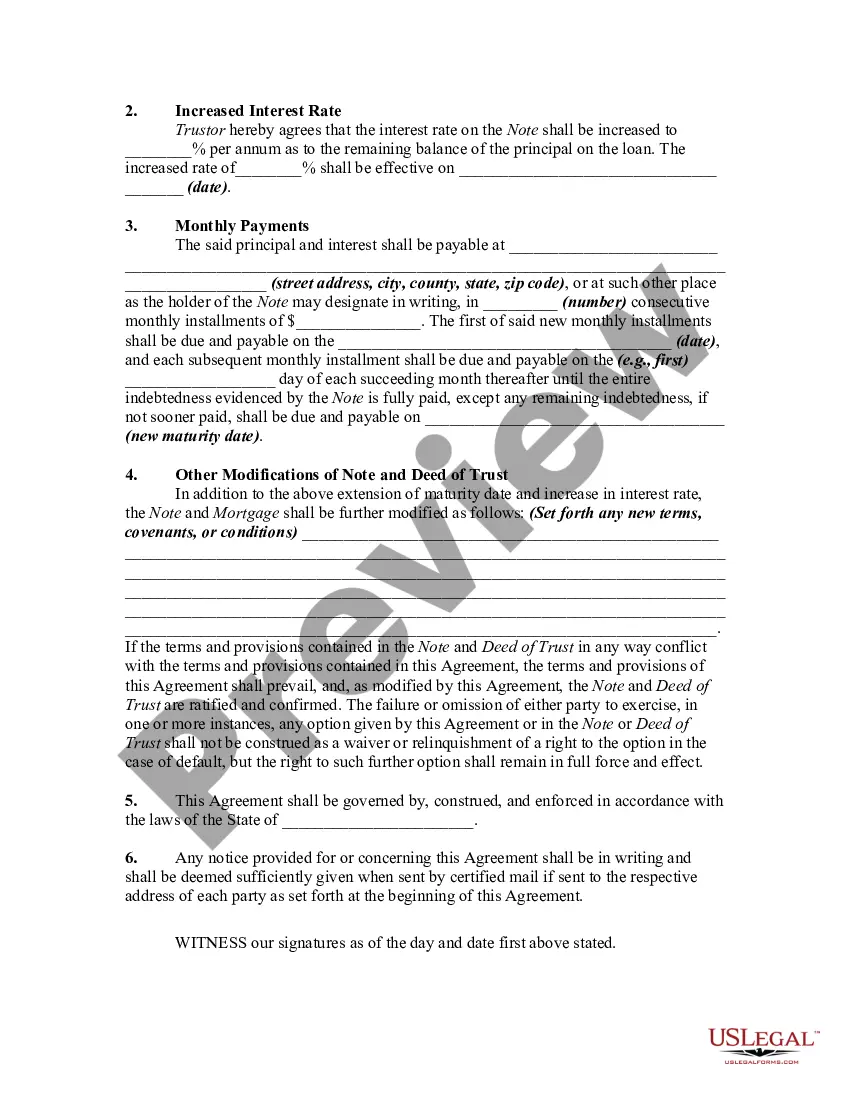

An agreement modifying a loan agreement and a deed of trust should be signed by both parties to the transaction and recorded in the office of the register of deeds and deeds of trust where the original deed of trust was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate

Description

How to fill out Extension Of Loan Agreement Secured By A Deed Of Trust As To Maturity Date And Increase In Interest Rate?

Discovering the right authorized record format could be a struggle. Needless to say, there are tons of templates accessible on the Internet, but how do you get the authorized type you require? Make use of the US Legal Forms web site. The services delivers a large number of templates, including the Wisconsin Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate , which can be used for company and personal demands. All the kinds are checked by specialists and fulfill state and federal demands.

Should you be previously authorized, log in to your bank account and then click the Download switch to have the Wisconsin Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate . Make use of bank account to appear throughout the authorized kinds you possess acquired previously. Proceed to the My Forms tab of your own bank account and acquire yet another version from the record you require.

Should you be a fresh customer of US Legal Forms, allow me to share simple recommendations so that you can comply with:

- Initially, be sure you have chosen the correct type to your metropolis/state. You may check out the form while using Review switch and browse the form explanation to ensure this is basically the right one for you.

- If the type is not going to fulfill your expectations, take advantage of the Seach discipline to discover the proper type.

- When you are certain that the form would work, select the Purchase now switch to have the type.

- Pick the prices plan you desire and enter in the necessary information and facts. Create your bank account and buy your order making use of your PayPal bank account or charge card.

- Opt for the data file structure and down load the authorized record format to your gadget.

- Total, modify and produce and indicator the received Wisconsin Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate .

US Legal Forms may be the greatest catalogue of authorized kinds for which you will find numerous record templates. Make use of the service to down load appropriately-produced paperwork that comply with express demands.

Form popularity

FAQ

A workout agreement is a contract mutually agreed to between a lender and borrower to renegotiate the terms on a loan that is in default, often in the case of a mortgage that is in arrears. Generally, the workout includes waiving any existing defaults and restructuring the loan's terms and covenants.

A loan workout is a new agreement between the borrower and lender that changes the loan. Many times the borrower in distress needs additional funds because of problems arising from its business and benefit from a loan restructuring. Some of the most common modified loan terms include: Payment Amount.

Wis. Stat. section 138.052(5m) governs escrow accounts required to be maintained to pay taxes or insurance in connection with consumer-purpose loans secured by a first lien real estate mortgage or equivalent security interest in the borrower's principal dwelling.

What is a workout? Just what it sounds like. Basically any arrangement in which the loan obligations of the borrower, lender or third parties are modified in a default situation or to prevent a default.

A business loan is a sum of money issued to a business exclusively for use in the company. The borrowed money is repaid ? with interest ? over an agreed loan term. From buying stock ahead of a seasonal peak to accessing new plant and machinery, business loans can be used for a range of operational and growth purposes.

The Bank Workout Group is a department in a commercial bank that handles what is known as the bank's special assets. Banks send their troubled commercial loans to this department to handle the negotiation and management of the bank's forbearance agreements.

Interest Rates Laws in Wisconsin Legal Maximum Rate of Interest5% unless otherwise agreed in writing (§138.04)ExceptionsState-chartered banks, credit unions, savings and loans, etc. (§138.041); residential mortgage loans (§138.052(7)); loans to corporations (§138.05(5)); installment contract on auto (§218.0142)2 more rows

A workout agreement allows a borrower in default and their lender to renegotiate the terms of a loan. The purpose is to accommodate the default borrower so that the lender has a more likely chance of recovering the loan principal and interest without foreclosure, making it mutually beneficial.