Wisconsin Post-Judgment: Basic Steps for Handling a Non-Earnings Garnishment is the process of recovering a debt after a judgment has been issued by a court. This process involves the garnishment of non-earnings, such as bank accounts, wages, property, and/or tax refunds. It is important to understand the steps necessary to properly handle a non-earnings garnishment. Step 1: The Creditor Files an Order of Garnishment. The creditor must submit a form to the court, known as an "Order of Garnishment," which provides details regarding the debt owed. Step 2: The Debtor is Served Notice. Once the Order of Garnishment is filed with the court, the debtor must be served notice of the garnishment. This is usually done through certified mail, personal delivery, or publication. Step 3: The Creditor Submits a Garnishment Summons. The creditor must then submit a Garnishment Summons to the third party (the garnishee) who holds the debtor's non-earnings. Step 4: The Garnishee Responds to the Garnishment. The garnishee must then respond by filing a Garnishment Answer, stating whether they have the debtor's non-earnings. Step 5: The Creditor Receives a Judgment. If the garnishee has the debtor's non-earnings, the creditor will receive a judgment from the court ordering the garnishee to turn over the non-earnings to the creditor. Step 6: The Garnishee Pays the Creditor. The garnishee must then pay the creditor the amount ordered by the court. In some cases, there may also be additional steps or different types of Wisconsin Post-Judgment: Basic Steps for Handling a Non-Earnings Garnishment. These may include steps related to filing motions, pursuing exemptions, or collecting on a judgment.

Wisconsin Post-Judgment: Basic Steps for Handling a Non-Earnings Garnishment

Description

How to fill out Wisconsin Post-Judgment: Basic Steps For Handling A Non-Earnings Garnishment?

How much time and resources do you typically spend on drafting formal documentation? There’s a greater way to get such forms than hiring legal experts or spending hours browsing the web for a proper blank. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, like the Wisconsin Post-Judgment: Basic Steps for Handling a Non-Earnings Garnishment.

To acquire and complete an appropriate Wisconsin Post-Judgment: Basic Steps for Handling a Non-Earnings Garnishment blank, follow these simple instructions:

- Examine the form content to ensure it meets your state laws. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t satisfy your needs, find another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Wisconsin Post-Judgment: Basic Steps for Handling a Non-Earnings Garnishment. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally reliable for that.

- Download your Wisconsin Post-Judgment: Basic Steps for Handling a Non-Earnings Garnishment on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously downloaded documents that you securely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us now!

Form popularity

FAQ

CV- 423,424, 426, 427 within 60 days of filing the Earnings Garnishment Notice but not more than 7 days after garnishee served, at least 3 days before next payday. Garnishment is good for 13 weeks unless debtor agrees to continued withholding in writing. Must renew every 13 weeks add cost to debtors owed amount.

Pay your debts if you can afford it. Make a plan to reduce your debt. If you cannot afford to pay your debt, see if you can set up a payment plan with your creditor.Challenge the garnishment.Do no put money into an account at a bank or credit union. See if you can settle your debt.Consider bankruptcy.

5 Ways to Stop a Garnishment Pay Off the Debt. If your financial situation is dire, paying off the debt may not be an option.Work With Your Creditor.Challenge the Garnishment.File a Claim of Exemption.File for Bankruptcy.

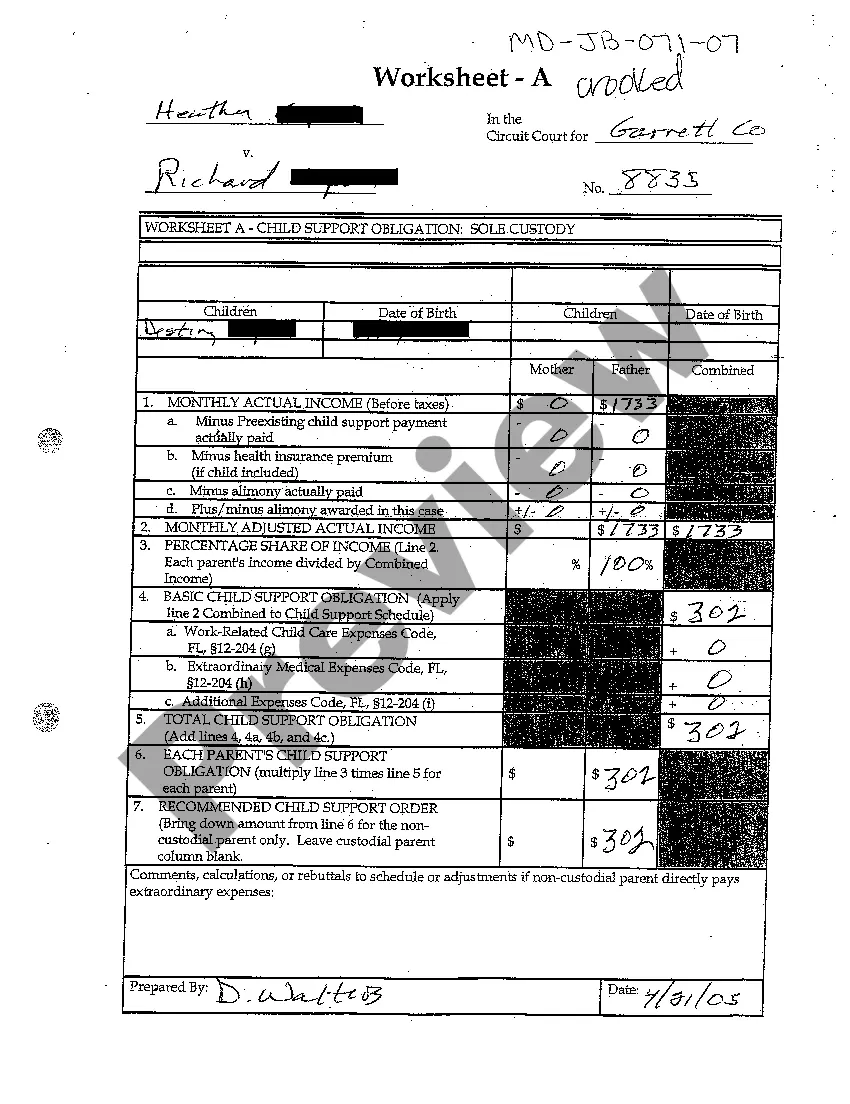

What is a non-earnings garnishment? A non-earnings garnishment is when the court orders a person or entity (garnishee), who is not an employer of the debtor but who owes money to the debtor, to pay a judgment creditor for an amount owed by the debtor to the creditor.

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

Another way to stop a wage garnishment is by negotiating with your creditor. Many creditors are reluctant to settle debts once they have a garnishment. However, an attorney can help you negotiate the best settlement by offering a lump sum amount or payment terms.

You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep. (If you're unable to pay your bills, learn which debts get wiped out in Chapter 7 bankruptcy.)

If wage garnishment means that you can't pay for your family's basic needs, you can ask the court to order the debt collector to stop garnishing your wages or reduce the amount. This is called a Claim of Exemption.