A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty of the payment of a debt is different from a guaranty of the collection of the debt. A guaranty of payment is absolute while a guaranty of collection is conditional.

Wisconsin Guaranty of Collection of Promissory Note

Description

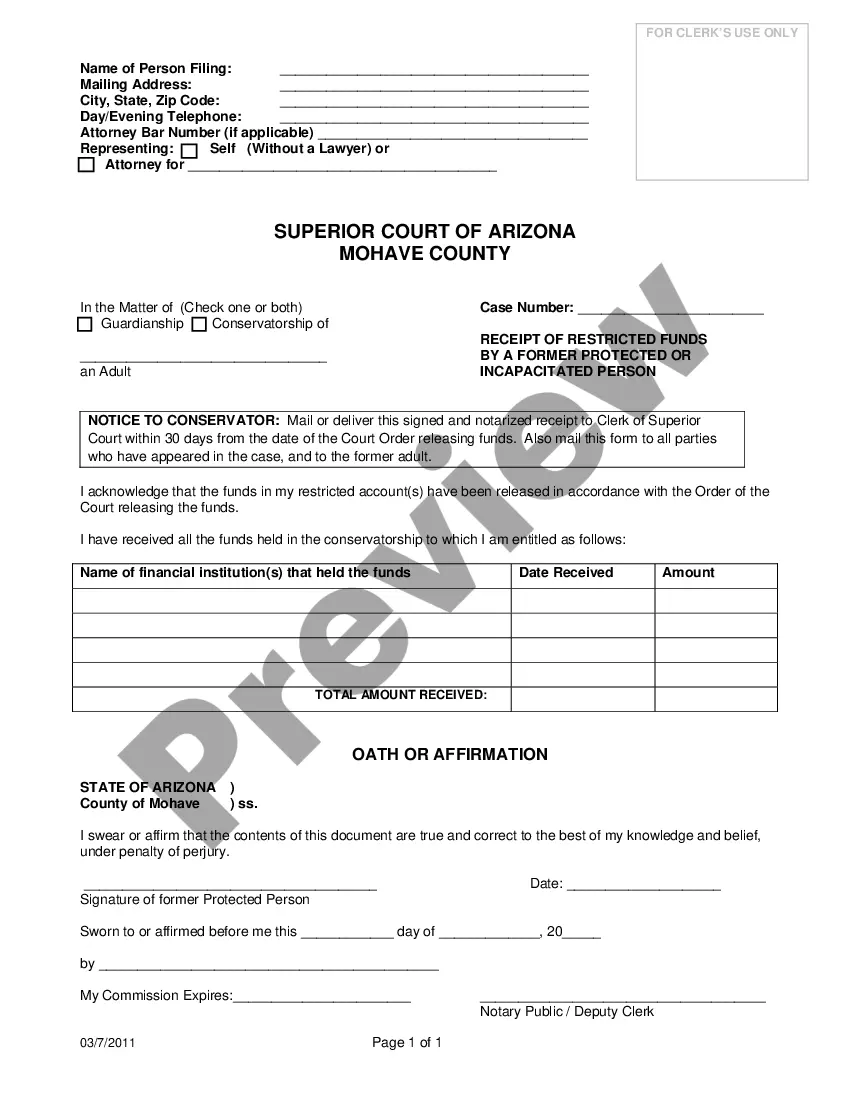

How to fill out Guaranty Of Collection Of Promissory Note?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent versions of forms such as the Wisconsin Guaranty of Collection of Promissory Note in just a few moments.

If the form does not fit your needs, use the Search area at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, choose your preferred pricing plan and provide your details to register for the account.

- If you already have a subscription, Log In to download the Wisconsin Guaranty of Collection of Promissory Note from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are some fundamental steps to get started.

- Make sure you have selected the correct form for your city/state.

- Select the Review button to examine the content of the form.

Form popularity

FAQ

The statute of limitations for written contracts in Wisconsin is generally six years, similar to the timeframe for debt collections. This applies to any written agreement, including promissory notes. Knowing the statute of limitations is crucial for all parties involved, as it outlines your rights and options under the Wisconsin Guaranty of Collection of Promissory Note.

In Wisconsin, a judgment is enforceable for 20 years from the date it was entered by the court. This means that creditors have a substantial timeframe to collect amounts owed under a promissory note. Being informed about the duration of judgment enforcement can be beneficial when navigating the Wisconsin Guaranty of Collection of Promissory Note, allowing you to plan your financial strategy accordingly.

In Wisconsin, the statute of limitations on most debts, including promissory notes, is six years. This means a creditor generally has six years from the date of the last payment or the date the debt was due to file a lawsuit to collect the debt. Familiarizing yourself with this timeframe is essential when dealing with the Wisconsin Guaranty of Collection of Promissory Note, as it helps both creditors and debtors understand their legal standing.

The statute 893.43 in Wisconsin pertains to the enforcement of written contracts and agreements. Specifically, this statute outlines the circumstances under which creditors can enforce judgments related to promissory notes. Understanding this statute is vital for anyone involved in the Wisconsin Guaranty of Collection of Promissory Note, as it directly impacts the creditor's ability to collect on a debt.

To find a promissory note, consider resources such as legal form websites, libraries, or legal professionals. Websites like US Legal Forms offer a rich selection of templates designed for compliance with the Wisconsin Guaranty of Collection of Promissory Note. These options help you create a document tailored to your financial agreement.

In Wisconsin, the statute of limitations for contract claims is generally six years. This means you have six years from the date of the breach to file a lawsuit. Understanding this timeframe is crucial, especially when it relates to the Wisconsin Guaranty of Collection of Promissory Note, to ensure you take appropriate legal action in time.

The Master Promissory Note (MPN) can be obtained from financial institutions, educational institutions, or directly online. It is important to ensure that the MPN complies with the Wisconsin Guaranty of Collection of Promissory Note, which provides assurance in financial transactions. You can find templates and guidance on platforms like US Legal Forms.

Yes, promissory notes are legal instruments in the USA. They are recognized under state law and enforceable in courts, provided they meet required legal standards. In Wisconsin, a properly created promissory note benefits from the Wisconsin Guaranty of Collection of Promissory Note, enhancing its enforceability.

You can find promissory notes from legal form websites, financial institutions, or by consulting with a lawyer. Resources like US Legal Forms offer a variety of customizable templates that align with the guidelines of the Wisconsin Guaranty of Collection of Promissory Note. This makes it easy for you to generate a valid, legally binding document.

Yes, you can create your own promissory note. However, it is crucial to ensure that it includes all necessary components, such as the terms of repayment and interest rates. Having a well-drafted document not only protects your interests but also aligns with the standards of the Wisconsin Guaranty of Collection of Promissory Note.