A Wisconsin Earnings Garnishment Order garnisheeing is a legal document used by creditors to collect a debt from a debtor’s employer. It is issued by a court or other competent authority and requires the employer to withhold a portion of the debtor’s wages and remit it to the creditor as payment for the debt. The Wisconsin Earnings Garnishment Order garnisheeing also outlines the procedures for the employer to follow when garnishing wages, such as maximum amount that can be withheld, frequency of payments, and so on. There are two types of Wisconsin Earnings Garnishment Order garnisheeing: one for a single debt and one for multiple debts. The single debt Wisconsin Earnings Garnishment Order garnisheeing requires the employer to withhold a portion of the debtor’s wages in order to satisfy an outstanding debt. The multiple debt Wisconsin Earnings Garnishment Order garnisheeing requires the employer to withhold wages from the debtor in order to satisfy multiple debts. The Release of Garnishee is a document issued by the court or other competent authority to release the employer from the obligation to garnish the debtor’s wages. This document is typically issued when the debt has been satisfied or the garnishment period has expired.

Wisconsin Earnings Garnishment Order to Garnishee/Release of Garnishee

Description

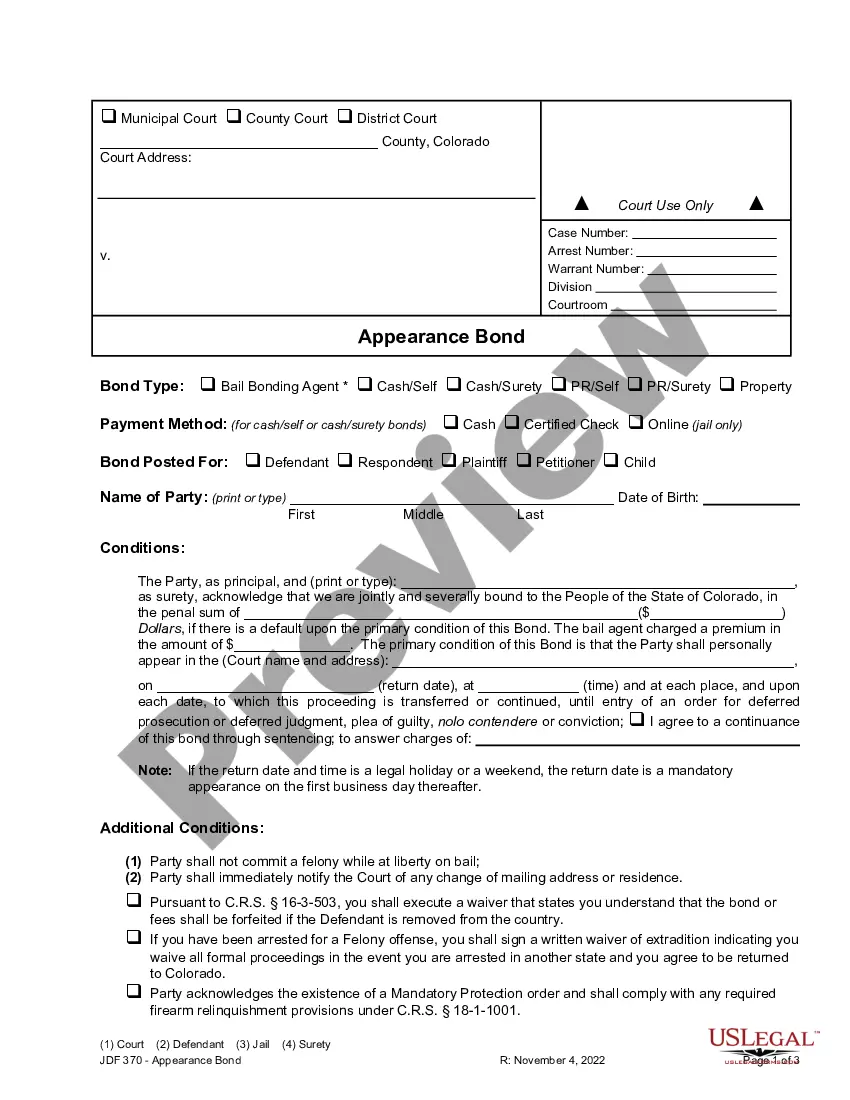

How to fill out Wisconsin Earnings Garnishment Order To Garnishee/Release Of Garnishee?

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state laws and are examined by our specialists. So if you need to complete Wisconsin Earnings Garnishment Order to Garnishee/Release of Garnishee, our service is the perfect place to download it.

Obtaining your Wisconsin Earnings Garnishment Order to Garnishee/Release of Garnishee from our service is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button after they find the correct template. Later, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

- Document compliance check. You should carefully examine the content of the form you want and ensure whether it suits your needs and complies with your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab above until you find a suitable blank, and click Buy Now when you see the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Wisconsin Earnings Garnishment Order to Garnishee/Release of Garnishee and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to get any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep. (If you're unable to pay your bills, learn which debts get wiped out in Chapter 7 bankruptcy.)

Garnishment is good for 13 weeks unless debtor agrees to continued withholding in writing. Must renew every 13 weeks add cost to debtors owed amount. The first 80% of the debtor's disposable earnings are exempt from garnishment. All earnings may be exempt in some cases.

You can avoid a levy by filing returns on time and paying your taxes when due. If you need more time to file, you can request an extension. If you can't pay what you owe, you should pay as much as you can and work with the IRS to resolve the remaining balance.

(1) The creditor shall pay a $15 fee to the garnishee for each earnings garnishment or each stipulated extension of that earnings garnishment. This fee shall be included as a cost in the creditor's claim in the earnings garnishment.

If your employee has any concerns about the amount of wages being withheld, they should contact us directly at 608-266-7879 or DORCompliance@wisconsin.gov.

In Wisconsin, the total amount a creditor can garnish can't be more than the amount of the judgment, which may include the original past-due debt plus any fees, costs, or interest. On a weekly basis, the judgment creditor can take the lesser of the following: 20% of your weekly disposable earnings, or.

812.01 Commencement of garnishment. (1) Any creditor may proceed against any person who is indebted to or has any property in his or her possession or under his or her control belonging to such creditor's debtor or which is subject to satisfaction of an obligation described under s.

CV- 423,424, 426, 427 within 60 days of filing the Earnings Garnishment Notice but not more than 7 days after garnishee served, at least 3 days before next payday. Garnishment is good for 13 weeks unless debtor agrees to continued withholding in writing. Must renew every 13 weeks add cost to debtors owed amount.