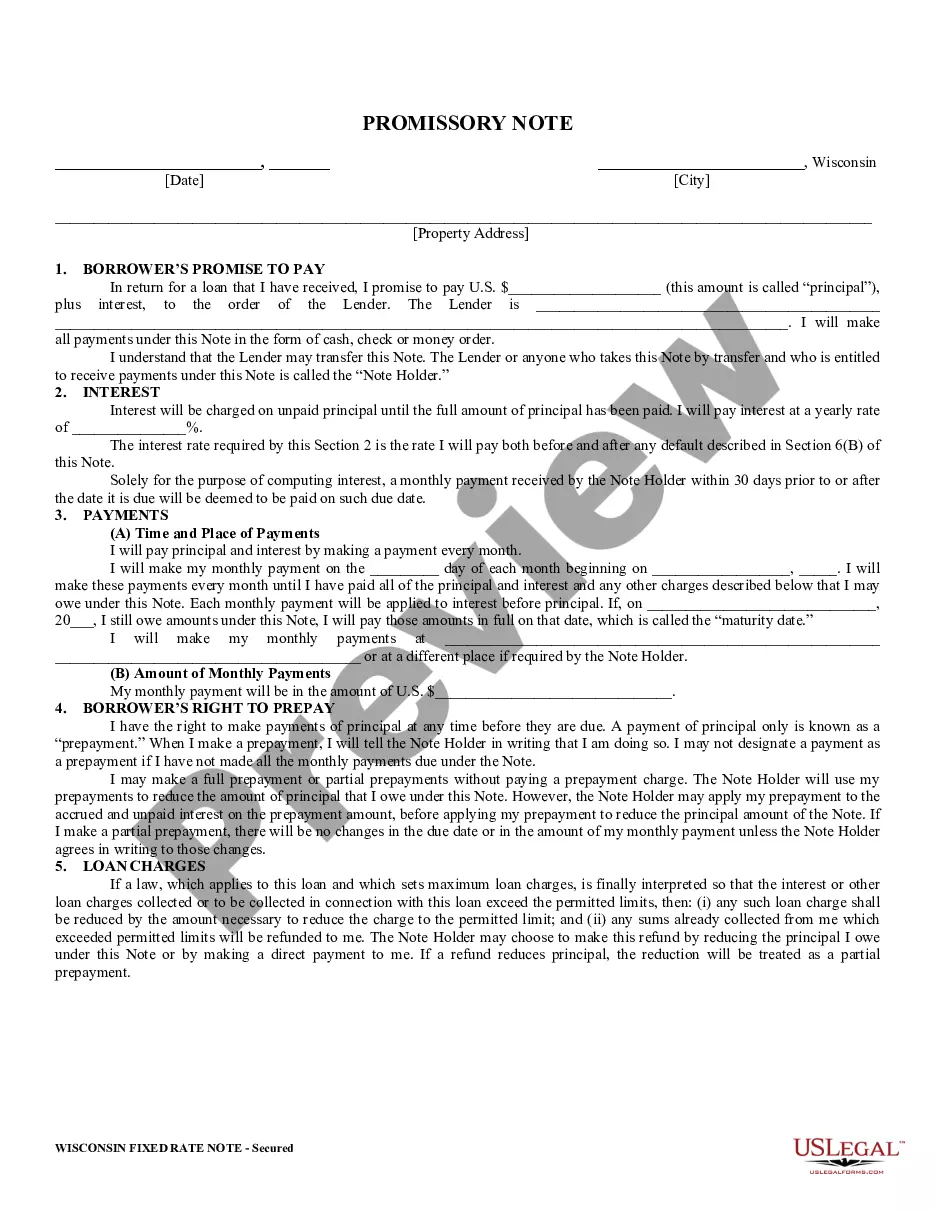

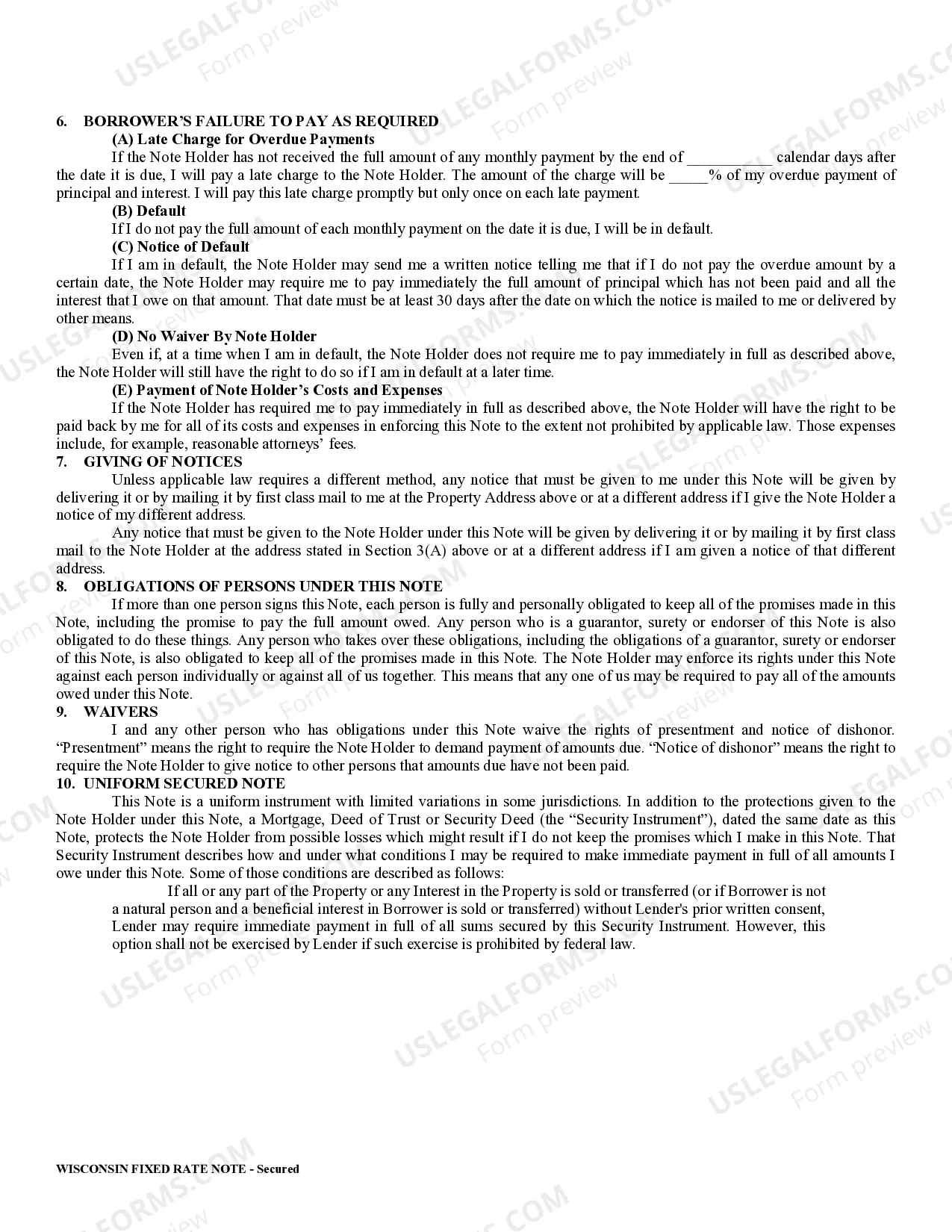

This is a Promissory Note for your state. The promissory note is secured, with a fixed interest rate, and contains a provision for installment payments.

Wisconsin Secured Promissory Note

Description

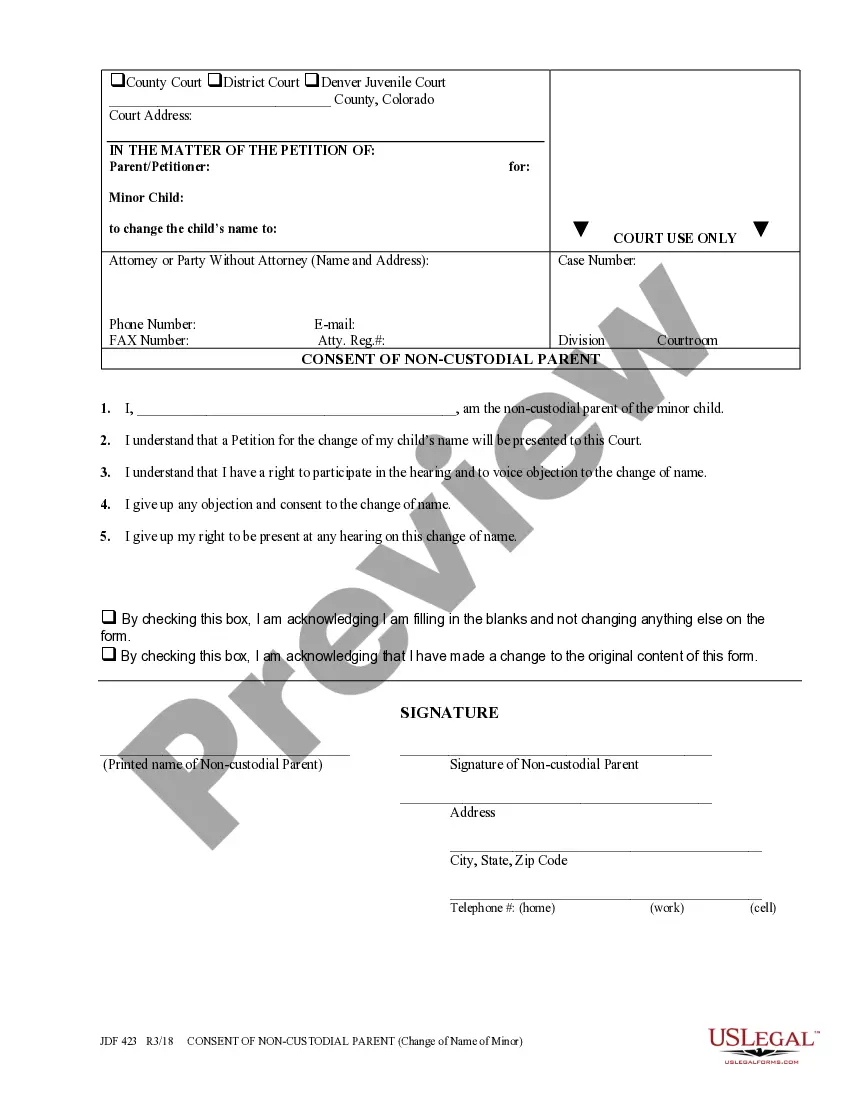

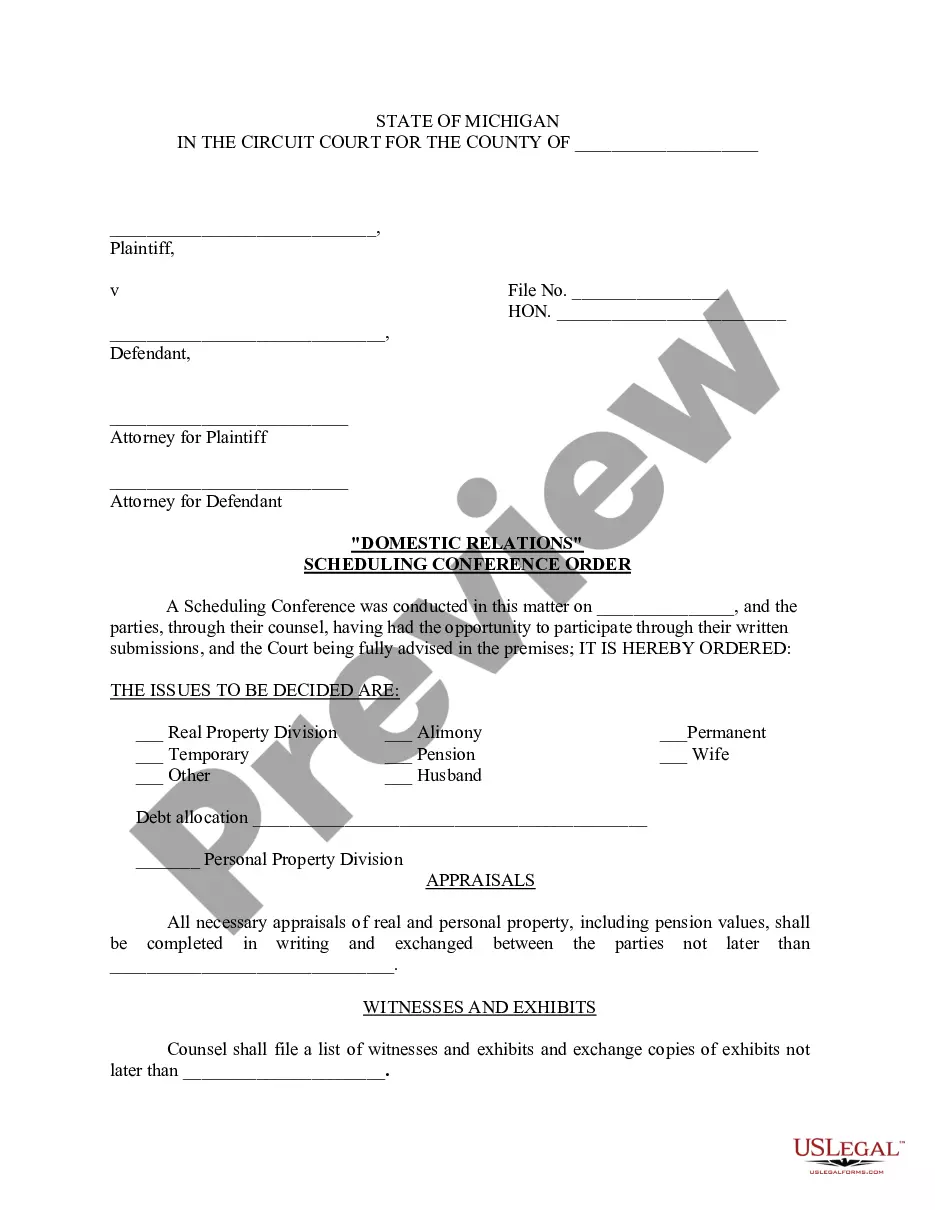

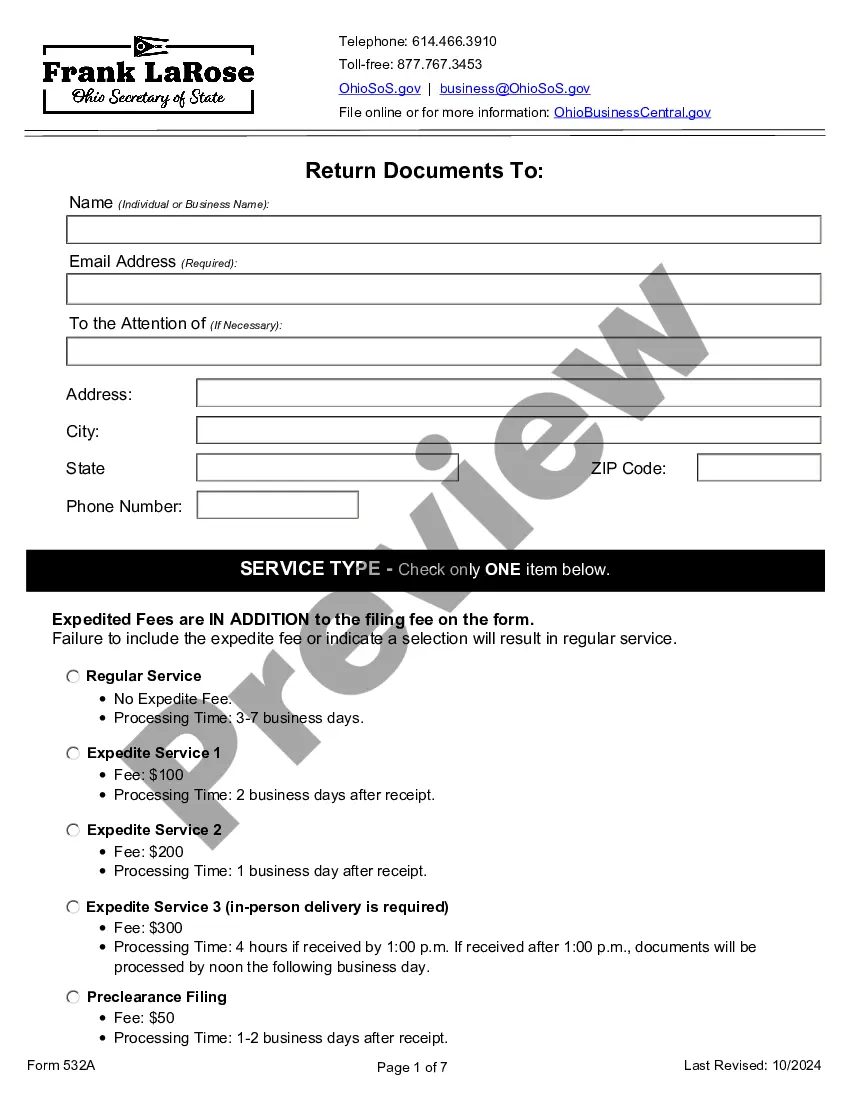

How to fill out Wisconsin Secured Promissory Note?

Out of the large number of platforms that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates before buying them. Its complete library of 85,000 templates is categorized by state and use for simplicity. All the forms on the platform have already been drafted to meet individual state requirements by certified lawyers.

If you have a US Legal Forms subscription, just log in, search for the form, click Download and gain access to your Form name in the My Forms; the My Forms tab holds your downloaded forms.

Follow the tips listed below to get the document:

- Once you discover a Form name, ensure it is the one for the state you need it to file in.

- Preview the template and read the document description just before downloading the template.

- Search for a new sample using the Search engine in case the one you have already found isn’t proper.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the document.

When you have downloaded your Form name, you are able to edit it, fill it out and sign it with an web-based editor that you pick. Any form you add to your My Forms tab can be reused many times, or for as long as it remains to be the most updated version in your state. Our platform offers quick and simple access to samples that suit both lawyers as well as their clients.

Form popularity

FAQ

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.

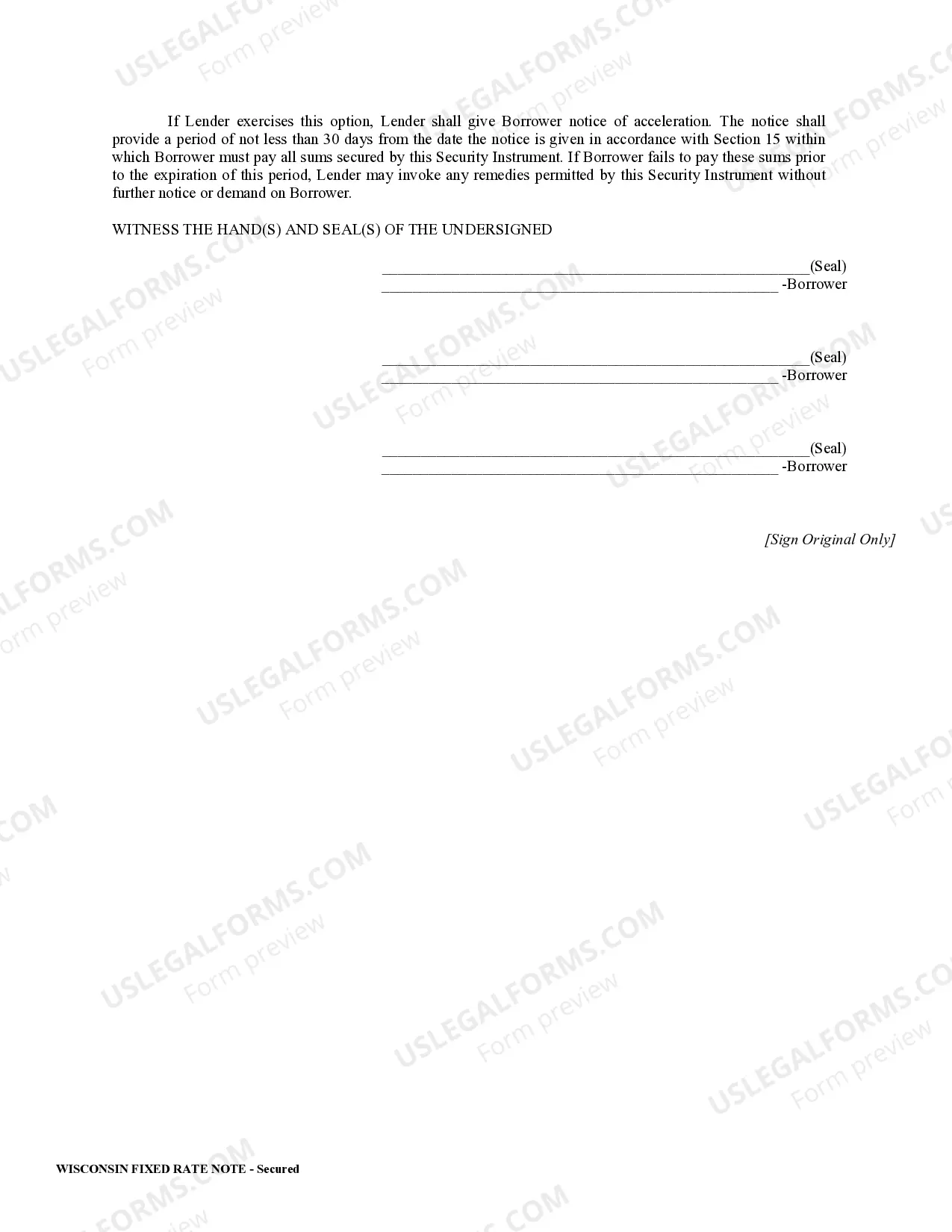

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.