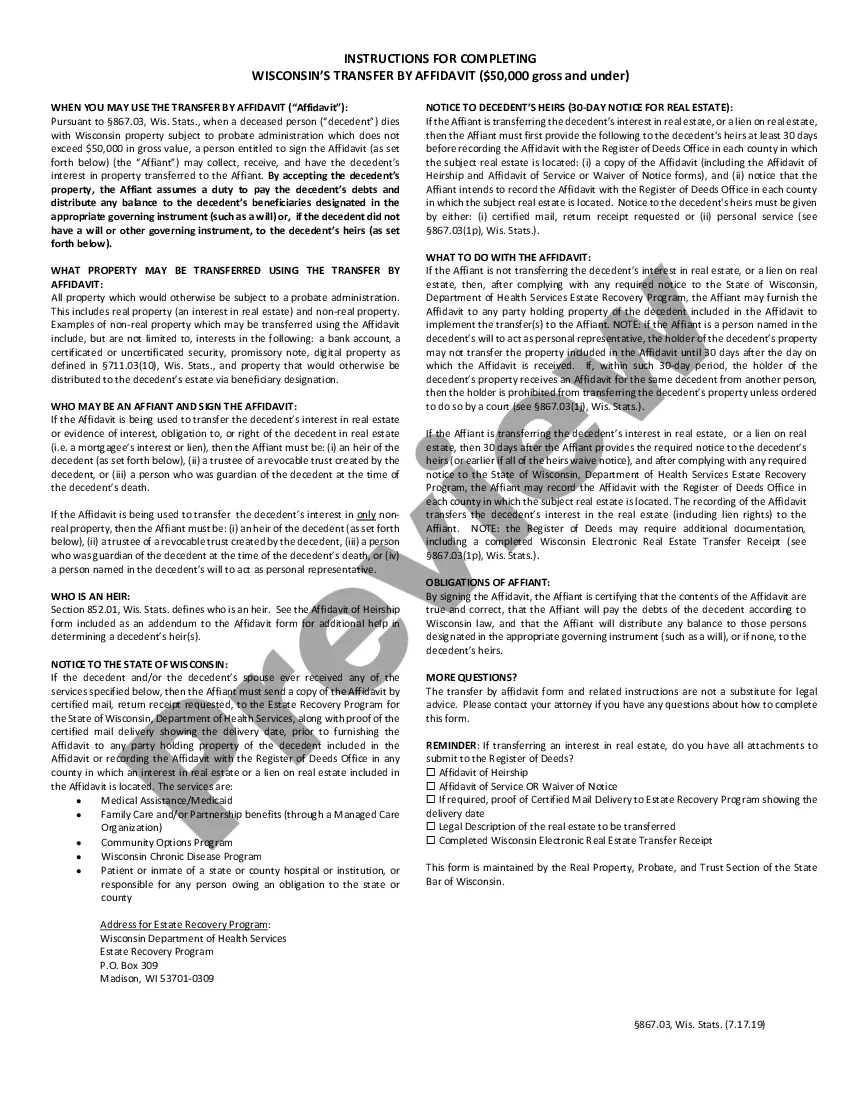

This is a Transfer by Affidavit form, to be used in the State of Wisconsin. This form allows an heir, or person who was guardian of decedent at time of decedent's death, to have property transferred by completing this affidavit.

Wisconsin Transfer by Affidavit - and $50,000 and under

Description

How to fill out Wisconsin Transfer By Affidavit - And $50,000 And Under?

Out of the large number of services that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey while previewing forms prior to buying them. Its extensive library of 85,000 templates is grouped by state and use for efficiency. All the forms available on the platform have been drafted to meet individual state requirements by accredited lawyers.

If you already have a US Legal Forms subscription, just log in, look for the template, press Download and access your Form name from the My Forms; the My Forms tab holds all of your downloaded documents.

Stick to the tips listed below to get the document:

- Once you discover a Form name, make sure it is the one for the state you really need it to file in.

- Preview the form and read the document description prior to downloading the sample.

- Search for a new sample using the Search field in case the one you have already found is not proper.

- Click on Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the template.

After you have downloaded your Form name, you can edit it, fill it out and sign it in an online editor that you pick. Any document you add to your My Forms tab might be reused many times, or for as long as it continues to be the most up-to-date version in your state. Our service offers easy and fast access to samples that fit both legal professionals as well as their customers.

Form popularity

FAQ

Dying Without a Will in Wisconsin The court will then follow intestate succession laws to determine who inherits your assets, and how much they get. If there isn't a will, the court will appoint someone, usually a relative, financial institution, or trust company to fill the role of executor or personal representative.

Probate is used to distribute a decedent's assets not only to beneficiaries but also to creditors and taxing authorities. Any Wisconsin estate that exceeds $50,000 in value must go through the probate process unless the property is subject to certain exemptions.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.

The transfer by affidavit process can be used to close a person's estate when the deceased has $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

In Wisconsin, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).