Wisconsin Change of Beneficiary

Description

How to fill out Change Of Beneficiary?

Finding the correct legal document template can be challenging. Naturally, there are numerous templates accessible online, but how do you secure the legal form you need? Utilize the US Legal Forms website. The platform offers thousands of templates, including the Wisconsin Change of Beneficiary, that you can utilize for business and personal purposes. All forms are verified by professionals and comply with federal and state regulations.

If you are already registered, sign in to your account and click the Download button to retrieve the Wisconsin Change of Beneficiary. Use your account to access the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward steps for you to follow: First, ensure you have selected the correct form for your area/region. You can preview the document using the Preview button and read the form details to confirm it is suitable for you. If the form does not fulfill your needs, use the Search box to find the appropriate form. Once you are certain that the form is acceptable, click the Purchase now button to acquire the form. Select the pricing plan you want and fill in the required information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document template for your device. Complete, modify, print, and sign the obtained Wisconsin Change of Beneficiary.

Maximize the benefits of using US Legal Forms to streamline your document needs.

- US Legal Forms is the largest repository of legal documents where you can find various file templates.

- Utilize the service to acquire professionally crafted documents that meet state standards.

- Ensure you have selected the appropriate document for your jurisdiction.

- All templates are verified and compliant with legal regulations.

- Easily access your purchased forms through your account.

- Follow simple steps to create and manage your account.

Form popularity

FAQ

If you own the policy and you're not financially supporting your ex-spouse after the divorce, you can likely remove them as your policy's beneficiary. If you're on the hook for alimony or child support, a judge may require you to keep your ex-spouse as a beneficiary so support continues if you were to die.

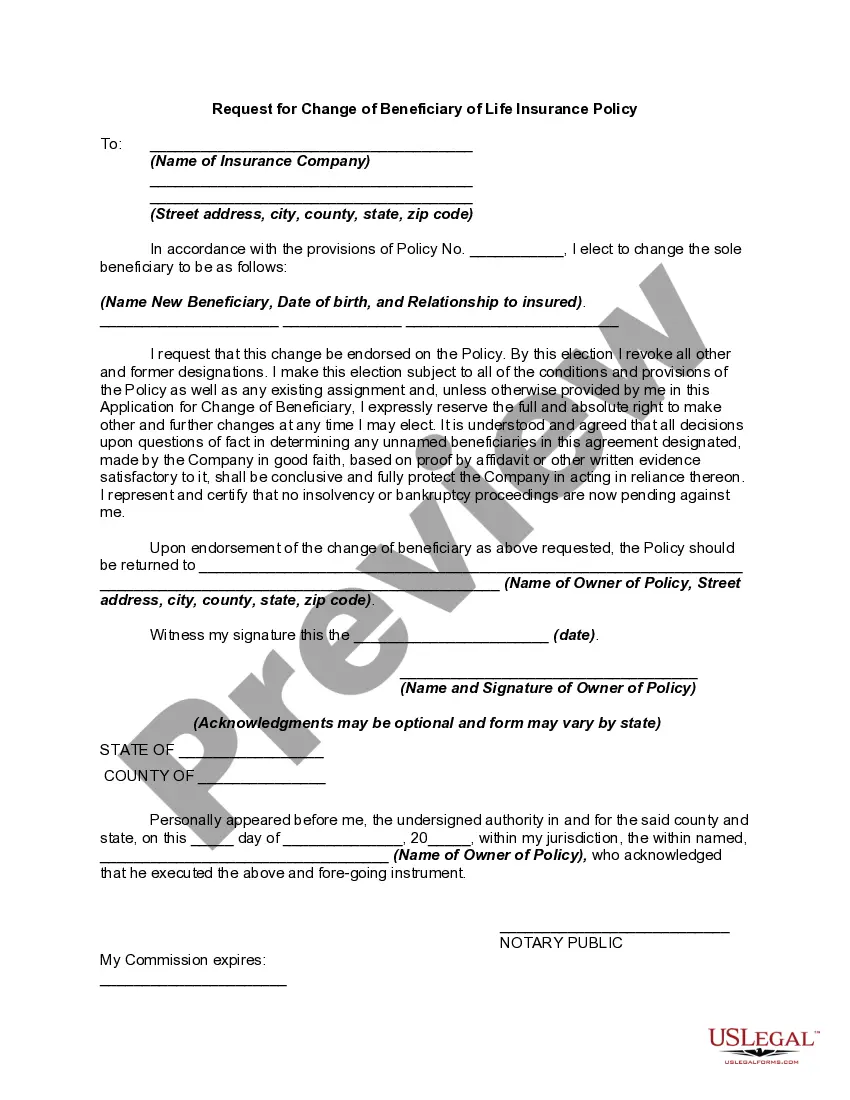

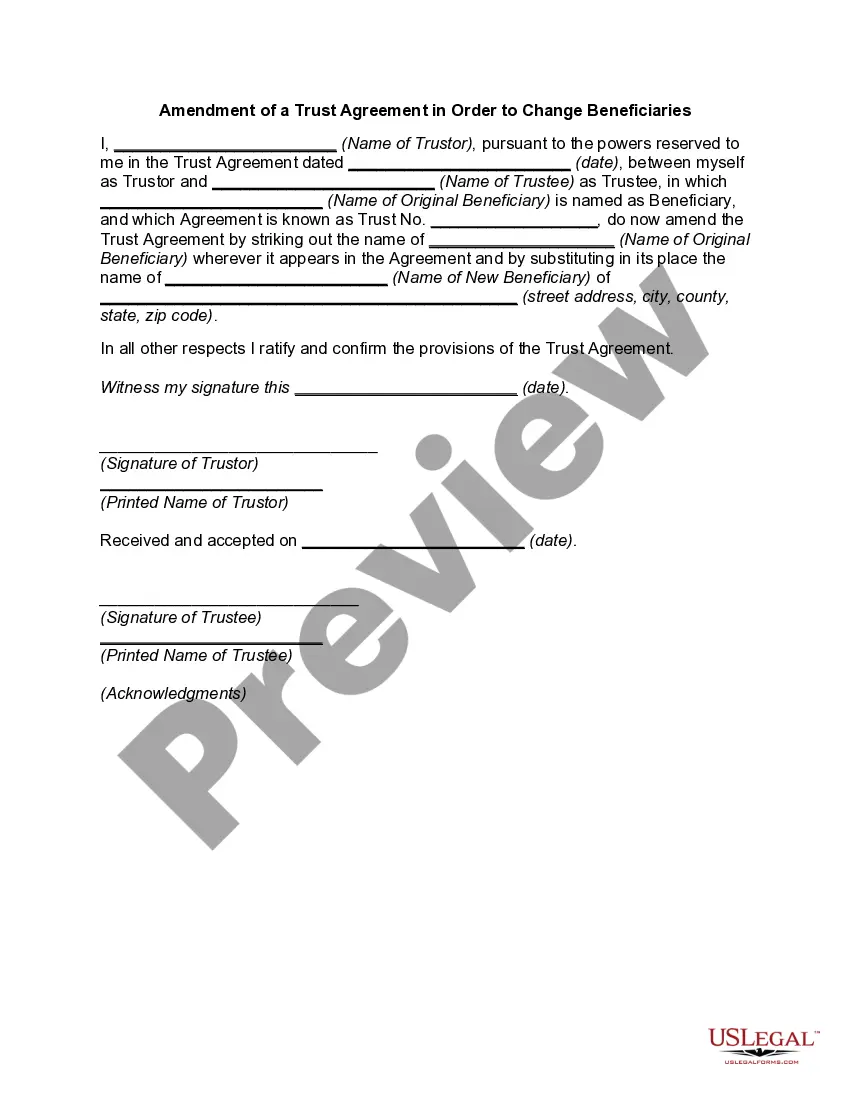

Change a beneficiary Generally, you can review and update your beneficiary designations by contacting the company or organization that provides your insurance or retirement plan. You can sometimes do this online. Otherwise, you'll have to complete, sign, and mail a paper form.

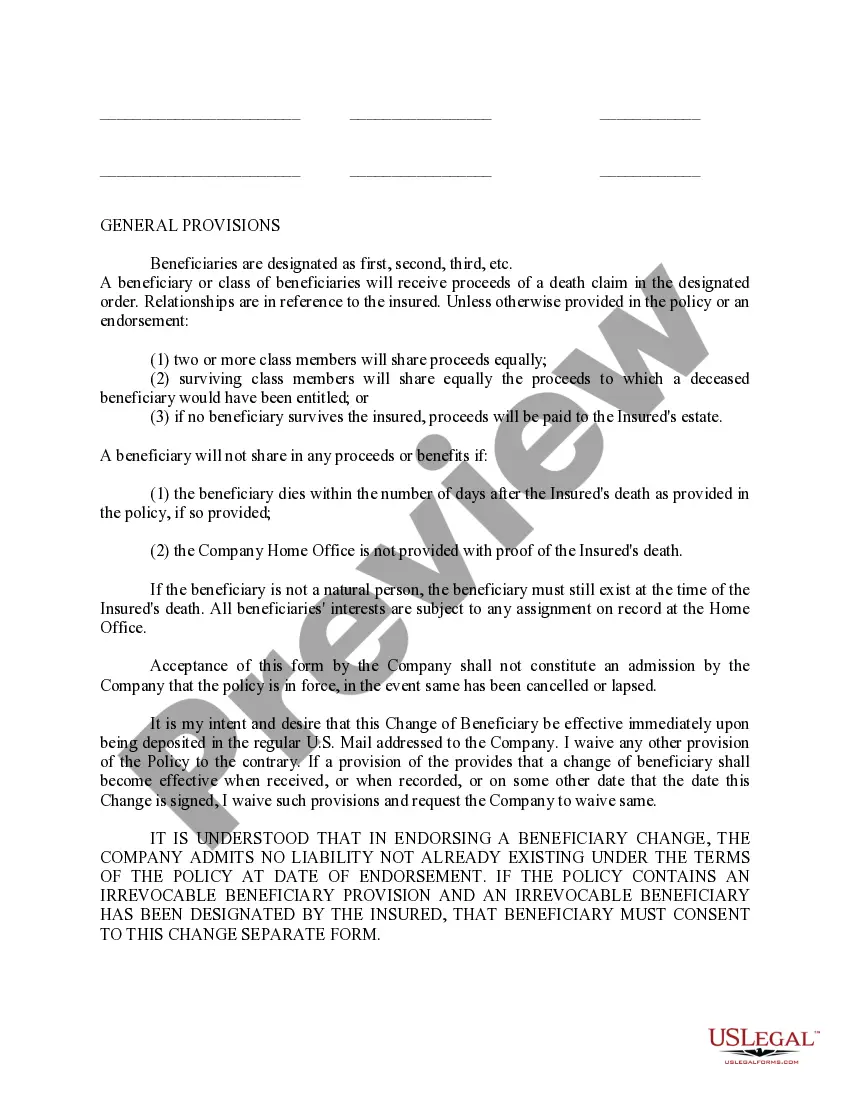

The beneficiary can be either revocable or irrevocable. A revocable beneficiary can be changed at any time. Once named, an irrevocable beneficiary cannot be changed without his or her consent. You can name as many beneficiaries as you want, subject to procedures set in the policy.

An irrevocable beneficiary is a person or entity who is designated to receive the assets in your life insurance policy and cannot easily be changed or removed unless they consent.

Only the policyholder can change a life insurance policy's beneficiaries, with rare exceptions. Here's how and when to make a beneficiary change, and when you might need another person's sign-off. The policy owner is the only person who can change the beneficiary designation in most cases.

As the policyholder, only you ? or someone who holds durable power of attorney for you ? can change your life insurance beneficiaries. However, if your policy names an irrevocable beneficiary, you will also need to get that beneficiary's consent before making changes.

Changing, adding and removing beneficiaries You can typically change, add or remove revocable life insurance beneficiaries at any time. The methods to do so vary among insurers. Some companies may require a change of beneficiary form signed by a witness, while others allow you to update your beneficiary online.

The policy owner is the only person who can change the beneficiary designation in most cases. If you have an irrevocable beneficiary or live in a community property state you need approval to make policy changes. A power of attorney can give someone else the ability to change your beneficiaries.