Wisconsin Security Agreement for Promissory Note

Description

How to fill out Security Agreement For Promissory Note?

It is feasible to spend hours online attempting to locate the legal document template that satisfies the state and federal requirements you desire.

US Legal Forms offers thousands of legal documents that are reviewed by professionals.

It is easy to obtain or print the Wisconsin Security Agreement for Promissory Note from our service.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Wisconsin Security Agreement for Promissory Note.

- Each legal document template you purchase is yours permanently.

- To get an additional copy of any purchased form, visit the My documents tab and click the relevant button.

- If you’re using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for the state/region of your choice.

- Check the form summary to confirm that you have selected the correct form.

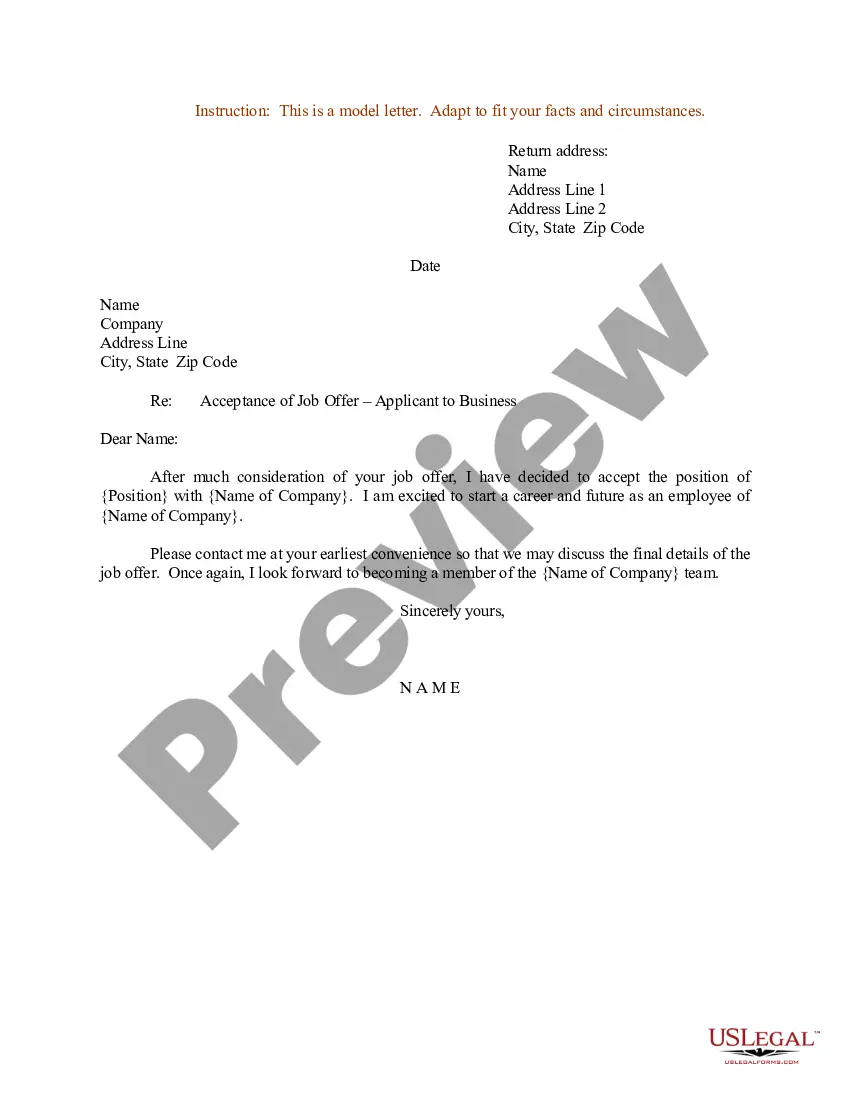

- If available, utilize the Preview button to review the document template as well.

- To obtain an additional version of your form, use the Search field to find the template that meets your requirements.

- Once you have located the template you need, click Purchase now to proceed.

- Select the pricing plan you desire, enter your details, and register for an account on US Legal Forms.

- Complete the transaction.

- You may use your credit card or PayPal account to pay for the legal document.

- Choose the format of your document and download it to your device.

- Make edits to your document if necessary.

- You can complete, revise, sign, and print the Wisconsin Security Agreement for Promissory Note.

- Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

General Definition. Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

A secured promissory note may include a security agreement as part of its terms. If a security agreement lists a business property as collateral, the lender might file a UCC-1 statement to serve as a lien on the property. A security agreement mitigates the default risk faced by the lender.

A security interest arising out of a sale of a promissory note (i.e., an instrument) is perfected automatically, without additional action, when it attaches. See Section 9-304(4) of the Uniform Commercial Code.

Secured Promissory Notes A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

The UCC treats the interest of a buyer of accounts, chattel paper, payment intangibles, or promissory notes as a security interest.

Collateral is an item of value used to secure a loan. Collateral minimizes the risk for lenders. If a borrower defaults on the loan, the lender can seize the collateral and sell it to recoup its losses. Mortgages and car loans are two types of collateralized loans.

A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust. If the collateral is personal property, there will be a security agreement.

If the issuer of the note sells a note as an investment to persons who resemble investors, in an offering that resembles a securities offering, then the note is a security.