The Wisconsin Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legal document used when a sole proprietor wishes to sell their retail store, including all goods and fixtures, to a buyer. This agreement outlines the terms and conditions of the sale, ensuring that both parties are aware of their rights and responsibilities. Keywords: Wisconsin Agreement for Sale, Retail Store, Sole Proprietorship, Goods, Fixtures, Invoice Cost, Percentage, Legal Document, Buyer, Terms and Conditions, Rights, Responsibilities. Different types of Wisconsin Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage may include: 1. Standard Wisconsin Agreement for Sale of Retail Store: This type of agreement covers the basic terms and conditions of the sale, including the purchase price, payment terms, and the transfer of ownership of the business. It ensures the protection of both the seller and the buyer. 2. Wisconsin Agreement for Sale with Inventory Details: This agreement includes a comprehensive inventory list of all goods, products, and merchandise included in the sale. It ensures that both parties are in agreement on the exact inventory being transferred and its corresponding costs. 3. Wisconsin Agreement for Sale with Fixture Details: This type of agreement specifically highlights the fixtures and fittings included in the sale. It lists all fixtures, such as shelving units, displays, lighting fixtures, and signage, along with their corresponding costs. 4. Wisconsin Agreement for Sale with Percentage Markup: In this agreement, the seller includes a percentage markup on the cost price of the goods and fixtures being sold. This ensures that the buyer is aware of the profit margin being applied and can negotiate accordingly. 5. Wisconsin Agreement for Sale with Invoice Cost Breakdown: This agreement provides a detailed breakdown of the invoice cost of the goods and fixtures, listing individual items, quantities, and unit prices. It provides transparency in the pricing and helps both parties in assessing the value of the sale. In conclusion, the Wisconsin Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a crucial legal document that safeguards the interests of both the seller and the buyer. It ensures a smooth transfer of ownership, protects against legal disputes, and establishes clarity regarding the terms and conditions of the sale.

Wisconsin Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

Are you in the location where you need to obtain documents for either organizational or personal purposes consistently.

There are numerous legitimate document templates available online, but identifying reliable ones can be challenging.

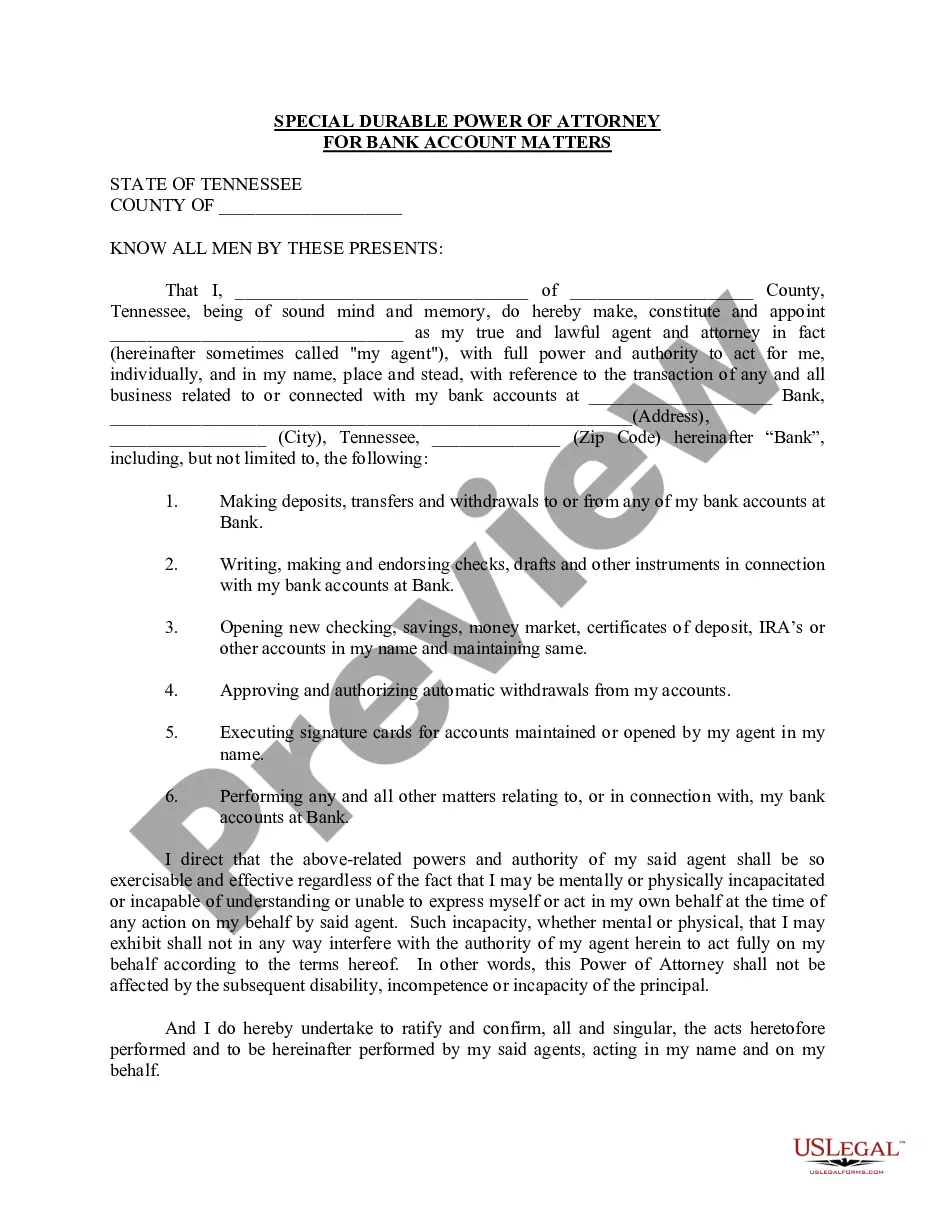

US Legal Forms offers a vast collection of document templates, including the Wisconsin Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, specifically designed to comply with federal and state regulations.

Access all the document templates you have purchased in the My documents menu.

You can download another copy of the Wisconsin Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage at any time if needed. Simply click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Wisconsin Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for your specific city/county.

- Utilize the Review button to verify the form.

- Check the details to confirm you have selected the correct document.

- If the document is not what you are looking for, use the Lookup section to find the form that meets your needs and requirements.

- Once you locate the appropriate document, click on Get now.

- Choose the pricing plan you prefer, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

Interesting Questions

More info

We promote a safe, healthy and culturally diverse environment for all residents of British Columbia by: Identifying the barriers to achieving social change Helping people overcome barriers to getting or staying involved with social change. Working with clients and key partners to improve the social outcomes they are seeking. We provide: Advancing the goals of social change — with a focus on health, social participation, well-being, education, culture and leadership (CCI). Communicating with the public to support key priorities and issues in the community (CCI). SDS develops, delivers, supports and coordinates community-based programming with a regional focus; through a partnership with community partners, individuals, families, and local organizations to impact the lives of every person in British Columbia. Working across jurisdictional boundaries, SDS helps promote social change through collaboration and partnership across communities.