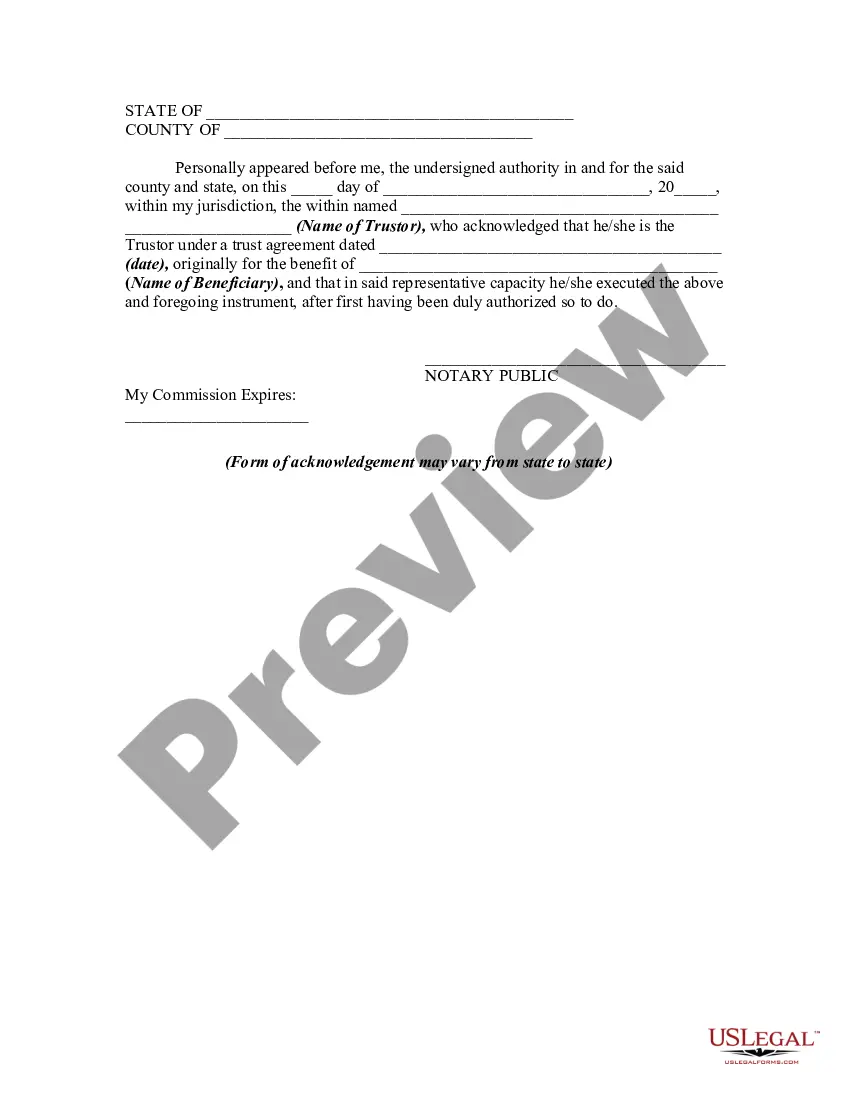

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to change beneficiaries. This form is a sample of a trustor amending the trust agreement in order to change beneficiaries.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Amendment to Trust Agreement in Order to Change Beneficiaries: In Wisconsin, an Amendment to Trust Agreement is a legal document that allows the settler (the person who created the trust) to modify the terms of the trust, specifically changing the designated beneficiaries. This amendment is crucial when circumstances or personal preferences change, necessitating the alteration of beneficiaries specified in the original trust agreement. There are several types of Wisconsin Amendment to Trust Agreement in Order to Change Beneficiaries, including: 1. Revocable Living Trust Amendment: A revocable living trust is a trust that can be altered or revoked by the settler during their lifetime. If the settler wishes to change the beneficiaries listed in the trust agreement, they can use a specific amendment that outlines the new beneficiaries. 2. Irrevocable Trust Amendment: An irrevocable trust, as the name suggests, cannot be altered or revoked without the consent of all parties involved, including beneficiaries. However, in Wisconsin, the settler can still modify the beneficiaries of an irrevocable trust through a court-approved amendment process. 3. Testamentary Trust Amendment: A testamentary trust is a type of trust that is created through a will and takes effect after the settler's death. If the settler wants to amend the beneficiaries designated in the testamentary trust, they can use a specific amendment to update the trust agreement accordingly. 4. Charitable Trust Amendment: If a trust serves a charitable purpose or involves charitable organizations, the settler may desire to change the designated beneficiaries, such as updating the charities or specifying new ones. A charitable trust amendment allows the settler to make these changes while adhering to Wisconsin's laws governing charitable trusts. The Wisconsin Amendment to Trust Agreement in Order to Change Beneficiaries is a legally binding instrument that ensures the settler's wishes regarding beneficiaries are accurately reflected in their trust documents. Consultation with an experienced estate planning attorney is highly recommended ensuring compliance with Wisconsin's specific legal requirements and guidelines when using such amendments.Wisconsin Amendment to Trust Agreement in Order to Change Beneficiaries: In Wisconsin, an Amendment to Trust Agreement is a legal document that allows the settler (the person who created the trust) to modify the terms of the trust, specifically changing the designated beneficiaries. This amendment is crucial when circumstances or personal preferences change, necessitating the alteration of beneficiaries specified in the original trust agreement. There are several types of Wisconsin Amendment to Trust Agreement in Order to Change Beneficiaries, including: 1. Revocable Living Trust Amendment: A revocable living trust is a trust that can be altered or revoked by the settler during their lifetime. If the settler wishes to change the beneficiaries listed in the trust agreement, they can use a specific amendment that outlines the new beneficiaries. 2. Irrevocable Trust Amendment: An irrevocable trust, as the name suggests, cannot be altered or revoked without the consent of all parties involved, including beneficiaries. However, in Wisconsin, the settler can still modify the beneficiaries of an irrevocable trust through a court-approved amendment process. 3. Testamentary Trust Amendment: A testamentary trust is a type of trust that is created through a will and takes effect after the settler's death. If the settler wants to amend the beneficiaries designated in the testamentary trust, they can use a specific amendment to update the trust agreement accordingly. 4. Charitable Trust Amendment: If a trust serves a charitable purpose or involves charitable organizations, the settler may desire to change the designated beneficiaries, such as updating the charities or specifying new ones. A charitable trust amendment allows the settler to make these changes while adhering to Wisconsin's laws governing charitable trusts. The Wisconsin Amendment to Trust Agreement in Order to Change Beneficiaries is a legally binding instrument that ensures the settler's wishes regarding beneficiaries are accurately reflected in their trust documents. Consultation with an experienced estate planning attorney is highly recommended ensuring compliance with Wisconsin's specific legal requirements and guidelines when using such amendments.