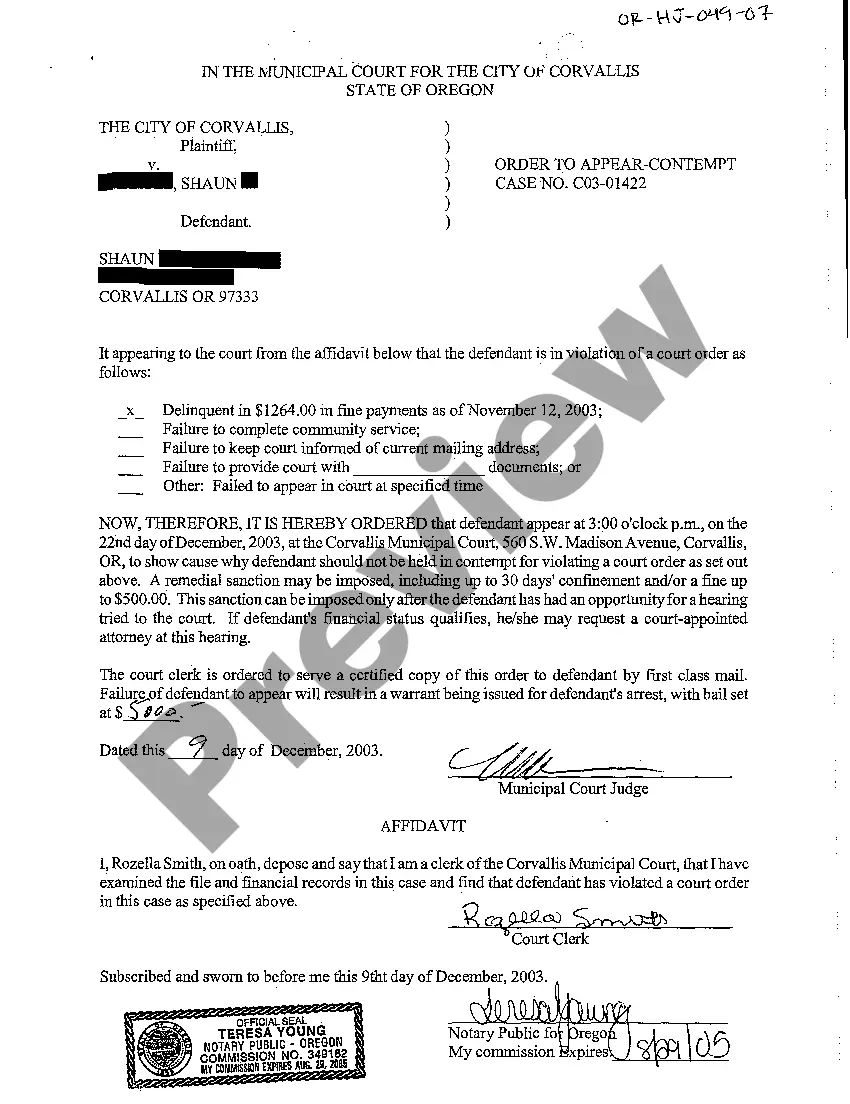

This is an official state court form. This form is used to provide notice to participants in a court proceeding of the date, time and place of hearing.

Wisconsin Notice of Hearing Probate

Description

How to fill out Wisconsin Notice Of Hearing Probate?

Out of the great number of platforms that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates before buying them. Its comprehensive catalogue of 85,000 samples is grouped by state and use for efficiency. All of the documents available on the service have already been drafted to meet individual state requirements by qualified lawyers.

If you have a US Legal Forms subscription, just log in, search for the template, hit Download and gain access to your Form name from the My Forms; the My Forms tab holds all your saved forms.

Follow the guidelines listed below to get the document:

- Once you see a Form name, ensure it is the one for the state you really need it to file in.

- Preview the template and read the document description just before downloading the sample.

- Look for a new sample using the Search engine in case the one you’ve already found is not proper.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

When you’ve downloaded your Form name, you are able to edit it, fill it out and sign it with an online editor that you pick. Any document you add to your My Forms tab can be reused multiple times, or for as long as it remains the most updated version in your state. Our platform offers quick and easy access to templates that fit both legal professionals as well as their clients.

Form popularity

FAQ

Probate is used to distribute a decedent's assets not only to beneficiaries but also to creditors and taxing authorities. Any Wisconsin estate that exceeds $50,000 in value must go through the probate process unless the property is subject to certain exemptions.

Although Wisconsin law requires that probate be completed within 18 months, a court may choose to grant an extension. On average, probate in Wisconsin takes no less than six months. The probate process must allow time for creditors to be notified, file required income tax returns, and resolve any disputes.

Probate of a Will cannot be granted until at least 28 days have passed since the date of death.But at the other end, there is no time limit specified in any legislation by which an Executor must take steps to obtain a grant of Probate.

Though there is no time limit on the probate application itself, there are aspects of the process which do have time scales. Inheritance tax for example, is a very important part of attaining probate in the first place and must be done within 6 months of date of death.

The cost of probate is dependent on the complexity of the case. In Wisconsin, the average probate in Wisconsin is about 4-5%, with attorney fees being about half.

Some states have a deadline for initiating this process, often between 10 and 90 days from the date of the deceased's passing or from when the executor received notice of death. In both California and Wisconsin, the deadline is 30 days.

How to Avoid Probate in Wisconsin: A Will is not the Answer. There is a common misconception that having a will allows you to avoid probate. This is not correct. Having a will has no effect on whether or not your estate will go through probate.

There is a $3 filing fee to file a claim against an estate. Probate office or online at Wisconsin Court System Circuit Court forms. File the completed form with the Register in Probate together with the $3.00 statutory filing fee. Send a copy to the Personal Representative and the estate attorney.

In Wisconsin, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).