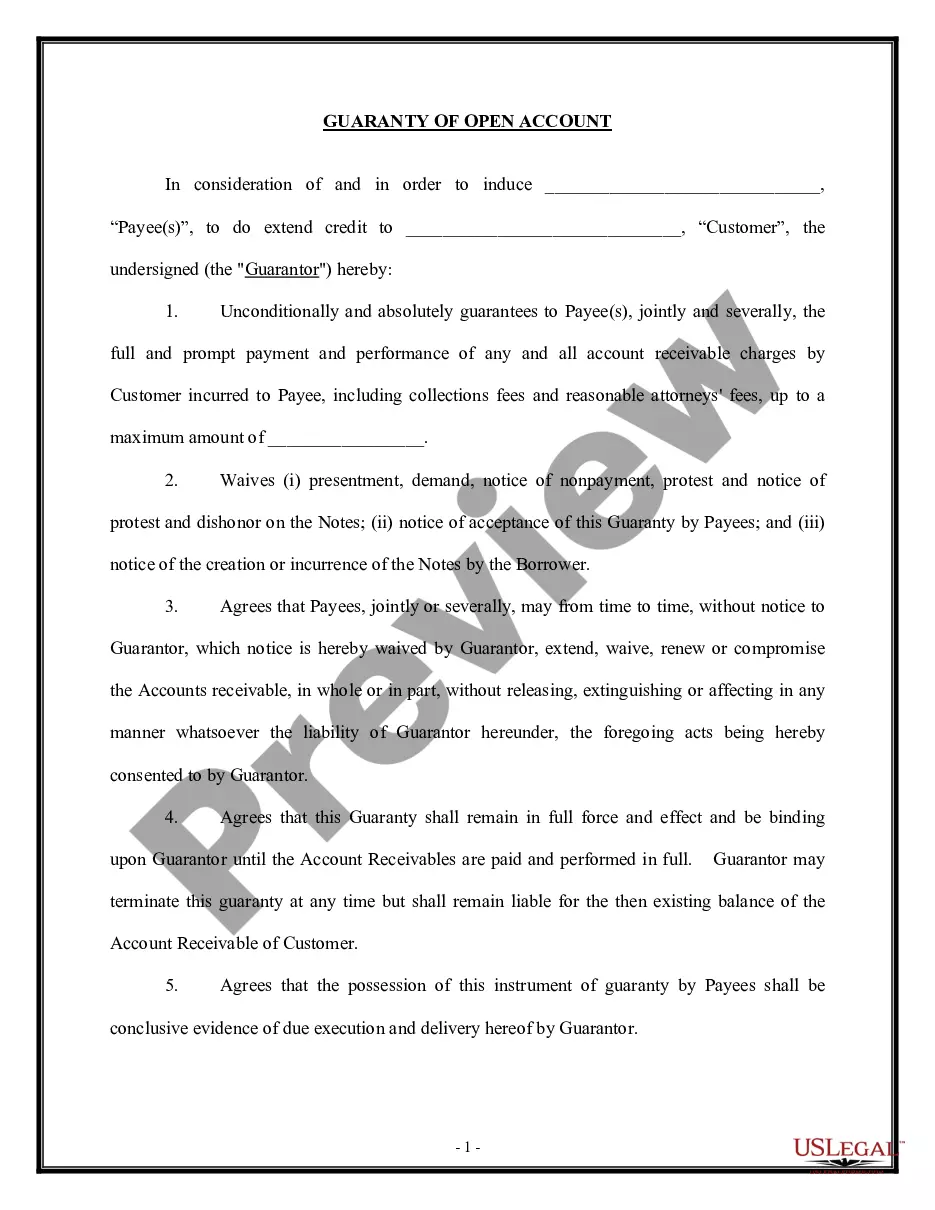

The Wisconsin Guaranty of Open Account — Alternate Form is a legal document that outlines the responsibilities and obligations of the guarantor in an open credit account agreement in the state of Wisconsin. This document is used to provide security to the creditor by ensuring repayment of the account balance in case the debtor defaults. In the context of commercial transactions, an open account refers to a credit arrangement between a seller and a buyer where goods or services are provided on credit, without any specific terms regarding payment. This type of agreement allows the buyer to make purchases on credit up to a predetermined limit, which is usually based on the buyer's creditworthiness. The Wisconsin Guaranty of Open Account — Alternate Form names different variations depending on the parties involved or the specific terms established. Some common types include: 1. Individual Guaranty: This version involves an individual acting as the guarantor, assuming personal liability for the repayment of the debtor's account balance. The guarantor's personal assets may be used to fulfill the debt. 2. Corporate Guaranty: In this case, a corporation assumes the role of the guarantor. This type of guaranty protects the creditor's interests by involving a business entity that takes responsibility for the debt. This allows the creditor to seek repayment from the corporation's assets, rather than relying solely on the debtor's assets. 3. Limited Guaranty: A limited guaranty establishes specific limitations on the guarantor's liability. For example, the guarantor may only be responsible for a certain percentage or amount of the debt, or their liability may be limited to a specific time frame. 4. Continuing Guaranty: This type of guaranty remains in effect until it is specifically revoked or terminated by the guarantor. It covers both existing and future debts incurred by the debtor, providing ongoing security to the creditor. This is particularly useful when dealing with long-term credit relationships. In conclusion, the Wisconsin Guaranty of Open Account — Alternate Form is a legal document that specifies the obligations and liabilities of a guarantor in an open credit account agreement. It ensures the creditor's protection by establishing a party who takes responsibility for repaying the debtor's account balance in case of default. The different types of guaranties, such as individual, corporate, limited, and continuing, provide flexibility to accommodate various commercial credit arrangements.

Wisconsin Guaranty of Open Account - Alternate Form

Description

How to fill out Wisconsin Guaranty Of Open Account - Alternate Form?

US Legal Forms - one of many largest libraries of legitimate types in the States - gives a variety of legitimate file web templates it is possible to obtain or print. Utilizing the site, you can find thousands of types for business and person purposes, categorized by classes, states, or keywords.You can get the most up-to-date variations of types just like the Wisconsin Guaranty of Open Account - Alternate Form in seconds.

If you already have a monthly subscription, log in and obtain Wisconsin Guaranty of Open Account - Alternate Form through the US Legal Forms catalogue. The Down load switch can look on every single kind you view. You get access to all in the past saved types inside the My Forms tab of your own accounts.

If you wish to use US Legal Forms initially, listed below are easy instructions to obtain started:

- Be sure to have picked the correct kind to your metropolis/county. Click the Preview switch to check the form`s content material. See the kind information to ensure that you have selected the right kind.

- If the kind doesn`t match your demands, utilize the Research industry towards the top of the display to discover the one which does.

- Should you be content with the shape, affirm your option by clicking the Purchase now switch. Then, opt for the rates strategy you like and provide your qualifications to sign up for the accounts.

- Process the transaction. Make use of your bank card or PayPal accounts to complete the transaction.

- Find the file format and obtain the shape on the product.

- Make modifications. Fill out, modify and print and sign the saved Wisconsin Guaranty of Open Account - Alternate Form.

Each and every format you put into your money does not have an expiry time and is also your own eternally. So, if you wish to obtain or print an additional duplicate, just visit the My Forms portion and then click on the kind you need.

Get access to the Wisconsin Guaranty of Open Account - Alternate Form with US Legal Forms, probably the most considerable catalogue of legitimate file web templates. Use thousands of professional and condition-distinct web templates that satisfy your company or person requires and demands.