Wisconsin Finder's Fee Agreement Regarding Real Property Sales

Description

How to fill out Finder's Fee Agreement Regarding Real Property Sales?

You can spend numerous hours online trying to locate the valid document format that meets the federal and state requirements you need.

US Legal Forms provides a vast array of valid forms that are assessed by experts.

It is easy to download or print the Wisconsin Finder's Fee Agreement Regarding Real Property Sales from our service.

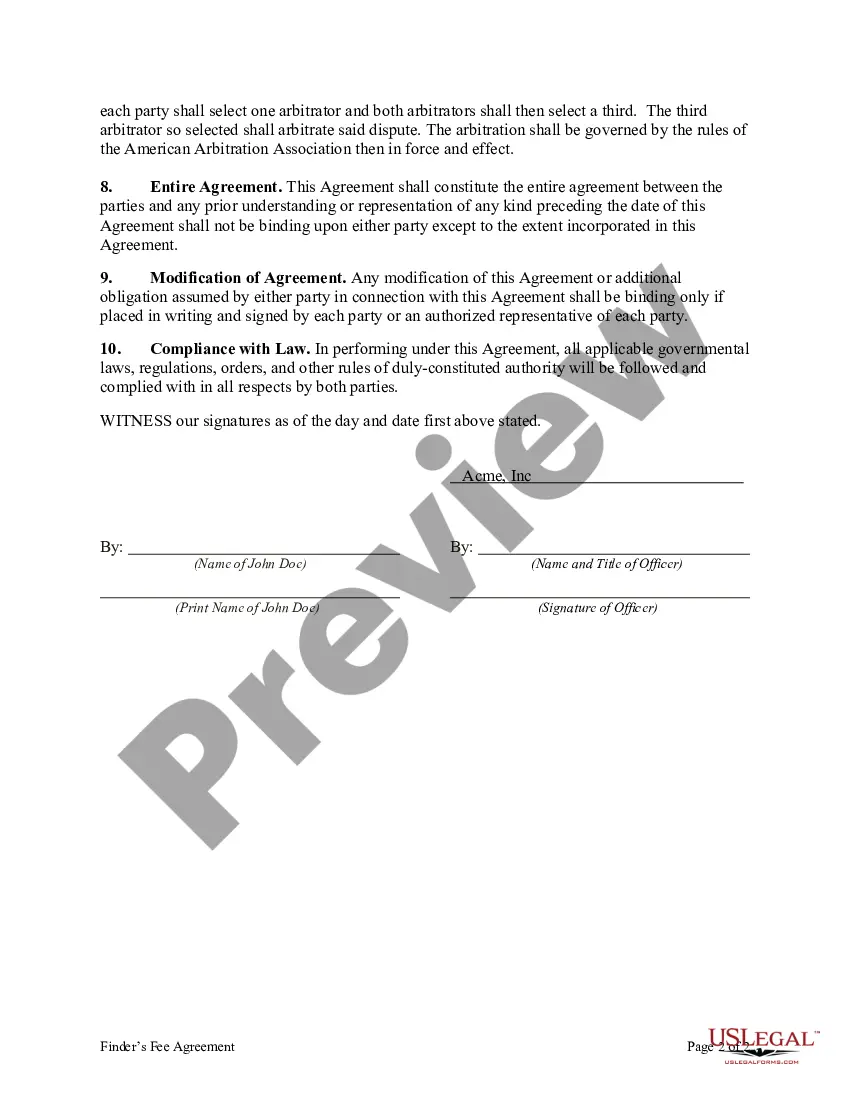

If available, use the Preview button to view the document format as well.

- If you have a US Legal Forms account, you can Log In and then click the Download button.

- Afterward, you can fill out, modify, print, or sign the Wisconsin Finder's Fee Agreement Regarding Real Property Sales.

- Each valid document format you purchase is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the state/area of your choice.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

A finder's fee is a type of cash commission paid to the coordinator or intermediary in a transaction between two other parties (a business and a potential customer). The fee rewards the finder for bringing the interested parties together and facilitating the deal.

Referral Fees vs.Under Australian law, referral selling is illegal. Referral selling is the practice of representing to a customer that they will receive a discount or benefit for purchasing a product, but only once they refer a second customer and that new customer also purchases the product.

Agencies typically pay referral fees of 5% to 10% of the revenue they receivebut there's plenty of nuance on how you handle it, and many agencies pay 0% in referral fees. You'll want to get advice from your lawyer on specific language, and your accountant on how to handle the money.

Paying referral fees to individuals is a way to reward them for consistently bringing you new customers. These individuals will usually have the experience and connections your business otherwise wouldn't have.

The terms of finder's fees can vary greatly, with some citing 5% to 35% of the total value of the deal being used as a benchmark. It's a staple of Fundera's business model. In many cases, the finder's fee may simply be a gift from one party to another, as no legal obligation to pay a commission exists.

Referral fees are a marketing expense, a payment for a lead (but it's only paid if the sale is made). Sales commissions are a sales expense, a payment to a salesperson to close a sale.

Wis. Stat. § 452.19 limits the payment of referral fees, finders fees and commission splits to Wisconsin real estate licensees and persons regularly and lawfully engaged in real estate brokerage in another state.

The short answer to this question is yes, real estate agents can pay referral fees to licensed persons.

The commission is usually a percentage of the sale price. Sales agents who earn commissions can work for the buyer or the seller. A finders fee, on the other hand, is a payment that someone earns after making an introduction or discovering an opportunity that results in a sale.

The terms of finder's fees can vary greatly, with some citing 5% to 35% of the total value of the deal being used as a benchmark. It's a staple of Fundera's business model. In many cases, the finder's fee may simply be a gift from one party to another, as no legal obligation to pay a commission exists.