Wisconsin Transfer of Property under the Uniform Transfers to Minors Act

Description

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

If you want to complete, acquire, or print lawful document themes, use US Legal Forms, the greatest collection of lawful types, that can be found online. Take advantage of the site`s simple and convenient lookup to find the paperwork you will need. A variety of themes for business and individual purposes are sorted by classes and says, or keywords and phrases. Use US Legal Forms to find the Wisconsin Transfer of Property under the Uniform Transfers to Minors Act in just a few click throughs.

In case you are previously a US Legal Forms customer, log in for your bank account and click on the Download option to find the Wisconsin Transfer of Property under the Uniform Transfers to Minors Act. You can even gain access to types you earlier downloaded inside the My Forms tab of your own bank account.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape for your correct metropolis/land.

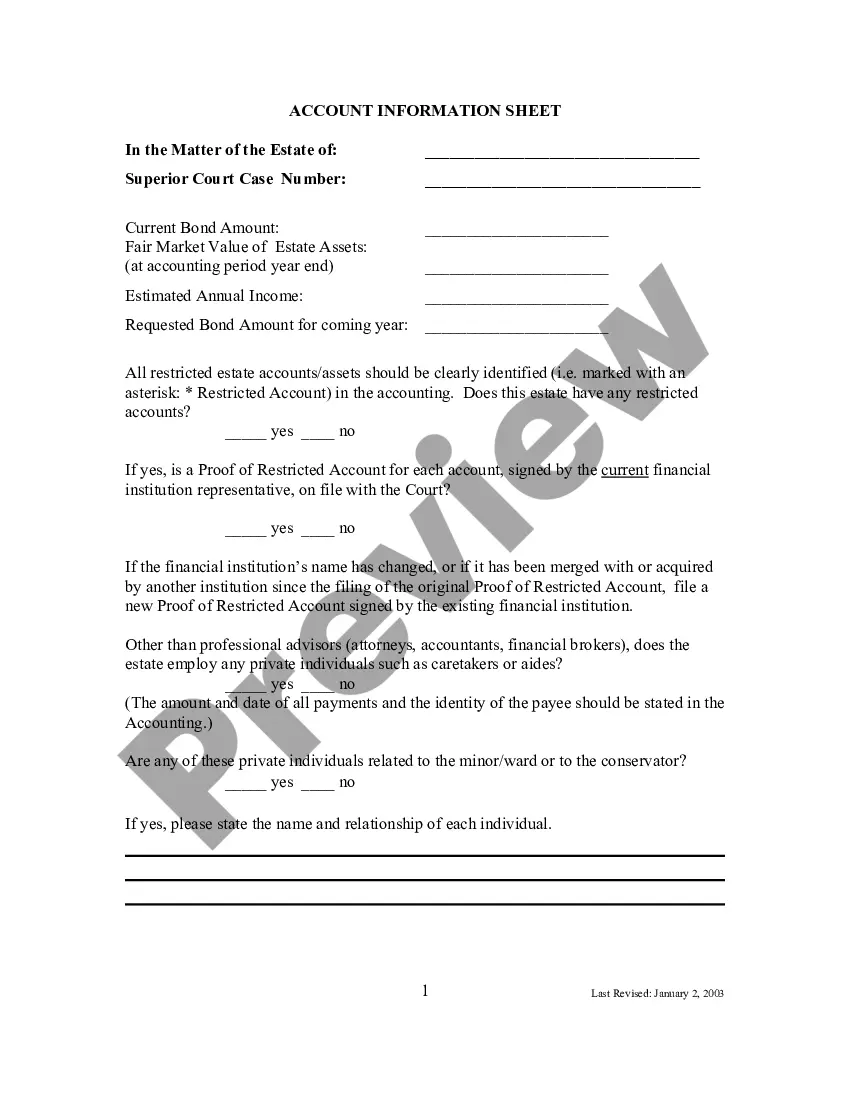

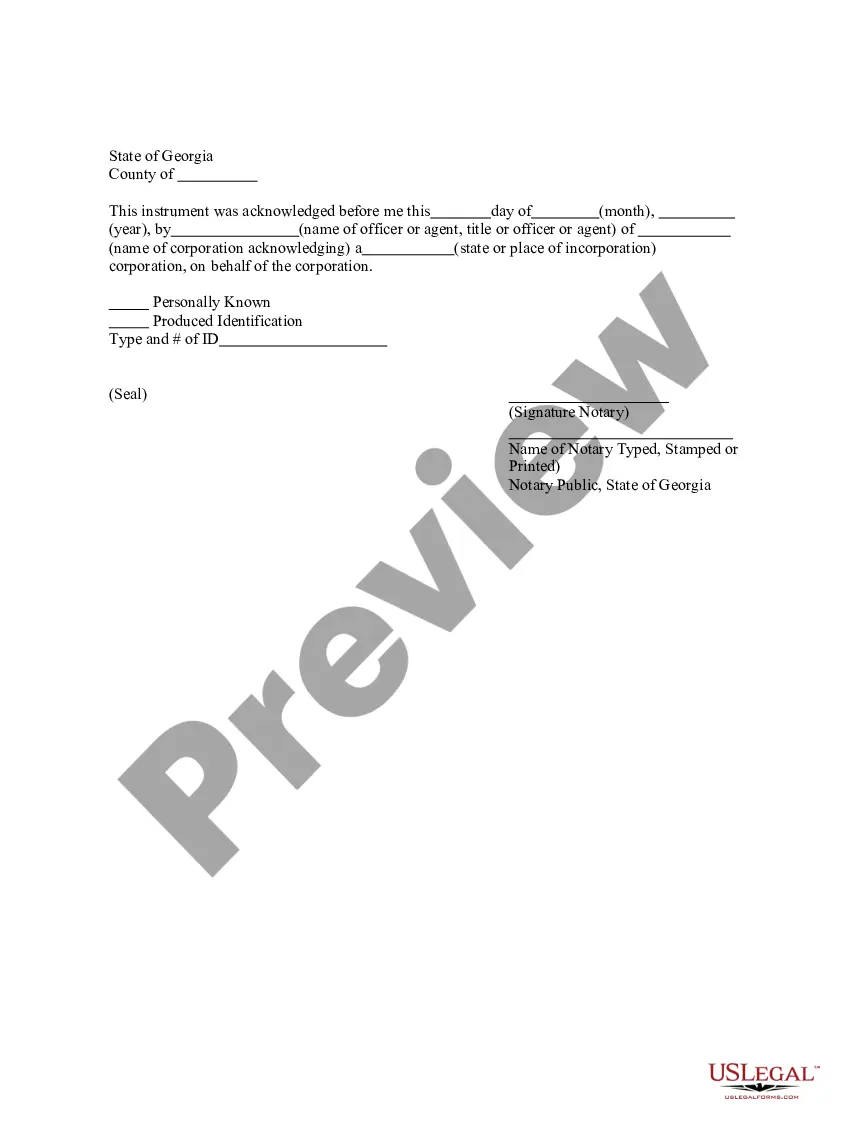

- Step 2. Take advantage of the Preview choice to look through the form`s information. Don`t forget about to see the explanation.

- Step 3. In case you are unsatisfied using the kind, use the Lookup area near the top of the display to locate other models of the lawful kind format.

- Step 4. When you have discovered the shape you will need, click the Buy now option. Select the prices prepare you prefer and add your qualifications to register on an bank account.

- Step 5. Procedure the financial transaction. You may use your charge card or PayPal bank account to complete the financial transaction.

- Step 6. Pick the file format of the lawful kind and acquire it in your product.

- Step 7. Full, edit and print or indicator the Wisconsin Transfer of Property under the Uniform Transfers to Minors Act.

Every lawful document format you acquire is the one you have forever. You possess acces to each kind you downloaded in your acccount. Go through the My Forms segment and choose a kind to print or acquire again.

Remain competitive and acquire, and print the Wisconsin Transfer of Property under the Uniform Transfers to Minors Act with US Legal Forms. There are thousands of professional and status-specific types you can utilize to your business or individual demands.

Form popularity

FAQ

An UGMA account, the original custodial account, can hold financial assets such as individual stocks, bonds, mutual funds, index funds, cash, and insurance policies. An UTMA account can hold all of the same assets as an UGMA account. But it can also hold physical assets such as real estate, fine art, and more.

Age of Majority and Trust Termination StateUGMAUTMAWashington2121West Virginia1821Wisconsin1821Wyoming182149 more rows

Under the Uniform Transfer to Minors Act (UTMA), recognized by the state of Wisconsin, you may set up a custodial account in which to deposit your gift, which can be funds, real property, or any other type of tangible or intangible property.

The Uniform Gifts to Minors Act (UGMA) allows money and financial securities to be transferred to minors through a UGMA account and is allowed in all states.

A Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) account is an account into which property is set aside for a minor's benefit. Whether a UGMA or UTMA account is used depends on the law of the state in which the account is established.

In Wisconsin, the age of majority is 18 for almost all purposes, but age 21 for purposes of UTMA and UGMA accounts.

The Uniform Gifts to Minors Act (UGMA) allows individuals to give or transfer assets to underage beneficiaries. The act, which was developed in 1956 and revised in 1966, is commonly used to transfer assets from parents to their children.