Wisconsin Subcontractor Agreement for Insurance

Description

How to fill out Subcontractor Agreement For Insurance?

US Legal Forms - one of the largest collections of legal documents in America - provides a range of legal template forms that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can find the latest templates like the Wisconsin Subcontractor Agreement for Insurance in just minutes.

If you already have a subscription, Log In and download the Wisconsin Subcontractor Agreement for Insurance from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms from the My documents tab in your account.

Select the format and download the form to your device.

Make changes. Complete, modify, print, and sign the acquired Wisconsin Subcontractor Agreement for Insurance. Each template added to your account does not have an expiration date and is yours indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

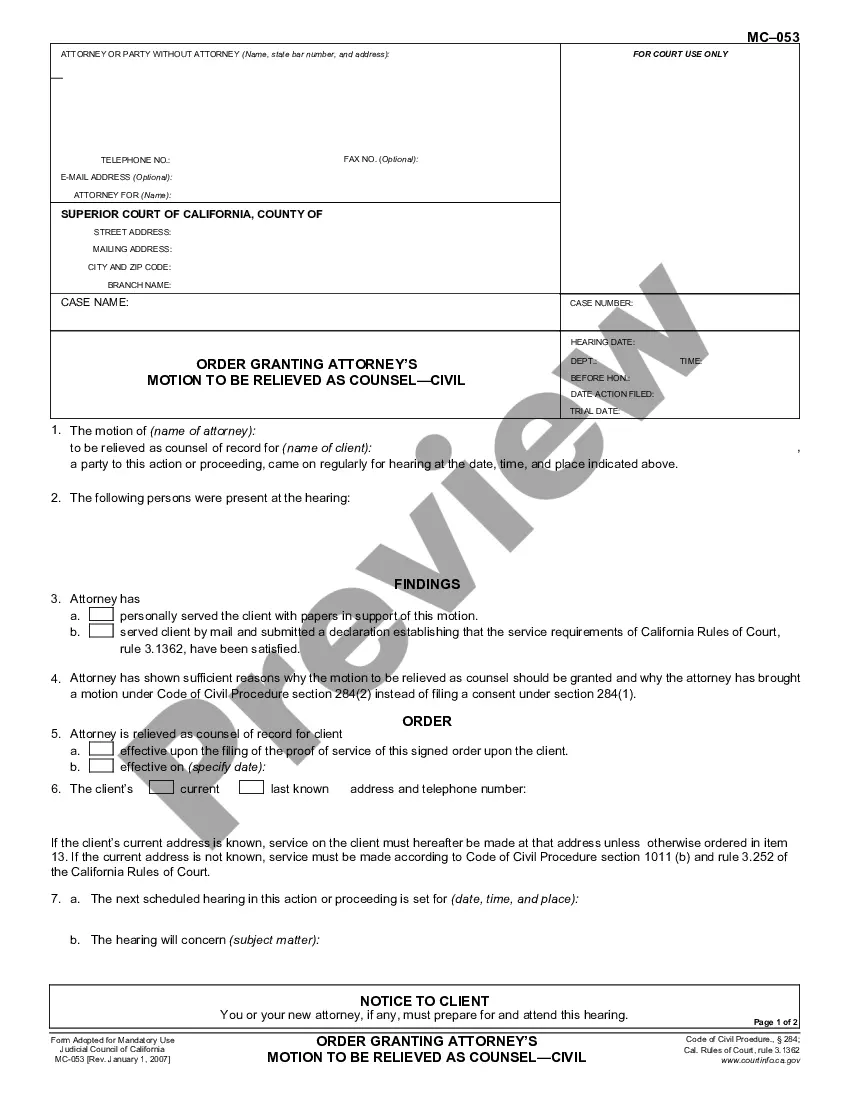

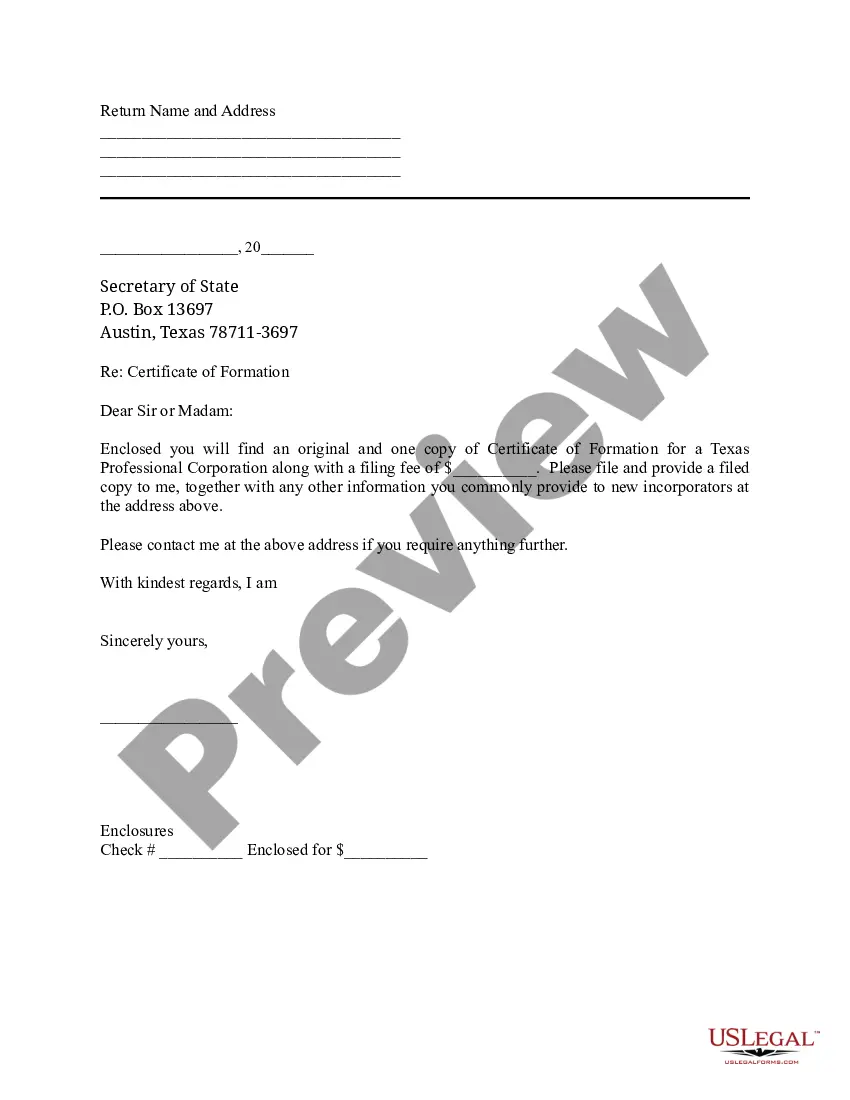

- Ensure you have selected the correct form for your area/state. Click the Preview button to review the form’s content.

- Check the form summary to confirm that you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose your preferred payment plan and input your credentials to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

Writing a subcontractor agreement requires focusing on specific details that govern the relationship. Start by clearly defining the scope of work, payment terms, and deadlines. Additionally, ensure that the agreement includes relevant clauses, such as dispute resolution and insurance requirements. Using a Wisconsin Subcontractor Agreement for Insurance helps in crafting a legally sound document that protects both parties involved.

Having a subcontractor agreement is essential for any project involving subcontractors. This document clearly outlines the roles, responsibilities, and expectations of each party. Without a Wisconsin Subcontractor Agreement for Insurance, misunderstandings may arise, potentially leading to legal disputes or financial losses. When you use a well-structured agreement, you can ensure protection and clarity throughout the project.

Contractors typically fill out a W-9 form to provide their taxpayer identification information to the client. The 1099 form, specifically the 1099-NEC, is filled out by the client or payor when reporting payments made to the contractor at the end of the year. This distinction is crucial for tax reporting purposes. Consider using resources from uslegalforms to ensure you have the appropriate forms and instructions.

To fill out an independent contractor agreement in Wisconsin, clearly outline the terms of the relationship, including work scope and payment details. Use a Wisconsin Subcontractor Agreement for Insurance to provide legal protection and clarify expectations. Be sure to include information on insurance requirements that may be necessary for the project. Platforms like uslegalforms offer easy-to-use templates to facilitate this process.

To work effectively, subcontractors must fill out a Wisconsin Subcontractor Agreement for Insurance, detailing the project specifics and their obligations. They also need to complete a W-9 form for tax purposes, which provides their taxpayer information to the contractor. Collectively, these forms ensure compliance with state regulations and tax laws. Utilizing services like uslegalforms can streamline this process.

A subcontractor should fill out a Wisconsin Subcontractor Agreement for Insurance, which specifies the scope and terms of the project. This agreement protects both the subcontractor and the primary contractor by detailing responsibilities and payment schedules. Additionally, subcontractors should complete a W-9 form as part of the tax documentation process. Look to uslegalforms to provide the necessary templates and guidance.

Subcontractors typically need to fill out a Wisconsin Subcontractor Agreement for Insurance to establish the terms of their work for a primary contractor. This agreement outlines payment terms, project timelines, and responsibilities. Additionally, subcontractors should complete a W-9 form for tax purposes. Utilizing uslegalforms can simplify obtaining the correct forms and ensuring they are filled out correctly.

Filling out a Wisconsin Subcontractor Agreement for Insurance requires you to start with accurate details about the project and the parties involved. Provide information like names, addresses, and the nature of the work. Ensure that you submit needed documentation, such as proof of insurance and licenses, to meet local requirements. Platforms like uslegalforms can guide you through the process to ensure that you comply with all necessary laws.

Subcontractor default insurance covers losses associated with a subcontractor failing to fulfill their contractual obligations. This type of insurance can be addressed in a Wisconsin Subcontractor Agreement for Insurance to ensure comprehensive protection. Understanding this coverage is essential for managing risks in construction and similar projects.

While it is technically possible to work without a contract, it is highly discouraged. A Wisconsin Subcontractor Agreement for Insurance formalizes the relationship and provides legal protection. This agreement helps mitigate misunderstandings and ensures that everyone meets their obligations.