The Wisconsin Sale of Deceased Partner's Interest refers to the process in which the ownership share of a deceased partner in a business is transferred or sold to another party. This transaction is necessary to determine how the deceased partner's interest will be handled in terms of ownership and financial rights. In Wisconsin, when a partner in a business passes away, their interest in the partnership is considered part of their estate. To ensure a smooth and fair transition, the deceased partner's share must be sold or transferred to another individual or entity. There are a few essential aspects to consider in such a sale: 1. Determining the Deceased Partner's Interest: Prior to selling or transferring the deceased partner's interest, it is crucial to determine the exact percentage or value of their stake in the business. This is typically determined by the partnership agreement or agreement among the partners. 2. Valuation of the Deceased Partner's Interest: The value of the deceased partner's interest must be determined. This could be done through various methods, such as appraisals or calculations based on the partnership's financials. 3. Offering the Deceased Partner's Interest to Existing Partners: In some cases, existing partners have the right of first refusal when it comes to purchasing the deceased partner's share. They can choose to buy the interest in proportion to their current stakes, or as agreed upon by the surviving partners. 4. Selling the Deceased Partner's Interest to Third Parties: If the existing partners decline to purchase the deceased partner's interest, it can be sold to a third party. This may involve advertising the opportunity to potentially interested parties and negotiating the terms of the sale. 5. Distributing Proceeds to the Deceased Partner's Estate: After the sale of the deceased partner's interest, the proceeds generated from the transaction should be distributed to their estate as per the applicable laws of Wisconsin. Regarding different types of Wisconsin Sale of Deceased Partner's Interest, they can be categorized as follows: 1. Intra-Partnership Sale: When the surviving partners within the same business entity purchase the deceased partner's interest. 2. Third-Party Sale: In cases where the deceased partner's interest is sold to an individual or entity not already involved in the partnership. 3. Forced Sale: If the partnership agreement contains specific provisions or circumstances that dictate the sale of a deceased partner's interest, it may be necessary to sell the interest regardless of the preferences of existing partners. 4. Voluntary Sale: In situations where the surviving partners voluntarily come to an agreement to sell the deceased partner's interest, ensuring a smooth transition and fulfilling the wishes of the deceased partner and their estate. In conclusion, the Wisconsin Sale of Deceased Partner's Interest is a crucial process that allows for the fair and efficient transfer of ownership and financial rights in a partnership following the death of a partner. Understanding the various methods of selling, valuing, and distributing the deceased partner's interest is essential to navigate this process in accordance with the laws and agreements in place.

Wisconsin Sale of Deceased Partner's Interest

Description

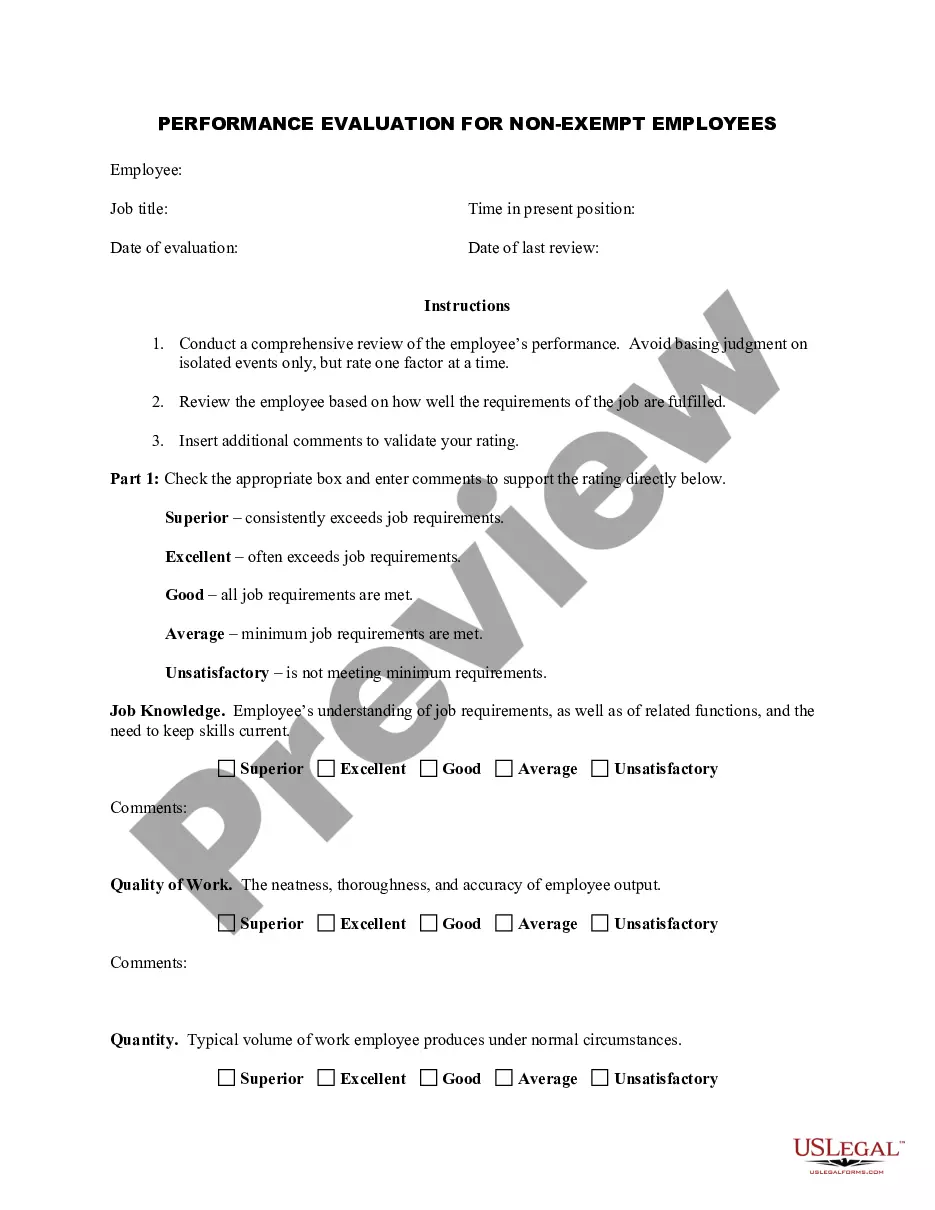

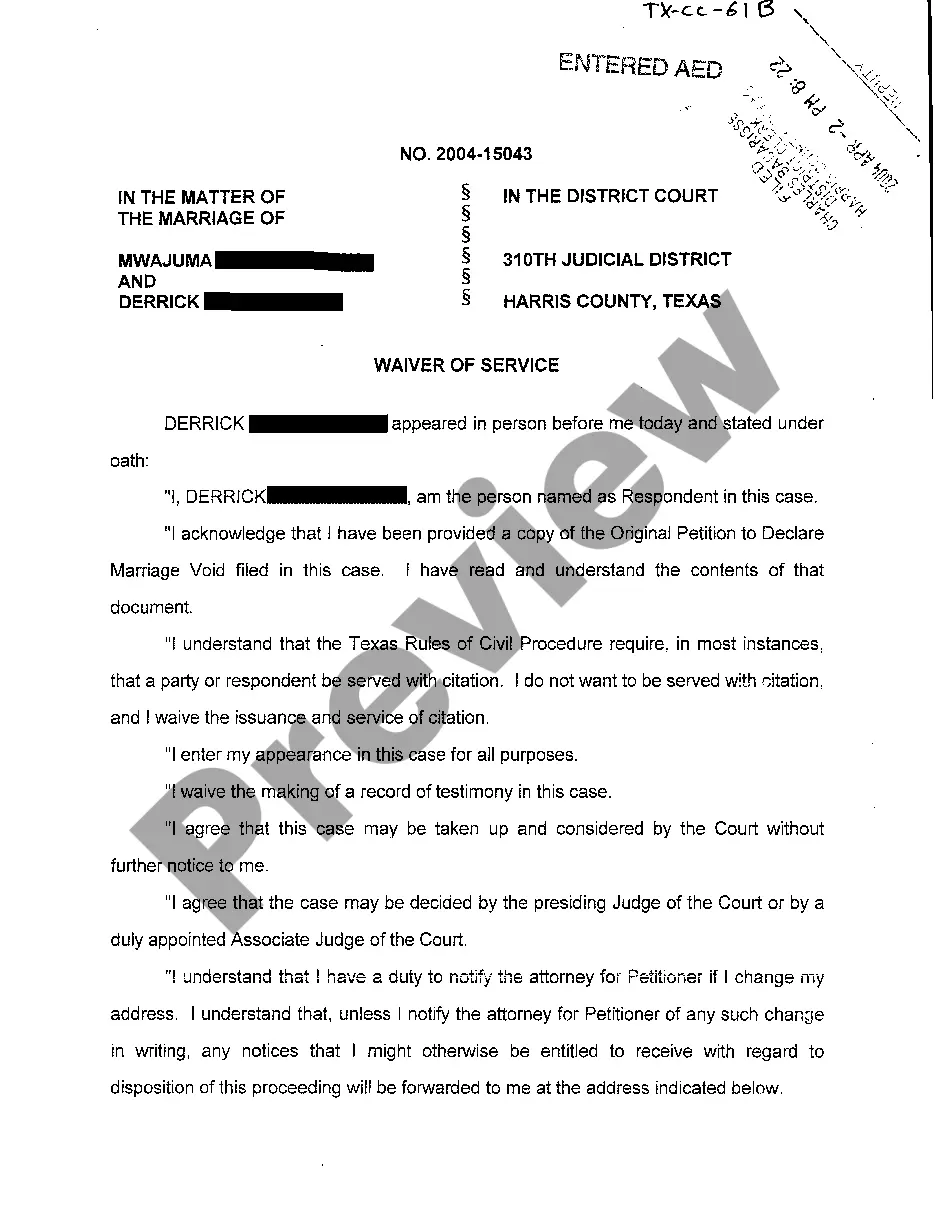

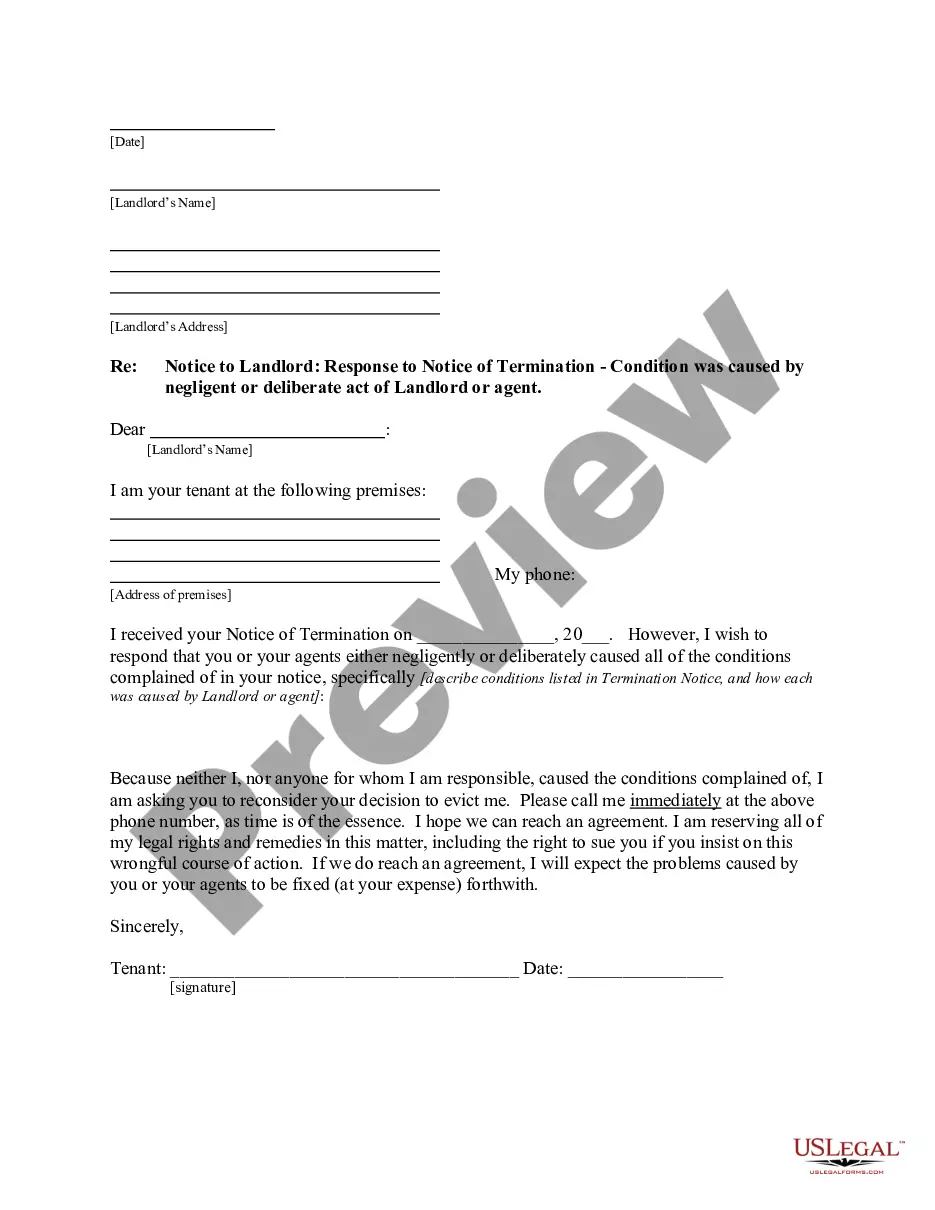

How to fill out Wisconsin Sale Of Deceased Partner's Interest?

US Legal Forms - one of the best collections of legal documents in the United States - offers a variety of legal form templates you can download or create.

By utilizing the website, you will find thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can access the most current versions of forms, such as the Wisconsin Sale of Deceased Partner's Interest, in just a few minutes.

Review the form description to confirm that you have selected the right form.

If the form does not meet your needs, take advantage of the Search field at the top of the screen to find the one that does.

- If you already have a monthly plan, Log In and download the Wisconsin Sale of Deceased Partner's Interest from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously obtained forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Make sure to have selected the correct form for your city/county.

- Click the Preview button to examine the form’s details.

Form popularity

FAQ

Wisconsin lets you register stocks and bonds in transfer-on-death (TOD) form. People commonly hold brokerage accounts this way. If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at your death.

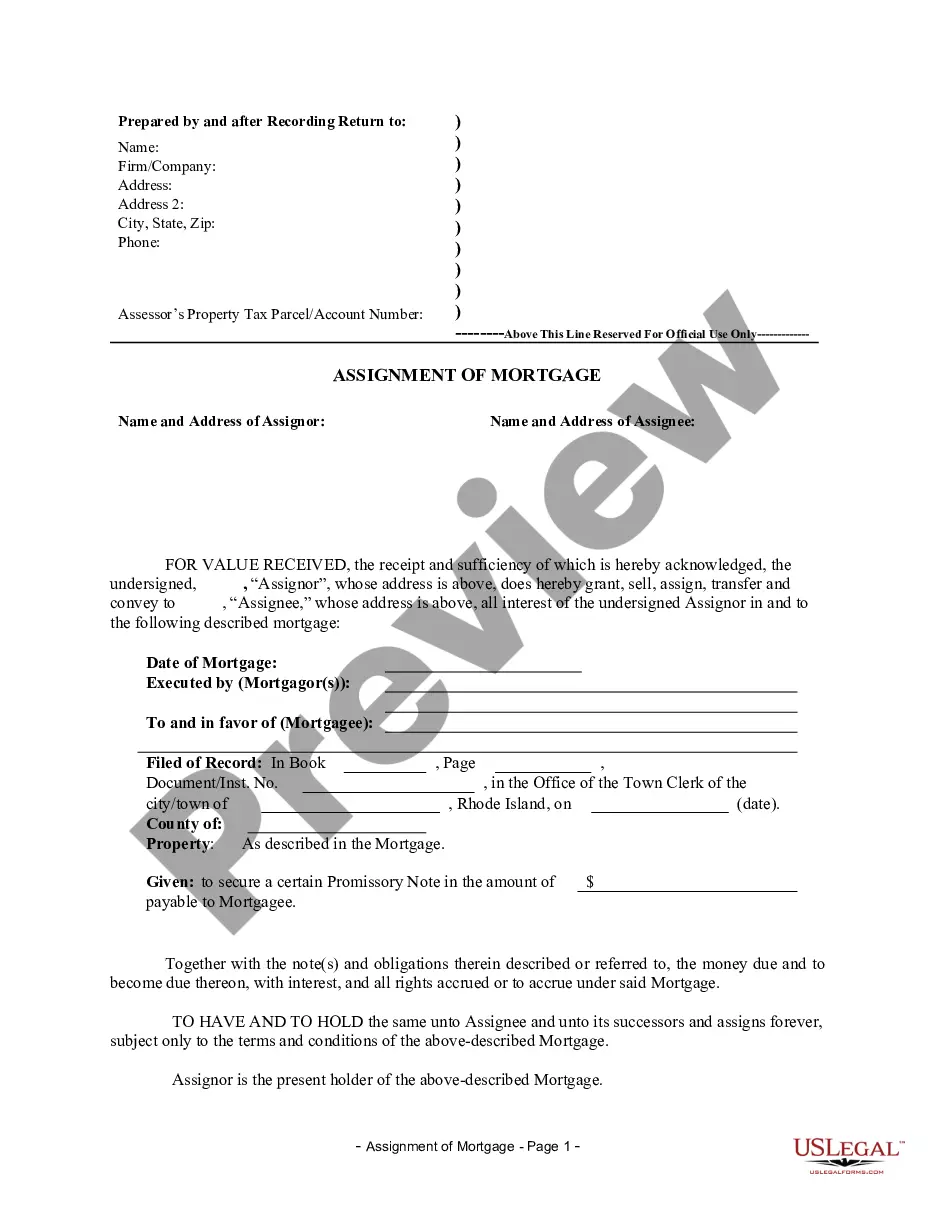

Wisconsin. When recording a property conveyance deed and other instruments, a seller of real estate is required to file a Real Estate Transfer Return (RETR) with the county Register of Deeds. Since July 1, 2009, a seller must electronically file (e-file) a return under state law.

Wisconsin Statutes § 705.15, entitled Non-probate Transfer of Real Property on Death (the Statute), effective April 11, 2006 for deaths after that date, provides a method for transferring real estate upon an owner's death to designated beneficiaries, without probate or a trust, through the recording of a form

Yes, Wisconsin's TOD deed statute lets property owners name more than one beneficiary in a TOD deed. Wisconsin's general rule is that multiple beneficiaries receive equal shares in a deceased owner's interest, but a property owner can specify different shares within a TOD deed.

According to Wisconsin law, inheritance is individual property as long as it was left to only one spouse. However, property that starts as individual property can become commingled. If a spouse commingles an inheritance by sharing it with the other party, it becomes community property.

If you have a surviving spouse but no children, your spouse will inherit all of your community and separate property. If you have a surviving spouse and children who are also the spouse's children, your spouse will still inherit all community and separate property.

Children's Shares in Wisconsin. If you die without a will in Wisconsin, your children will receive an "intestate share" of your property. The size of each child's share depends on how many children you have, whether or not you are married, and whether you have any children from other relationships.

How Long do you Have to File Probate After Death in Wisconsin? In general, Wisconsin state law requires that an estate be closed within 18 months of the person's death. However, several Wisconsin counties have recently adopted statutes requiring that probate be completed within 12 months of death.

Wisconsin's Transfer on Death Deed (TOD Deed) allows for the non-probate transfer of real property upon death. This seemingly simple law, Wisconsin Statute 705.15, can be used as a powerful estate planning tool, in the right circumstances.

Interesting Questions

More info

Login to Register A login allows users to create an account or to edit their existing account. A login allows users to create an account or to edit their existing account. Users can also add a custom link to their account. If additional options are added to the account, they can be selected in the Custom link field before the log on button is clicked. Logon Page All logons are on the same page. Select Login from the main menu or click Logon to open the user's page. The following sections explain the types of pages and procedures used to log onto the account management system. Login page types and procedures: All user logons are submitted to an internal gateway server (Interconnect) which forwards them to the appropriate pages. It also stores the login data in a logon database. Each user can have more than one page of their own, and multiple pages can have the same user. Users may be registered multiple times.