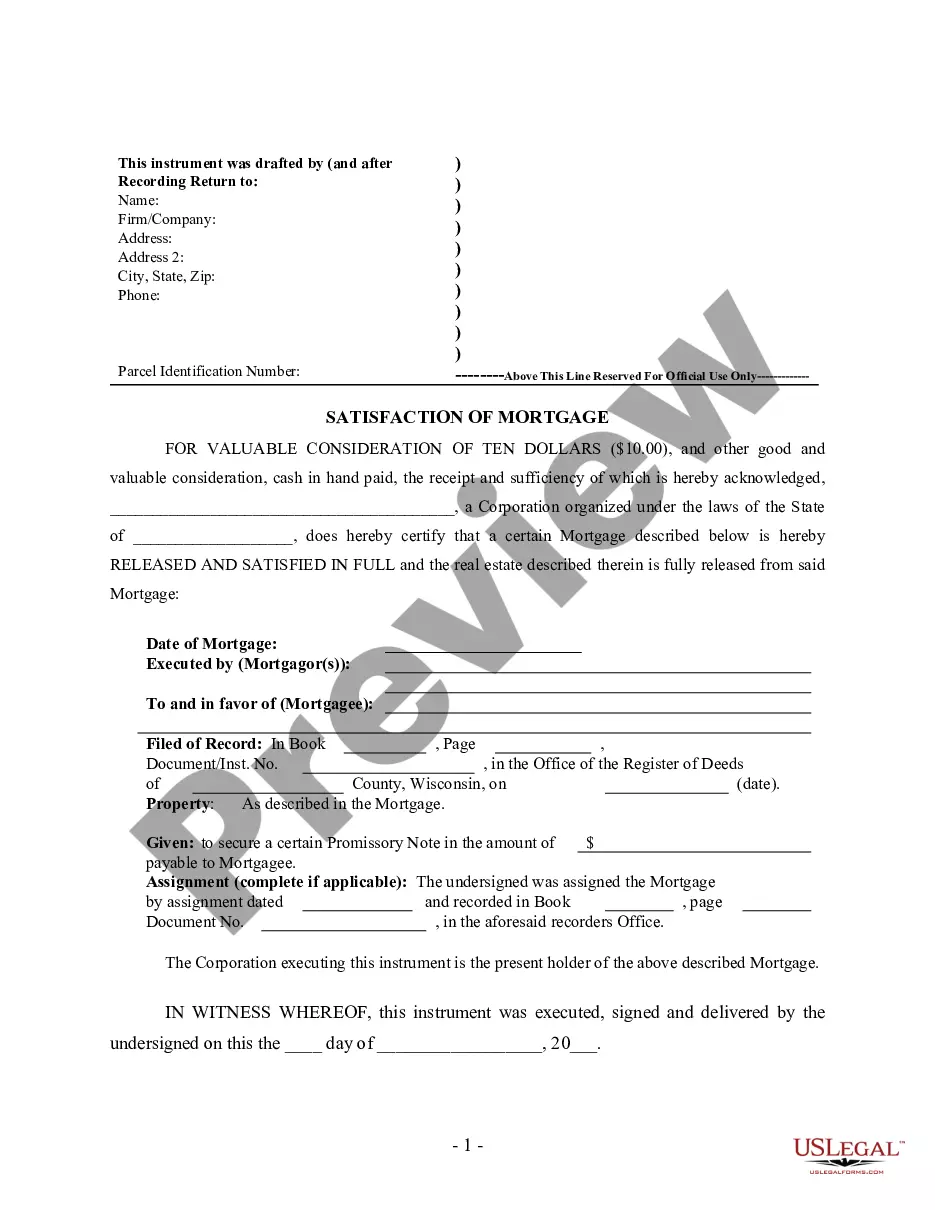

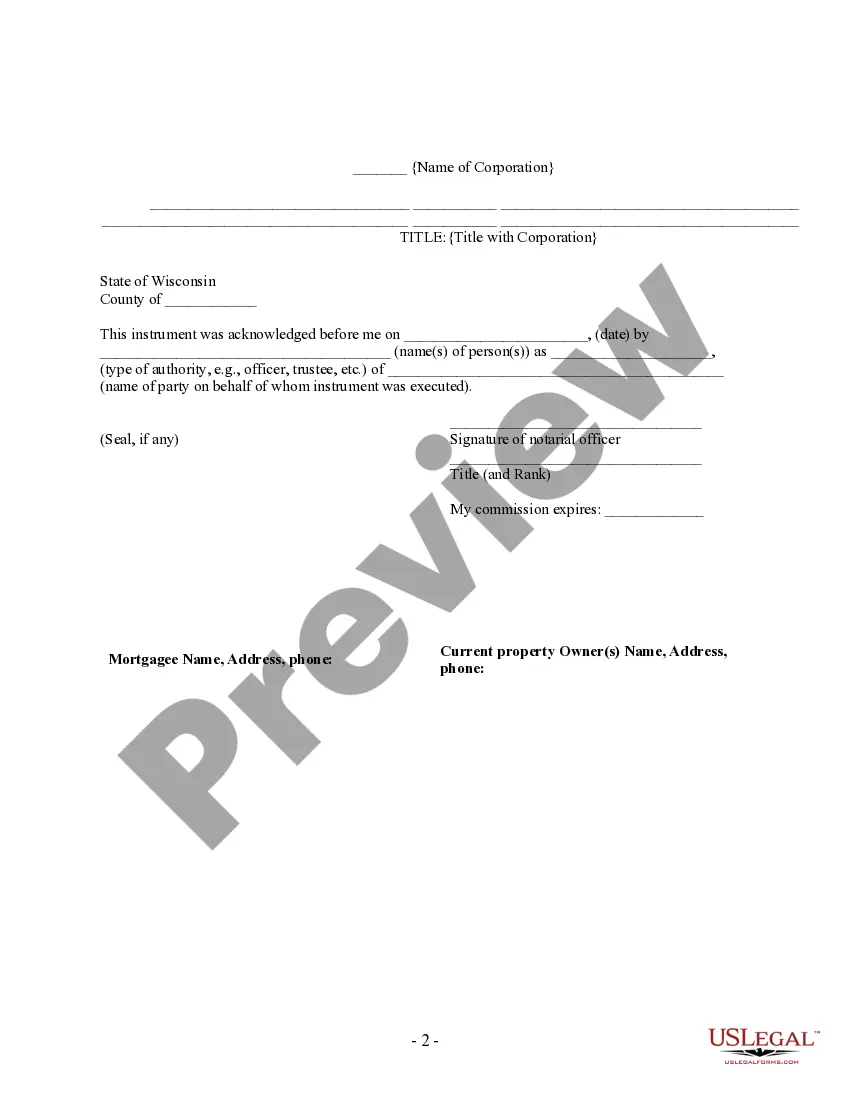

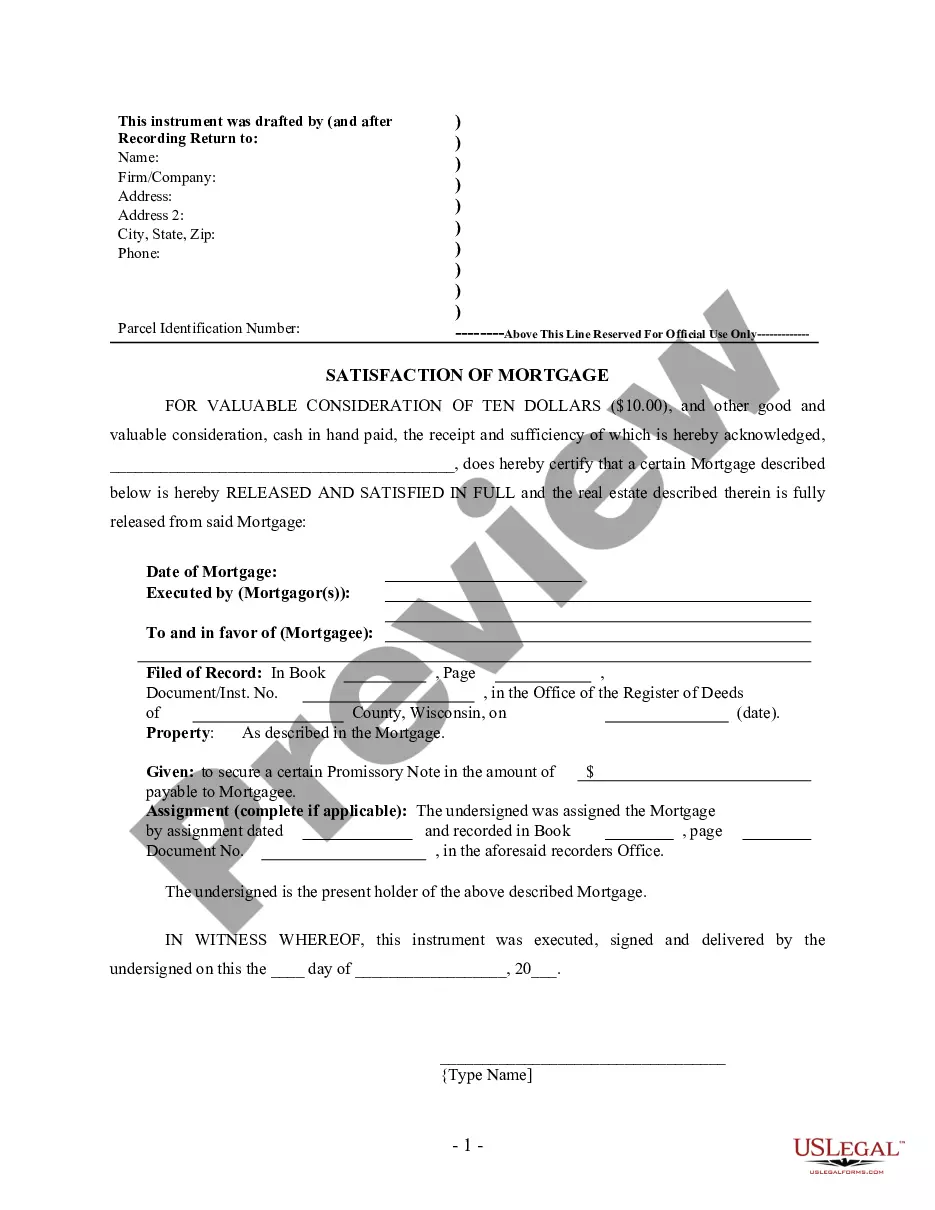

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Wisconsin by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

In Witness Whereof Sample

Description Wi Release Of Mortgage Editable

How to fill out Wisconsin Satisfaction Of Mortgage Form?

Out of the multitude of platforms that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms prior to buying them. Its complete catalogue of 85,000 templates is categorized by state and use for simplicity. All the forms available on the platform have been drafted to meet individual state requirements by certified lawyers.

If you have a US Legal Forms subscription, just log in, search for the template, hit Download and get access to your Form name in the My Forms; the My Forms tab holds all your downloaded forms.

Stick to the guidelines below to get the document:

- Once you discover a Form name, ensure it is the one for the state you need it to file in.

- Preview the form and read the document description before downloading the sample.

- Look for a new template through the Search engine if the one you’ve already found is not correct.

- Click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the template.

When you have downloaded your Form name, you may edit it, fill it out and sign it with an online editor that you pick. Any form you add to your My Forms tab can be reused multiple times, or for as long as it continues to be the most up-to-date version in your state. Our platform offers fast and easy access to templates that fit both legal professionals and their clients.