This form is a sample letter in Word format covering the subject matter of the title of the form.

Wisconsin Sample Letter for Exemption - Relevant Information

Description

How to fill out Sample Letter For Exemption - Relevant Information?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print. By using the website, you will obtain thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Wisconsin Sample Letter for Exemption - Related Information in seconds.

If you already have a subscription, Log In and download the Wisconsin Sample Letter for Exemption - Related Information from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get you started: Ensure you have selected the correct form for your city/region. Click the Preview button to examine the form’s details. Review the form summary to make sure you have chosen the correct form. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the pricing plan you prefer and provide your information to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Select the file format and download the form to your device. Make modifications. Complete, edit, and print and sign the saved Wisconsin Sample Letter for Exemption - Related Information.

- Every template you added to your account has no expiration date and is yours forever.

- If you want to download or print an additional copy, just go to the My documents section and click on the form you need.

- Access the Wisconsin Sample Letter for Exemption - Related Information with US Legal Forms, one of the most extensive libraries of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Explore a wide array of forms tailored for various purposes.

- Easily manage and retrieve your saved documents whenever necessary.

Form popularity

FAQ

An example of an exemption could be a request for relief from property taxes due to financial hardship or a medical condition. This type of exemption allows individuals to alleviate some of their financial burdens based on their specific situations. Utilizing a Wisconsin Sample Letter for Exemption - Relevant Information can help you articulate your request clearly and effectively. Such templates provide guidance on how to structure your example, making it easier for the receiving party to understand your circumstances.

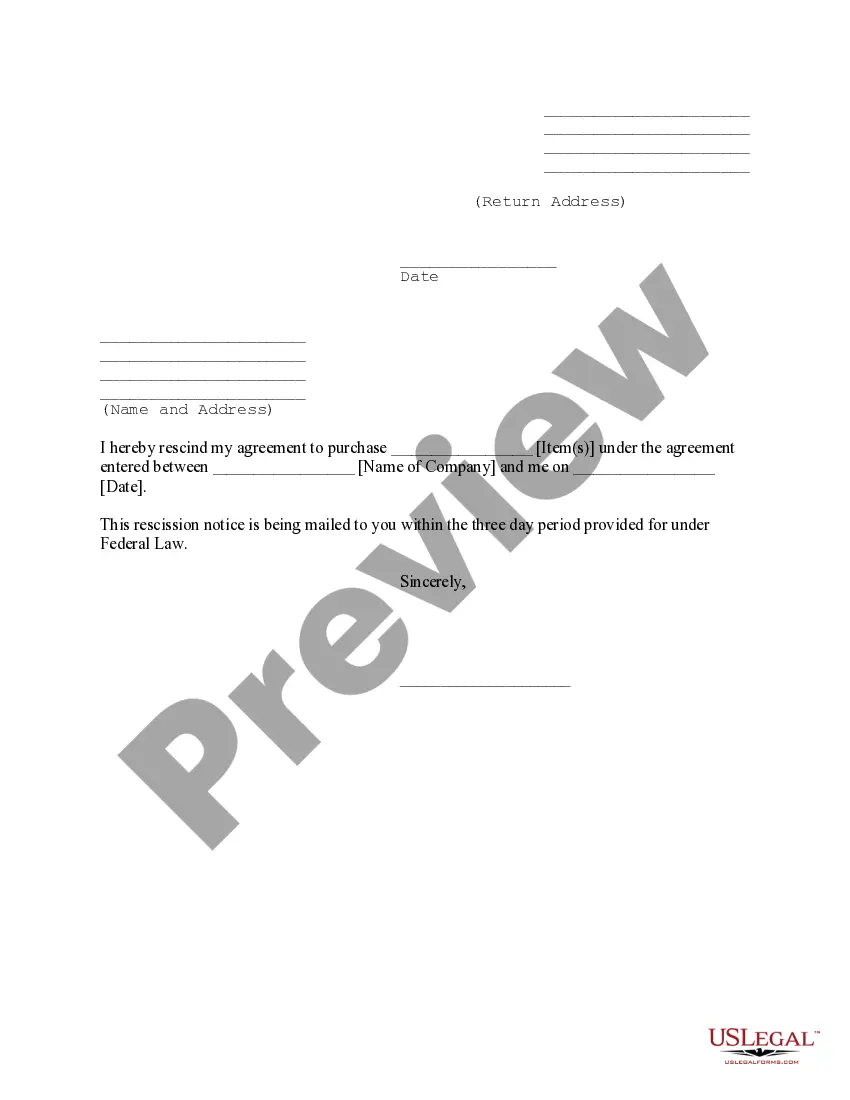

When drafting an exemption letter, include your full name, address, and contact information at the top of the letter. Additionally, specify the reason for your exemption request, referencing any applicable laws or regulations. A Wisconsin Sample Letter for Exemption - Relevant Information can guide you on the necessary components, ensuring you present your case logically and persuasively. Make sure to conclude with a polite request for consideration and provide any supporting documents if required.

An exemption letter is a formal document that requests relief from certain obligations or requirements, often based on specific criteria. In the context of Wisconsin, a Wisconsin Sample Letter for Exemption - Relevant Information provides a template to help you draft this letter effectively. It explains the grounds for your request and outlines your circumstances clearly. Using such a sample ensures you include all necessary details to enhance your chances of approval.

To get tax exempt in Wisconsin, you generally need to submit an application along with supporting documentation to the appropriate state agency. This process often requires specific forms and may involve proving your eligibility based on your organization’s status or purpose. Utilizing resources like uslegalforms can provide you with the Wisconsin Sample Letter for Exemption - Relevant Information to ensure you meet all requirements efficiently. Stay organized and thorough to facilitate a smooth application process.

The exemption for yourself in Wisconsin typically refers to personal exemptions that reduce your taxable income. This can include exemptions for you, your spouse, and dependents. It's essential to understand the criteria for these exemptions, as they can significantly affect your tax liability. For detailed instructions and examples, consider consulting the Wisconsin Sample Letter for Exemption - Relevant Information.

A certificate of exempt status in Wisconsin serves as proof that a specific organization is exempt from certain taxes. This certificate is crucial for nonprofits, religious organizations, and other qualifying entities, allowing them to operate without the burden of specific tax obligations. You can find more details and templates, including the Wisconsin Sample Letter for Exemption - Relevant Information, on platforms like uslegalforms. This can simplify the process of obtaining your certificate.

To write a request letter for tax exemption, start by clearly stating your purpose in the opening paragraph. Include your personal information, such as name and address, as well as any relevant identification numbers. In the body, explain why you believe you qualify for tax exemption, referencing the Wisconsin Sample Letter for Exemption - Relevant Information for guidance. Finally, conclude with a polite request for consideration and your signature.