The Wisconsin Tax Free Exchange Agreement Section 1031 is a provision that allows individuals and businesses to dispose of their property and acquire a replacement property without incurring immediate tax liability on the capital gains. This exchange agreement, named after Section 1031 of the Internal Revenue Code, is widely used by taxpayers in Wisconsin to defer taxes on the sale of real estate, personal property, or other assets. Under the Wisconsin Tax Free Exchange Agreement Section 1031, taxpayers can defer paying capital gains taxes upon the sale of their property as long as they reinvest the proceeds into a like-kind replacement property. Like-kind refers to properties that are of the same nature or character, regardless of their quality or grade. This means that a taxpayer can exchange their commercial property for another commercial property, or even swap a residential property for a vacant land. There are several key benefits to utilizing the Wisconsin Tax Free Exchange Agreement Section 1031. Firstly, it allows taxpayers to defer the payment of capital gains taxes, potentially freeing up additional funds for investment purposes. Secondly, it provides individuals and businesses with the flexibility to reallocate their investments while preserving their equity. This provision encourages economic growth by fostering active property exchanges and stimulating investment activity. In Wisconsin, there are two primary types of tax-free exchange agreements that fall under Section 1031: simultaneous exchanges and delayed exchanges. 1. Simultaneous Exchange: In a simultaneous exchange, the taxpayer sells their property and acquires the replacement property in a single transaction. Both properties are transferred at the same time, ensuring a seamless exchange without the need for intermediaries or a delay in ownership. 2. Delayed Exchange: On the other hand, a delayed exchange, also known as a deferred exchange, occurs when the taxpayer sells their property first and subsequently purchases the replacement property within a specific timeframe. This timeframe is crucial and must be adhered to for the exchange to qualify for tax deferral. Within 45 days of selling their property, the taxpayer must identify potential replacement properties, and within 180 days, they must acquire one or more of the identified properties. In conclusion, the Wisconsin Tax Free Exchange Agreement Section 1031 provides individuals and businesses with a valuable opportunity to defer capital gains taxes by reinvesting proceeds into like-kind replacement properties. With simultaneous and delayed exchange options available, taxpayers have flexibility in executing these exchanges while enjoying the associated tax benefits. The provision's ability to stimulate economic growth and incentivize investment makes it a popular choice for taxpayers in Wisconsin.

Wisconsin Tax Free Exchange Agreement Section 1031

Description

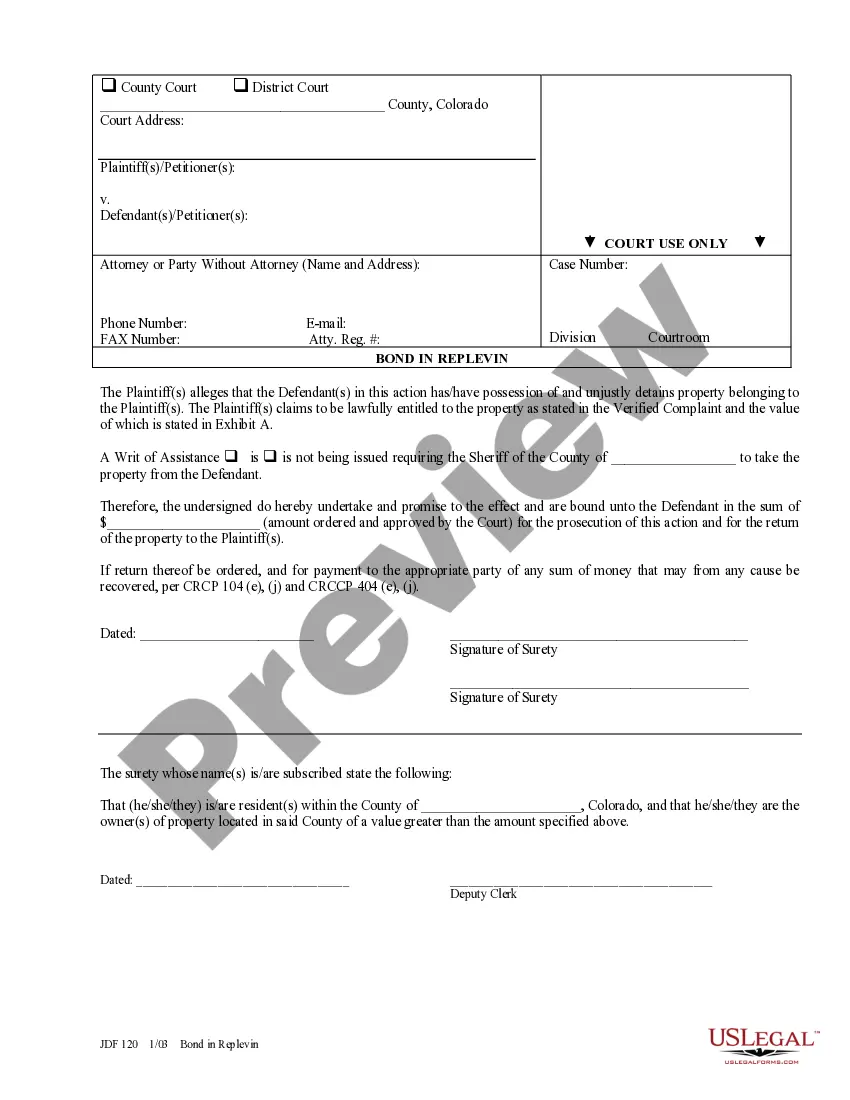

How to fill out Wisconsin Tax Free Exchange Agreement Section 1031?

Are you in the location where you often require documents for various organizational or personal activities daily? There are numerous legal document templates accessible online, but finding reliable ones is challenging.

US Legal Forms offers thousands of template forms, including the Wisconsin Tax Free Exchange Agreement Section 1031, which can be customized to meet both federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can download the Wisconsin Tax Free Exchange Agreement Section 1031 template.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Review option to examine the document.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Lookup field to find the form that suits your requirements.

- Once you find the correct form, click Acquire now.

- Choose the pricing plan you desire, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

While you can't do a 1031 exchange directly into a personal residence -- exchanges are limited to real property that is held strictly for investment or business purposes -- you can convert an investment property into personal property so long as you follow the IRS' rules to the letter.

Tom: The short answer is yes. Section 1031 is a federal tax code, so it is recognized in all states, so you can exchange from state to state. We regularly are dealing with transactions from our home state of Oregon and into California, Washington, and vice versa.

While you can't do a 1031 exchange directly into a personal residence -- exchanges are limited to real property that is held strictly for investment or business purposes -- you can convert an investment property into personal property so long as you follow the IRS' rules to the letter.

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind.

A 1031 exchange allows you to sell one investment or business property and buy another without incurring capital gains taxes as long as the exchange is completed according to IRS rules and the new property is of the same nature or character (like kind).

As mentioned, a 1031 exchange is reserved for property held for productive use in a trade or business or for investment. This means that any real property held for investment purposes can qualify for 1031 treatment, such as an apartment building, a vacant lot, a commercial building, or even a single-family residence.

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,

Steps in a Reverse 1031 Exchange in Wisconsin. Investors have the option of utilizing the "reverse" 1031 exchange method to defer taxes upon the sale and purchase of real estate.

A 1031 exchange allows the seller of real estate to avoid the payment of taxes by acquiring new real estate. As long as the proper procedures are followed, the Internal Revenue Service will recognize the transaction, not as a sale and purchase, but as an exchange of a relinquished property for a replacement property.

Interesting Questions

More info

Aviation Aircraft for which Exchanger is agent currently registered with Federal Aviation Administration equipped with Honeywell Model engines bearing manufacturer serial numbers collectively treated property referred herein Relieved Aircraft for which Exchanger is agent owned by Holdings Delaware corporation having address South Monaco Street Denver hereinafter referred Exchanger Relieved Aircraft for which Exchanger is agent registered with Federal Aviation Administration presently equipped with Honeywell Model engines bearing manufacturer serial numbers collectively treated property referred herein Reissued Aircraft for which Exchanger is agent currently equipped with Honeywell Model engines bearing manufacturer serial numbers collectively treated property referred herein I.