Wisconsin Owner Financing Contract for Land

Description

How to fill out Owner Financing Contract For Land?

Are you currently in a position where you require documents for both professional or personal purposes almost daily.

There are numerous legal document templates accessible online, but finding reliable ones isn't simple.

US Legal Forms offers thousands of form templates, such as the Wisconsin Owner Financing Contract for Land, intended to satisfy state and federal regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you want, complete the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Wisconsin Owner Financing Contract for Land template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

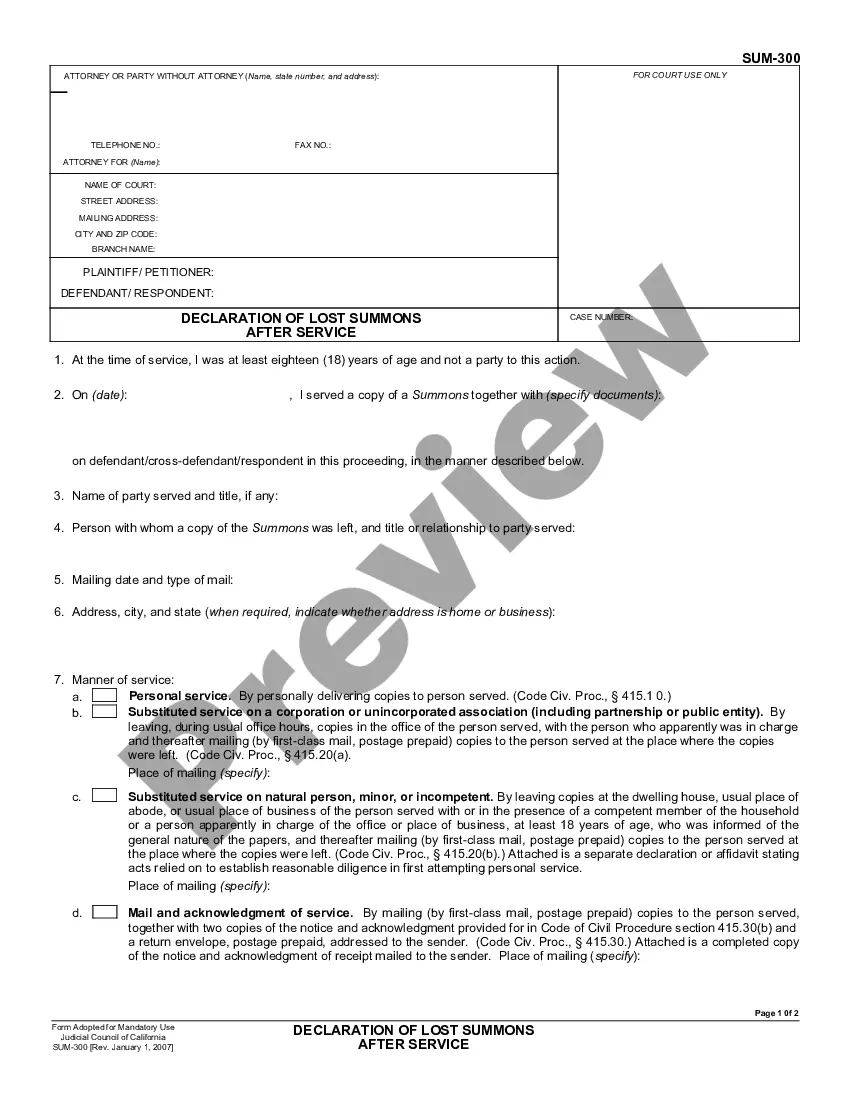

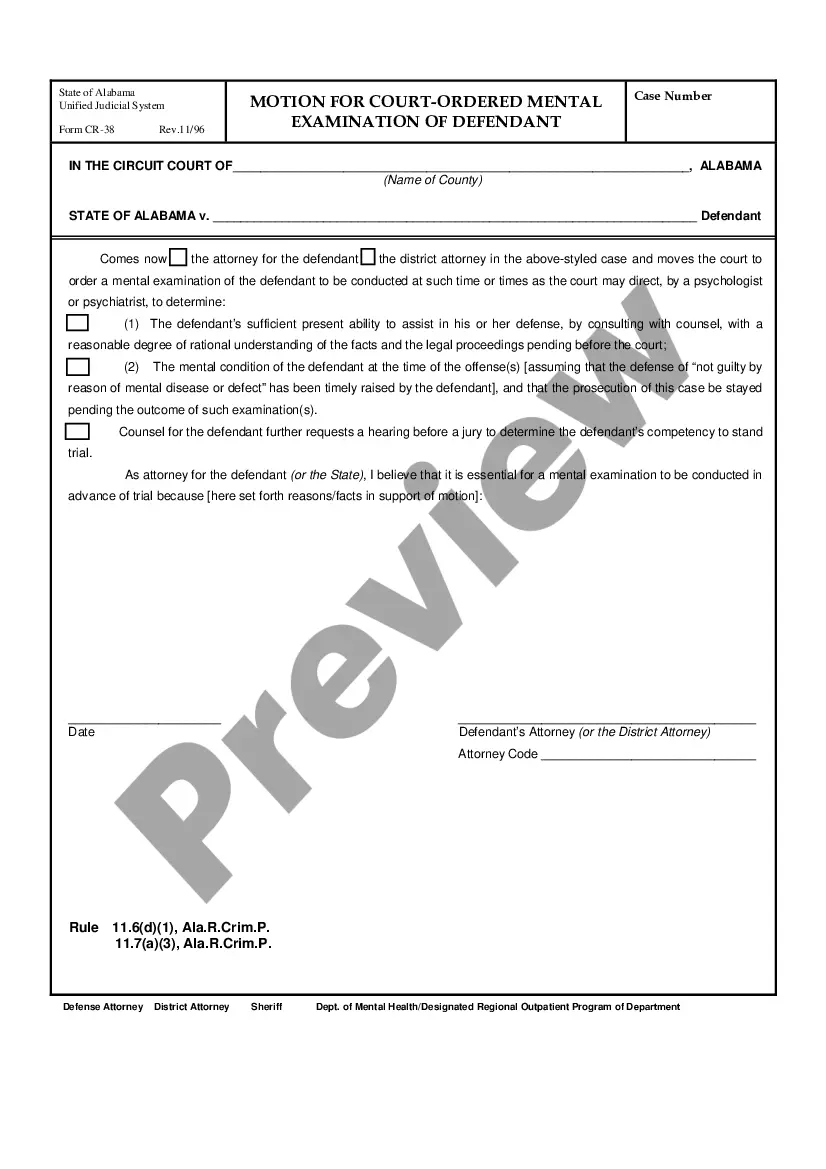

- Use the Review option to evaluate the form.

- Check the description to confirm you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

To obtain owner financing on land, start by searching for properties with sellers open to this financing option. Once you find a suitable property, express your interest in a Wisconsin Owner Financing Contract for Land to the seller. Preparing a strong offer and discussing your financial situation can bolster your chances. Additionally, using platforms like uslegalforms can simplify the contract process, ensuring you create a well-structured agreement.

Typical terms for a Wisconsin Owner Financing Contract for Land can vary, but they often include a down payment between 5% and 20% and repayment terms ranging from 5 to 30 years. Interest rates might be slightly higher than traditional financing, reflecting the risk taken by the seller. Customizing these terms to suit both parties is common, making owner financing a flexible option for buyers. Open communication can create favorable agreements that work for everyone.

Owner financing setups often involve the property seller and the buyer. In most cases, sellers willing to provide financing can create contracts with buyers who prefer this flexible option. You can also enlist professionals, like real estate agents or attorneys, to guide you through the process. Their expertise can help ensure that the Wisconsin Owner Financing Contract for Land meets all legal requirements.

In Wisconsin, land contracts are governed by specific state laws that protect both buyers and sellers. These laws outline the rights and responsibilities of each party, including payment terms, property inspections, and remedies for default. It is essential to follow state regulations for a valid contract. Utilizing a reliable platform like USLegalForms can help you create a compliant Wisconsin Owner Financing Contract for Land.

The primary disadvantage for sellers in a land contract is the risk of default by the buyer. If the buyer fails to make payments, the seller may have to go through the foreclosure process to reclaim the property. Additionally, sellers remain responsible for the property until the contract is fulfilled. By using a Wisconsin Owner Financing Contract for Land, sellers can navigate these risks more effectively.

Yes, owner financing land is often a great solution for buyers and sellers alike. Buyers can bypass the stringent requirements of banks, while sellers can attract a larger pool of potential buyers. This method facilitates flexibility in payment options and enhances the selling process. A Wisconsin Owner Financing Contract for Land streamlines these advantages.

Owner financing can be a strong option for land purchases. It allows buyers to secure property without going through traditional bank loans, making it accessible for those with less than perfect credit. Additionally, sellers benefit from a steady income stream. With a Wisconsin Owner Financing Contract for Land, both parties can tailor terms that meet their unique needs.

In Wisconsin, anyone can draft a Wisconsin Owner Financing Contract for Land, as long as they understand the legal requirements involved. However, it is highly recommended that you work with a qualified attorney or a real estate professional to ensure that the contract meets all state laws. This approach not only helps in creating a clear and enforceable agreement but also protects your interests throughout the transaction. Using platforms like US Legal Forms can provide templates and guidance, making the process smoother and more efficient.

Yes, you can write your own land contract, but it's essential to ensure it covers all relevant provisions. A well-drafted Wisconsin Owner Financing Contract for Land will help protect both parties' interests. Using platforms like USLegalForms can simplify this process, providing templates that comply with Wisconsin law.

One downside of owner financing is the potential for buyer default, which could leave you with property and no payments. Additionally, financing your land may also introduce risks related to interest rates or legal complications. It's vital to weigh these factors and maybe consult a legal professional to draft a secure Wisconsin Owner Financing Contract for Land.