This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

Wisconsin Receipt for Payment Made on Real Estate Promissory Note

Description

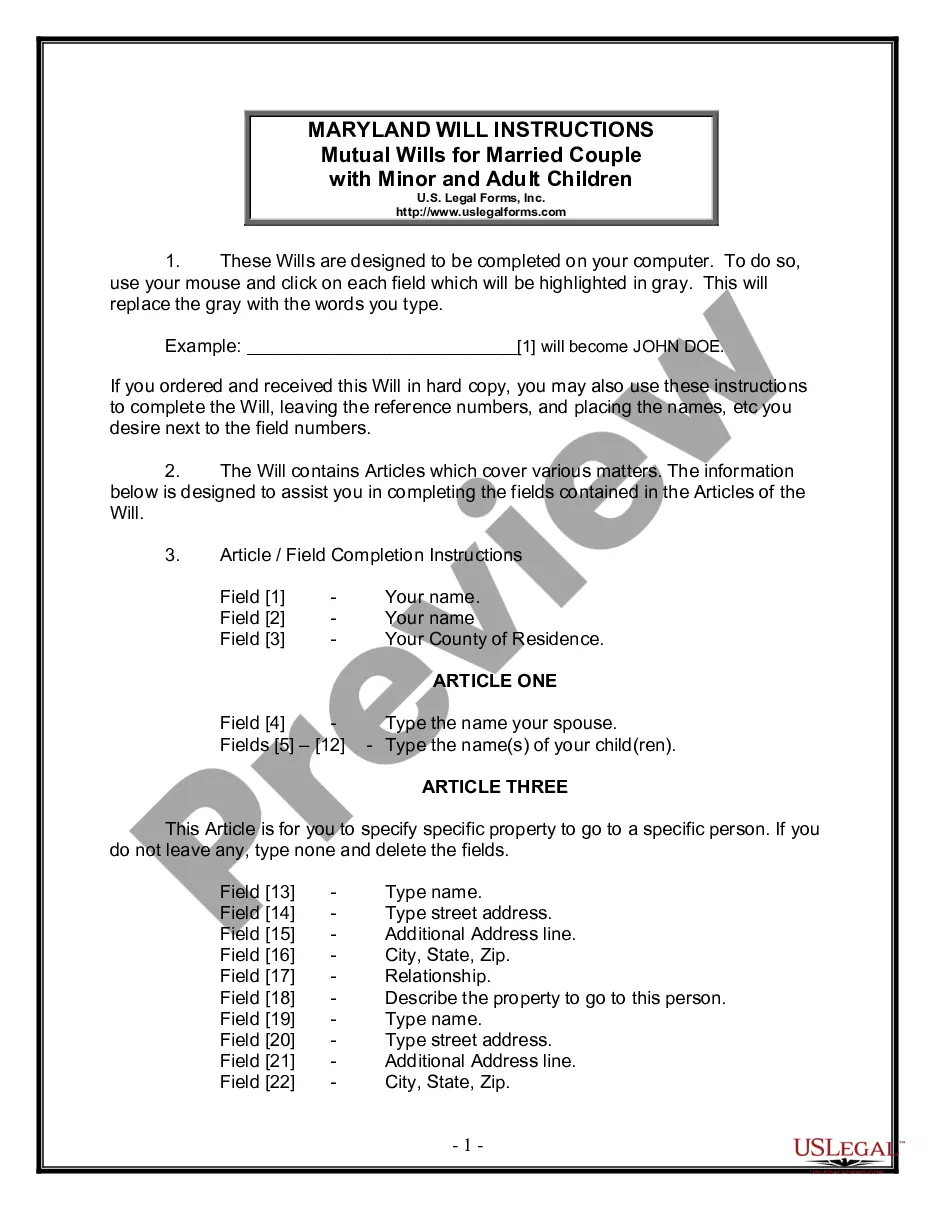

How to fill out Receipt For Payment Made On Real Estate Promissory Note?

Locating the appropriate legal document template can be challenging.

Clearly, there are numerous templates accessible online, but how can you find the legal form you need.

Use the US Legal Forms website. The platform offers thousands of templates, including the Wisconsin Receipt for Payment Made on Real Estate Promissory Note, suitable for both business and personal use.

If the form does not fulfill your requirements, utilize the Search field to find the appropriate form. Once you are confident that the form is correct, click the Purchase now button to acquire the document. Select your desired payment plan and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Wisconsin Receipt for Payment Made on Real Estate Promissory Note. US Legal Forms is the largest repository of legal forms where you can explore numerous document templates. Use the service to download professionally crafted documents that adhere to state stipulations.

- All documents are vetted by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Wisconsin Receipt for Payment Made on Real Estate Promissory Note.

- Utilize your account to view the legal forms you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

- First, ensure you have selected the correct form for your city/state. You can examine the document using the Preview button and read the document description to confirm it meets your needs.

Form popularity

FAQ

When a promissory note matures, the borrower must repay the entire principal amount, along with any accrued interest, by the due date. If the borrower fails to meet this obligation, the lender has the right to take legal action to recover the owed amount. It is essential to document the payment with a Wisconsin Receipt for Payment Made on Real Estate Promissory Note to provide proof and protect both parties in the transaction. For additional guidance, consider using the uslegalforms platform to access templates and related documents.

To fill out a promissory demand note, begin by clearly stating the names and addresses of the parties involved. Next, specify the amount to be borrowed and the interest rate, if applicable. Don't forget to include payment terms, such as the due date and method of payment. Finally, ensure the note has a space for signatures to make it legally binding, which is crucial when obtaining a Wisconsin Receipt for Payment Made on Real Estate Promissory Note.

A strict foreclosure in Wisconsin refers to a legal procedure used in land contracts where the seller can regain ownership of the property without having to go through a traditional foreclosure process. This process occurs when the buyer defaults on payments, allowing the seller to reclaim the property directly. If you are dealing with a situation related to a Wisconsin Receipt for Payment Made on Real Estate Promissory Note and need more clarity, US Legal Forms offers insights and documentation to assist you.

In Wisconsin, a personal representative manages the estate of a deceased person, ensuring that assets are distributed according to the will or state law if there is no will. Their responsibilities include collecting and valuing estate assets, paying debts, and filing necessary documents with the court. If you need guidance with the process involving a Wisconsin Receipt for Payment Made on Real Estate Promissory Note, consider utilizing US Legal Forms for templates and resources.

The Wisconsin real estate transfer return is a required form that documents the details of real estate transactions for the purpose of assessing transfer fees. It includes crucial information such as property descriptions and sale prices. When issuing a Wisconsin Receipt for Payment Made on Real Estate Promissory Note, completing the transfer return is essential to ensure compliance with state laws.

Certain transactions are exempt from Wisconsin real estate transfer fees, including transfers between spouses or transfers for government purposes. It's important to check the specific exemptions that may apply to your situation. Understanding these exemptions can help with the proper documentation of a Wisconsin Receipt for Payment Made on Real Estate Promissory Note and potentially save you on fees.

Wisconsin does recognize Transfer on Death (TOD) deeds. This allows property owners to designate a beneficiary who will receive the real estate upon the owner's death, bypassing probate. Utilizing a TOD can streamline your estate planning, which may relate to how you manage a Wisconsin Receipt for Payment Made on Real Estate Promissory Note.

To calculate Wisconsin sales tax, you need to determine the total sales amount and multiply that by the current state sales tax rate of 5.0%. Additionally, some municipalities may impose local taxes, raising the total rate up to 5.6%. Ensuring accurate calculations is essential, especially when documenting transactions related to a Wisconsin Receipt for Payment Made on Real Estate Promissory Note.

Bills receivable refer to amounts owed to you, which can include promissory notes, but they are not the same. A bill receivable represents any claim for payment due to your business, while a promissory note is a specific type of agreement. Managing your Wisconsin Receipt for Payment Made on Real Estate Promissory Note alongside other bills receivable can enhance your financial tracking effectively.

An invoice and a promissory note serve different purposes. An invoice requests payment for goods or services rendered, while a promissory note is a commitment to repay a specified amount. In transactions involving real estate, a Wisconsin Receipt for Payment Made on Real Estate Promissory Note may be issued alongside an invoice to provide comprehensive documentation of financial exchanges.