Wisconsin Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser

Definition and meaning

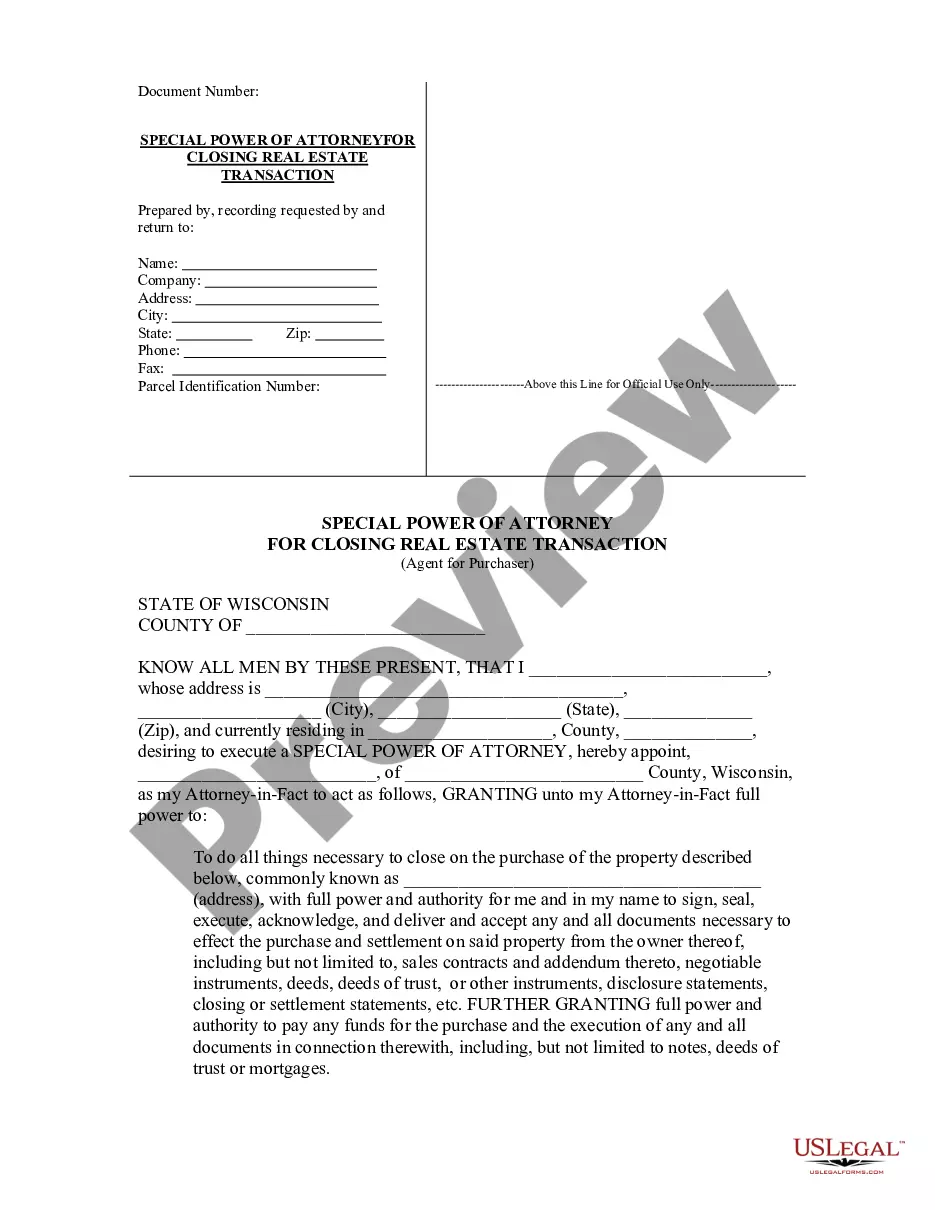

The Wisconsin Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser is a legal document that allows a person (the purchaser) to appoint another individual as their Attorney-in-Fact. This document grants the Attorney-in-Fact specific powers to act on behalf of the purchaser regarding the purchase of real estate. The powers include the ability to sign documents, make payments, and complete transactions related to the property purchase.

Legal use and context

This form is used in situations where a purchaser cannot be present to handle the closing of a real estate transaction. Common scenarios include:

- Out-of-state buyers who cannot attend the closing in person.

- Individuals with health or mobility issues.

- Those who are unavailable due to personal or professional commitments.

By using this form, purchasers can ensure their interests are represented during important transactions.

How to complete a form

To complete the Wisconsin Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser, follow these steps:

- Download the form from a reliable source.

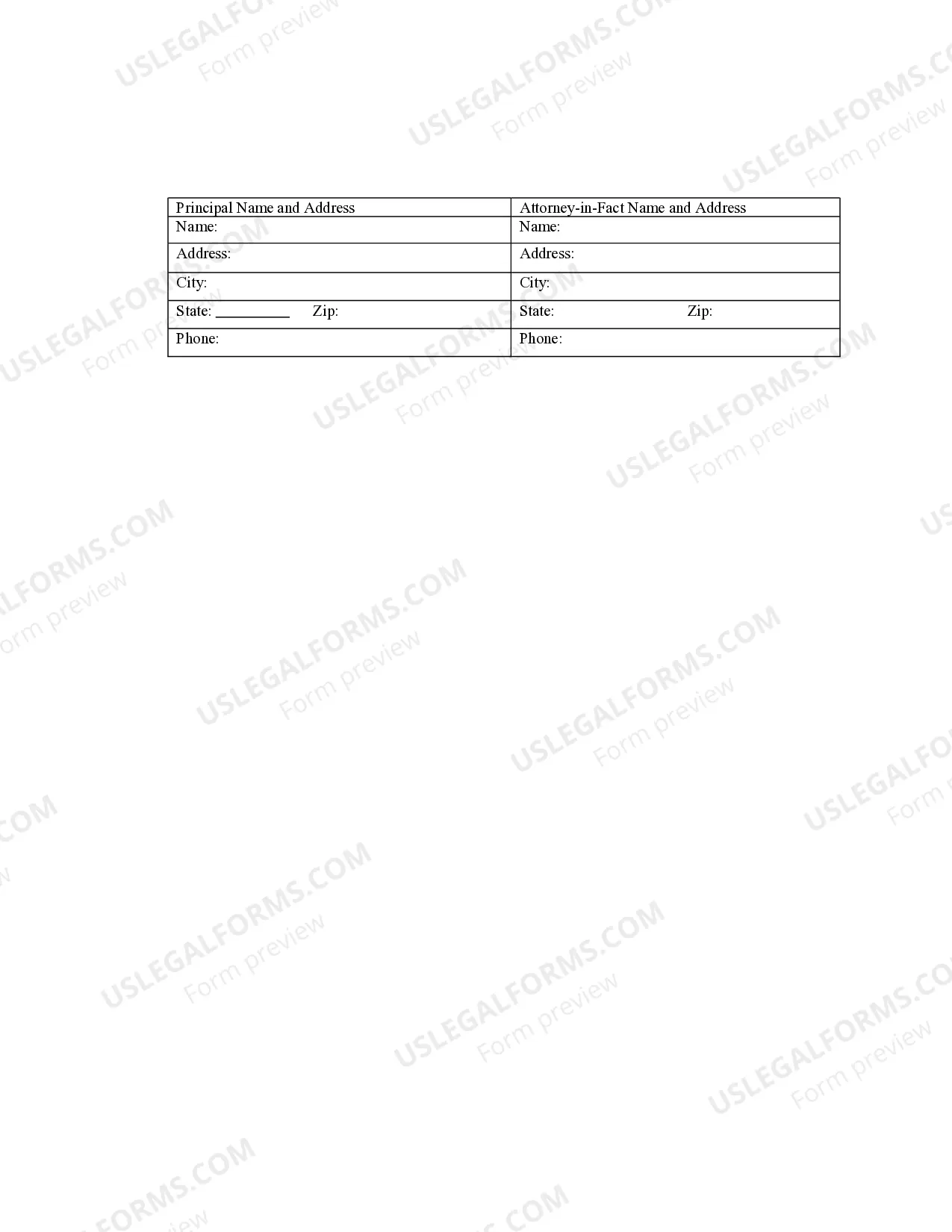

- Fill in your name and address, as well as the name and address of your Attorney-in-Fact.

- Provide the legal description of the property being purchased.

- Sign the document in the presence of a notary public.

Ensure all fields are accurately completed to avoid any issues during the transaction.

Key components of the form

The form includes several important sections:

- Powers Granted: Outlines what the Attorney-in-Fact is authorized to do.

- Legal Description: Details the property involved in the transaction.

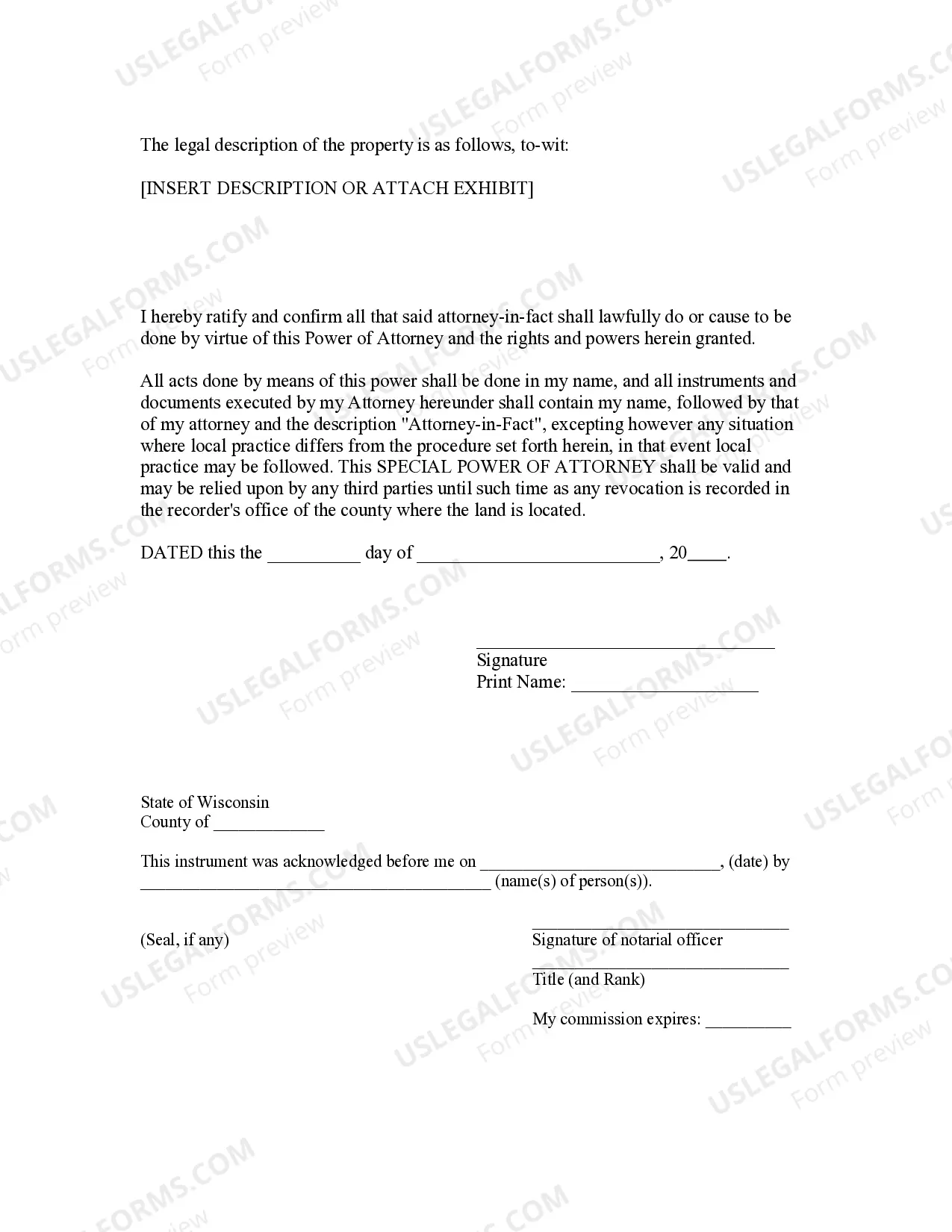

- Principal's Signature: The purchaser must sign to validate the document.

- Notary Section: Provides space for a notary to acknowledge the signature.

Common mistakes to avoid when using this form

When completing the form, keep in mind the following common mistakes:

- Not providing a complete legal description of the property.

- Failing to have the document notarized, which is essential for its validity.

- Leaving any fields blank or omitting required signatures.

Review the completed form thoroughly to prevent these errors.

What to expect during notarization or witnessing

During the notarization process, you can expect:

- A notary public will verify your identity and witness your signature.

- They may ask you to provide valid identification.

- Once signed, the notary will place their seal on the document, confirming its legitimacy.

Ensure that the notarization takes place in a timely manner to avoid delays in your real estate transaction.

Benefits of using this form online

Utilizing the Wisconsin Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser online provides several advantages:

- Convenience of completing the form from anywhere at any time.

- Access to up-to-date templates designed by legal professionals.

- The ability to easily store and retrieve the document for future use.

These benefits simplify the process and enhance the overall user experience.

Form popularity

FAQ

A limited PoA, amongst other things, grants the PoA holder access and permission to execute trades/orders on your trading account, on your behalf. However, it does not allow the PoA holder to perform withdrawals requests or transfer of funds. All withdrawals must be requested by the authorized signatory of the account.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

The durable power of attorney is almost always required. This instrument gives another person specific powers to sign for an individual in a real estate transaction where the exact name and description of the property is stated in the document.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

Step 1: Bring Your Power of Attorney Agreement and ID. Step 2: Determine the Preferred Signature Format. Step 3: Sign as the Principal. Step 4: Sign Your Own Name. Step 5: Express Your Authority as Attorney-in-Fact. Step 6: File the Documentation Somewhere Safe.

The non-durable power of attorney is used only for a set period of time and usually for a particular transaction in which you grant your agent authority to act on your behalf. Once the transaction is completed, or should the principal become incapacitated during this time, the non-durable power of attorney ceases.

You can draft a durable power of attorney by writing out or typing the document, which should include the date, your full name, and speech that clearly identifies the document as a durable power of attorney that applies even in the case of your incapacitation.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.