This is a Personal Representative's Statement to Close Estate, to be used in the State of Wisconsin. This form is used to verify that the Personal Repersentative has completed the estate.

Wisconsin Personal Representative's Statement to Close Estate - Informal Administration

Description

How to fill out Wisconsin Personal Representative's Statement To Close Estate - Informal Administration?

Out of the multitude of services that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates prior to buying them. Its complete library of 85,000 samples is categorized by state and use for efficiency. All of the documents on the service have already been drafted to meet individual state requirements by licensed legal professionals.

If you already have a US Legal Forms subscription, just log in, search for the template, click Download and obtain access to your Form name in the My Forms; the My Forms tab keeps all of your downloaded documents.

Follow the tips below to get the document:

- Once you see a Form name, make certain it’s the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Look for a new sample using the Search field if the one you’ve already found isn’t correct.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

Once you’ve downloaded your Form name, it is possible to edit it, fill it out and sign it in an online editor of your choice. Any document you add to your My Forms tab might be reused multiple times, or for as long as it remains to be the most updated version in your state. Our service provides easy and fast access to samples that fit both legal professionals and their customers.

Form popularity

FAQ

Generally speaking, a Personal Representative is responsible for opening the estate, collecting the assets of the estate, protecting the estate property, preparing an inventory of the property, paying various estate expenses, valid claims (including debts and taxes) against the estate, representing the estate in claims

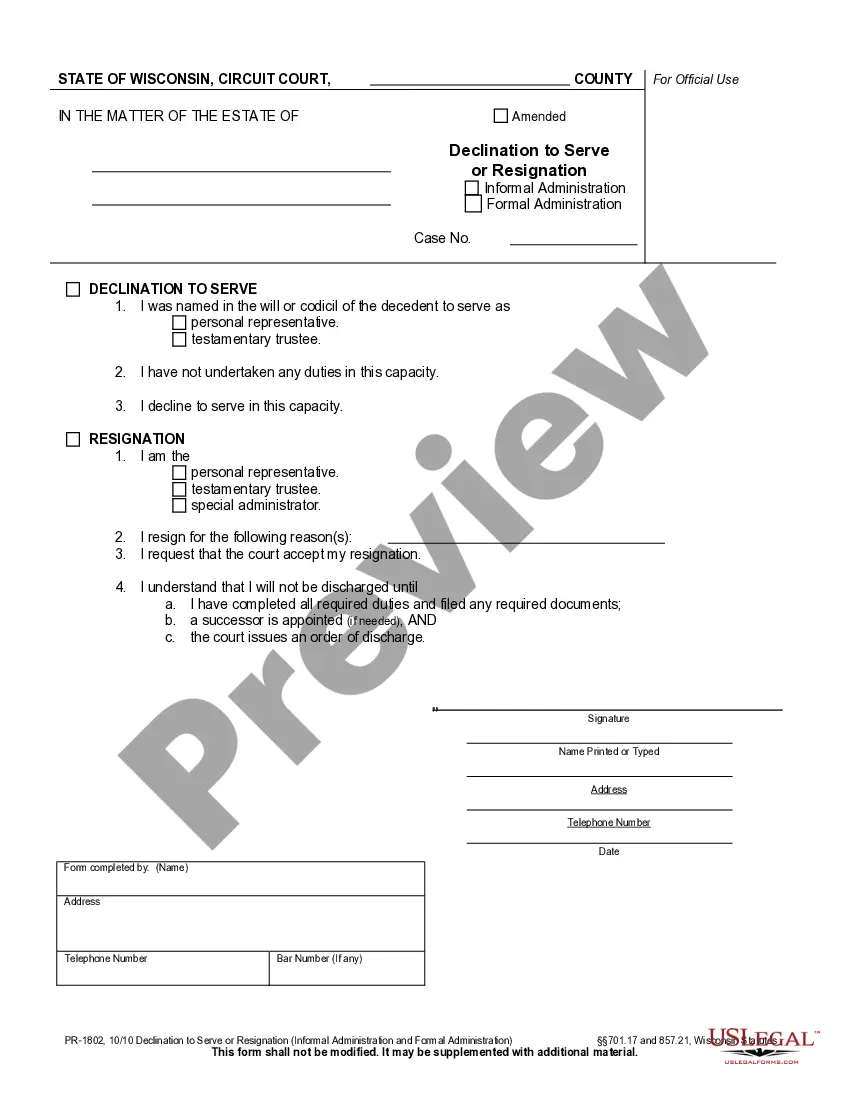

If the personal representative tires of the duties associated with administering the estate, the person cannot simply resign. Rather, the court must accept the resignation before the person is free to relinquish the reigns to a different (successor) personal representative.

The process of removing a personal representative begins with filing a petition or removal. An heir or interested party must file the petition with the probate court and serve a copy of the petition on the personal representative. The probate court schedules a hearing date and time to hear the matter.

Yes, you can remove an executor of estate under certain circumstances in California. California State Probate Code §8502 allows for the removal of an executor or administrator when: They have wasted, embezzled, mismanaged, or committed a fraud on the estate, or are about to do so.

As a fiduciary, a personal representative can be removed for waste, embezzlement, mismanagement, fraud, and for any other reason the court deems sufficient.

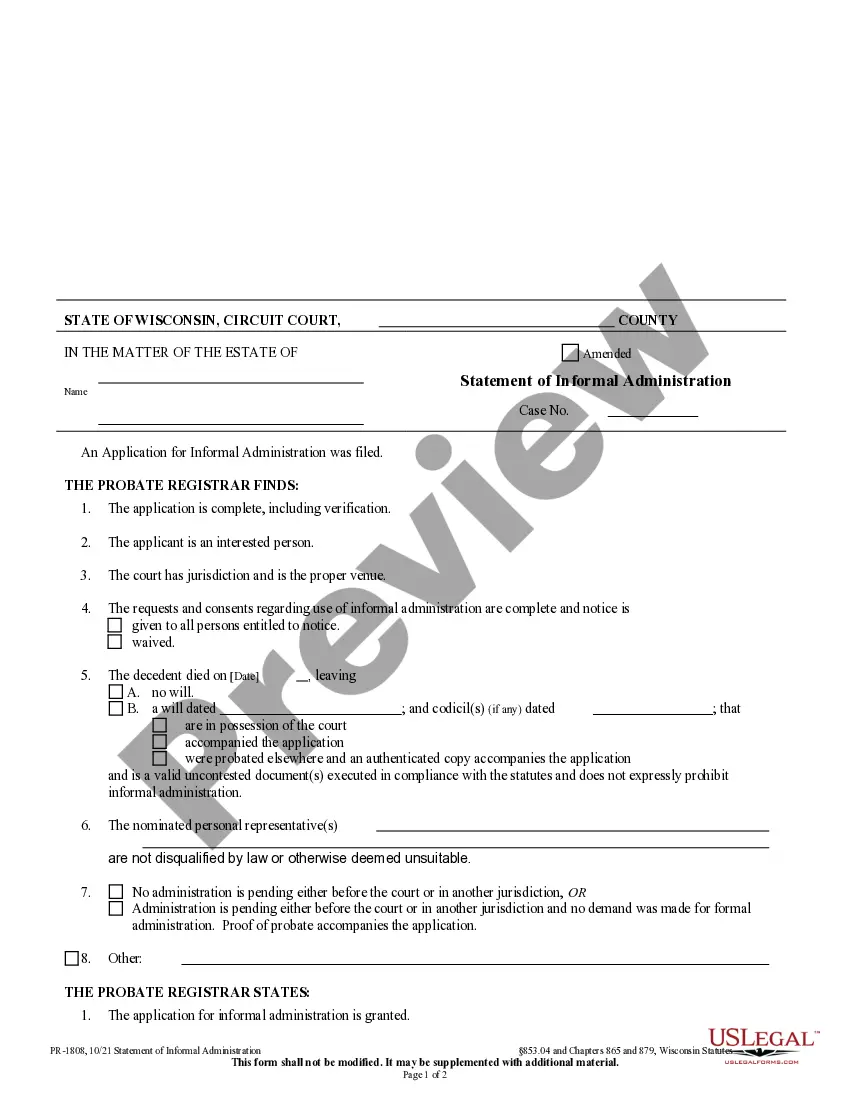

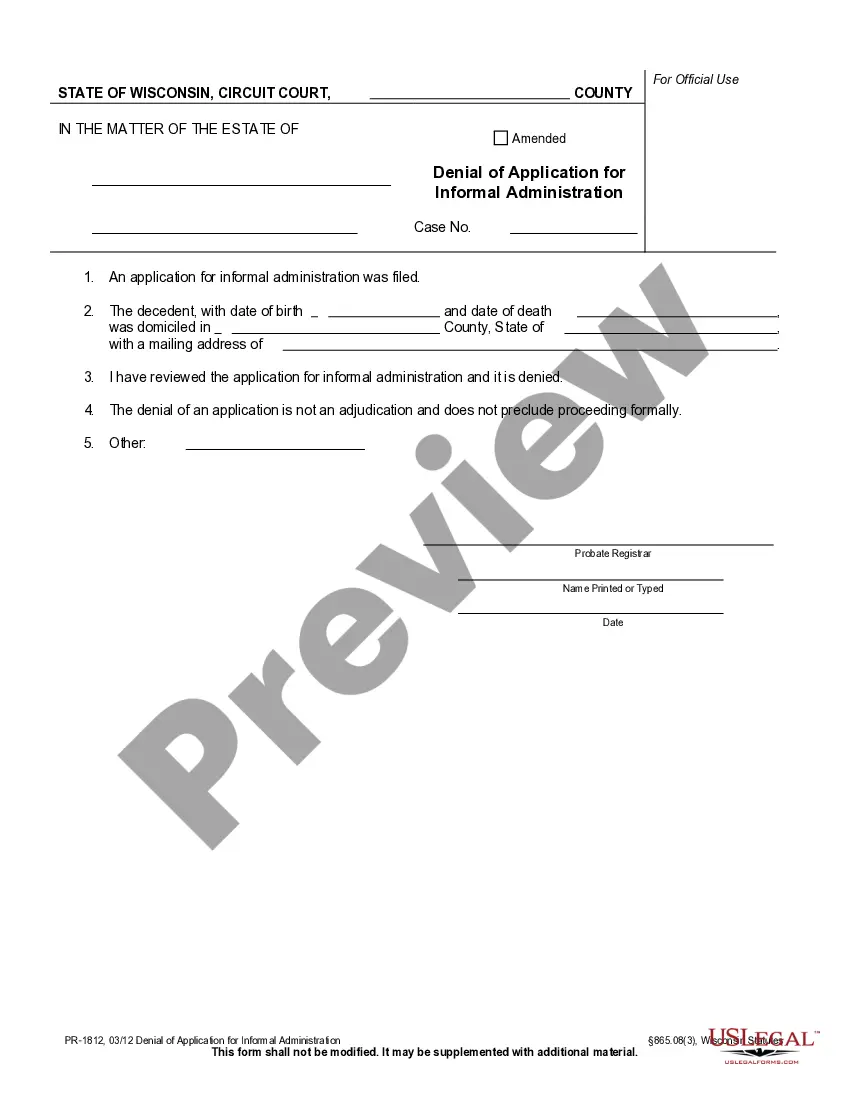

Informal probate is the administration of a deceased person's estate without continuous court supervision.Formal probate is required in a number of instances and Wisconsin statutes require the estate's personal representative to procure the assistance of an attorney.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.