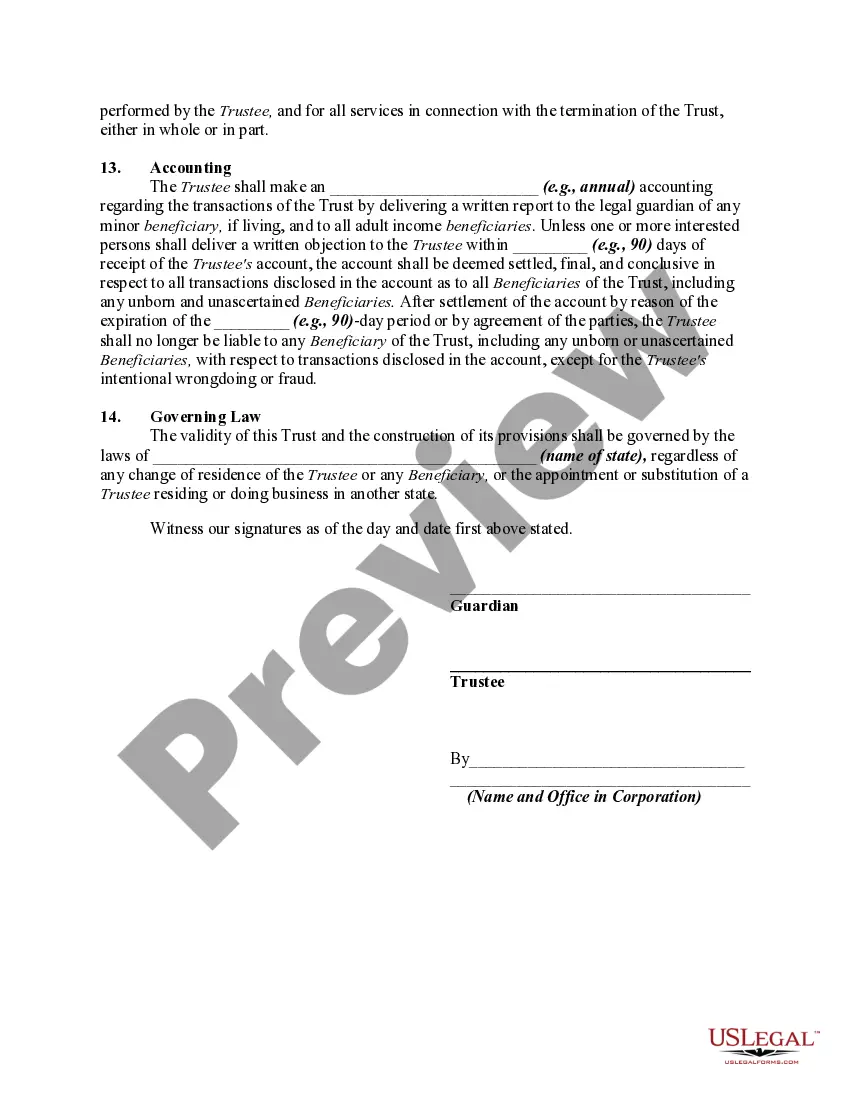

A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. Most trusts are founded by the persons (called trustors, settlors and/or donors) who execute a written declaration of trust which establishes the trust and spells out the terms and conditions upon which it will be conducted. The declaration also names the original trustee or trustees, successor trustees or means to choose future trustees.

Wisconsin Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor

Description

How to fill out Trust Agreement To Hold Funds For Minor Resulting From Settlement Of A Personal Injury Action Filed On Behalf Of Minor?

You can allocate time online searching for the legal document template that fulfills the state and federal specifications you need.

US Legal Forms offers a vast array of legal forms that have been reviewed by professionals.

You can effortlessly download or print the Wisconsin Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor from our platform.

First, ensure that you have selected the correct document template for the county/city you choose. Review the document summary to ensure you have selected the right template. If available, use the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can complete, modify, print, or sign the Wisconsin Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased template, proceed to the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Yes, you can place a settlement into a trust, which is often recommended for minors. By using a Wisconsin Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor, you can provide a structured way to manage the funds until the minor reaches maturity. This approach not only safeguards the assets but also ensures they are used for the minor's benefit, such as education or medical needs.

A reasonable settlement offer in a personal injury case takes into account various factors, such as medical expenses, pain and suffering, and long-term impacts on the minor's well-being. It's essential to assess all these factors objectively when negotiating a settlement. Utilizing a Wisconsin Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor can ensure the settlement is preserved and used appropriately for the minor's future needs.

In Wisconsin, a minor is defined as anyone under the age of 18. This legal status means that minors typically cannot enter into contracts or manage their own financial settlements. Thus, establishing a Wisconsin Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor is crucial for protecting a minor's financial interests until they reach adulthood.

A minor settlement refers to a financial agreement made on behalf of a child or minor who has been involved in a personal injury action. These settlements help compensate for injuries and generally require court approval to ensure they serve the child's best interest. When establishing a Wisconsin Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor, this ensures that the funds are managed responsibly until the minor reaches adulthood.

A structured settlement for a minor operates by providing financial support over time instead of a single payment. This system often involves a Wisconsin Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor, which holds and distributes the funds in a controlled manner. It allows for regular payments or specific distributions based on the minor's needs, ensuring financial stability as they grow.

An example of a structured settlement for minors is when a parent or guardian receives compensation from a personal injury claim. Instead of a lump sum, the settlement might provide monthly payments or set up a trust that releases funds at certain milestones, such as educational expenses. This approach aligns with a Wisconsin Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor, ensuring that the child’s future needs are adequately met.

A minor settlement in Wisconsin refers to a legal resolution concerning a child's claim, often resulting from personal injury cases. The settlement aims to compensate the minor while safeguarding their financial interests. Typically, a Wisconsin Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor is established, ensuring that the funds are managed appropriately until the child reaches legal adulthood.

A structured settlement for child support refers to a financial arrangement designed to provide regular payments to support a minor child. In Wisconsin, these arrangements often connect to a Wisconsin Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor. This setup ensures that funds are disbursed responsibly over time, prioritizing the child's financial security and needs.