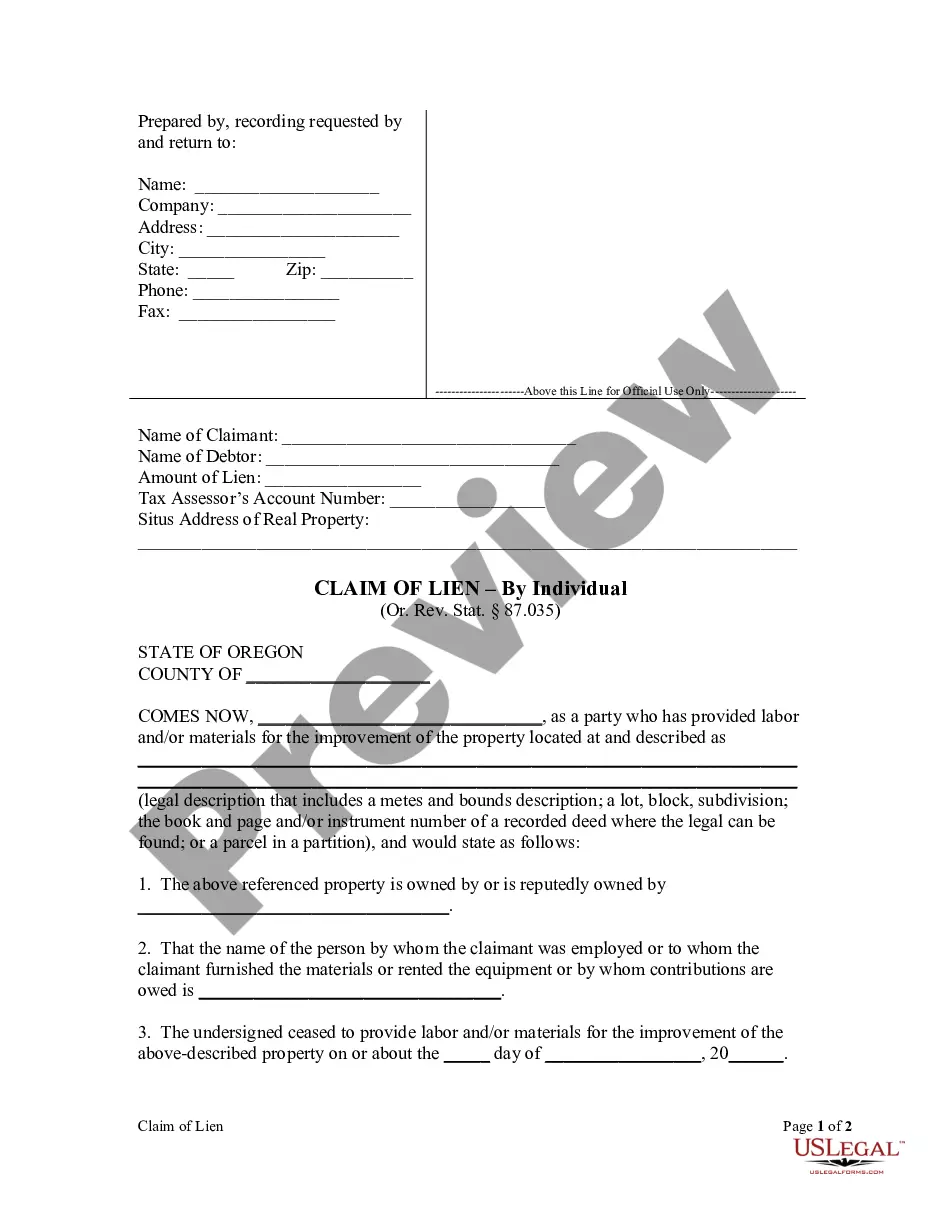

Wisconsin Schedule D: Creditors Who Have Claims Secured By Property (non-individuals) is a document filed with the Wisconsin Bankruptcy Court. This form allows creditors to list any claims they may have that are secured by property which is held by a non-individual. This form must be filled out completely and accurately and all information provided must be true and correct. It covers information such as the name, address, and telephone number of the creditor, the amount of the claim, the description of the property, the type of lien or security interest, and the date when the lien or security interest was created. There are two types of Wisconsin Schedule D: Creditors Who Have Claims Secured By Property (non-individuals): Creditors Who Have Fixed Liens and Creditors Who Have Floating Liens. A fixed lien is a lien that is attached to a specific piece of property and cannot be transferred to another piece of property. A floating lien is a lien that can be moved from one piece of property to another.

Wisconsin Schedule D: Creditors Who Have Claims Secured By Property (non-individuals) is a document filed with the Wisconsin Bankruptcy Court. This form allows creditors to list any claims they may have that are secured by property which is held by a non-individual. This form must be filled out completely and accurately and all information provided must be true and correct. It covers information such as the name, address, and telephone number of the creditor, the amount of the claim, the description of the property, the type of lien or security interest, and the date when the lien or security interest was created. There are two types of Wisconsin Schedule D: Creditors Who Have Claims Secured By Property (non-individuals): Creditors Who Have Fixed Liens and Creditors Who Have Floating Liens. A fixed lien is a lien that is attached to a specific piece of property and cannot be transferred to another piece of property. A floating lien is a lien that can be moved from one piece of property to another.