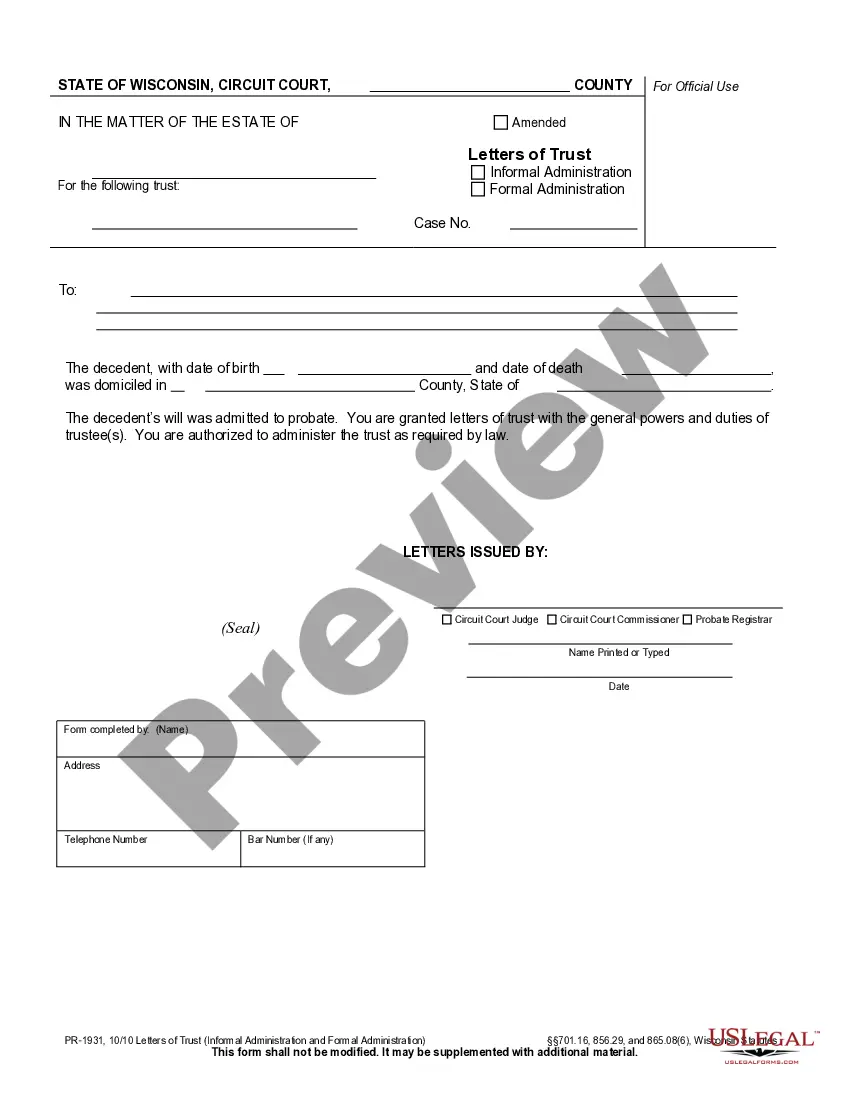

Wisconsin Letters of Trust (Informal and Formal Administration) are legal documents that provide authorization for a trustee to manage the assets of a trust. Informal administration refers to the process of administering a trust without court supervision, while formal administration requires court approval. The informal administration requires the trust or, or the person who created the trust, to designate a trustee to manage the trust assets, but it does not require court approval. The formal administration, on the other hand, requires the trust or to apply for a court order allowing the trustee to manage the assets. Wisconsin Letters of Trust (Informal and Formal Administration) are used to create a trust agreement between the trust or and the trustee that outlines the trustee’s duties and responsibilities. These documents also include the trust or’s instructions for how the trust should be managed, and any specific instructions for how the trustee should handle the trust’s assets. The two main types of Wisconsin Letters of Trust (Informal and Formal Administration) are the Informal Administration Letter and the Formal Administration Letter. The Informal Administration Letter is used to create a trust without court supervision. The Formal Administration Letter is used to create a trust with court supervision, and requires the trust or to apply for a court order allowing the trustee to manage the trust’s assets.

Wisconsin Letters of Trust (Informal and Formal Administration)

Description

How to fill out Wisconsin Letters Of Trust (Informal And Formal Administration)?

If you’re looking for a way to properly prepare the Wisconsin Letters of Trust (Informal and Formal Administration) without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every personal and business scenario. Every piece of documentation you find on our online service is drafted in accordance with federal and state laws, so you can be certain that your documents are in order.

Adhere to these simple instructions on how to get the ready-to-use Wisconsin Letters of Trust (Informal and Formal Administration):

- Ensure the document you see on the page complies with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and select your state from the list to locate another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to save your Wisconsin Letters of Trust (Informal and Formal Administration) and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

A Formal Administration requires the assistance of an attorney. Informal Administration may be granted without an attorney's assistance. Informal Administration is the administration of the decedent's estate without continuous court supervision, and is supervised by a Probate Registrar.

Any Wisconsin estate that is valued in excess of $50,000 must go through the probate administration process unless the property is subject to certain exemptions. For example, assets placed in a revocable living trust or life insurance proceeds are not subject to probate.

Wisconsin probate laws require an estate to be settled within 18 months.

In Wisconsin, the estate executor is known as a "personal representative". Subject to approval of the court, executor fees are set at 2% of the net value of the estate assets, or a rate agreed with the decedent or the majority interest of the heirs.

Domiciliary Letters are written proof that a person is authorized by the court to act as Personal Representative on behalf of the estate. Letters are issued as part of opening the probate case for an estate.

How Much Does an Executor get paid in Wisconsin? Wisconsin law stipulates that the personal representative of an estate is paid 2% of the total value of the estate.

857.05 Allowances to personal representative for expenses and services. (1) Expenses. The personal representative shall be allowed all necessary expenses in the care, management and settlement of the estate.

Personal Representative: Any person authorized to administer a decedent's estate. Evidence of this authorization is found in Domiciliary Letters granted by the court or by the Probate Registrar. A personal representative may be nominated in a Will or Codicil.