The Wisconsin Direct Deposit Form for Social Security is a document that allows individuals to request that their Social Security payments be deposited directly into their bank accounts, rather than receiving paper checks. This form is specifically designed for residents of Wisconsin who are receiving Social Security benefits. The purpose of this form is to provide a convenient and secure method for individuals to receive their payments. By opting for direct deposit, beneficiaries can have their funds automatically transferred into their bank account on the scheduled payment dates. This eliminates the need to wait for and deposit physical checks, saving both time and effort. The Wisconsin Direct Deposit Form for Social Security requires various pieces of information to be provided. These include the individual's name, Social Security number, address, and contact information. Additionally, individuals need to provide their bank account details, including the bank's routing number and the individual's account number. Ensuring accurate and complete information on the form is crucial to ensure successful direct deposits. It is important to note that there may be different types or versions of the Wisconsin Direct Deposit Form for Social Security, depending on individual circumstances. These variations may include forms for retirees, disability recipients, survivors, or any other category of Social Security beneficiaries. Each form may have specific requirements and instructions tailored to the corresponding type of recipient. To ensure obtaining the correct form, it is recommended to visit the official website of the Social Security Administration or the local Wisconsin's Department of Health Services. Alternatively, these forms may also be available at local Social Security offices, banks, or financial institutions. It is crucial to use the designated form that corresponds to the specific category of Social Security beneficiaries to avoid any complications or errors in the direct deposit process.

Wisconsin Direct Deposit Form for Social Security

Description

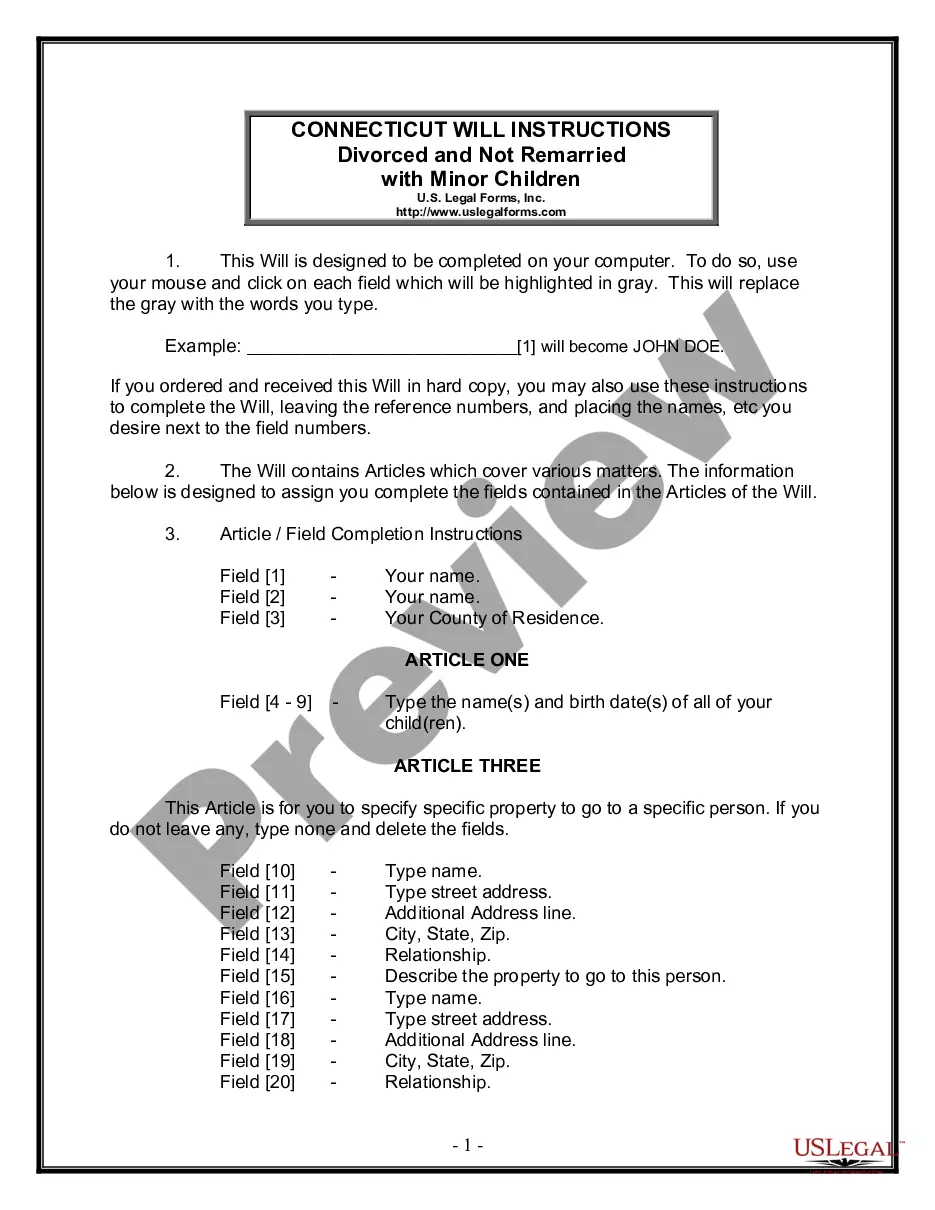

How to fill out Wisconsin Direct Deposit Form For Social Security?

Are you presently within a placement where you will need documents for both organization or personal uses almost every day time? There are a lot of legitimate document layouts available on the net, but finding types you can trust is not effortless. US Legal Forms offers a large number of type layouts, much like the Wisconsin Direct Deposit Form for Social Security, which can be published to fulfill state and federal requirements.

If you are previously informed about US Legal Forms website and possess a merchant account, merely log in. After that, you are able to acquire the Wisconsin Direct Deposit Form for Social Security web template.

Unless you have an accounts and need to begin to use US Legal Forms, follow these steps:

- Discover the type you require and make sure it is for that right city/area.

- Utilize the Preview option to check the shape.

- Read the explanation to ensure that you have chosen the correct type.

- If the type is not what you`re searching for, use the Research discipline to obtain the type that suits you and requirements.

- Once you obtain the right type, just click Buy now.

- Choose the rates strategy you want, fill in the necessary info to generate your bank account, and buy your order with your PayPal or charge card.

- Decide on a handy file structure and acquire your copy.

Get each of the document layouts you may have bought in the My Forms menu. You can get a extra copy of Wisconsin Direct Deposit Form for Social Security any time, if possible. Just click the essential type to acquire or print the document web template.

Use US Legal Forms, probably the most considerable variety of legitimate kinds, to conserve time as well as stay away from faults. The services offers expertly manufactured legitimate document layouts that can be used for a variety of uses. Create a merchant account on US Legal Forms and commence making your way of life easier.