Wisconsin Revocable Trust for Child

Description

How to fill out Revocable Trust For Child?

Should you need exhaustive, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are categorized by groups and states, or by keywords.

Utilize US Legal Forms to acquire the Wisconsin Revocable Trust for Child with just a few clicks.

Each legal document template you acquire is yours permanently. You will have access to every form you have saved in your account. Click the My documents section and select a form to print or download again.

Fill out and download, and print the Wisconsin Revocable Trust for Child with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Wisconsin Revocable Trust for Child.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

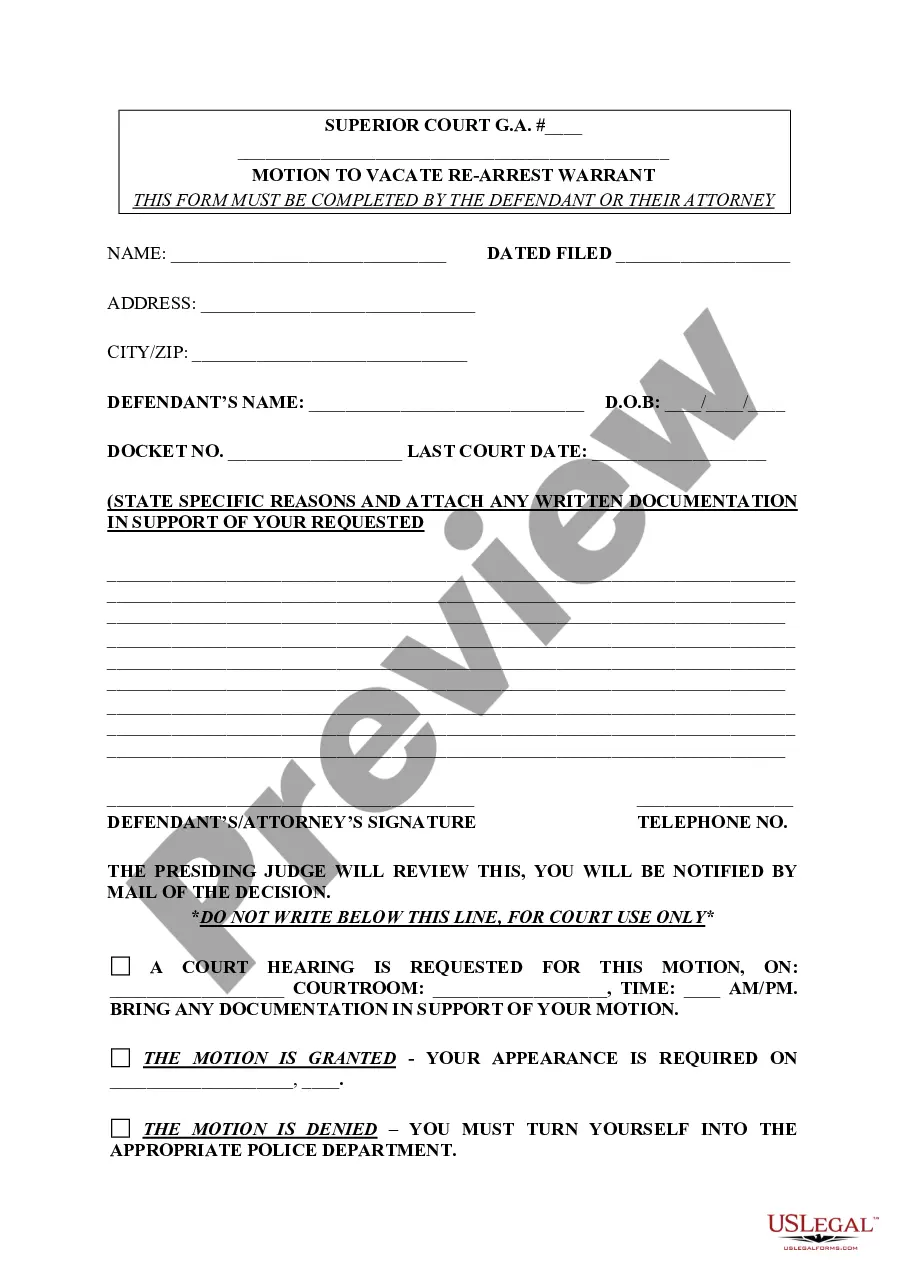

- Step 2. Utilize the Review option to examine the content of the form. Don't forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Process the payment. You may use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Wisconsin Revocable Trust for Child.

Form popularity

FAQ

Yes, you can create your own trust in Wisconsin. However, it is crucial to follow the legal requirements to ensure it is valid and effective. A do-it-yourself Wisconsin Revocable Trust for Child can be an excellent option, but consider using a reliable platform like uslegalforms to guide you through the process. With the right resources, you can create a trust that secures your child's future while maintaining your peace of mind.

The best type of trust for children often depends on your specific goals and circumstances. A Wisconsin Revocable Trust for Child can serve as a great foundation, offering flexibility and control for parents. It nurtures the child's financial needs while providing clear instructions for asset management, making it easier for a guardian or trustee to fulfill your wishes. Ultimately, tailoring the trust to your child's future needs is key.

A revocable trust in Wisconsin offers several benefits, especially for parents. It allows you to maintain control over your assets while you are alive, and you can modify or revoke the trust anytime. Furthermore, a Wisconsin Revocable Trust for Child can provide specific instructions for your child's inheritance, minimizing potential disputes among beneficiaries. This approach not only simplifies the distribution of assets but also ensures your child's financial security.

In Wisconsin, a trust document does not necessarily need to be notarized to be valid. However, having the trust notarized can provide an extra layer of protection and make it easier to enforce. If you are considering a Wisconsin Revocable Trust for Child, it may be beneficial to consult with a legal professional to ensure all guidelines are followed. A properly executed trust can manage your child's inheritance seamlessly.

Yes, you can write your own will in Wisconsin. However, it is important to ensure that it meets all legal requirements to be valid. Utilizing a Wisconsin Revocable Trust for Child can help simplify the process of estate planning, allowing you to outline your wishes clearly. Additionally, a revocable trust may provide benefits such as avoiding probate and protecting your assets.

The best way to set up a trust for children is by creating a Wisconsin Revocable Trust for Child. This trust allows you to define specific terms and conditions for asset distribution. You can also designate a trustee to manage the trust, ensuring that your children’s needs are met until they become adults.

To fund a trust in Wisconsin, you need to transfer ownership of your assets to the Wisconsin Revocable Trust for Child. This process involves changing the title of your property, bank accounts, and investments to the trust's name. It is often beneficial to seek guidance from a legal professional or use platforms like US Legal Forms to help streamline the funding process.

The best type of trust for a child is typically a Wisconsin Revocable Trust for Child. It offers parents the ability to control the distribution and use of assets, protecting them from immediate mismanagement or creditors. This type of trust can be tailored to meet your specific wishes for your child's future.

For children, a Wisconsin Revocable Trust for Child can be an excellent choice. This trust allows you to manage assets on behalf of your children until they reach a certain age or milestone. It provides flexibility in handling the trust's assets while ensuring their financial security.

The best way to leave your house to your children is often through a Wisconsin Revocable Trust for Child. This type of trust enables you to specify how and when your property is transferred to your children. Additionally, it can help avoid probate, ensuring that your children receive their inheritance more efficiently.