An IOU is usually an informal document acknowledging a debt. The term is derived from the phrases I owe unto and I owe you. An IOU differs from a promissory note in that an IOU is not a negotiable instrument as defined by the Uniform Commercial Code and generally does not specify repayment terms such as the time of repayment. IOUs usually specify the debtor, the amount owed, and sometimes the creditor.

Wisconsin Debt Acknowledgment - IOU

Description

How to fill out Debt Acknowledgment - IOU?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a vast array of legal document templates that you can download or print. By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest forms such as the Wisconsin Debt Acknowledgment - IOU within moments.

If you have an account, Log In and download the Wisconsin Debt Acknowledgment - IOU from the US Legal Forms library. The Download option will be available on every form you view. You can access all previously downloaded forms in the My documents section of your account.

To use US Legal Forms for the first time, here are straightforward steps to get started: Ensure you have selected the correct form for your city/county. Click the Preview button to review the form's details. Read the form description to confirm that you have chosen the right form. If the form doesn’t meet your requirements, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you prefer and provide your credentials to register for the account. Process the payment. Use a credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make adjustments. Fill out, modify, and print and sign the downloaded Wisconsin Debt Acknowledgment - IOU. Each template you added to your account has no expiration date and is yours permanently. Therefore, if you need to download or print another copy, simply visit the My documents section and click on the form you require.

- Access the Wisconsin Debt Acknowledgment - IOU with US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

Form popularity

FAQ

An IOU, a phonetic acronym of the words "I owe you," is a document that acknowledges the existence of a debt. An IOU is often viewed as an informal written agreement rather than a legally binding commitment. Dating as far back as the 18th century, at least, IOUs are still very much in use.

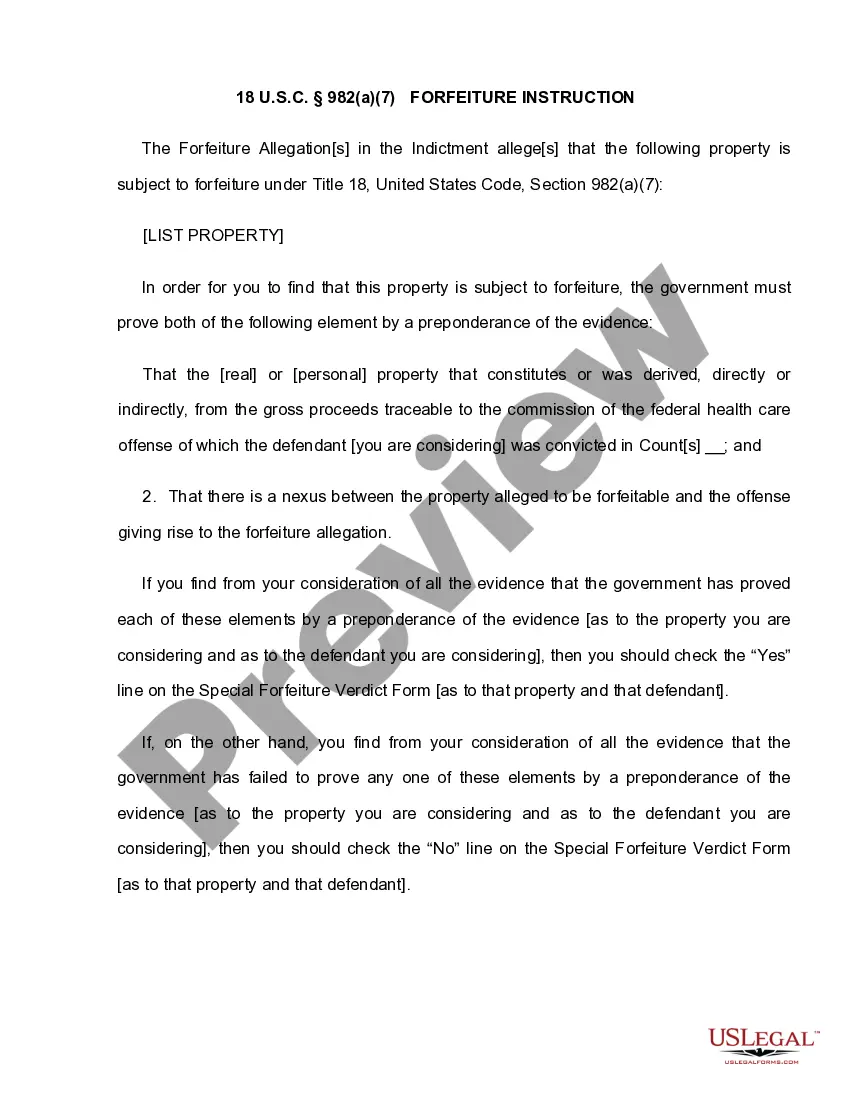

I, the undersigned [BORROWER NAME] (the ?Borrower?), hereby confirm and acknowledge to [LENDER NAME] (the ?Lender?) that I am indebted to said Lender in the amount of $[AMOUNT] (the ?Debt?) as of the date set forth below.

An IOU merely acknowledges a debt and the amount one party owes another. A promissory note includes a promise to pay on demand or at a specified future date, and steps required for repayment (like the repayment schedule).

An IOU is a written promise that you will pay back some money that you have borrowed. IOU is an abbreviation for 'I owe you'.

Other Uses of the Term IOU Bonds are technically a form of IOU, whereby an individual loans an amount of money to a company or government and is given a contract promising to repay the money with interest by a certain date. Whilst this agreement is sometimes referred to as an ?IOU?, it is in fact legally binding.

How To Write An IOU Letter Step 1 ? Fill in loan and party details. ... Step 2 ? Include the payment information. ... Step 3 ? Set the interest rate (optional) ... Step 4 ? Note down the cosigner or guarantor (optional) ... Step 5 ? Include other terms. ... Step 6 ? Specify the Governing Law. ... Step 7 ? Sign the document.

A promissory note is a written promise from one person or business to pay another. Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable.

An IOU is a document recording a debt and an informal agreement typically to pay someone, though it can be to do something. Without memorializing the debt in a more formal written contract, the IOU is not clearly legally binding, and thus more difficult to enforce.