The Wisconsin Transfer of Title and Assignment of Equipment from Nonprofit Foundation including a Waiver and Release of Liability refers to a legal document that facilitates the transfer of ownership rights of equipment from a nonprofit foundation to another entity or individual within the state of Wisconsin. This document is critical in ensuring a smooth and legally valid transfer of ownership. Keywords: Wisconsin, transfer of title, assignment of equipment, nonprofit foundation, waiver and release of liability. The Wisconsin Transfer of Title and Assignment of Equipment from Nonprofit Foundation including a Waiver and Release of Liability document typically includes several key sections to address various aspects of the transfer process and protect the parties involved. 1. Parties Involved: This section identifies the nonprofit foundation as the "Transferor" and the entity or individual receiving the equipment as the "Transferee." It includes their legal names, addresses, and contact information. 2. Description of Equipment: Here, a comprehensive description of the equipment being transferred is provided, including make, model, serial number, and any notable identifying features. This ensures accurate identification of the equipment and reduces the risk of confusion or disputes in the future. 3. Transfer of Title: This section explicitly states that the Transferor is transferring ownership rights, title, and interest in the equipment to the Transferee. By executing this document, the Transferor relinquishes all claims and rights associated with the equipment, and the Transferee assumes full ownership and responsibility. 4. Condition of Equipment: The document may include a disclaimer by the Transferor that the equipment is being transferred as-is, without any warranties or guarantees regarding condition or fitness for a particular purpose. This clause protects the Transferor from any liability that may arise due to the equipment's condition after the transfer. 5. Waiver and Release of Liability: This crucial section contains a waiver and release of liability clause, wherein the Transferee agrees to release the Transferor and its officers, directors, employees, and agents from any liabilities, claims, damages, or expenses arising from the use, ownership, or condition of the equipment transferred. This release protects the Transferor and ensures that the Transferee assumes all risks associated with the equipment after the transfer. Different types of Wisconsin Transfer of Title and Assignment of Equipment from Nonprofit Foundation including a Waiver and Release of Liability documents may exist depending on the specific circumstances and nature of the equipment being transferred. For example, there may be separate templates or variations available for the transfer of vehicles, machinery, or other specialized equipment. It is essential to consult with legal professionals familiar with Wisconsin state laws and regulations, as well as specific requirements of the nonprofit foundation, to ensure the correct document is used and all relevant information and clauses are included.

Wisconsin Transfer of Title and Assignment of Equipment from Nonprofit Foundation including a Waiver and Release of Liability

Description

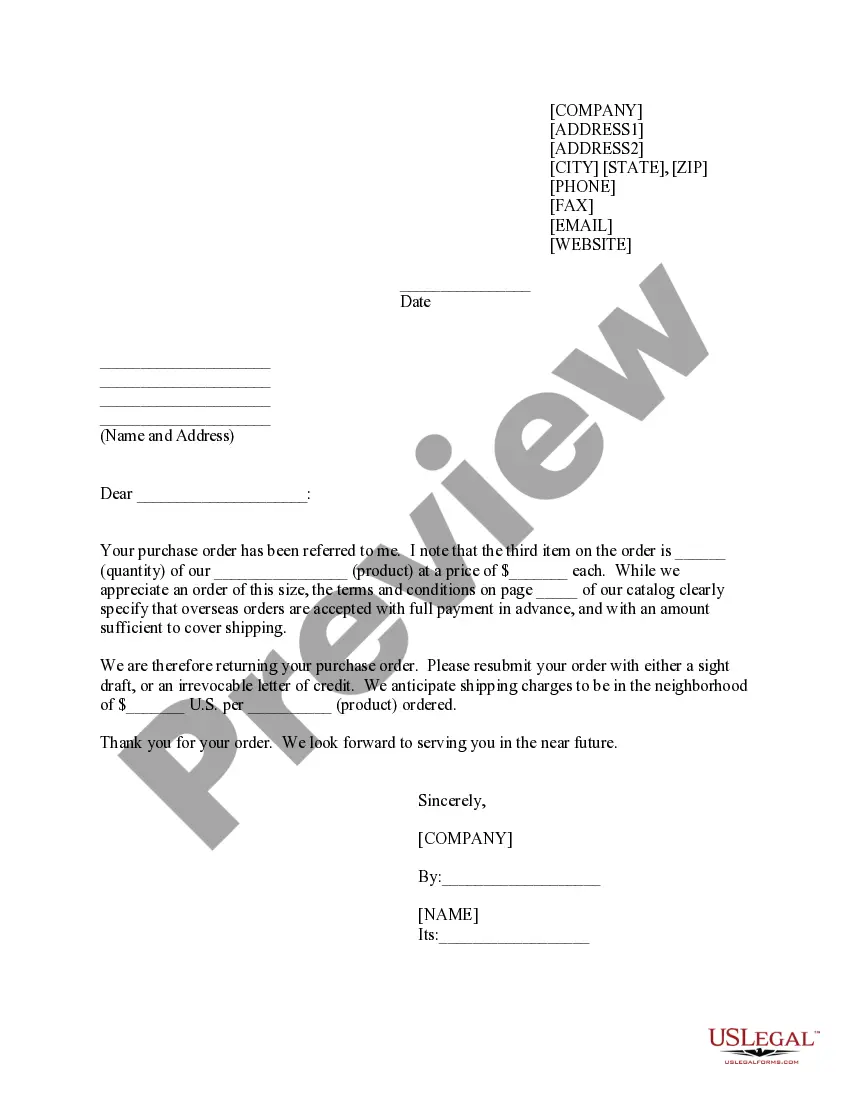

How to fill out Wisconsin Transfer Of Title And Assignment Of Equipment From Nonprofit Foundation Including A Waiver And Release Of Liability?

If you want to finalize, obtain, or print authentic document templates, utilize US Legal Forms, the largest repository of official forms available online.

Leverage the site's straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or by keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose your desired pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Misa or Mastercard or PayPal account to finalize the transaction.Step 6. Choose the format of your legal form and download it onto your device.Step 7. Fill out, edit, and print or sign the Wisconsin Transfer of Title and Assignment of Equipment from Nonprofit Foundation including a Waiver and Release of Liability.

- Utilize US Legal Forms to find the Wisconsin Transfer of Title and Assignment of Equipment from Nonprofit Foundation including a Waiver and Release of Liability in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download option to retrieve the Wisconsin Transfer of Title and Assignment of Equipment from Nonprofit Foundation including a Waiver and Release of Liability.

- You can also access forms you have previously saved from the My documents tab in your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Utilize the Review process to verify the form's content. Don't forget to read the description.

- Step 3. If you are not content with the document, use the Search bar at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

On July 30, 2012, Wisconsin joined other states in becoming a title to lien holder (lender) state. This means that any title with a lien (loan) listed on or after July 30, 2012, will be sent to the lien holder rather than the owner.

In Wisconsin, the law doesn't require you to use a bill of sale when transferring ownership of personal property. However, the document may provide legal protection for all parties involved. For example, the buyer will be able to prove that the transaction took place if there is an ownership dispute.

On July 30, 2012, Wisconsin joined other states in becoming a title to lien holder (lender) state. This means that any title with a lien (loan) listed on or after July 30, 2012, will be sent to the lien holder rather than the owner.

Unlicensed dealers cost you moneyDon't have vehicles titled in their name before selling them. This is called "title jumping," and it makes it easier for the unlicensed dealer to commit fraud without being caught. Lie about a vehicle's condition, and how it was used.

If you wish to have a record of the sale, you may also complete the Instructions for Selling a Vehicle form MV2928. The Bill of Sale is provided for your convenience, it is not a required form. You may keep a copy with your records, and make a copy for the buyer as documentation of the sale.

Instead of printing a paper title and mailing it to the lienholder, the WI DMV transmits title information electronically to the lienholder's ELT service provider.

Title Transfer RequirementsYour driver's license.The completed original title.No photocopies of a title will be accepteda duplicate is acceptable.The completed MV1 form.A check or money order for all title fees, taxes, and registration fees.

Most online title and registration applications using eMV Public are completed in three days or less. Most mailed-in title applications are completed in 14 days or less. Use this title search application to show if your title has been processed and when to expect it in the mail.

In the State of Wisconsin a Bill of Sale Form is not required but it's recommended to complete one in any used vehicle transaction because a Bill of Sale serves as a legal receipt from the buyer to the seller documenting both the change in ownership and the purchase price.

In Wisconsin, you can apply for a new title through the Wisconsin Public website or by visiting your local DMV Customer Service Center. It is possible to also apply for a new title through the mail, but if any information is missing or illegible, the application will be returned to you without processing.