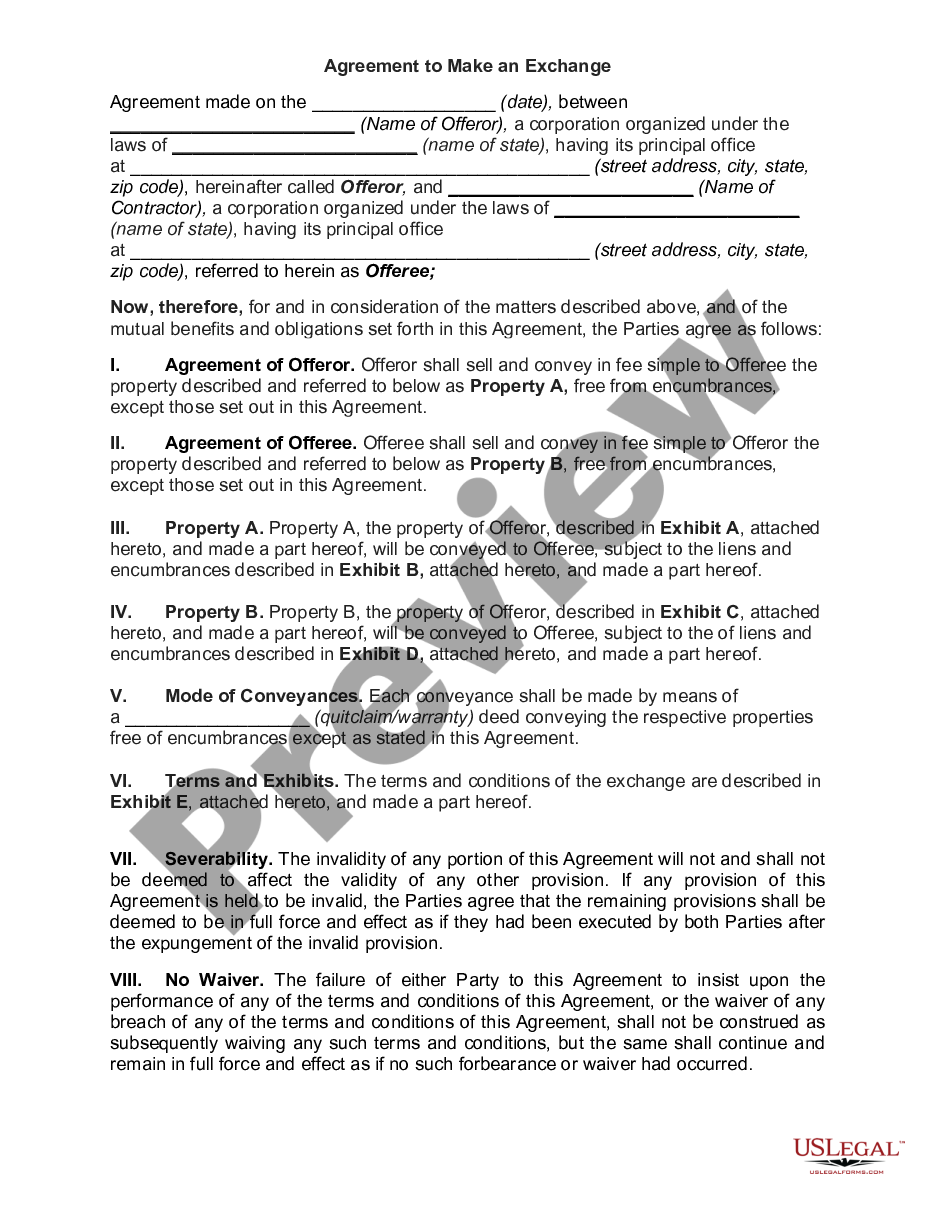

Wisconsin ? Simultaneous Exchange Agreement is a type of real estate transaction that allows two or more parties to exchange properties simultaneously. This agreement is used when property owners wish to exchange one property for another without the need for a third party or closing costs. It is also sometimes referred to as a simultaneous closing or a 1031 exchange. This type of exchange is beneficial for both parties since it allows them to avoid paying capital gains tax on the sale of their property. This tax savings allows the parties to reinvest their money into another property with greater potential value. This agreement also eliminates the need to obtain a loan from a bank to purchase the new property. There are two types of Wisconsin ? Simultaneous Exchange Agreement: a Delayed Exchange and an Improved Exchange. In a Delayed Exchange, one party will transfer their current property to the other party and then receive the new property at a later date. An Improved Exchange is used when one party is transferring an improved property (i.e. a property that has been renovated or improved in some way) to the other party in exchange for their current property. Both types of exchange agreements are regulated by the Wisconsin Department of Revenue and are subject to certain restrictions and requirements. All parties involved in the exchange must be properly advised, and the exchange must be properly reported to the Department of Revenue.

Wisconsin ?Simultaneous Exchange Agreement

Description

How to fill out Wisconsin ?Simultaneous Exchange Agreement?

US Legal Forms is the most straightforward and cost-effective way to find appropriate formal templates. It’s the most extensive web-based library of business and individual legal documentation drafted and checked by attorneys. Here, you can find printable and fillable blanks that comply with federal and local laws - just like your Wisconsin ?Simultaneous Exchange Agreement.

Getting your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Wisconsin ?Simultaneous Exchange Agreement if you are using US Legal Forms for the first time:

- Read the form description or preview the document to ensure you’ve found the one corresponding to your requirements, or locate another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you like most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your Wisconsin ?Simultaneous Exchange Agreement and save it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more effectively.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the required official paperwork. Try it out!

Form popularity

FAQ

The biggest downside of simultaneous Exchange and Completion is that both parties will need to do all of this preparation without the security of the other party actually being bound, as there is no obligation on either party to complete the sale until contracts have been exchanged.

But if you're exchanging and completing on the same day, you'll have to arrange removals without being in a legally binding contract, meaning you could end up not moving on that day. You could end up emptying one property and finding yourself unable to load your belongings into the other.

Disadvantages: It is very difficult to find another party who wants to swap for your property. The other party has to want what you have at exactly the same time you want to acquire their property. Also, the equity and debt must match on both properties to avoid one party recognizing some ?boot.?

Occasionally, the sale of the old property and the acquisition of the new property close in one extended closing. This is called a simultaneous 1031 exchange.

A Simultaneous Exchange, is an exchange in which the closing of the relinquished property and the replacement property occur on the same day, usually simultaneously. There is no interval of time between the two closings.

A simultaneous 1031 exchange occurs when the relinquished and replacement properties close at the same time. While on the surface this kind of exchange appears to be simple, issues can arise, particularly involving constructive receipt.

The swap or two-party trade is the simplest form of the simultaneous exchange, but it's also the more challenging type to complete. In this method, two parties hold properties that meet 1031 exchange requirements for one another.