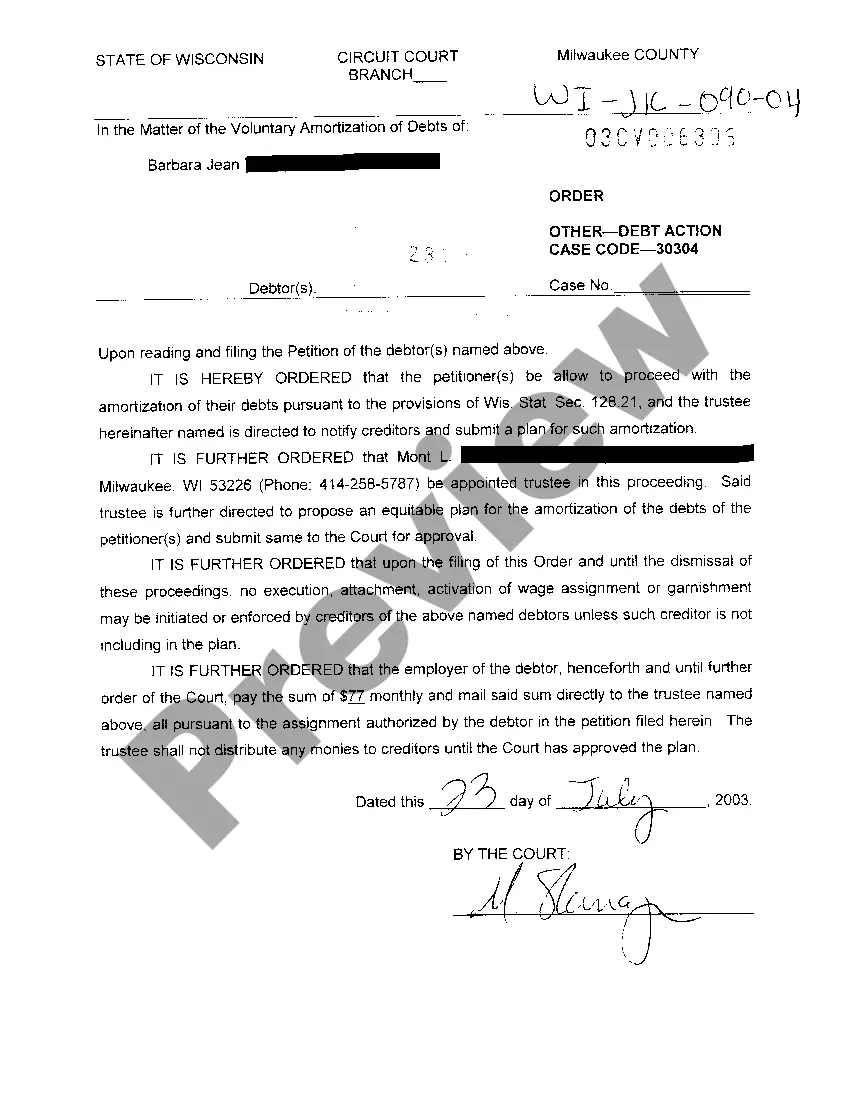

Wisconsin Order - Debt Action

Description

How to fill out Wisconsin Order - Debt Action?

Out of the large number of services that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms before buying them. Its complete catalogue of 85,000 samples is grouped by state and use for simplicity. All of the documents available on the service have already been drafted to meet individual state requirements by licensed legal professionals.

If you have a US Legal Forms subscription, just log in, search for the template, press Download and get access to your Form name from the My Forms; the My Forms tab keeps all your downloaded documents.

Follow the tips below to get the form:

- Once you see a Form name, ensure it’s the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Look for a new template via the Search engine if the one you’ve already found is not proper.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the document.

After you’ve downloaded your Form name, you are able to edit it, fill it out and sign it with an online editor that you pick. Any form you add to your My Forms tab might be reused multiple times, or for as long as it remains to be the most updated version in your state. Our platform offers quick and easy access to templates that fit both legal professionals and their customers.

Form popularity

FAQ

For Wisconsin, the statute of limitations on debt is six years (more on what this means below). Speak with an attorney to discuss the next step if you're past the statute. Submit a dispute.

In Wisconsin, the statute of limitations on a judgment can be up to 20 years.

Small claims court is limited to claims of $10,000 or less. However, third-party complaints, personal injury claims, and actions based in tort are limited to claims of $5,000 or less. Claims exceeding the maximum amount allowed must be filed in civil court.

In Wisconsin, a judgment becomes a lien for 10 years on all real property the judgment-debtor owns or acquires in the county or counties where the judgment is docketed. A judgment-creditor has 20 years from the judgment date to have a county sheriff attempt to seize the debtor's property.

Renew the judgment Money judgments automatically expire (run out) after 10 years.If the judgment is not renewed, it will not be enforceable any longer and you will not have to pay any remaining amount of the debt. Once a judgment has been renewed, it cannot be renewed again until 5 years later.

In the fiscal year of 2019, Wisconsin's state debt stood at about 22.57 billion U.S. dollars. The national debt of the United Stated can be found here.

In most cases, judgments can stay on your credit reports for up to seven years. This means that the judgment will continue to have a negative effect on your credit score for a period of seven years. In some states, judgments can stay on as long as ten years, or indefinitely if they remain unpaid.

A judgment can remain on your credit report for seven years or until the statute of limitations expires, whichever is longer. In Wisconsin, the statute of limitations on a judgment can be up to 20 years.

Electronically filed cases are subject to a fee of $20 per case per party. See page 4. CSS = court support services surcharge, 814.85: $51 for claims $10,000 or less, $169 for claims over $10,000, $68 for claims other than money judgments.