Wisconsin Letter to Social Security Administration Notifying Them of Death

Description

How to fill out Letter To Social Security Administration Notifying Them Of Death?

Discovering the right lawful papers design could be a struggle. Naturally, there are a lot of web templates available online, but how would you discover the lawful kind you want? Make use of the US Legal Forms internet site. The services delivers 1000s of web templates, like the Wisconsin Letter to Social Security Administration Notifying Them of Death, that can be used for organization and personal demands. Each of the varieties are inspected by experts and meet up with state and federal needs.

Should you be already listed, log in to your accounts and click on the Obtain button to get the Wisconsin Letter to Social Security Administration Notifying Them of Death. Make use of accounts to appear with the lawful varieties you have ordered formerly. Go to the My Forms tab of your accounts and have another backup in the papers you want.

Should you be a brand new end user of US Legal Forms, here are straightforward instructions so that you can comply with:

- Initially, be sure you have chosen the correct kind for your city/area. It is possible to look over the form using the Preview button and study the form information to make sure this is basically the right one for you.

- If the kind does not meet up with your requirements, use the Seach industry to obtain the right kind.

- Once you are certain the form would work, click on the Buy now button to get the kind.

- Select the pricing program you need and enter the required information and facts. Build your accounts and pay for the order using your PayPal accounts or credit card.

- Choose the file file format and acquire the lawful papers design to your system.

- Comprehensive, revise and print out and indication the attained Wisconsin Letter to Social Security Administration Notifying Them of Death.

US Legal Forms is definitely the biggest catalogue of lawful varieties in which you can see numerous papers web templates. Make use of the company to acquire skillfully-made papers that comply with express needs.

Form popularity

FAQ

If it comes to your attention that the SSA has mistakenly listed you as deceased, you'll need to correct that error at once, and you can do so by visiting your local Social Security office.

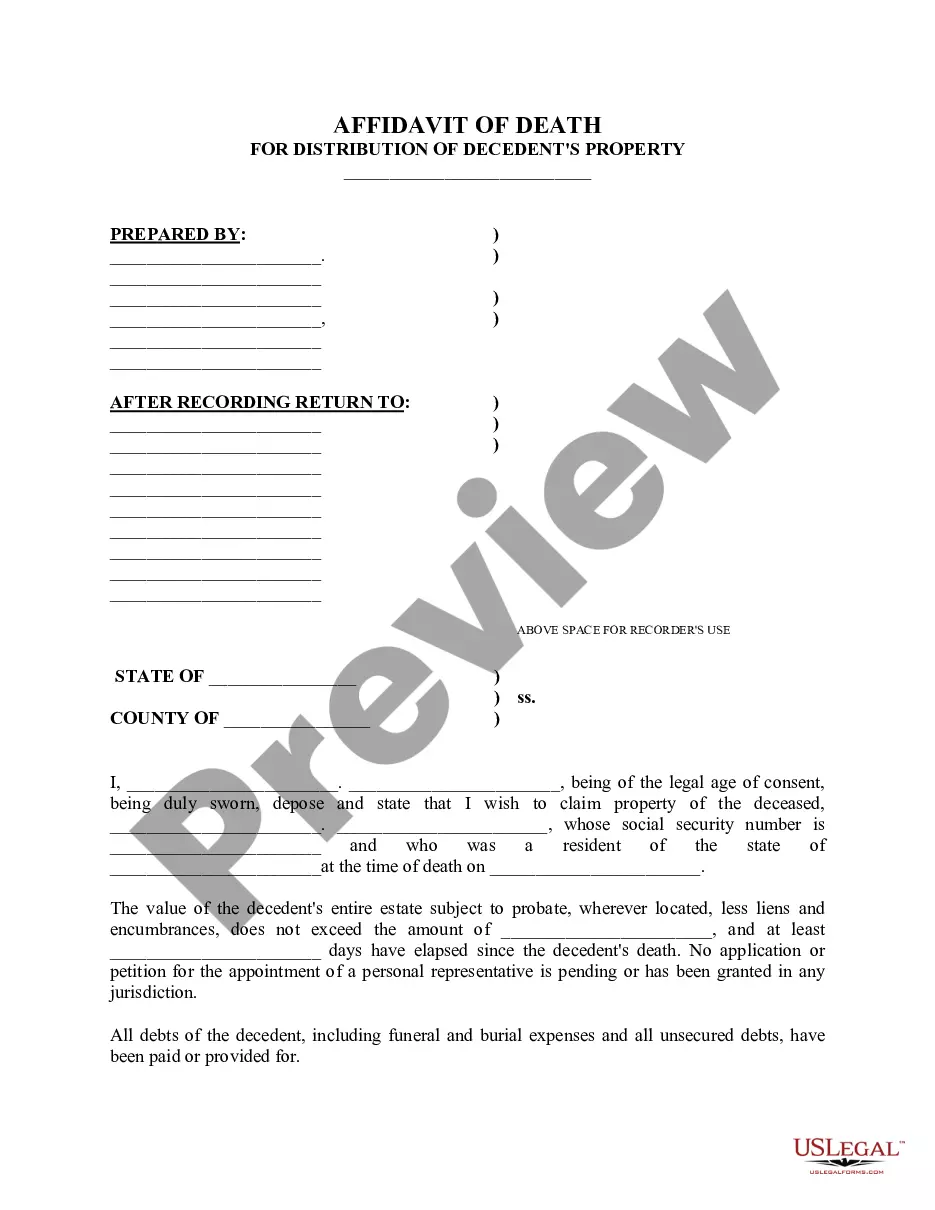

Disposing Conserved Funds When a Beneficiary Dies Any payment received for the month of death or later must be returned. Payments are payable for the month of death. However, you must return any SSI payments received for any months after the month of death.

A surviving spouse, surviving divorced spouse, unmarried child, or dependent parent may be eligible for monthly survivor benefits based on the deceased worker's earnings. In addition, a one-time lump sum death payment of $255 can be made to a qualifying spouse or child if they meet certain requirements.

Does Social Security Pay a Month Ahead or a Month Behind? Social Security benefits are paid in the month following the month in which they are due. For example, Social Security benefits awarded in January are paid in February.

Nonetheless, Social Security payments are sometimes sent after someone's death, and the payment must be returned. Returning the check requires Social Security to contact the bank that received the payment. Receiving that request from Social Security is another way the bank can learn if an account holder died.

The Social Security office automatically notifies Medicare of the death. If the deceased was receiving Social Security payments, the payment for the month of the death must be returned to Social Security. Contact the deceased's bank to return the full month's payment as soon as possible.

Let us know if a person who receives Social Security benefits dies. We can't pay benefits for the month of death. That means if the person died in July, the check received in August (which is payment for July) must be returned.

If the deceased was receiving Social Security benefits, you must return the benefit received for the month of death and any later months. For example, if the person died in July, you must return the benefits paid in August.