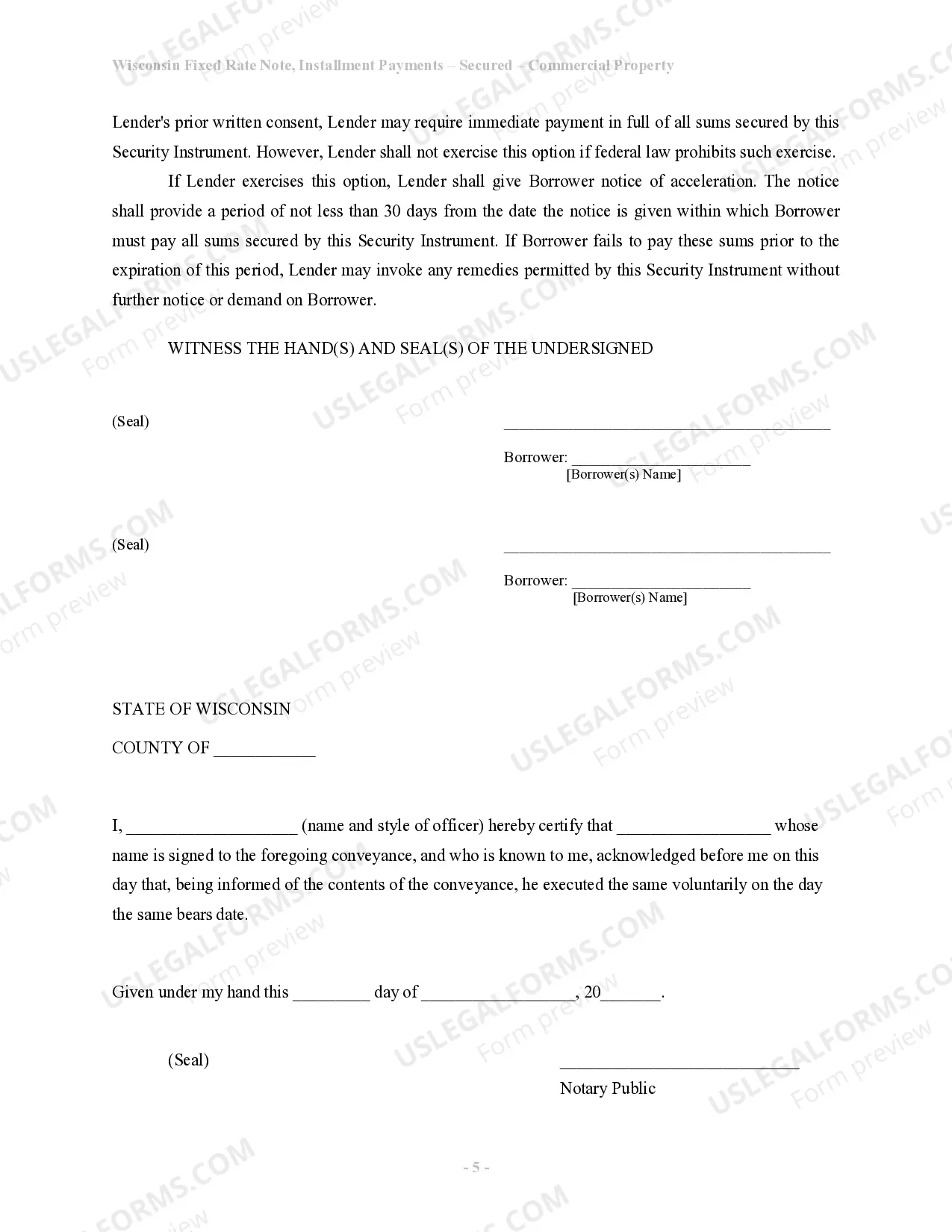

This is a Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Wisconsin Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Wisconsin Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Out of the great number of services that provide legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms prior to buying them. Its comprehensive library of 85,000 samples is categorized by state and use for simplicity. All the forms on the service have already been drafted to meet individual state requirements by accredited lawyers.

If you have a US Legal Forms subscription, just log in, search for the form, press Download and obtain access to your Form name from the My Forms; the My Forms tab holds all of your saved documents.

Keep to the guidelines below to obtain the form:

- Once you find a Form name, ensure it is the one for the state you need it to file in.

- Preview the template and read the document description just before downloading the template.

- Search for a new template through the Search field in case the one you have already found isn’t correct.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the document.

Once you have downloaded your Form name, it is possible to edit it, fill it out and sign it with an online editor of your choice. Any form you add to your My Forms tab might be reused many times, or for as long as it remains to be the most updated version in your state. Our platform offers quick and easy access to templates that fit both lawyers as well as their customers.

Form popularity

FAQ

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

"A promissory note is enforceable through an ordinary breach of contract claim." In other words, it's not required that the loan be secured; an unsecured loan is still enforceable as long as the promissory note is fully completed. Lender and borrower information.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

To secure a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.