Wisconsin Contract with Employee to Work in a Foreign Country

Description

How to fill out Contract With Employee To Work In A Foreign Country?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a vast selection of legal document formats that you can download or print.

By utilizing the site, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the newest templates such as the Wisconsin Contract with Employee to Work in a Foreign Country in moments.

If you are already a subscriber, Log In and retrieve the Wisconsin Contract with Employee to Work in a Foreign Country from the US Legal Forms library. The Download button will be available on each form you view. You can access all previously saved forms in the My documents section of your account.

Make edits. Complete, modify, and print or sign the saved Wisconsin Contract with Employee to Work in a Foreign Country.

Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Wisconsin Contract with Employee to Work in a Foreign Country with US Legal Forms, one of the most extensive collections of legal document formats. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

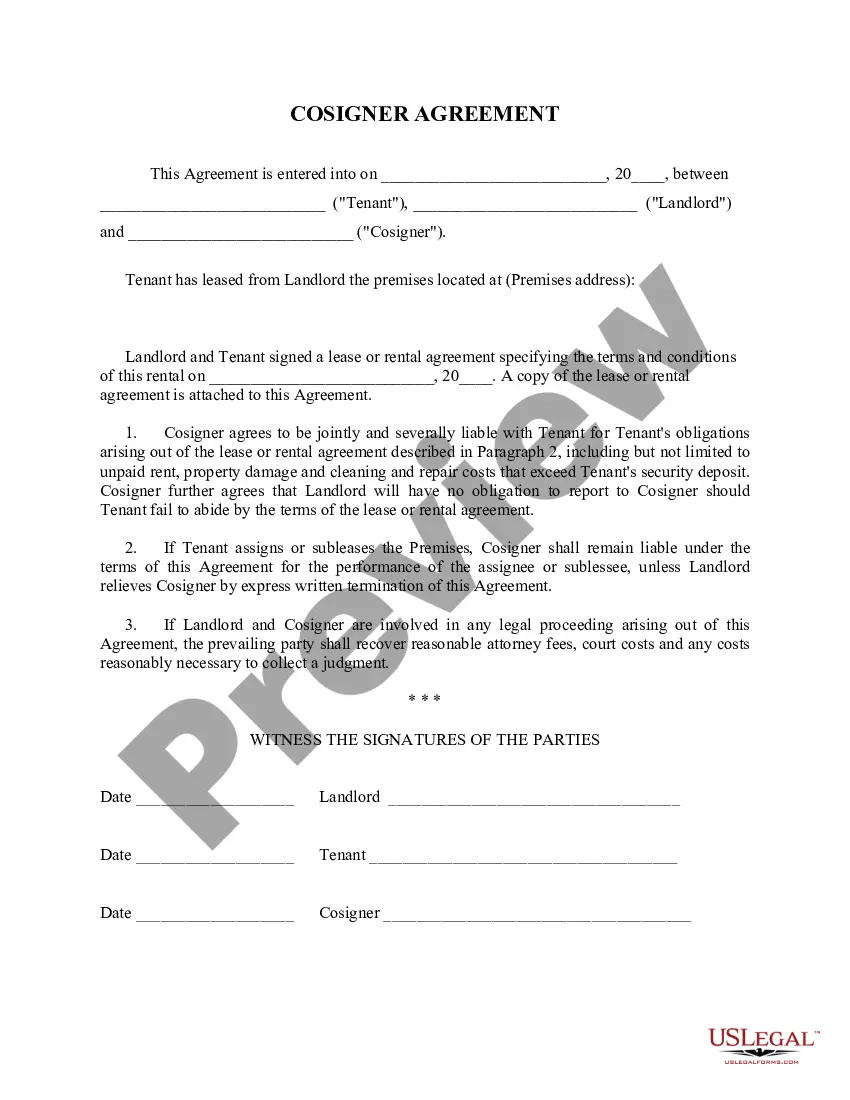

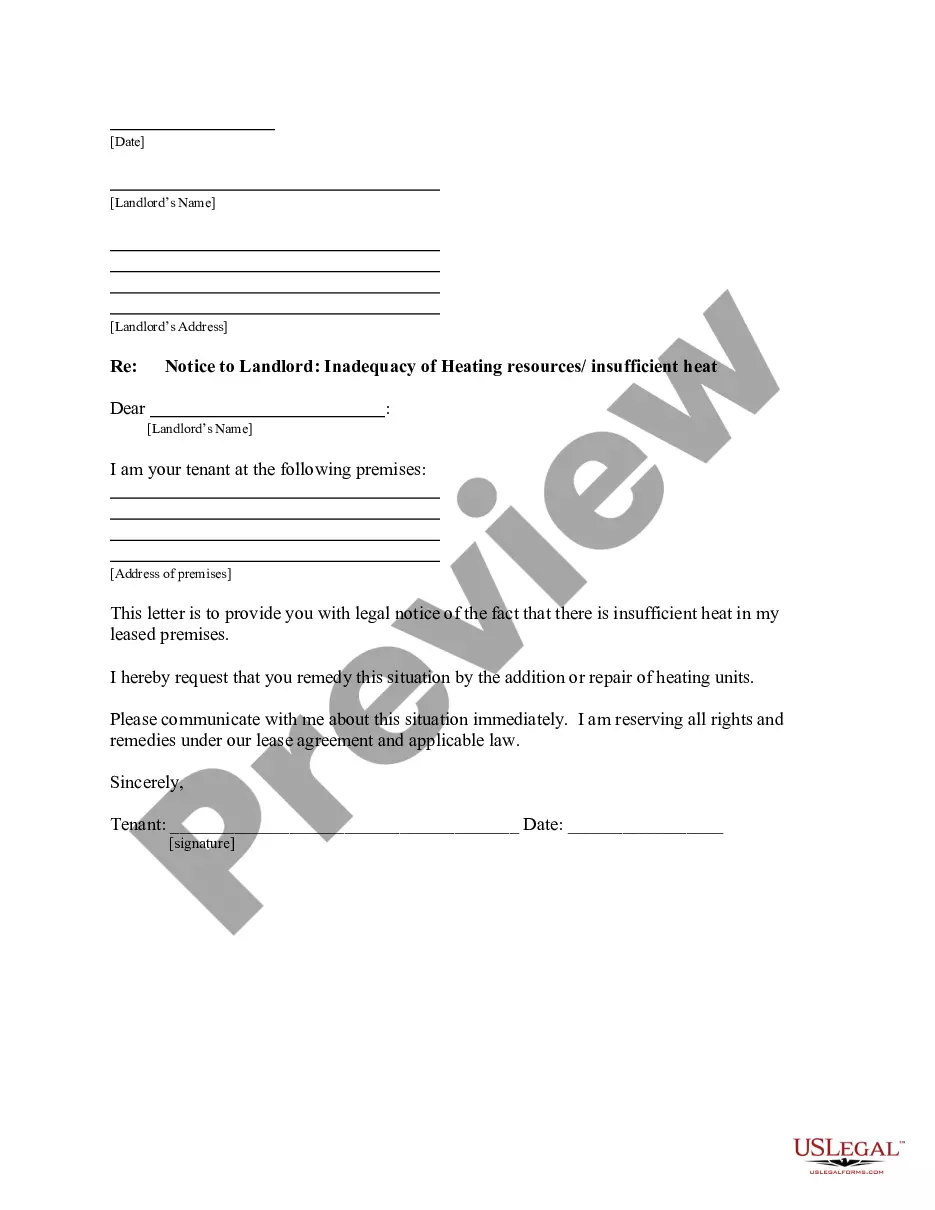

- Ensure you have selected the correct form for your city/county. Click the Preview button to review the form’s content.

- Check the form details to confirm you have selected the right one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you prefer and provide your information to register for the account.

- Process the payment. Use a credit card or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

Yes, Wisconsin residents are generally required to report their foreign income for tax purposes. Therefore, if you have a Wisconsin Contract with Employee to Work in a Foreign Country, it is crucial to understand how your foreign income interacts with state tax laws. Consulting a tax professional can help navigate these complexities effectively.

The convenience of the employer rule states that if you work remotely outside Wisconsin but your employer is located in Wisconsin, you may still owe Wisconsin state taxes. This rule is particularly relevant for those entering into a Wisconsin Contract with Employee to Work in a Foreign Country. To avoid unexpected tax liabilities, employees should clarify their work arrangements with their employer.

Reciprocal states are those that allow residents to work without facing double taxation on their income. For Wisconsin, the reciprocal states include Illinois, Iowa, Indiana, and Minnesota. If you have a Wisconsin Contract with Employee to Work in a Foreign Country, it is essential to be aware of how these reciprocal agreements could influence your tax situation.

As of now, Wisconsin has not announced any plans to eliminate its reciprocity agreements with neighboring states. However, state tax laws are subject to change, so it’s good practice to stay informed about any developments that might affect your Wisconsin Contract with Employee to Work in a Foreign Country. Following updates from the Wisconsin Department of Revenue can keep you in the loop easily.

The states that have reciprocity with Wisconsin include Illinois, Iowa, Indiana, and Minnesota. This means that if you earn income in these states but reside in Wisconsin, you can potentially avoid double taxation. This is especially important for those considering a Wisconsin Contract with Employee to Work in a Foreign Country, as understanding your tax residency will be essential.

Yes, if you are a resident of Wisconsin or earn income from sources within the state, you are required to file Wisconsin state taxes. Even if you sign a Wisconsin Contract with Employee to Work in a Foreign Country, you still may have tax obligations in Wisconsin depending on your residency status. Consulting a tax advisor is wise to understand your specific situation and ensure compliance.

Wisconsin shares borders with four states: Minnesota to the west, Iowa to the southwest, Illinois to the south, and Michigan to the northeast. Understanding these borders is crucial for anyone entering into a Wisconsin Contract with Employee to Work in a Foreign Country. This geographical knowledge can help prepare for potential tax implications related to your employment across state lines.

The foreign earned income exclusion is a provision that allows U.S. citizens and residents to exclude income earned in a foreign country from their taxable income. For individuals under a Wisconsin Contract with Employee to Work in a Foreign Country, this can significantly reduce tax liabilities. It's advisable to consult with a tax professional to understand the eligibility and maximize benefits under this exclusion.

Wisconsin has reciprocity agreements with several states regarding various legal matters and licensing. Typically, these agreements allow for mutual recognition of certain legal aspects and help individuals navigating a Wisconsin Contract with Employee to Work in a Foreign Country. Check with a legal professional or your state’s resources for a comprehensive list and details to understand how this may impact your situation.

You may have grounds to sue your employer for firing you under specific circumstances in Wisconsin. If your termination violates a Wisconsin Contract with Employee to Work in a Foreign Country or breaches anti-discrimination laws, you could have a case. Consulting with a legal expert can help clarify your rights and options in these situations, ensuring you take appropriate action.