The Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift is an important legal document used by non-profit organizations to officially recognize and acknowledge receipt of charitable donations or gifts. This document serves as proof for both the donor and the recipient institution that the donation has been received and is eligible for tax deductions. There are different types of Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift, including: 1. Monetary Gift Acknowledgment: This type of acknowledgment is issued when a donor makes a cash or check donation to a charitable or educational institution in Wisconsin. It includes specific details such as the donation amount, date of receipt, and the purpose for which the donation will be used. 2. In-Kind Gift Acknowledgment: In cases where a donor contributes non-monetary items such as goods, services, or property to a non-profit organization, an in-kind gift acknowledgment is used. This document describes the nature of the donation, its fair market value, and any conditions or restrictions associated with the gift. 3. Securities or Stock Gift Acknowledgment: When individuals or entities donate stocks, bonds, or other securities to a charitable or educational institution in Wisconsin, a specialized acknowledgment is required. This document highlights the specific securities donated, their fair market value, and any relevant details regarding the transfer process. 4. Pledged Gift Acknowledgment: Sometimes, donors commit to making a gift or donation to a non-profit organization over a certain period. In such cases, a pledged gift acknowledgment is used. This document acknowledges the donor's commitment and states the terms and conditions of the pledge, including the timeframe and payment schedule. In all cases, the Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift is a crucial document for both the donor and the recipient organization. It ensures transparency, accountability, and compliance with Wisconsin's tax laws. Both parties should carefully review and retain a copy of the acknowledgment for tax filing purposes. It's important to note that the exact format and content of the acknowledgment may vary depending on the specific requirements set by the Wisconsin Department of Revenue and other relevant regulations. Non-profit organizations should consult legal professionals or tax advisors to ensure their acknowledgment documents are accurate, complete, and compliant with the necessary guidelines.

Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

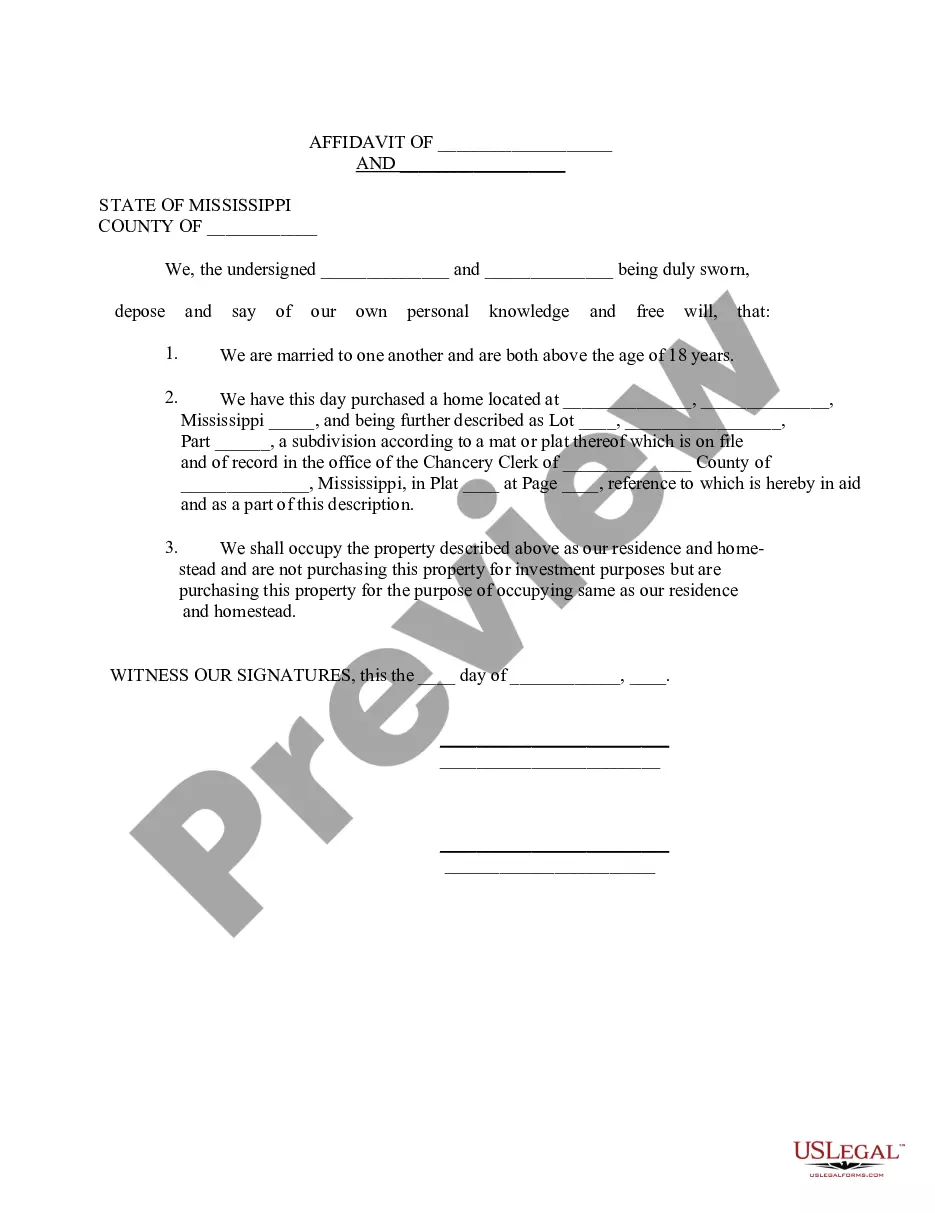

How to fill out Wisconsin Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

US Legal Forms - one of many most significant libraries of legitimate forms in the States - provides an array of legitimate papers templates you can obtain or produce. Making use of the web site, you can find 1000s of forms for company and individual reasons, categorized by classes, states, or keywords.You can find the latest types of forms just like the Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift within minutes.

If you have a monthly subscription, log in and obtain Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift in the US Legal Forms collection. The Download option can look on each kind you perspective. You have access to all in the past downloaded forms in the My Forms tab of your respective bank account.

If you would like use US Legal Forms initially, here are simple recommendations to help you get began:

- Be sure to have picked the right kind to your town/state. Click the Preview option to review the form`s content material. Browse the kind information to actually have selected the correct kind.

- In case the kind doesn`t fit your specifications, take advantage of the Lookup area on top of the display to find the one which does.

- Should you be content with the shape, verify your selection by simply clicking the Get now option. Then, opt for the prices program you favor and offer your credentials to register for an bank account.

- Procedure the transaction. Use your Visa or Mastercard or PayPal bank account to complete the transaction.

- Find the file format and obtain the shape in your system.

- Make changes. Load, change and produce and sign the downloaded Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

Each and every format you put into your account does not have an expiry time and is also your own property permanently. So, if you wish to obtain or produce yet another backup, just proceed to the My Forms section and click on the kind you want.

Get access to the Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift with US Legal Forms, by far the most comprehensive collection of legitimate papers templates. Use 1000s of skilled and express-specific templates that fulfill your small business or individual requires and specifications.

Form popularity

FAQ

Gift acknowledgment letters are letters sent to donors that formally acknowledge their generous donation. These letters should express gratitude and appreciation while also providing the donor with a record of the donation.

Things Your Acknowledgement Letters Should Include Name of your organization. Amount of contribution. Description (not necessarily the value) of non-cash contribution. Statement confirming no exchange of goods/services (if applicable) Description and good-faith value estimate of goods/services provided (if applicable)

How should I recognize in-kind donations? Send the donor an acknowledgment that includes your tax ID number, a description of the goods and/or services they donated and the date you received them. This letter should also confirm that donors received no substantial goods or services in exchange for their contribution.

You should always have the following information on your donation receipts: Name of the organization. Donor's name. Recorded date of the donation. Amount of cash contribution or fair market value of in-kind goods and services. Organization's 501(c)(3) status.

Dear [DONOR NAME], Thank you for your generous donation to [ORGANIZATION NAME], a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code ([EIN #]). On [DATE], you made a contribution of [AMOUNT] in support of our mission. This gift was processed as credit card transaction.

Sample Acknowledgment for an In-Kind Gift ?Thank you for your generous gift of ________(Full Description)________ which we received on ____(Date)____. Your generous contribution will help to further the important work of our organization.