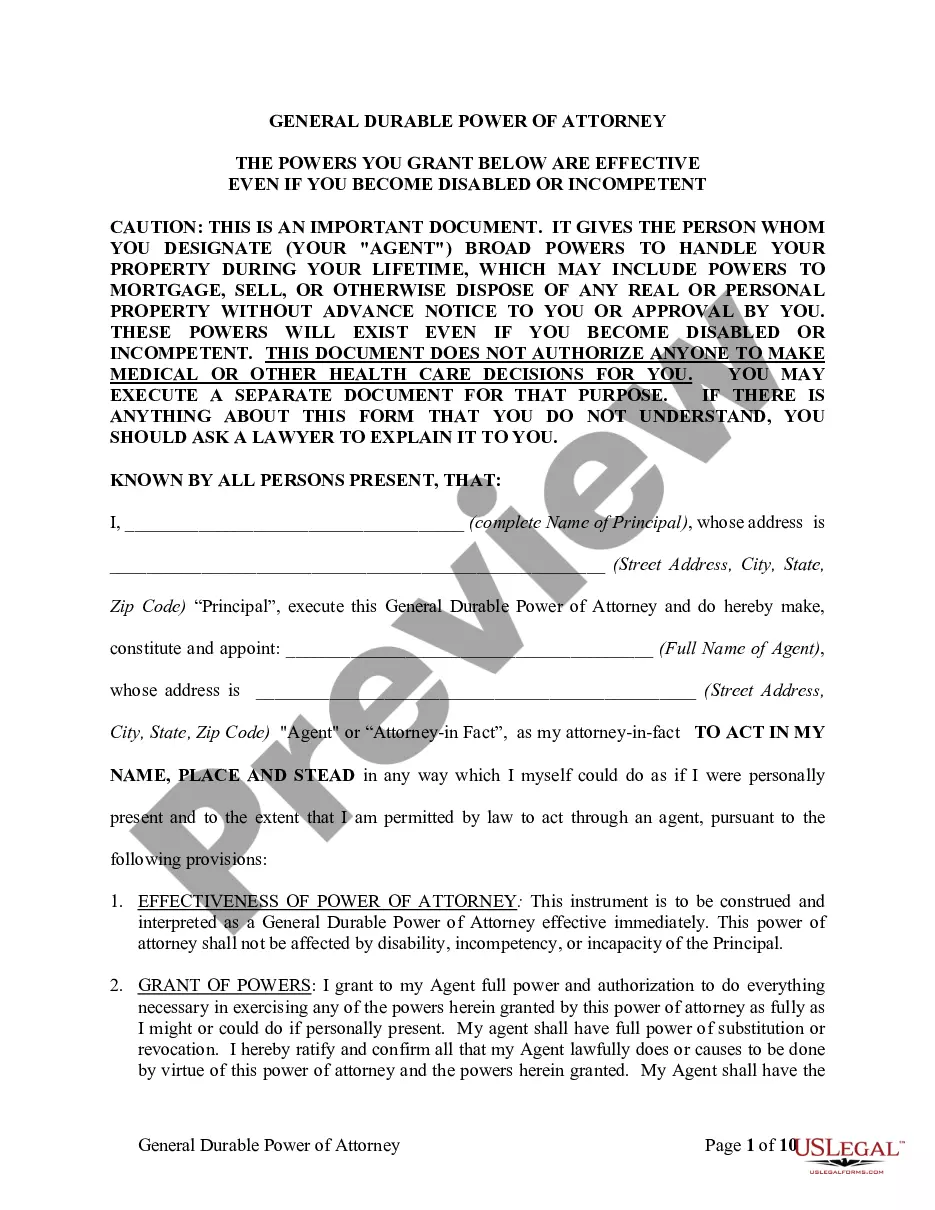

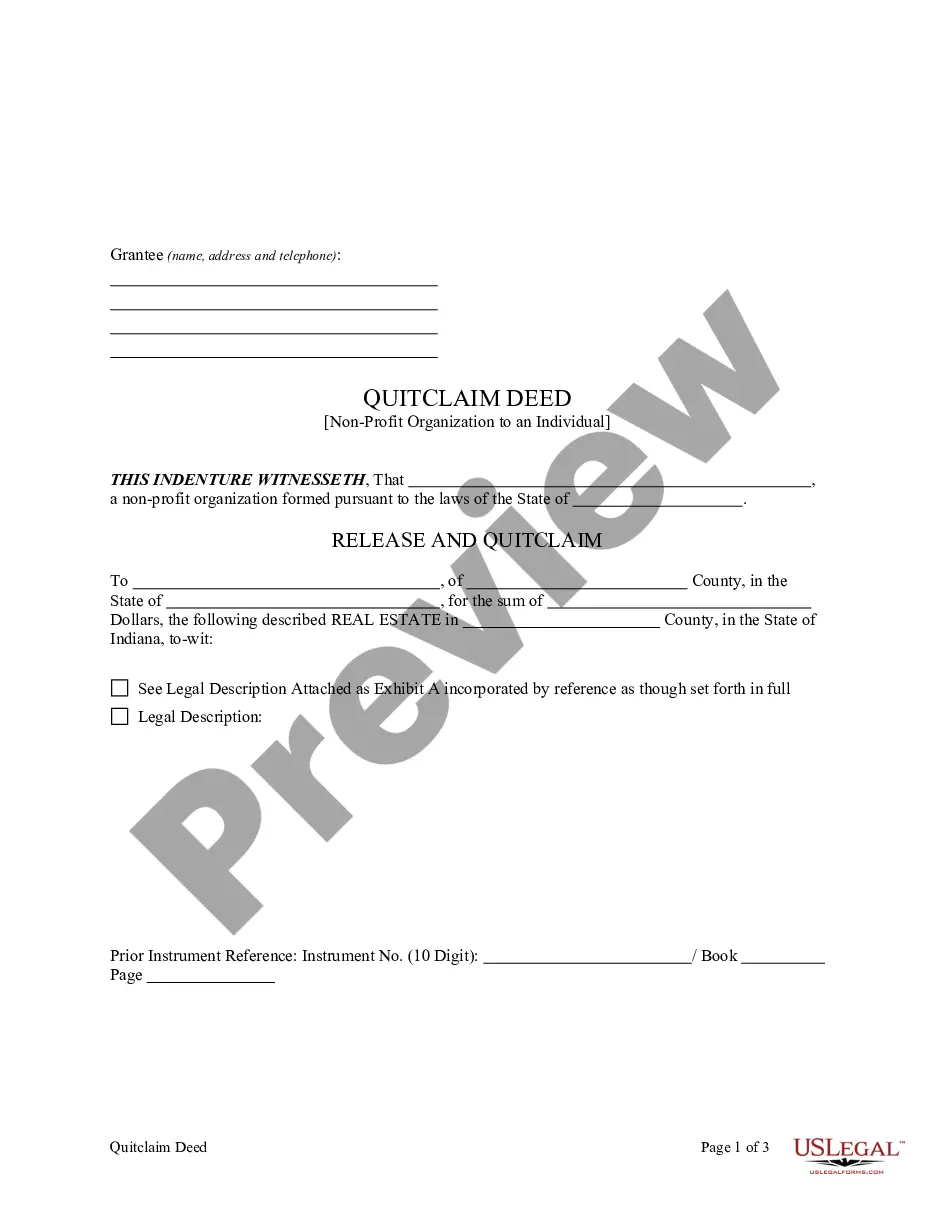

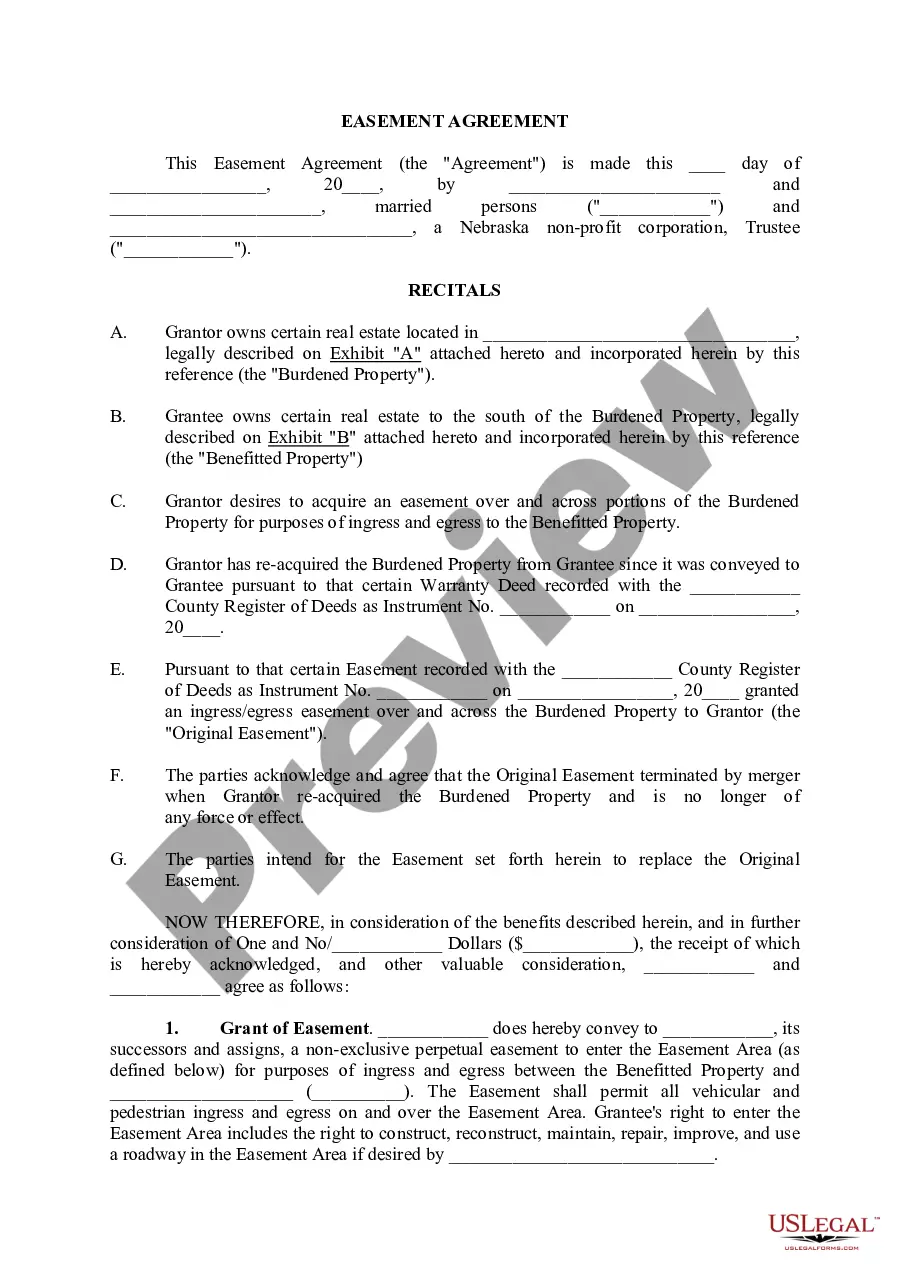

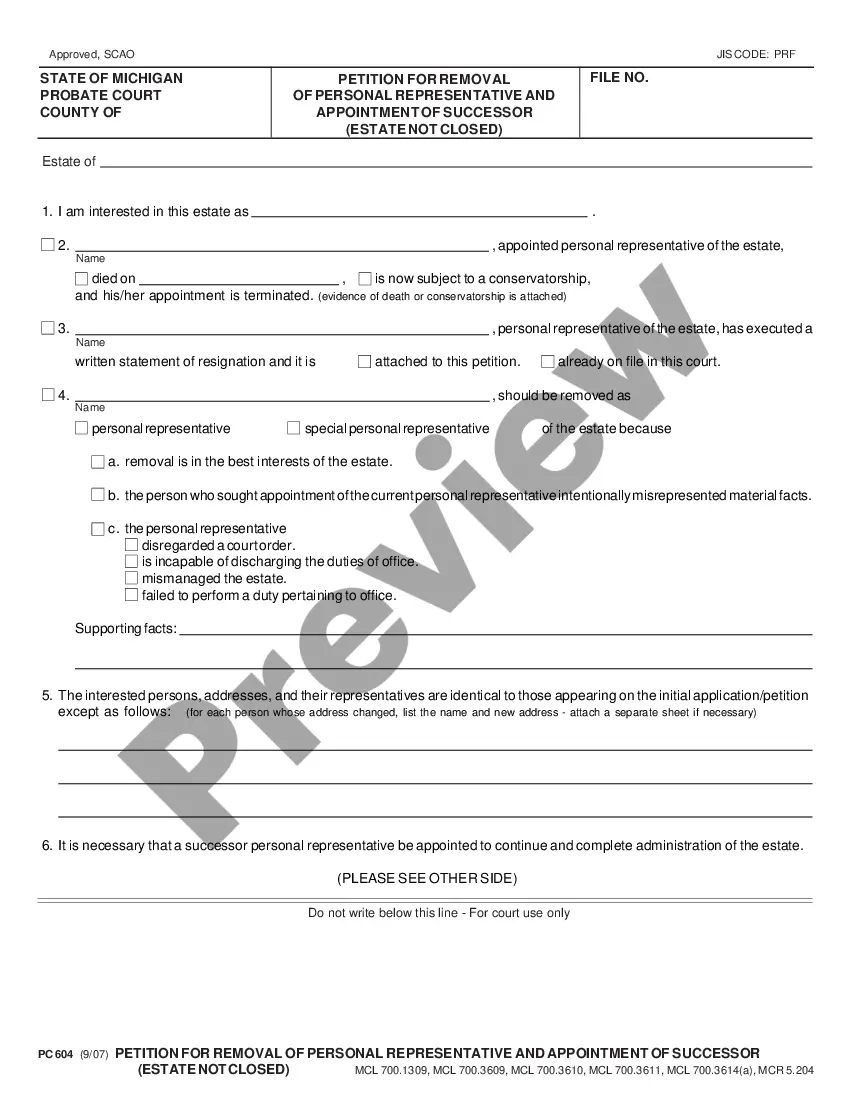

Wisconsin Trust Inventory (PR-1932) is a type of trust document used in the state of Wisconsin. It is a legal document used to create and oversee a trust and its assets. The Wisconsin Trust Inventory (PR-1932) is designed to help individuals and organizations create a trust that meets their specific needs and objectives. It includes a pre-filled form that is used to create the trust, as well as other documents that are needed for the trust to be established and managed. The Wisconsin Trust Inventory (PR-1932) includes a trust agreement, a power of attorney, a trust deed, an inventory of assets, and other necessary documents. There are several types of Wisconsin Trust Inventory (PR-1932) available, including a revocable trust, an irrevocable trust, a charitable trust, a spendthrift trust, and a special needs trust.

Wisconsin Trust Inventory (PR-1932) is a type of trust document used in the state of Wisconsin. It is a legal document used to create and oversee a trust and its assets. The Wisconsin Trust Inventory (PR-1932) is designed to help individuals and organizations create a trust that meets their specific needs and objectives. It includes a pre-filled form that is used to create the trust, as well as other documents that are needed for the trust to be established and managed. The Wisconsin Trust Inventory (PR-1932) includes a trust agreement, a power of attorney, a trust deed, an inventory of assets, and other necessary documents. There are several types of Wisconsin Trust Inventory (PR-1932) available, including a revocable trust, an irrevocable trust, a charitable trust, a spendthrift trust, and a special needs trust.