Wisconsin Assignment of Debt

Description

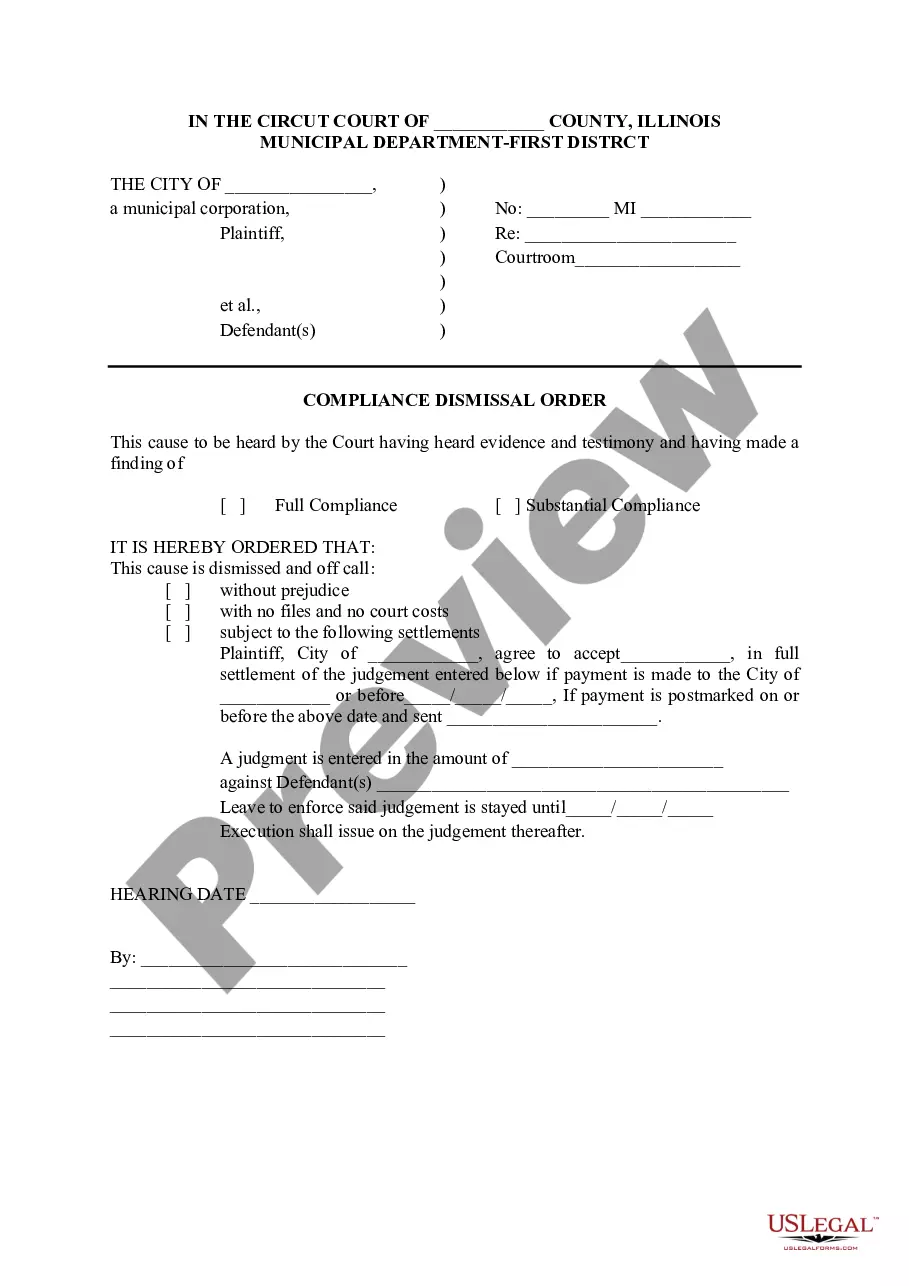

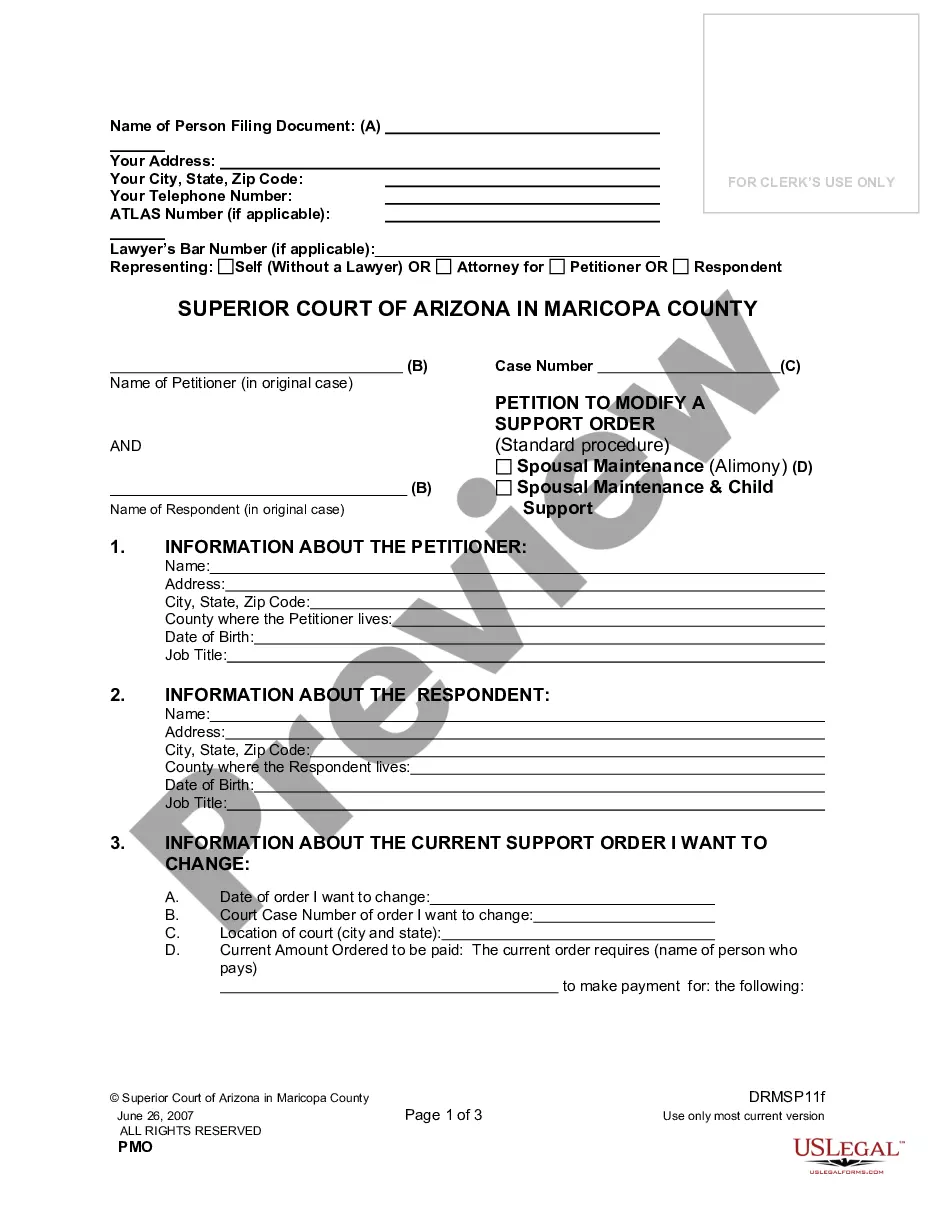

How to fill out Assignment Of Debt?

Are you in a circumstance where you need documents for either business or personal tasks nearly every day.

There are many legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Wisconsin Assignment of Debt, designed to meet federal and state requirements.

If you find the correct form, click Get now.

Select the pricing plan you want, provide the necessary information to create your account, and complete your purchase using PayPal, Visa, or Mastercard.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Wisconsin Assignment of Debt template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific area/county.

- Use the Review button to inspect the form.

- Check the summary to ensure you have selected the correct form.

- If the form does not match what you're looking for, utilize the Lookup section to find the form that satisfies your needs.

Form popularity

FAQ

Assigning a debt involves legally transferring the right to collect from one party to another. Begin by drafting a debt assignment agreement that outlines the key terms and parties involved. Both you and the new creditor should sign this document to formalize the transfer. To simplify this process, consider using USLegalForms, which offers templates that can assist in managing a Wisconsin Assignment of Debt smoothly.

In Wisconsin, debt collectors can actively pursue repayment for a maximum of six years for most consumer debts. After this period, they lose the legal grounds to sue for repayment. Nevertheless, it's wise to be aware that collectors may still contact you even after the statute of limitations has passed. Utilizing resources around Wisconsin Assignment of Debt may offer strategies for dealing with persistent collectors.

A debt typically becomes uncollectible after the statute of limitations expires, which is six years for most debts in Wisconsin. Once this timeframe passes, the creditor can no longer legally enforce repayment through the courts. However, debt remains on your credit report for seven years, potentially affecting your credit score. Exploring options like Wisconsin Assignment of Debt can provide more insight into managing uncollectible debts.

Yes, a 10-year-old debt can sometimes still be collected in Wisconsin. However, the ability to collect depends on the statute of limitations, which is typically six years for most consumer debts. After this period, a debt may become more difficult to enforce, but collectors might still attempt to pursue it. Understanding the implications of a Wisconsin Assignment of Debt can help you navigate these situations effectively.

Filling out a proof of debt form requires accurate details about the debt. Start by entering your information, including name and address, followed by the debtor's details. Next, specify the amount owed and attach any supporting documentation, such as contracts or invoices. A resource like USLegalForms can help you access the correct proof of debt forms needed for your Wisconsin Assignment of Debt.

Filing a Chapter 128 in Wisconsin involves several steps. First, gather necessary documents, including a list of your debts and income. Next, complete the Chapter 128 petition form, which you can find online or through legal services. Finally, submit your forms to the designated court while ensuring you meet all filing requirements. Using a platform like USLegalForms can simplify this process by providing templates and guidance tailored to Wisconsin Assignment of Debt.

Debts in Wisconsin become uncollectible after a six-year period, depending on the type of debt involved. This timeframe begins when the debt becomes due, so staying informed about your obligations is crucial. While this may relieve some pressure, it is essential to note that uncollected debts can still affect your credit score. Utilizing resources such as US Legal Forms can provide you with the tools to manage these debts effectively and understand your rights.

In Wisconsin, the statute of limitations for collecting a debt generally lasts six years for most debts. After this period, creditors can no longer take legal action to collect the debt. However, bear in mind that this does not erase the debt; it simply makes it uncollectible through the courts. Knowing this can help you navigate your financial responsibilities more confidently.

Chapter 128 allows individuals in Wisconsin to manage their debts under a court-supervised plan. Debtors propose a repayment plan that must be approved by the court, ensuring that both you and your creditors have a clear understanding of the repayment terms. This structure aims to protect you, providing relief from overwhelming debts while allowing you to regain financial stability. Consider exploring US Legal Forms for more information on this procedure.

To file a Chapter 128 in Wisconsin, you need to complete specific forms that detail your debt and income. Start by gathering your financial documents to accurately represent your situation. Then, submit your paperwork to the circuit court in your county. Using a reliable platform like US Legal Forms can simplify this process by providing easy access to the right forms and guidance.