A Wisconsin Private Annuity Agreement is a legally binding contract between two parties, commonly known as the annuitant (seller) and the annuitant/purchaser. This agreement facilitates the transfer of assets from the annuitant to the purchaser in exchange for regular annuity payments. This arrangement is commonly used as an estate planning tool to achieve tax benefits and provide income security. The Wisconsin Private Annuity Agreement involves the transfer of ownership of assets, such as real estate or investments, from the annuitant to the purchaser. In return, the annuitant receives regular annuity payments for a specified period, providing a steady stream of income. This agreement is particularly useful for individuals looking to transfer assets to the next generation, as it can reduce estate taxes and eliminate potential capital gains taxes. There are a few different types of Wisconsin Private Annuity Agreements: 1. Straight Life Annuity: This agreement provides the annuitant with fixed periodic annuity payments until their death. Once the annuitant passes away, the payments cease. 2. Joint and Survivor Annuity: This type of agreement ensures that both the annuitant and their spouse or partner receive annuity payments for their lifetimes. After the death of one party, the surviving spouse continues to receive the payments. 3. Period Certain Annuity: This agreement guarantees annuity payments for a specific number of years, regardless of whether the annuitant is alive or not. If the annuitant dies before the specified period, the payments continue to a designated beneficiary. Wisconsin Private Annuity Agreements offer several advantages for both the annuitant and the purchaser. For the annuitant, it provides a means of transferring assets without immediate tax consequences. Additionally, the annuitant can secure a steady income stream for their retirement years or to support their financial needs. On the other hand, the purchaser benefits from potential tax advantages. The agreement allows them to acquire assets at a reduced cost, as the transfer is generally based on the annuitant's life expectancy. Moreover, any appreciation of the assets after the transfer occurs outside the annuitant's estate, resulting in potential estate tax savings. It is important to note that Wisconsin Private Annuity Agreements involve complex legal and tax considerations. Seeking the advice of a qualified attorney or financial professional is highly recommended ensuring compliance with state laws and to fully understand the implications and risks associated with entering into such agreements.

Wisconsin Private Annuity Agreement

Description

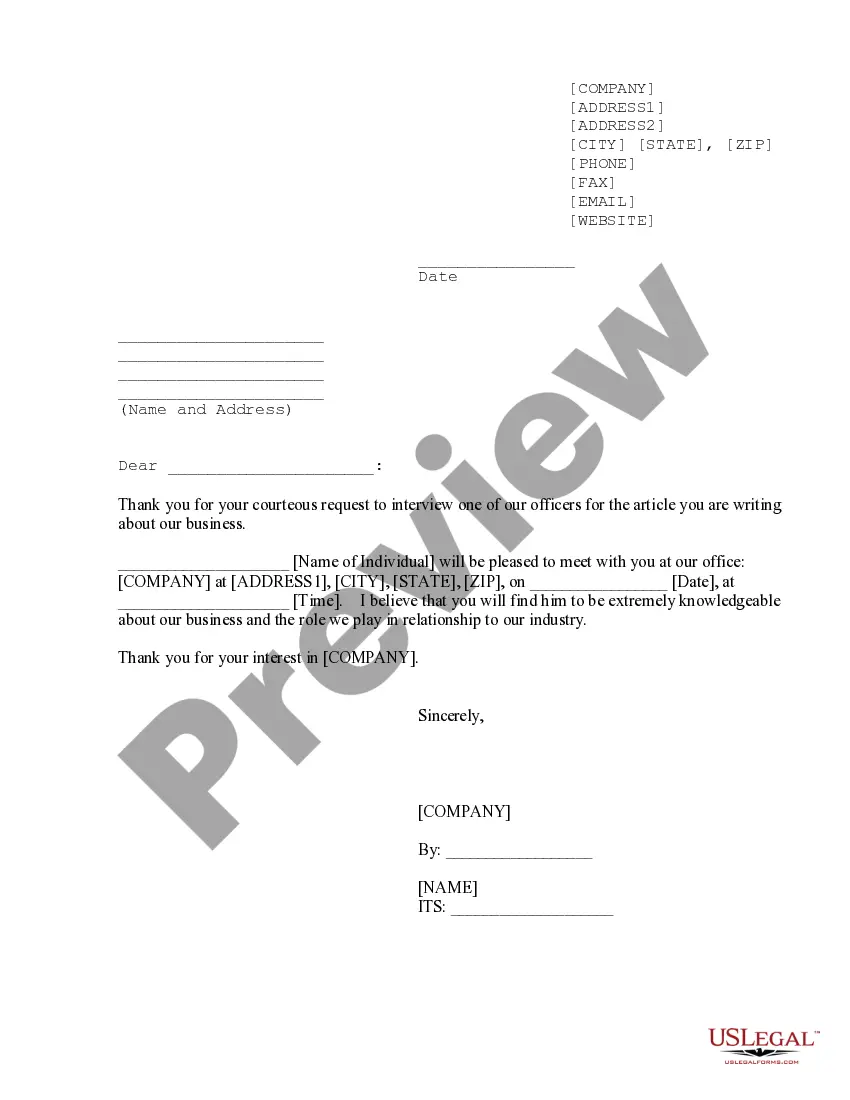

How to fill out Wisconsin Private Annuity Agreement?

US Legal Forms - one of many most significant libraries of lawful types in America - gives a variety of lawful document themes you may download or print out. Utilizing the web site, you will get a large number of types for organization and person functions, sorted by categories, claims, or key phrases.You will discover the most up-to-date models of types just like the Wisconsin Private Annuity Agreement within minutes.

If you currently have a registration, log in and download Wisconsin Private Annuity Agreement in the US Legal Forms collection. The Down load option will appear on every single form you view. You have access to all previously saved types inside the My Forms tab of your respective profile.

In order to use US Legal Forms the first time, listed here are simple guidelines to help you started off:

- Be sure to have chosen the best form for your town/state. Go through the Preview option to examine the form`s articles. Read the form outline to ensure that you have selected the appropriate form.

- If the form doesn`t match your requirements, use the Lookup industry near the top of the display to get the one that does.

- In case you are pleased with the shape, verify your selection by clicking the Purchase now option. Then, opt for the prices prepare you prefer and supply your qualifications to register for an profile.

- Method the purchase. Make use of your Visa or Mastercard or PayPal profile to complete the purchase.

- Find the file format and download the shape on your own gadget.

- Make modifications. Complete, revise and print out and indication the saved Wisconsin Private Annuity Agreement.

Every format you included with your bank account does not have an expiration day which is your own forever. So, in order to download or print out another version, just proceed to the My Forms section and then click about the form you will need.

Gain access to the Wisconsin Private Annuity Agreement with US Legal Forms, probably the most considerable collection of lawful document themes. Use a large number of expert and condition-distinct themes that meet your business or person requires and requirements.