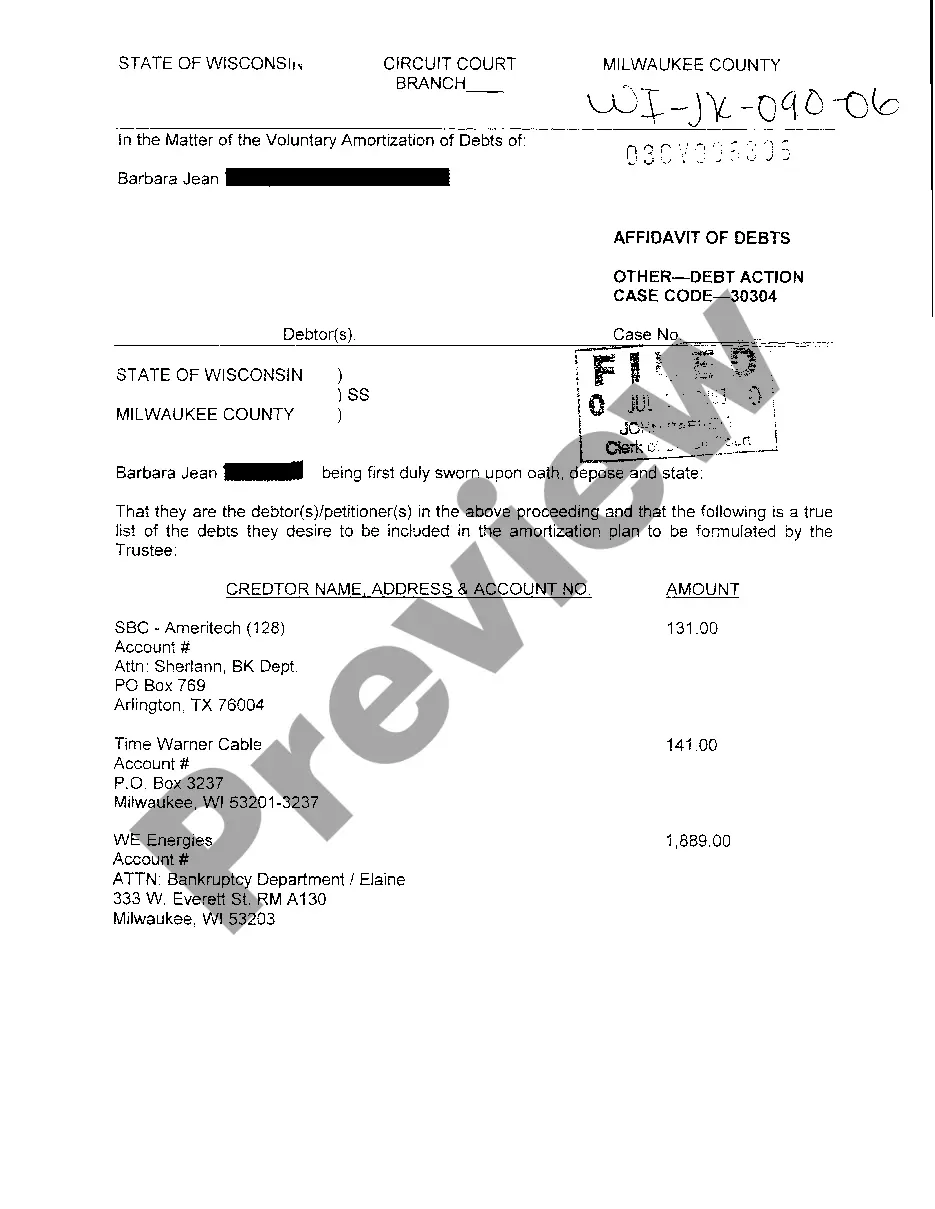

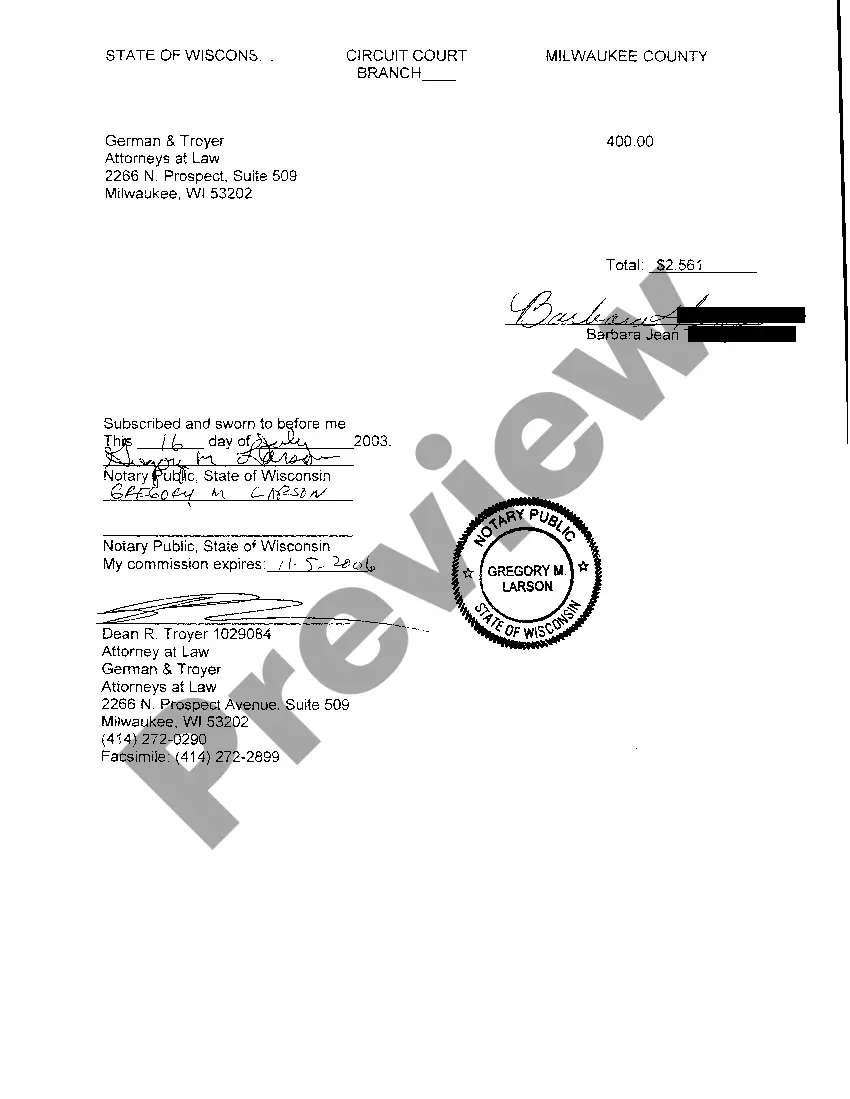

Wisconsin Affidavit Of Debts

Description

How to fill out Wisconsin Affidavit Of Debts?

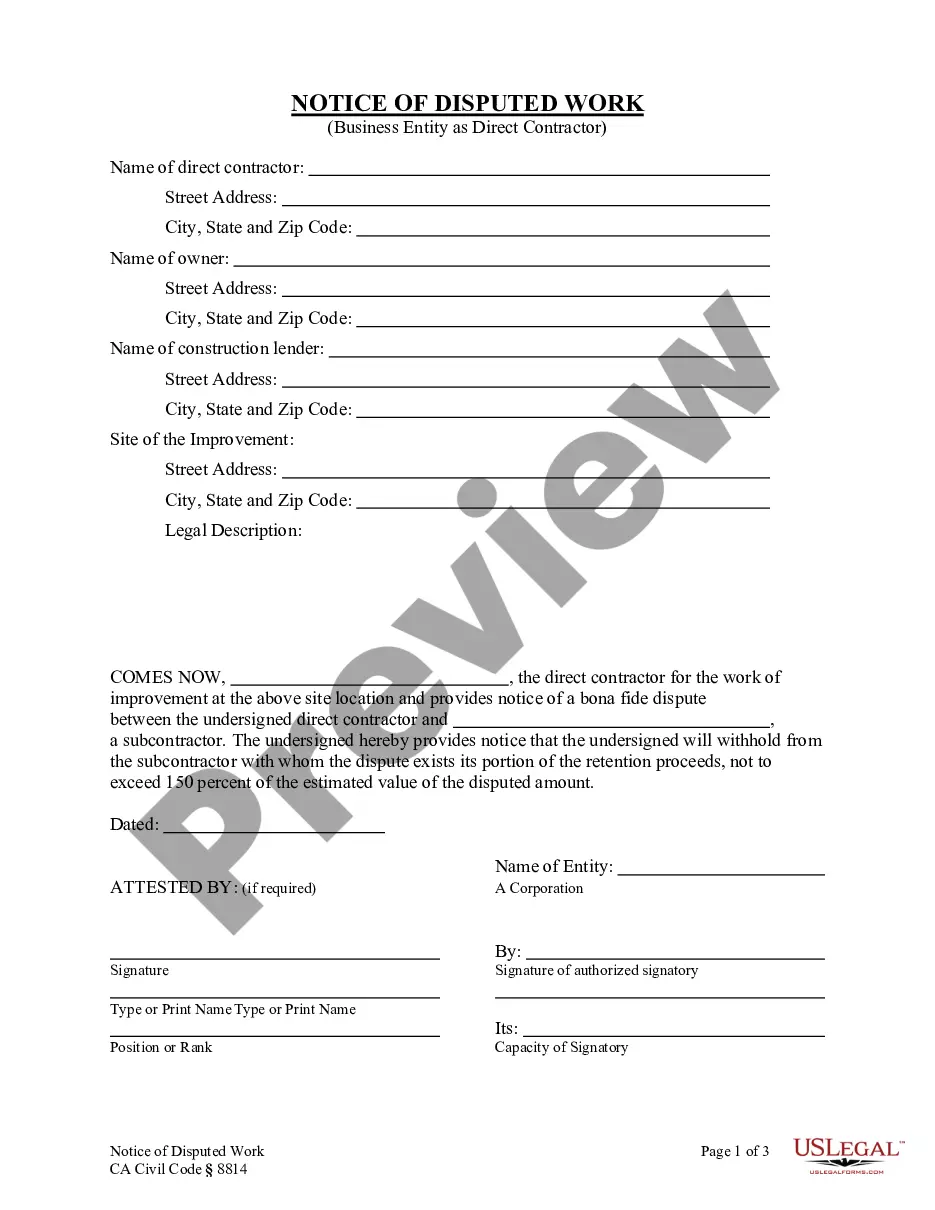

Out of the multitude of services that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms before purchasing them. Its comprehensive library of 85,000 templates is grouped by state and use for simplicity. All of the documents on the service have been drafted to meet individual state requirements by licensed legal professionals.

If you have a US Legal Forms subscription, just log in, search for the form, hit Download and obtain access to your Form name in the My Forms; the My Forms tab keeps all of your saved documents.

Follow the guidelines below to obtain the form:

- Once you discover a Form name, make sure it is the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Search for a new template using the Search engine in case the one you’ve already found is not proper.

- Click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the template.

After you’ve downloaded your Form name, it is possible to edit it, fill it out and sign it in an online editor of your choice. Any document you add to your My Forms tab might be reused many times, or for as long as it continues to be the most up-to-date version in your state. Our platform provides easy and fast access to samples that suit both attorneys and their customers.

Form popularity

FAQ

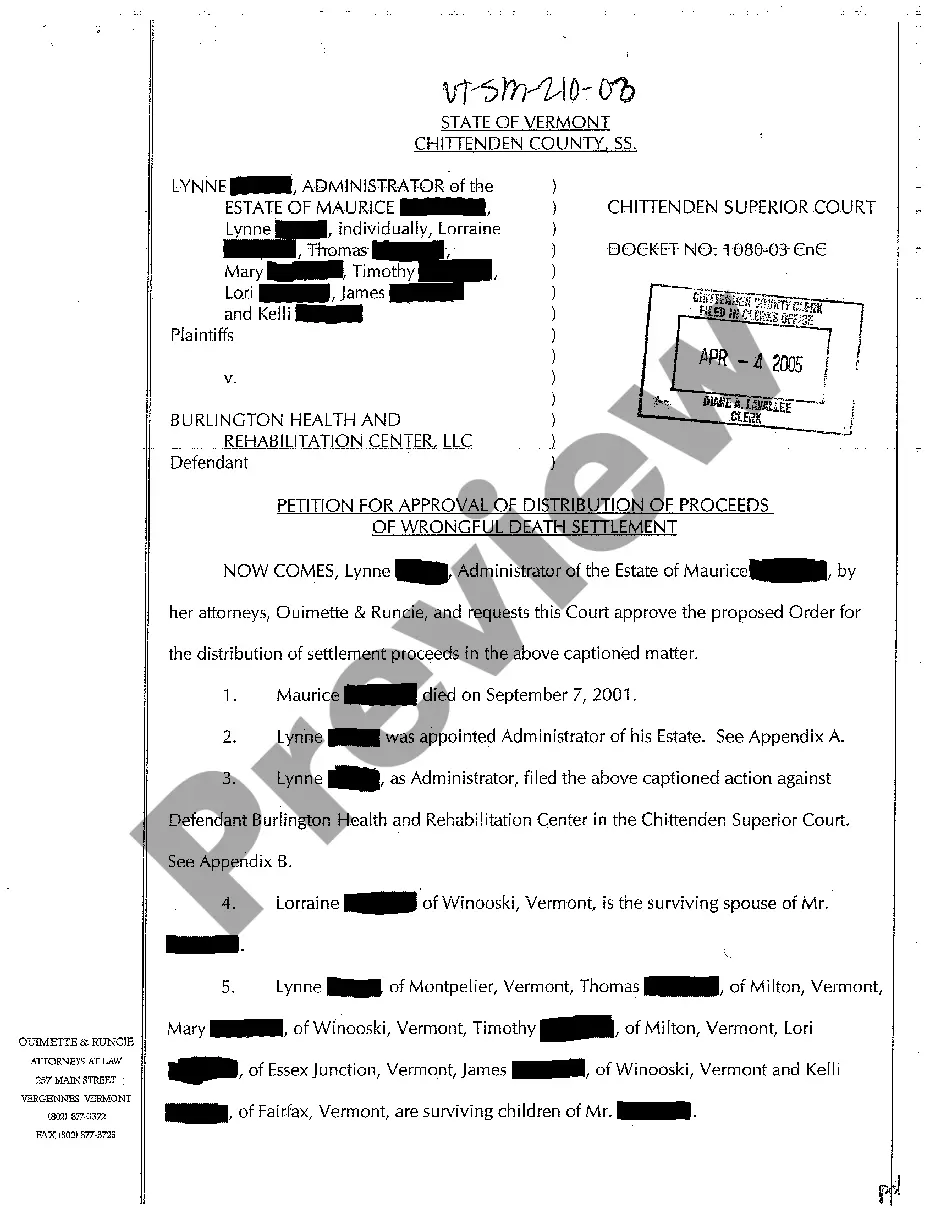

Though there is no time limit on the probate application itself, there are aspects of the process which do have time scales. Inheritance tax for example, is a very important part of attaining probate in the first place and must be done within 6 months of date of death.

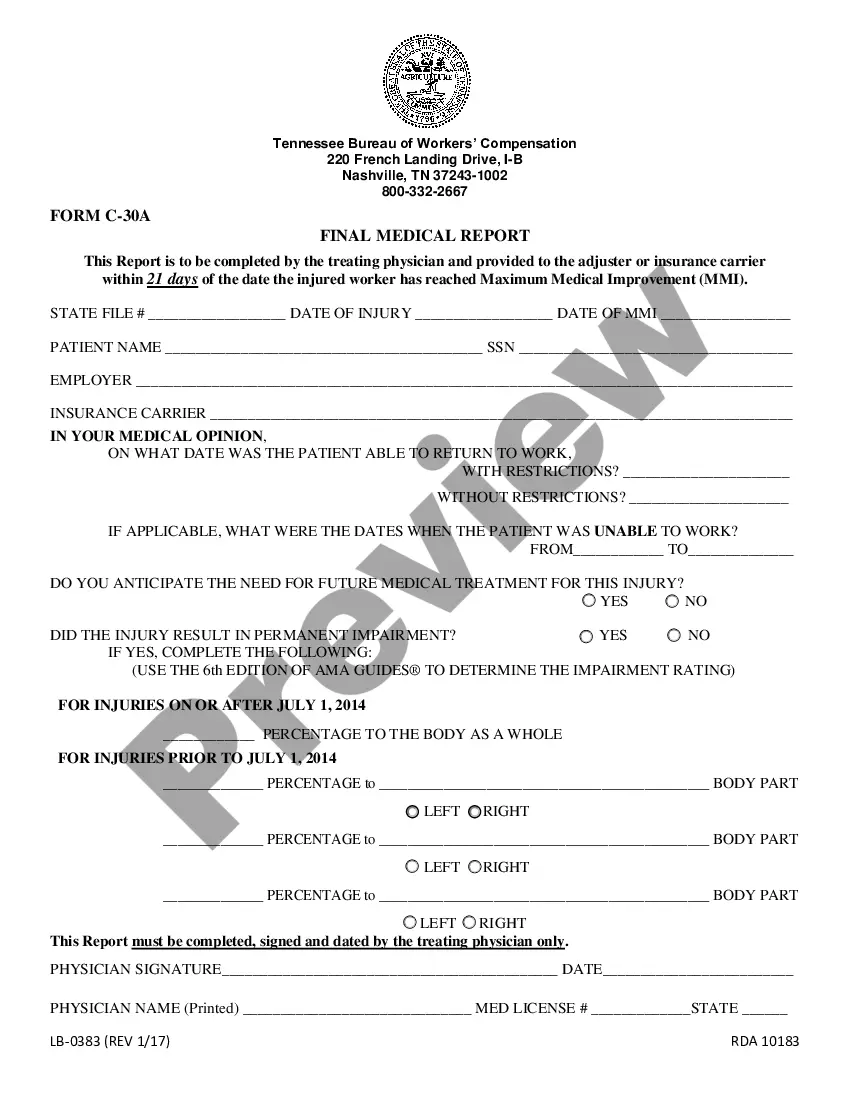

A debtor filing Chapter 128 fills out a simple petition to reorganize debts and an affidavit listing the debts he or she wishes to include. Chapter 128 covers unsecured debts such as credit cards, payday loans, speeding tickets, medical bills, late utility bills and rent payments.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

Although Wisconsin law requires that probate be completed within 18 months, a court may choose to grant an extension. On average, probate in Wisconsin takes no less than six months. The probate process must allow time for creditors to be notified, file required income tax returns, and resolve any disputes.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.

Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor). Create the new deed. Sign and notarize the deed. File the deed in the county land records.

With voluntary amortization of debts, you work with a court-appointed trustee to set up an approved payment plan and amortize all debts included in the plan so they're paid in full within three years.If you renege on the plan or do not pay the debt in full, creditors can resume debt-collection efforts.

The transfer by affidavit process can be used to close a person's estate when the deceased has $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.