Companies who seek venture capital are willing to exchange equity in the company in return for money to grow or expand the business. Those who provide venture capital generally seek a greater degree of control in the company affairs and quicker return on their investment than standard investors.

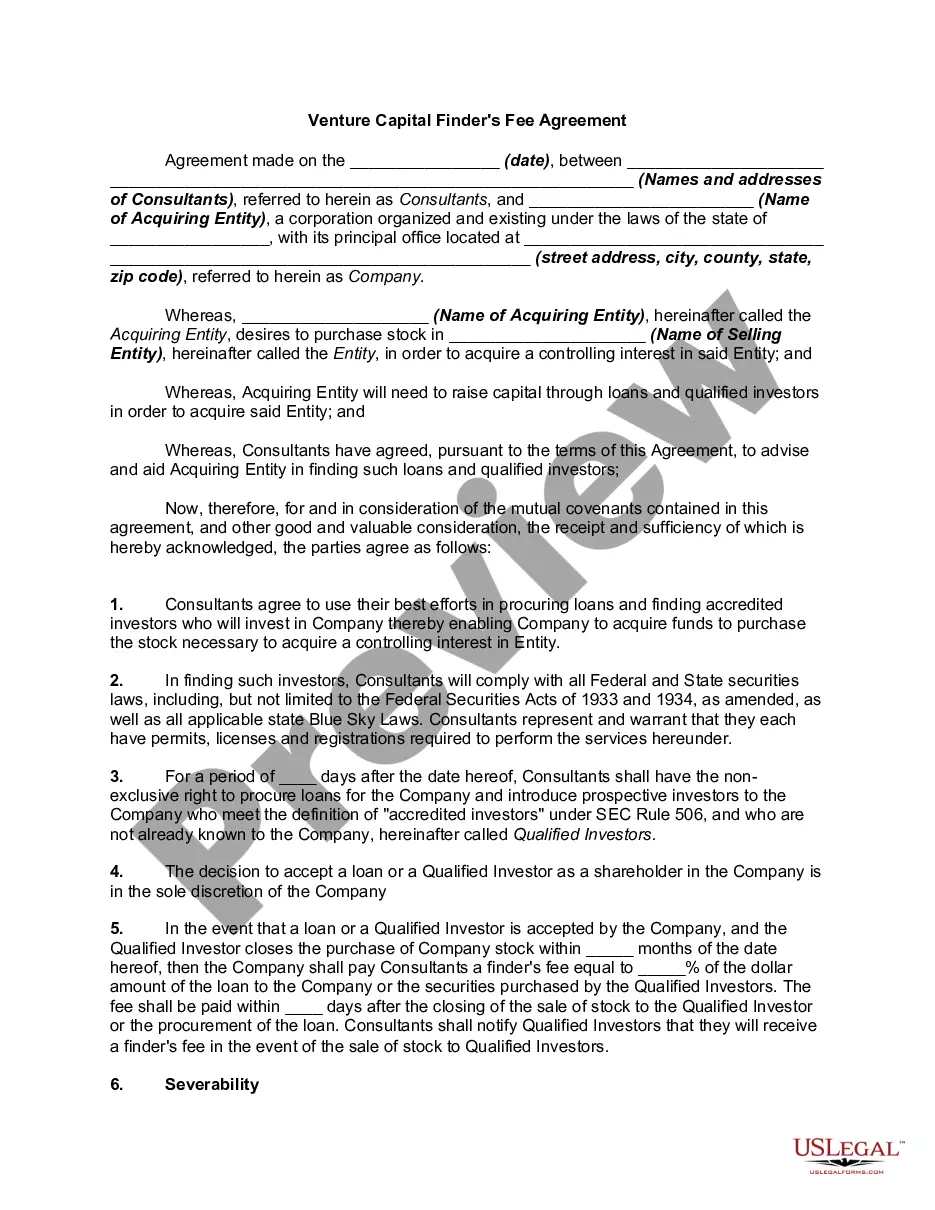

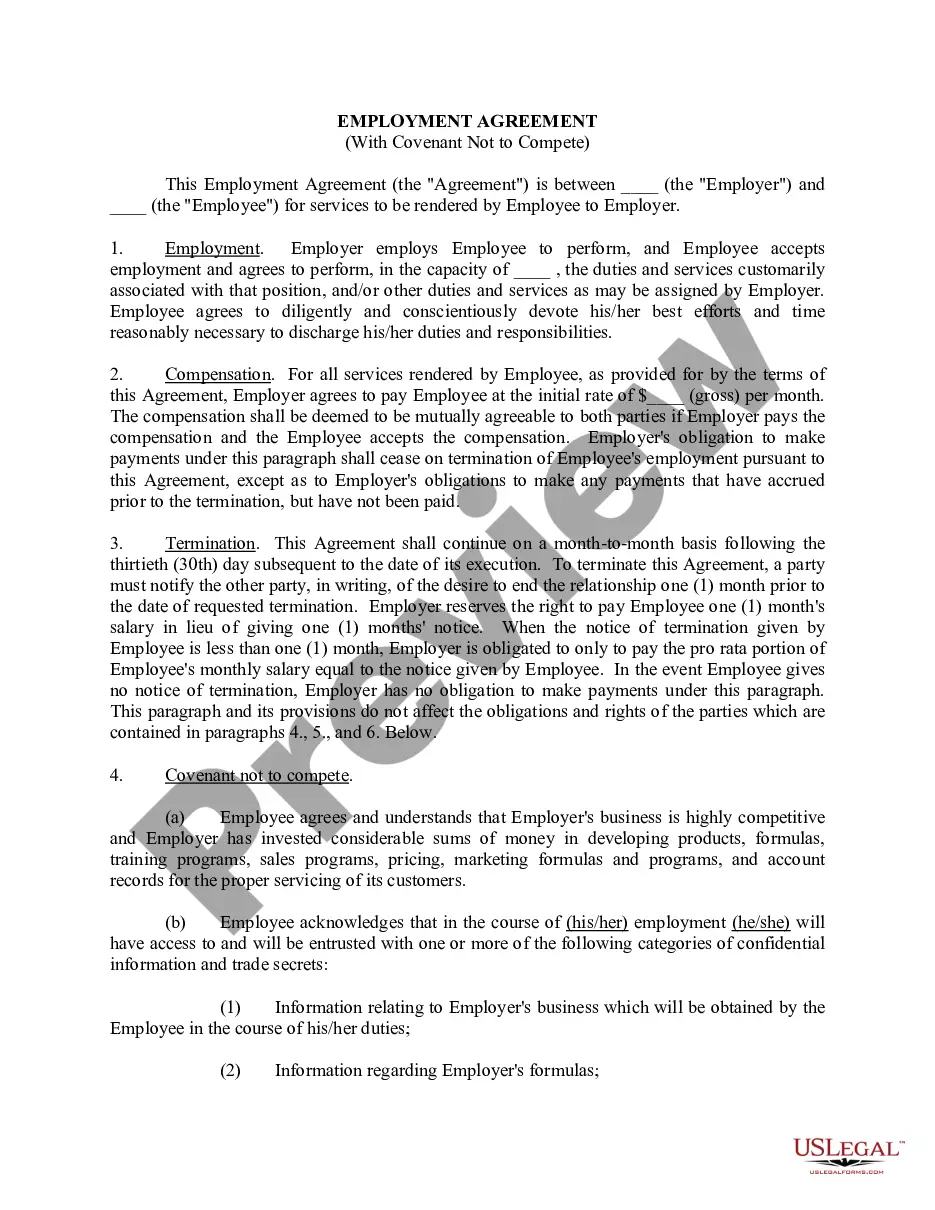

Title: Understanding the Wisconsin Venture Capital Finder's Fee Agreement: Types and Key Considerations Introduction: The Wisconsin Venture Capital Finder's Fee Agreement serves as a valuable tool for businesses and individuals seeking venture capital funding in Wisconsin. This agreement establishes the terms and conditions between a finder, who assists in connecting the company with potential venture capital investors, and the company seeking funding. In this article, we will delve into the details of the Wisconsin Venture Capital Finder's Fee Agreement, highlighting its key aspects, types, and essential keywords. Key Terms and Components: 1. Finder's Fee: The finder's fee is the compensation acknowledged for the services provided by the finder in facilitating the connection between the company seeking funding and potential venture capital investors. It is typically stated as a percentage of the capital raised or as a fixed fee. 2. Capital Raised: This refers to the total funds secured by the company through the finder's efforts. It includes investments made by venture capital firms or other accredited investors introduced by the finder. 3. Exclusive vs. Non-Exclusive Agreements: A Wisconsin Venture Capital Finder's Fee Agreement can be either exclusive or non-exclusive. An exclusive agreement grants the finder the sole authority to source venture capital investors for the company during the agreement period. On the other hand, a non-exclusive agreement allows the company to engage multiple finders simultaneously. 4. Finder's Duties and Obligations: The agreement outlines the specific responsibilities and tasks expected from the finder. These may include conducting due diligence on potential investors, compiling investment materials, arranging meetings with investors, and maintaining confidentiality. Types of Wisconsin Venture Capital Finder's Fee Agreement: 1. Success Fee Agreement: Under this agreement, the finder is entitled to a percentage commission for successfully securing venture capital funding for the company. The fee is usually calculated based on the capital raised or a predetermined rate. 2. Retainer Fee Agreement: In this type of agreement, the finder is compensated with a fixed fee, regardless of the ultimate success or failure in securing funding. The retainer fee acknowledges the finder's efforts and the provision of their expertise throughout the funding process. 3. Hybrid Fee Agreement: A hybrid fee agreement combines elements of both success and retainer fee agreements. It may involve a lower retainer fee, supplemented by a success fee if funding is successfully secured within a specified timeframe. Key Considerations: 1. Clear Scope of Engagement: The agreement should clearly define the scope of engagement, specifying the industries, geographic regions, and types of investors the finder will target on behalf of the company. 2. Confidentiality and Non-Disclosure: Protection of sensitive information is crucial, and the agreement should contain clauses ensuring confidentiality and non-disclosure of proprietary information shared between the company and the finder. 3. Compliance with Securities Regulations: It is essential to acknowledge and comply with securities laws, regulations, and licensing requirements when engaging in activities related to the Wisconsin Venture Capital Finder's Fee Agreement. 4. Termination and Dispute Resolution: The agreement should outline the circumstances and procedures for termination, as well as mechanisms for resolving disputes that may arise during the engagement. Conclusion: The Wisconsin Venture Capital Finder's Fee Agreement plays a vital role in connecting companies seeking venture capital funding with potential investors. By understanding its key terms, components, and types, businesses can effectively navigate the funding landscape in Wisconsin, with the assistance of experienced finders. Careful consideration of the agreement's contents and adherence to legal requirements will help establish a fruitful and mutually beneficial relationship between the company and the finder.