Wisconsin Revocable Trust for Real Estate

Description

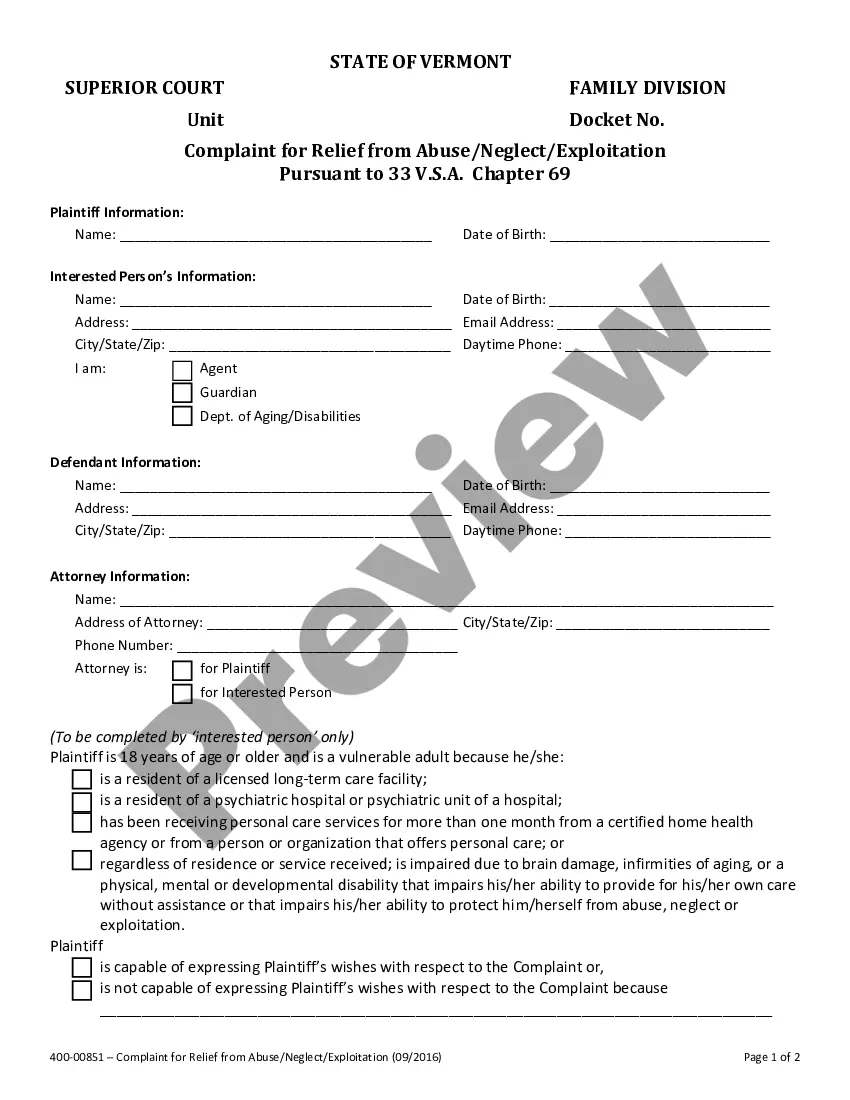

How to fill out Revocable Trust For Real Estate?

You can spend extensive time online looking for the legal document format that meets the federal and state requirements you seek.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

It is easy to download or print the Wisconsin Revocable Trust for Real Estate from our platform.

If available, use the Review button to view the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Next, you can complete, edit, print, or sign the Wisconsin Revocable Trust for Real Estate.

- Each legal document format you obtain is yours permanently.

- To access another copy of a purchased form, visit the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document format for your state/city of choice.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

A Wisconsin Revocable Trust for Real Estate offers several advantages, including a straightforward way to manage your assets during your lifetime and distribute them after your death. It can help reduce administrative complexities while ensuring that your wishes regarding property transfer are fulfilled. Moreover, this trust type can protect your privacy, as it typically avoids public probate proceedings. Discover the power of a revocable trust for smooth estate management.

Yes, placing your house in a Wisconsin Revocable Trust for Real Estate can be a strategic decision. This approach allows you to maintain control over your property while avoiding the probate process upon your passing. Additionally, it provides flexibility, as you can modify or revoke the trust at any time. Overall, it's a beneficial move for estate planning.

Transferring assets into a trust involves changing the ownership of the assets from your name to the trust's name. This can include real estate, bank accounts, and investments. The benefit of a Wisconsin Revocable Trust for Real Estate is that it allows for easy management and distribution of your assets according to your preferences. Always consider seeking legal advice to navigate this process smoothly.

Transferring property into a trust in Wisconsin requires a few straightforward steps. First, create a new title deed that identifies the trust as the owner. You must then file this deed with the appropriate county office. A Wisconsin Revocable Trust for Real Estate makes this process more manageable, ensuring your property is held and distributed as you desire.

To transfer property to a trust in Wisconsin, you typically need to execute a new deed that names the trust as the new owner. This process involves filing the new deed with the county register of deeds. Utilizing a Wisconsin Revocable Trust for Real Estate simplifies this transfer and clarifies your intentions regarding your property.

One primary downside of a revocable trust is that it does not provide asset protection from creditors. Although a Wisconsin Revocable Trust for Real Estate allows you to manage assets and avoid probate, it does not shield those assets from liabilities. It's essential to understand this limitation, especially if you have debt or potential lawsuits.

Deciding whether to gift a house or place it in a trust depends on your circumstances. When you use a Wisconsin Revocable Trust for Real Estate, you maintain control over your property during your lifetime and can decide how it will be managed after your passing. Gifting a house removes your control over it, and may have tax implications. It's wise to weigh these options carefully.

Many parents overlook the importance of clarity in their estate plans when establishing a trust fund. They might assume that their intentions are clear, but without proper documentation and communication, misunderstandings can arise. A Wisconsin Revocable Trust for Real Estate can help ensure that assets are protected and distributed according to your wishes, minimizing confusion for your heirs.

The primary downfall of having a Wisconsin Revocable Trust for Real Estate lies in the costs associated with setting it up and maintaining it. Legal fees, management fees, and additional administrative tasks can add complexity and expenses. However, many find the benefits, such as avoiding probate and simplifying asset transfers, outweigh these potential challenges.

The major disadvantage of a Wisconsin Revocable Trust for Real Estate is that it does not provide asset protection from lawsuits or creditors. While it streamlines the estate planning process and avoids probate, the lack of protection can be a significant concern for individuals with substantial assets. It's important to consider life circumstances when deciding on estate planning tools.